Xong Yiang

commented on

Xong Yiang

commented on

Dear mooers, ![]()

AAPL Q1 2022 Earnings Conference Call is coming up! Last quarter, $Apple (AAPL.US)$’s CEO, Tim Cook, stated that supply limitations caused by chips shortages cost the company $6 billion. What is Apple's performance in this quarter?

How will this affect the stock price? What do you anticipate from the market?

![]() Win Reward:

Win Reward:

Place your bet on Apple's percentage change in closing price (i.e.+3%) of Jan. 28 ET / Jan. 29 ...

AAPL Q1 2022 Earnings Conference Call is coming up! Last quarter, $Apple (AAPL.US)$’s CEO, Tim Cook, stated that supply limitations caused by chips shortages cost the company $6 billion. What is Apple's performance in this quarter?

How will this affect the stock price? What do you anticipate from the market?

Place your bet on Apple's percentage change in closing price (i.e.+3%) of Jan. 28 ET / Jan. 29 ...

15

27

5

Xong Yiang

liked

Technical DNA collects 10 most-traded bottom divergence tickers from stocks with market cap of more than $2B, aiming to help investors look for good investment opportunities. ![]()

![]()

![]() $JPMorgan (JPM.US)$ $Medtronic (MDT.US)$ $Starbucks (SBUX.US)$ $Enphase Energy (ENPH.US)$ $Albemarle (ALB.US)$ $Bilibili (BILI.US)$ $Aptiv PLC (APTV.US)$ $Tencent (TCEHY.US)$ $Corning (GLW.US)$ $Freshpet (FRPT.US)$

$JPMorgan (JPM.US)$ $Medtronic (MDT.US)$ $Starbucks (SBUX.US)$ $Enphase Energy (ENPH.US)$ $Albemarle (ALB.US)$ $Bilibili (BILI.US)$ $Aptiv PLC (APTV.US)$ $Tencent (TCEHY.US)$ $Corning (GLW.US)$ $Freshpet (FRPT.US)$

What is MACD divergence?![]()

![]()

![]()

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms. MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

What is MACD divergence?

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms. MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

44

4

Xong Yiang

liked

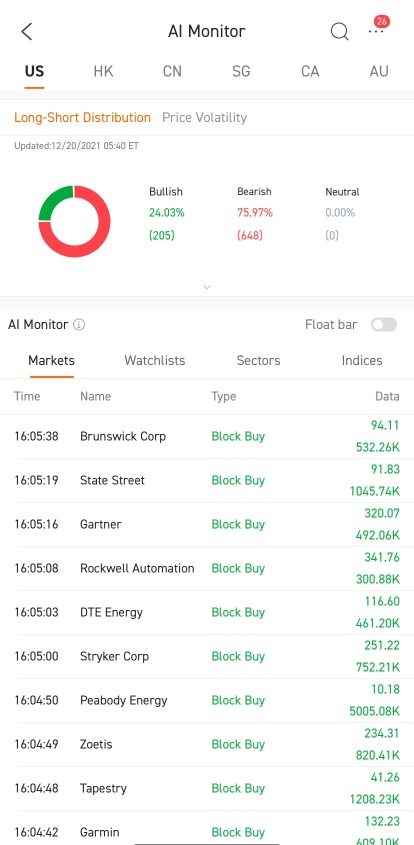

Are you always missing out on great opportunities? Try moomoo's AI Monitor feature. Our system will automatically monitor the market sentiment and alert you on the stocks you may find interesting.

![]() What is AI Monitor

What is AI Monitor

AI Monitor aims to keep tabs on the real-time abnormal movements of the market to make investing easier. It issues alerts to help you get the good timing of trades and seize investment opportunities.

It monitors the fluctuations...

AI Monitor aims to keep tabs on the real-time abnormal movements of the market to make investing easier. It issues alerts to help you get the good timing of trades and seize investment opportunities.

It monitors the fluctuations...

202

8

8

Xong Yiang

liked

$Rivian Automotive (RIVN.US)$ WHY DO PEOPLE STILL BUY THIS???

6

5

Xong Yiang

liked

Stock futures were flat in overnight trading on Monday after a rebound from a rollercoaster week as investors looked past the potential impact from the new omicron coronavirus variant.

Futures on the $Dow Jones Industrial Average (.DJI.US)$ rose just 15 points. $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ were both little changed.

The overnight session followed a comeback on Wall Street that saw the blue-chip Dow gain nearly 650 points. The S&P 500 jumped 1.1% on Monday with all 11 sectors registering gains. The Nasdaq Composite reversed higher to end the day up 0.9%. The rally was led by travel-related stocks such as airlines and cruise line operators.

$Norwegian Cruise (NCLH.US)$ $United Airlines (UAL.US)$ $Royal Caribbean (RCL.US)$ $Carnival (CCL.US)$ $American Airlines (AAL.US)$ $Moderna (MRNA.US)$ $Monolithic Power Systems (MPWR.US)$ $Pfizer (PFE.US)$ $Generac (GNRC.US)$ $Fortinet (FTNT.US)$

Futures on the $Dow Jones Industrial Average (.DJI.US)$ rose just 15 points. $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ were both little changed.

The overnight session followed a comeback on Wall Street that saw the blue-chip Dow gain nearly 650 points. The S&P 500 jumped 1.1% on Monday with all 11 sectors registering gains. The Nasdaq Composite reversed higher to end the day up 0.9%. The rally was led by travel-related stocks such as airlines and cruise line operators.

$Norwegian Cruise (NCLH.US)$ $United Airlines (UAL.US)$ $Royal Caribbean (RCL.US)$ $Carnival (CCL.US)$ $American Airlines (AAL.US)$ $Moderna (MRNA.US)$ $Monolithic Power Systems (MPWR.US)$ $Pfizer (PFE.US)$ $Generac (GNRC.US)$ $Fortinet (FTNT.US)$

35

7

2

Xong Yiang

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)