y o w

reacted to

KPJ started tracking early this year.

The reason is after the epidemic.

I think a lot of surgeries and cancer treatments, etc.

Will flow into large hospitals.

During the epidemic, everyone is also afraid of being infected in the hospital.

Choosing not to seek treatment and delaying it.

Another reason is foreign tourists.

Especially patients from Indonesia and the Middle East region.

There is no way to come during the epidemic period.

With these logical thinking skills in place

Naturally, KPJ becomes the target.

Sure enough, the hospital bed utilization rate has significantly increased.

There are more and more patients.

KPJ sold the loss-making hospital in Indonesia during the process.

Sold off some hospital assets in Malaysia.

Then re-leased them.

Release more cash flow.

Also significantly reduced debt.

The opening of KP J Damansara 2 hospital.

Another growth indicator has emerged.

Expand by adding more hospitals.

Very good.

The increase in profits is a natural law.

The rise in stock prices is also reasonable.

2023年股价上涨60%

恭喜学生和我一起参与

也欢迎你联系我们,2024我们再寻找新的盈利上升企业

$KPJ (5878.MY)$

The reason is after the epidemic.

I think a lot of surgeries and cancer treatments, etc.

Will flow into large hospitals.

During the epidemic, everyone is also afraid of being infected in the hospital.

Choosing not to seek treatment and delaying it.

Another reason is foreign tourists.

Especially patients from Indonesia and the Middle East region.

There is no way to come during the epidemic period.

With these logical thinking skills in place

Naturally, KPJ becomes the target.

Sure enough, the hospital bed utilization rate has significantly increased.

There are more and more patients.

KPJ sold the loss-making hospital in Indonesia during the process.

Sold off some hospital assets in Malaysia.

Then re-leased them.

Release more cash flow.

Also significantly reduced debt.

The opening of KP J Damansara 2 hospital.

Another growth indicator has emerged.

Expand by adding more hospitals.

Very good.

The increase in profits is a natural law.

The rise in stock prices is also reasonable.

2023年股价上涨60%

恭喜学生和我一起参与

也欢迎你联系我们,2024我们再寻找新的盈利上升企业

$KPJ (5878.MY)$

Translated

7

y o w

commented on

y o w

voted

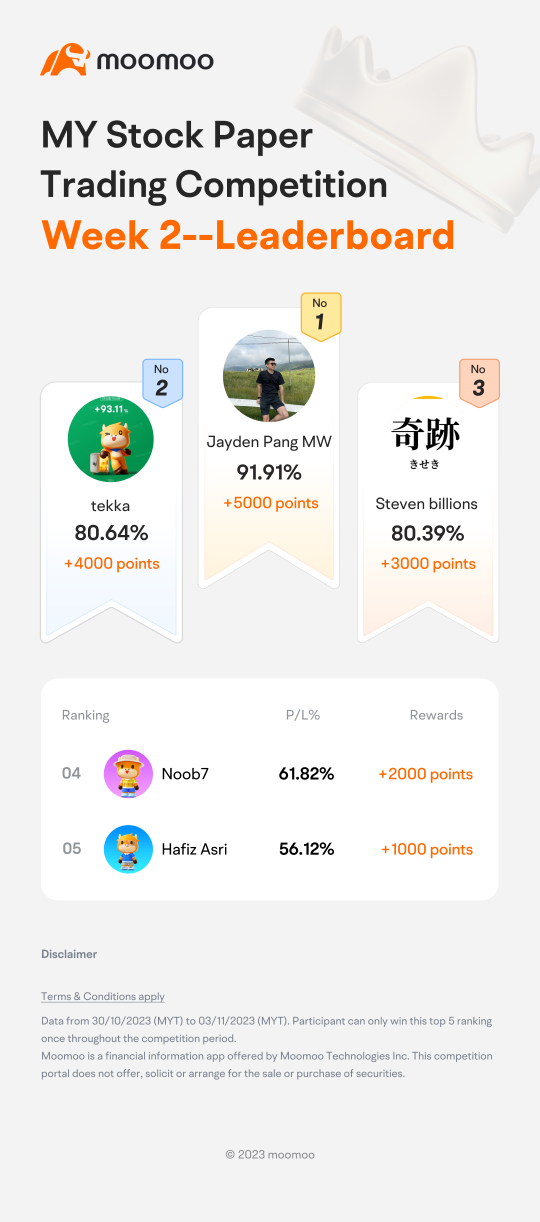

Hi mooers! The MY Stock Paper Trading Competition has been going on for a week, let’s see which users are ahead!![]()

