YaBABEYYY

voted

Morning mooers, it is Thursday, May 9th. The market is open and mixed, with two out of three indexes climbing. My name is Kevin Travers, and here are stories moving the market today:

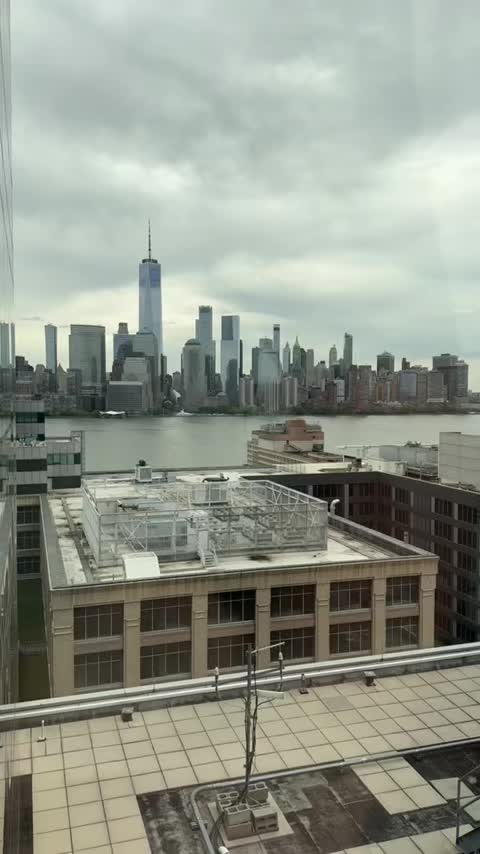

ps: I will record the view of the New York Financial District from my desk in the moomoo office for these videos!

MOOVERS

$Airbnb (ABNB.US)$ pulled down the S&P 500 and Nasdaq 100 after its earnings met expectations, but its Q2 guidance came i...

ps: I will record the view of the New York Financial District from my desk in the moomoo office for these videos!

MOOVERS

$Airbnb (ABNB.US)$ pulled down the S&P 500 and Nasdaq 100 after its earnings met expectations, but its Q2 guidance came i...

29

10

YaBABEYYY

liked

iEdge S-Reit Index Weekly Review 31 Dec 23

S-REITs continue to receive upside pressure. Question remains. Is this merely sentiment driven? Despite speculation of rate cuts, economic conditions remain tight.

$AIMS APAC Reit (O5RU.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$ $PARAGONREIT (SK6U.SG)$ $FRASERS LOGISTICS & COM TRUST (BUOU.SG)$ $Mapletree Ind Tr (ME8U.SG)$ $Lendlease Reit (JYEU.SG)$ $CapLand China T (AU8U.SG)$ $CSOP S-REITs INDEX ETF (SRT.SG)$ $CapLand India T (CY6U.SG)$ $CapLand IntCom T (C38U.SG)$ $CapLand Ascendas REIT (A17U.SG)$ $FRASERS CENTREPOINT TRUST (J69U.SG)$

S-REITs continue to receive upside pressure. Question remains. Is this merely sentiment driven? Despite speculation of rate cuts, economic conditions remain tight.

$AIMS APAC Reit (O5RU.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$ $PARAGONREIT (SK6U.SG)$ $FRASERS LOGISTICS & COM TRUST (BUOU.SG)$ $Mapletree Ind Tr (ME8U.SG)$ $Lendlease Reit (JYEU.SG)$ $CapLand China T (AU8U.SG)$ $CSOP S-REITs INDEX ETF (SRT.SG)$ $CapLand India T (CY6U.SG)$ $CapLand IntCom T (C38U.SG)$ $CapLand Ascendas REIT (A17U.SG)$ $FRASERS CENTREPOINT TRUST (J69U.SG)$

8

10

YaBABEYYY

liked

A Fed Funds rate of 2.75-3% (250bps below the current policy rate of 5.25-5.5%) would put the real rate at 1%, assuming inflation is at the Fed’s 2% target. In other words, as long as disinflation continues, the Fed can reduce the Fed Funds target while keeping the real policy rate restrictive, e.g., at or above the Fed’s estimate of long-term neutral (0.5%). There is every indication that inflation is not as ‘sticky’ as...

1

YaBABEYYY

liked

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$ with the markets in extreme greed, inflation dropping faster than ever before, manufacturing taking a hit, unemployment down, and housing market waiting on rates to drop...we are in a credit bubble like never seen before.

the fed is only making its trillion dollar ...

the fed is only making its trillion dollar ...

7

2

YaBABEYYY

liked

$Apple (AAPL.US)$ Still not falling, really impressive.

Translated

1

1

YaBABEYYY

liked

$AMC Entertainment (AMC.US)$ Now sell, wouldn't it be better to buy in again at $28?

Translated

2

4

YaBABEYYY

liked

$Clover Health (CLOV.US)$ A pile of duvet covers

Translated

1

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)