Yap Ooi Leong

reacted to and voted

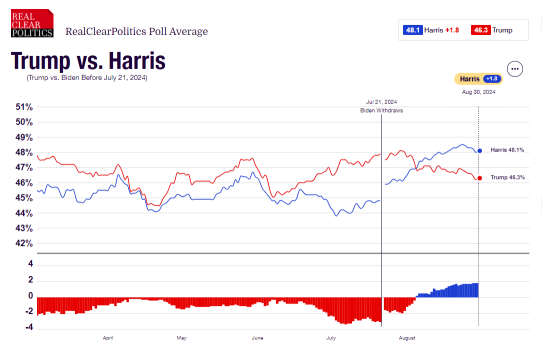

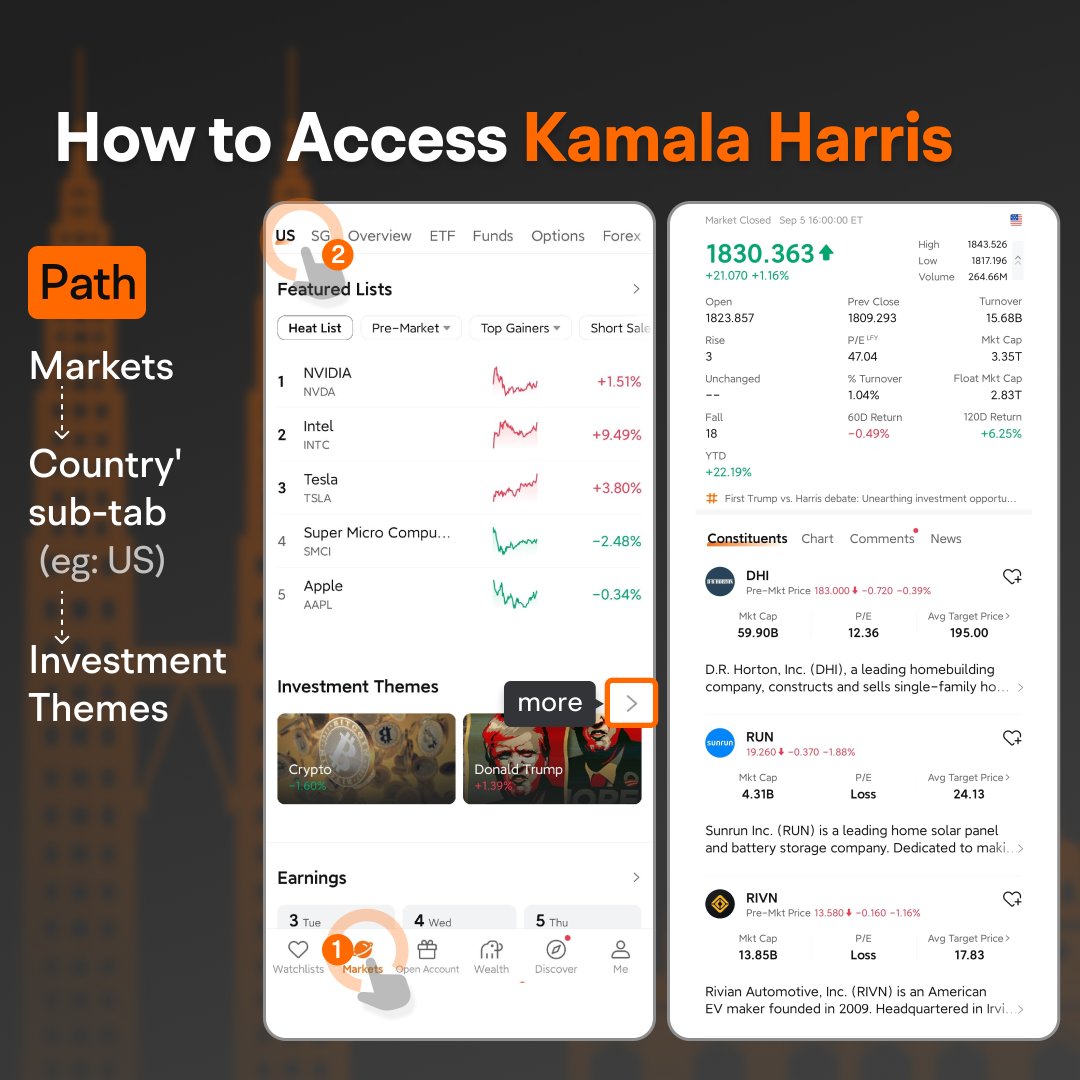

In the previous article, we introduced "Trump Trade" strategy. According to RCP poll, as of August 30, Harris's chance of being elected was 48.1%, ahead of Trump's 46.3%. At this point, it is time to talk about "Harris Trade".

Source: Realclear Polling. Data as of August 30, 2024.

![]() What are the differences in Harris's new policy?

