xelaRis1978

voted

The U.S. stock market has hit new highs again! Congrats!👏 If you started investing in the US market at the beginning of the year and haven't made any major mistakes, you've probably seen some gains! 🎉

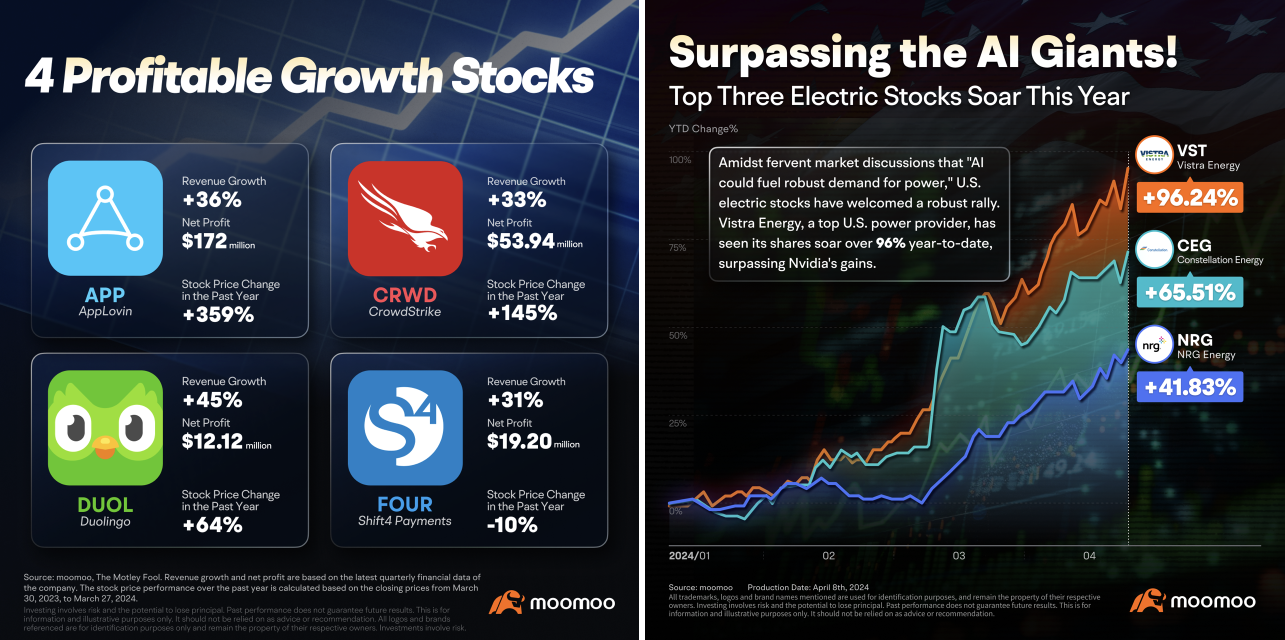

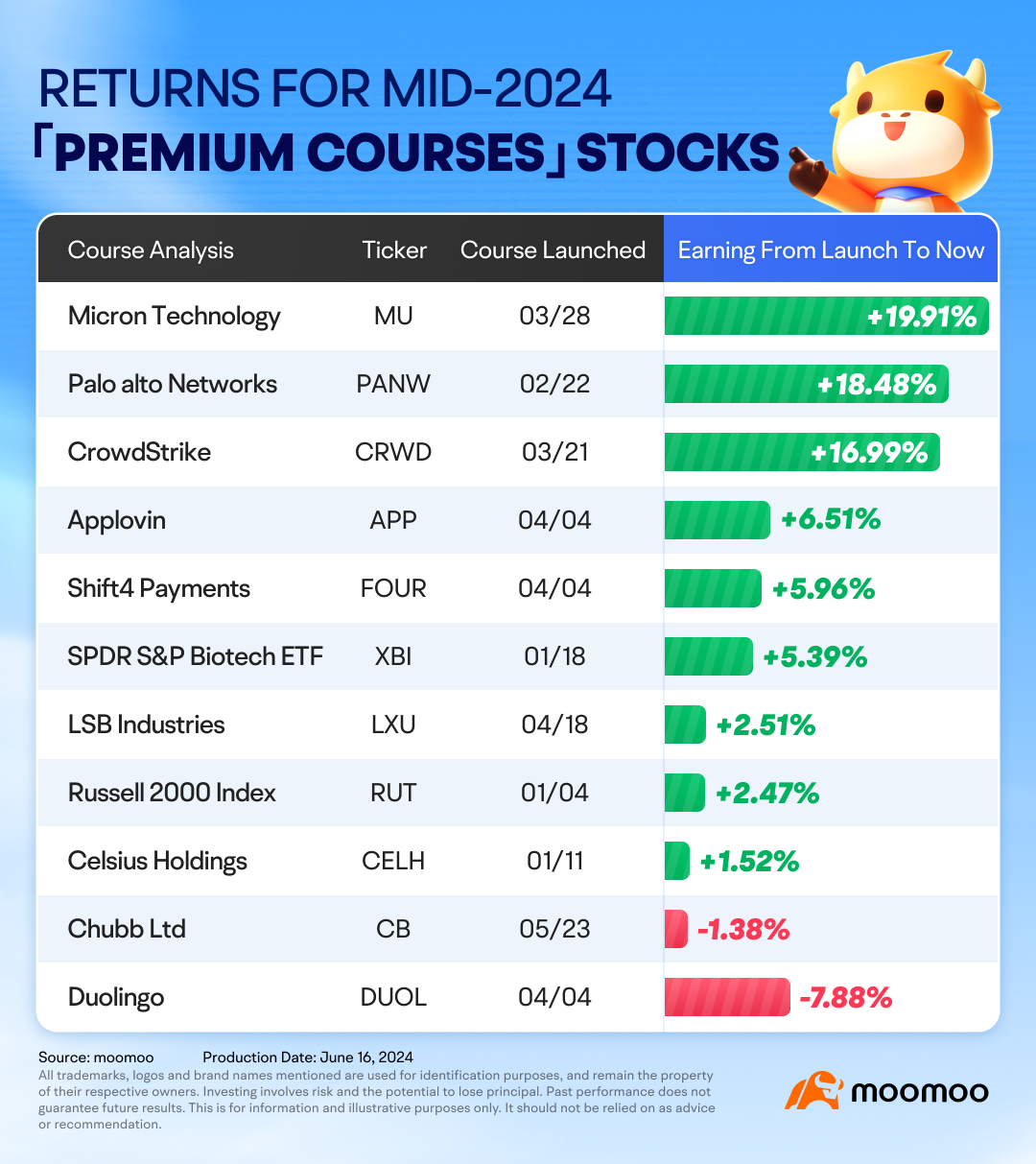

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index(.SPX.US$ and $Nasdaq Composite Index(.IXIC.US$ have repeatedly reached new highs over...

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index(.SPX.US$ and $Nasdaq Composite Index(.IXIC.US$ have repeatedly reached new highs over...

+5

427

227

xelaRis1978

Set a live reminder

We’re back next Tuesday, 18 June at 11am!

Apple’s share price soared to an all-time high on Thursday, as investors reacted postively to the tech giant’s long-awaited announcement of its generative artificial intelligence plans.

This comes closely on the back of the Nvidia’s meteoric rise this year, buoyed by optimism after CEO Jensen Huang outlined details of a new line of chips and processors that could further cement its grip on the global AI market.What’s next for these tech giants? Well, we...

Apple’s share price soared to an all-time high on Thursday, as investors reacted postively to the tech giant’s long-awaited announcement of its generative artificial intelligence plans.

This comes closely on the back of the Nvidia’s meteoric rise this year, buoyed by optimism after CEO Jensen Huang outlined details of a new line of chips and processors that could further cement its grip on the global AI market.What’s next for these tech giants? Well, we...

222

66

xelaRis1978

voted

Spoiler: There are big chances to win rewarding points in this post! Don't miss out!! ![]()

The 2024 United States presidential election will be the 60th quadrennial presidential election, scheduled for Tuesday, November 5, 2024. Incumbent President Joe Biden, as well as his predecessor Donald Trump, are running for re-election. If both Biden and Trump are nominated by their respective parties, it would mark the first presidential rematch...

