xyin88

liked

$Denison Mines (DNN.US)$ With a large volume breaking through 2.32, there will be a wave of increases. Currently still encountering these three support and resistance lines, knowing how to get involved with this stock.

Translated

4

xyin88

liked

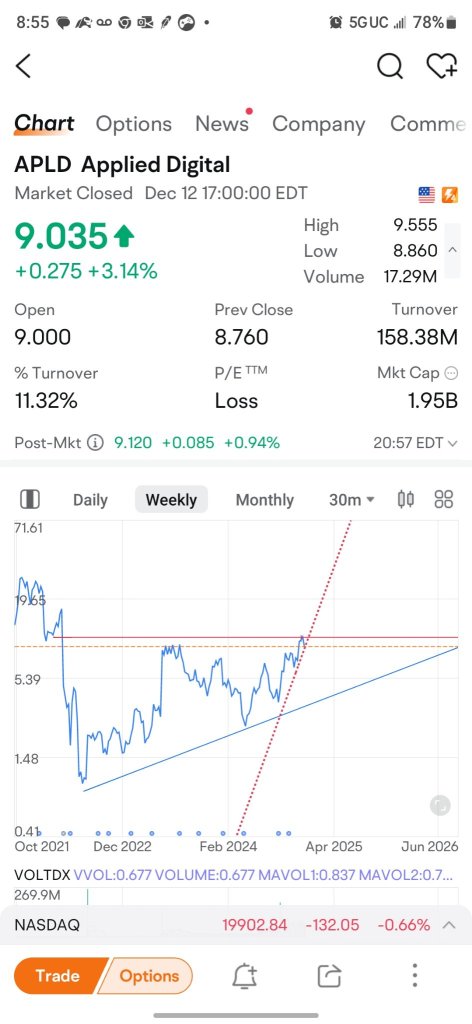

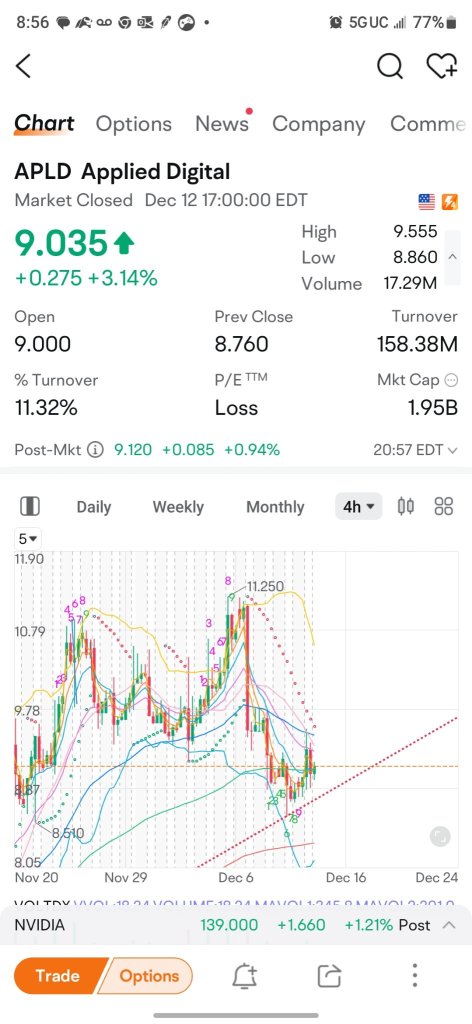

$Applied Digital (APLD.US)$ it looks as though we may catch traction here and retest this massive long-term resistance. If not,

we move down to the long-term support. Either way, this stock will come back this way. Unless you swing or daytrade, there is no average that is too much. Sell OTM covered calls to make passive income while the stock is retreating. NFA, not even what I do, I just see a lot of peeps grumbling.

we move down to the long-term support. Either way, this stock will come back this way. Unless you swing or daytrade, there is no average that is too much. Sell OTM covered calls to make passive income while the stock is retreating. NFA, not even what I do, I just see a lot of peeps grumbling.

1

xyin88

liked

Translated

4

3

xyin88

liked

$MicroStrategy (MSTR.US)$ noticed the shorting almost immediately stopped at Market closed, right before Post Market hour

is there some control on shorting during Post Market?

is there some control on shorting during Post Market?

5

4

xyin88

liked and commented on

$Archer Aviation (ACHR.US)$ Several viewpoints for everyone to consider 1) No matter how big the pancake is, can it be made? Look at the company's plans over the years, how many have been accomplished on time. 2) The same concept has already been successfully test-flown within China (from Shenzhen to Zhuhai). If an industry has already been seized by competitors, it's hard to catch up. Even if high-tech products cannot be sold in the USA, what about the global market? The Middle East market will still buy, at least from a sales perspective, China has already achieved it, unless the USA uses its soft power again to prohibit the global purchase of Chinese airplanes. 3) If everything goes according to the company's plan and obtains commercial flight qualifications, would you take a flight? From one airport to another, or from the airport to the city center (how many city centers have large enough spaces for takeoff and landing). Yes, time is reduced, but it still takes time to get from another airport or from the city center to your final destination. 4) Would Dǒng Wáng (understood king) support electric airplanes? Will the USA military industry be a potential buyer?

Translated

6

1

xyin88

liked

$Coinbase (COIN.US)$ ccb! btc goes up, u didnt go up, they dip abit, u keep falling. wtf! its like u are playing a game and u cannot win the computer.

3

2

1

xyin88

liked

Keep an eye on these recently announced & closed M&As: 👀

🟢 Recently Announced:

⇒ $Organon & Co (OGN.US)$ to acquire Dermavant

⇒ $Rafael Holdings (RFL.US)$ to acquire Cyclo Tx

⇒Crown Lab to acquire $Revance Therapeutics (RVNC.US)$

⇒ $Recursion Pharmaceuticals (RXRX.US)$ merger with Exscientia

🔴 Recently Closed:

⇒ $Johnson & Johnson (JNJ.US)$ acquired V-Wave

⇒ Pharmacosmos acquired $GTHX

What companies will be next? 🤔

🟢 Recently Announced:

⇒ $Organon & Co (OGN.US)$ to acquire Dermavant

⇒ $Rafael Holdings (RFL.US)$ to acquire Cyclo Tx

⇒Crown Lab to acquire $Revance Therapeutics (RVNC.US)$

⇒ $Recursion Pharmaceuticals (RXRX.US)$ merger with Exscientia

🔴 Recently Closed:

⇒ $Johnson & Johnson (JNJ.US)$ acquired V-Wave

⇒ Pharmacosmos acquired $GTHX

What companies will be next? 🤔

13

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)