What are the differences in Harris's new policy?

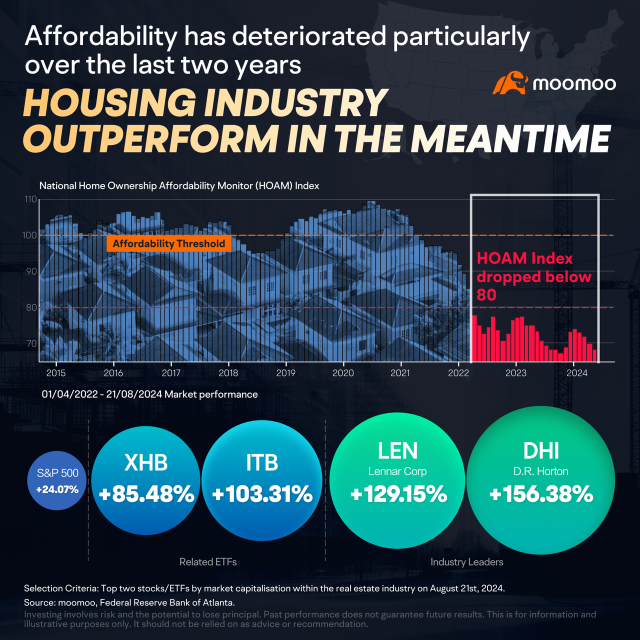

1. Core: Reducing the cost of living

In Harris's economic policy speech, the focus is on reducing ...

Source: Realclear Polling. Data as of August 30, 2024.

1. Core: Reducing the cost of living

In Harris's economic policy speech, the focus is on reducing ...

+2

410

252

56

Yap Ooi Leong

liked

What is the fair value of GENETEC? The reason for the big drop in stock price! How to use technical analysis to find bargains? [CC English Subtitles]

$GENETEC (0104.MY)$

What is the fair value of GENETEC? The reason for the big drop in stock price! How to use technical analysis to find bargains? [CC English Subtitles]

$GENETEC (0104.MY)$

What is the fair value of GENETEC? The reason for the big drop in stock price! How to use technical analysis to find bargains? [CC English Subtitles]