Week 2 Leaderboard

Period: 30/10/2023 (MYT) to 03/11/2023 (MYT).

Congratulations to all users who made it to the weekly leaderboard!![]()

@Jayden Pang MW @tekka @Steven billions @Noob7 @Hafiz Asri

What is your favourite MY stock in papertrading?

Share your P/L (Profits/Losses) orders & insights of your favourite MY s...

Week 2 Leaderboard

Period: 30/10/2023 (MYT) to 03/11/2023 (MYT).

Congratulations to all users who made it to the weekly leaderboard!

@Jayden Pang MW @tekka @Steven billions @Noob7 @Hafiz Asri

What is your favourite MY stock in papertrading?

Share your P/L (Profits/Losses) orders & insights of your favourite MY s...

17

2

y o w

voted

These were mentioned in last week's class - passive investment methods: dividends, DCA into ETFs, REITs, and so on.

Although I am not a passive investor myself, passive investing strategies are actually relatively simple. The real challenge lies in consistency, discipline, and the belief during that period of persistence.

This class is actually designed for friends who want to start investing in stocks but due to work nature, do not have much time for active management, hence adopting passive investment strategies.

This class is limited-time only, and I will not continue to hold it after this month. The number of participants is also limited. If you are interested, please PM me.

Translated

3

y o w

voted

$CLOUDPT (0277.MY)$

- Top 5 shareholders hold 70% of the shares.

- Recently, the bosses bought million units.

- Broke through a two-month base.

- Still in moratorium.

- Pocket pivot volume.

- IPO price is 38c, it rose to 0.75c on the first day, and closed at 0.515c.

- Volume profile.

- Today's price trend is currently up by +8%.

$GENTING (3182.MY)$ $SPTOTO (1562.MY)$ $BURSA (1818.MY)$ $UEMS (5148.MY)$ $GENM (4715.MY)$

- Top 5 shareholders hold 70% of the shares.

- Recently, the bosses bought million units.

- Broke through a two-month base.

- Still in moratorium.

- Pocket pivot volume.

- IPO price is 38c, it rose to 0.75c on the first day, and closed at 0.515c.

- Volume profile.

- Today's price trend is currently up by +8%.

$GENTING (3182.MY)$ $SPTOTO (1562.MY)$ $BURSA (1818.MY)$ $UEMS (5148.MY)$ $GENM (4715.MY)$

26

2

y o w

voted

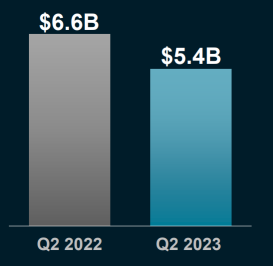

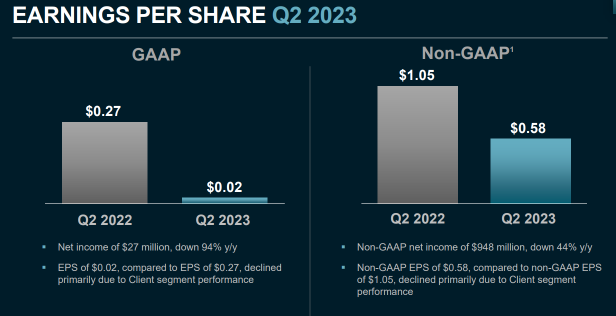

When it last released its previous quarterly results, there were little to no insights on how it would capitalize on the AI boom.

Even though it is easily one of the largest GPU designers.