The 2024 United States presidential election will be the 60th quadrennial presidential election, scheduled for Tuesday, November 5, 2024. Incumbent President Joe Biden, as well as his predecessor Donald Trump, are running for re-election. If both Biden and Trump are nominated by their respective parties, it would mark the first presidential rematch...

224

235

xelaRis1978

liked

Hi, mooers! ![]()

Over the past three months, the Federal Reserve is rumored to be ending rate hikes, leading to a rise in US Treasury yields and market uncertainty. As a result, investors are seeking diversified asset allocation. Experts and institutions have shared their interpretations and suggestions on moomoo, while mooers have also contributed their investment performance and insights.

Join us for a summary of moomoo's most t...

Over the past three months, the Federal Reserve is rumored to be ending rate hikes, leading to a rise in US Treasury yields and market uncertainty. As a result, investors are seeking diversified asset allocation. Experts and institutions have shared their interpretations and suggestions on moomoo, while mooers have also contributed their investment performance and insights.

Join us for a summary of moomoo's most t...

279

122

xelaRis1978

commented on

Hi, mooers!![]()

The monetary policy is a barometer that investors follow closely. On 20th September, the Federal Reserve announced that it would maintain the current interest rates, without any indication of an impending cut. What's your outlook on interest rates? Do you think there will be a rate cut this year?

The uncertainty of future monetary policy suggests that market volatility will increase significantly in the short term. In this situat...

The monetary policy is a barometer that investors follow closely. On 20th September, the Federal Reserve announced that it would maintain the current interest rates, without any indication of an impending cut. What's your outlook on interest rates? Do you think there will be a rate cut this year?

The uncertainty of future monetary policy suggests that market volatility will increase significantly in the short term. In this situat...

70

16

If I can go back in time, I would go back to the days when my children were young and parents were healthy. I will invest my money consistently for it to accumulate and work harder for my later years. I would go back home to them early and spend less time working overtime. Relationships takes TIME, likewise for our investments...and TIME is a precious, limited resource. moomoo - Smart trading platform

2

xelaRis1978

liked

US stocks were very exciting, yesterday $Netflix(NFLX.US$After the release of the first quarter report, the market immediately fled in a panic. At one point, the stock price fell by nearly 40%, then recovered some of its current declines and reached 35%.

I just bought some Netflix based on the results after “US Stocks, Japan Research 2: Internet Stocks in the US Stock Market”, which was released on the 31st of last month. Yesterday I saw a sharp decline and checked the investment logic at the time again:

Netflix's net profit curve is very good, and the revenue curve is also very good. Note that the net profit growth rate is much higher than the revenue growth rate, which shows that Netflix's scale effect is very obvious. Even if revenue continues to grow at a slow rate, net profit will still grow at a relatively high rate. Currently, the market value is 169 billion, the price-earnings ratio is 33.86, the 4-year average growth rate is 74%, and the average revenue growth rate is 26%. The valuation is also relatively low, so you can choose (⭐️⭐️⭐️).

So, did the first quarter report actually damper Netflix's growth?

Opening the income statement, revenue increased 9.8% in the first quarter, which is very good. However, operating expenses increased by 20.7%, with management expenses increasing by 34% (100 million) and R&D expenses by 25% (130 million). After these two increases, operating profit increased by only 0.6%. Although operating profit did not change much, income tax increased by 16.6% (50 million).

See the problem? The decline in profits was not due to the so-called reduction in revenue, but to increased spending. The increased R&D costs are actually long...

I just bought some Netflix based on the results after “US Stocks, Japan Research 2: Internet Stocks in the US Stock Market”, which was released on the 31st of last month. Yesterday I saw a sharp decline and checked the investment logic at the time again:

Netflix's net profit curve is very good, and the revenue curve is also very good. Note that the net profit growth rate is much higher than the revenue growth rate, which shows that Netflix's scale effect is very obvious. Even if revenue continues to grow at a slow rate, net profit will still grow at a relatively high rate. Currently, the market value is 169 billion, the price-earnings ratio is 33.86, the 4-year average growth rate is 74%, and the average revenue growth rate is 26%. The valuation is also relatively low, so you can choose (⭐️⭐️⭐️).

So, did the first quarter report actually damper Netflix's growth?

Opening the income statement, revenue increased 9.8% in the first quarter, which is very good. However, operating expenses increased by 20.7%, with management expenses increasing by 34% (100 million) and R&D expenses by 25% (130 million). After these two increases, operating profit increased by only 0.6%. Although operating profit did not change much, income tax increased by 16.6% (50 million).

See the problem? The decline in profits was not due to the so-called reduction in revenue, but to increased spending. The increased R&D costs are actually long...

Translated

4

5

xelaRis1978

voted

In investment, there is often no single right answer. People can make money through thousands of different strategies.

However, the best thing about investing strategies is that they’re always flexible. All you need to do is to find ways that suit you.

So what strategies do you use the most? The answer will define what kind of investors you are.

However, the best thing about investing strategies is that they’re always flexible. All you need to do is to find ways that suit you.

So what strategies do you use the most? The answer will define what kind of investors you are.

30

8

xelaRis1978

voted

It's a tradition for the Chinese worldwide to send new-year greetings to relatives and friends during the Chinese New Year. From what I observe, those who send the most heartfelt new-year greetings typically receive the most red hongbao.

Agree or not?

Time to upskill, buddy! Pick some of the following CNY greetings and impress your relatives right now!

We've prepared a small lucky hongbao for all of you at the end of this...

Agree or not?

Time to upskill, buddy! Pick some of the following CNY greetings and impress your relatives right now!

We've prepared a small lucky hongbao for all of you at the end of this...

113

121

Portfolio diversification is key to being able to sleep soundly at night while we make our money in the markets. I had always been a value investor and im grateful for this especially after what happened at the end of 2021. Growth and Value - we need to find a balance that suits our risk profile.

These are my 4 resolutions for my Moo-vestments for 2022.

1. Add 50k to my existing counters over the year consistently - DCA works most of the time for the long term.

...

These are my 4 resolutions for my Moo-vestments for 2022.

1. Add 50k to my existing counters over the year consistently - DCA works most of the time for the long term.

...

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)