In Q2'23 results, would likely highlight this topic again. Share prices actually rally even though some misses in its results.

1. Revenue continues to decline

Revenue declined 18% YoY as client segment revenue dipped.

Client segment revenue continues to be impacted by the ...

Even though it is easily one of the largest GPU designers.

In Q2'23 results, would likely highlight this topic again. Share prices actually rally even though some misses in its results.

1. Revenue continues to decline

Revenue declined 18% YoY as client segment revenue dipped.

Client segment revenue continues to be impacted by the ...

+1

20

1

1

y o w

voted

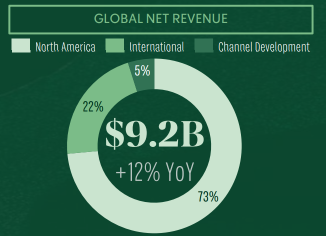

Columns Starbucks - worth the buck?

The world's favourite coffee chain - $Starbucks (SBUX.US)$ released its results.

Share prices are now back to USD 100 per share.

There are some misses amidst the good results, so even though share prices are up, here are some of the key points investors should take note of.

1. North America contributes to 73% of net revenue

Even though Starbucks is seemingly everywhere wherever we go, it is still surprising to see North America contributing 73% of Starbucks' total reven...

Share prices are now back to USD 100 per share.

There are some misses amidst the good results, so even though share prices are up, here are some of the key points investors should take note of.

1. North America contributes to 73% of net revenue

Even though Starbucks is seemingly everywhere wherever we go, it is still surprising to see North America contributing 73% of Starbucks' total reven...

+1

19

1

y o w

liked

Good morning mooers! Here are things you need to know about today's market:

●U.S. stocks rebounded last Friday to cap off a week of gains

●Bursa Malaysia opens higher on Monday

●Maybank IB identifies four prime sectors for investors in 2H

●Investment momentum in Malaysia to stay positive for Q2 2023 – Tengku Zafrul

●Average household income at RM8,479 in 2022

●Stocks to watch: Tenaga Nasional, Gas Malaysia, DXN Holdings, Capital A

-moomoo Ne...

●U.S. stocks rebounded last Friday to cap off a week of gains

●Bursa Malaysia opens higher on Monday

●Maybank IB identifies four prime sectors for investors in 2H

●Investment momentum in Malaysia to stay positive for Q2 2023 – Tengku Zafrul

●Average household income at RM8,479 in 2022

●Stocks to watch: Tenaga Nasional, Gas Malaysia, DXN Holdings, Capital A

-moomoo Ne...

22

1

y o w

commented on and voted

Up to this date, they are all performing.. Check the current charts $MSC (5916.MY)$ $ECOWLD (8206.MY)$ $CAPITALA (5099.MY)$

$ECOWLD (8206.MY)$ goes to higher ground after the breakout from its previous high, indicating the strength in the property sector. Nobody talks about property sector in the beginning of the month. We also see huge up in $UEMS (5148.MY)$ as well.

$CAPITALA (5099.MY)$ breakout ...

$ECOWLD (8206.MY)$ goes to higher ground after the breakout from its previous high, indicating the strength in the property sector. Nobody talks about property sector in the beginning of the month. We also see huge up in $UEMS (5148.MY)$ as well.

$CAPITALA (5099.MY)$ breakout ...

+1

17

3

2

y o w

voted

Our retirement can be supported by a stream of passive income from REITs, and these distributions may even increase over time.

The three major strategies used by REITs to increase their distribution per unit (DPU) are as follows:

1. acquisitions that can increase their asset base and DPU

2. organic and involve positive rental reversions

3. the use of asset enhancement initiatives (AEI) to attract higher rental income

There are 3 S-REITs announce...

The three major strategies used by REITs to increase their distribution per unit (DPU) are as follows:

1. acquisitions that can increase their asset base and DPU

2. organic and involve positive rental reversions

3. the use of asset enhancement initiatives (AEI) to attract higher rental income

There are 3 S-REITs announce...

8

2

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)