Translated

From YouTube

25

4

2

Yap Ooi Leong

commented on and voted

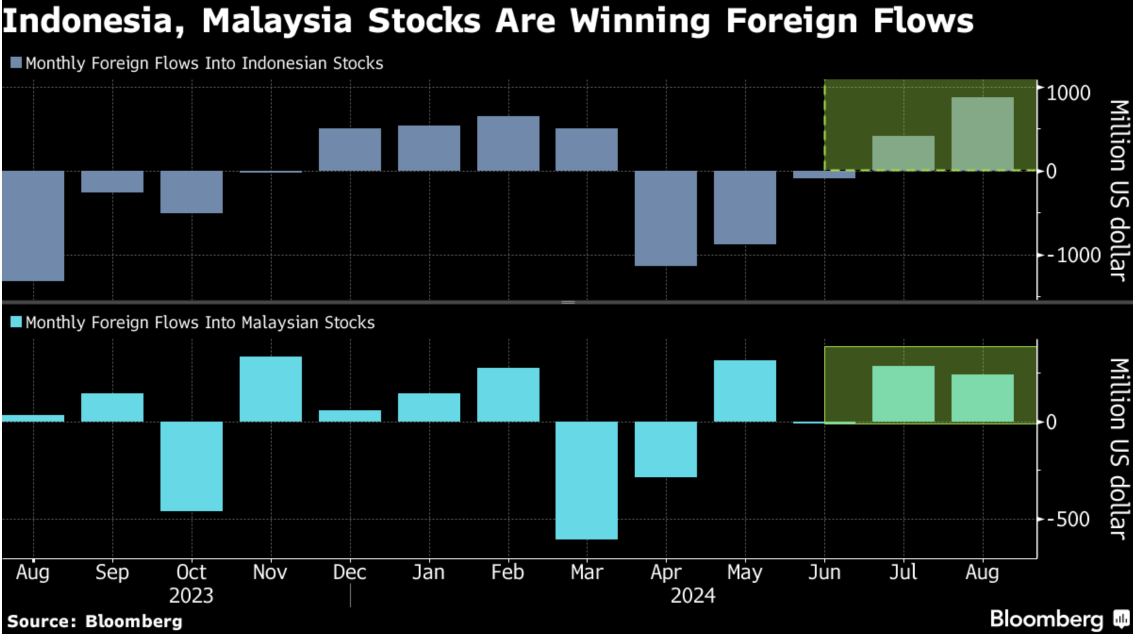

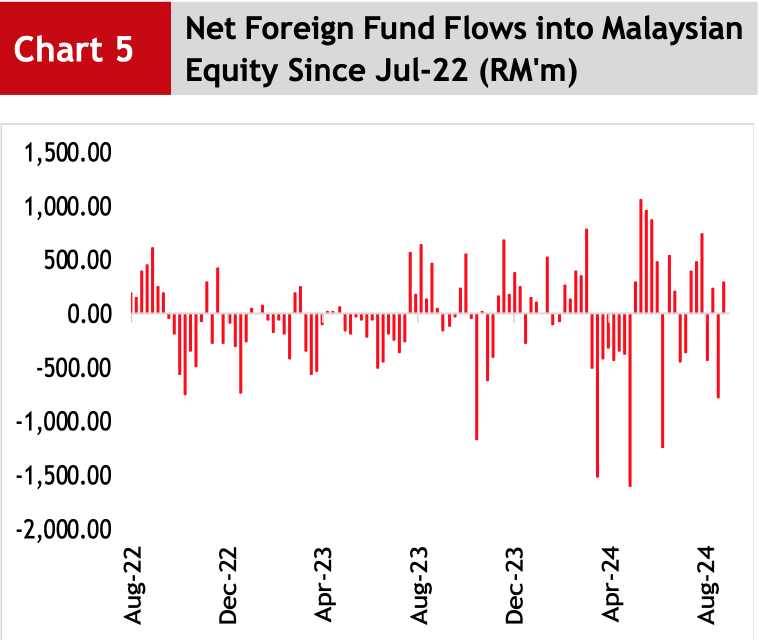

Another major international investment bank is bullish on the prospects of the Chinese stock market. Japan's Nomura Securities believes that investors should reduce their holdings of Chinese stocks and instead invest in Malaysian and Indonesian stocks.

According to analysts from Nomura Securities, including Chettan Setti and others, in a recent report, Malaysian and Indonesian stock markets are expected to benefit from the trend of accelerated rate cuts in the United States, one of the reasons for upgrading the stock market ratings of both countries from "neutral" to "buy."

Nomura Securities has also downgraded the rating of the MSCI China Index from "buy" to "neutral."

"Now is the time to make a major move into the ASEAN stock market. With the Federal Reserve about to cut interest rates and investors reigniting their interest in emerging markets, investing in the Indonesian stock market may be the best bet."

Last week, Federal Reserve Chairman Powell has issued a clear signal of interest rate cuts starting in September.

Bloomberg pointed out that before Nomura Securities raised its ratings on Malaysia's and Indonesia's stock markets, foreign capital had shown increased interest in the two countries' stock markets, with two consecutive months of inflow of foreign capital.

"Investors have good reasons to take Nomura Securities' comments seriously. In December last year, they upgraded the Taiwan stock market, and the Taiwan Weighted Index has risen by 25% this year, while the MSCI Asia Pacific Index has increased by 9.8% during the same period."

Before Nomura Securities, many internationally renowned investment banks or financial media, including JP Morgan Chase, Goldman Sachs, and Forbes, had already turned optimistic about the Malaysian market outlook.

$FTSE Taiwan50 Index (.FTTW50.TW)$

���������...

According to analysts from Nomura Securities, including Chettan Setti and others, in a recent report, Malaysian and Indonesian stock markets are expected to benefit from the trend of accelerated rate cuts in the United States, one of the reasons for upgrading the stock market ratings of both countries from "neutral" to "buy."

Nomura Securities has also downgraded the rating of the MSCI China Index from "buy" to "neutral."

"Now is the time to make a major move into the ASEAN stock market. With the Federal Reserve about to cut interest rates and investors reigniting their interest in emerging markets, investing in the Indonesian stock market may be the best bet."

Last week, Federal Reserve Chairman Powell has issued a clear signal of interest rate cuts starting in September.

Bloomberg pointed out that before Nomura Securities raised its ratings on Malaysia's and Indonesia's stock markets, foreign capital had shown increased interest in the two countries' stock markets, with two consecutive months of inflow of foreign capital.

"Investors have good reasons to take Nomura Securities' comments seriously. In December last year, they upgraded the Taiwan stock market, and the Taiwan Weighted Index has risen by 25% this year, while the MSCI Asia Pacific Index has increased by 9.8% during the same period."

Before Nomura Securities, many internationally renowned investment banks or financial media, including JP Morgan Chase, Goldman Sachs, and Forbes, had already turned optimistic about the Malaysian market outlook.

$FTSE Taiwan50 Index (.FTTW50.TW)$

���������...

Translated

29

5

6

Yap Ooi Leong

liked

Federal Reserve Chair Jerome Powell laid the groundwork Friday for interest rate cuts ahead, though he declined to provide exact indications on timing or extent.

“The time has come for policy to adjust,” the central bank leader said in his much-awaited keynote address at the Fed’s annual retreat in Jackson Hole, Wyoming. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlo...

“The time has come for policy to adjust,” the central bank leader said in his much-awaited keynote address at the Fed’s annual retreat in Jackson Hole, Wyoming. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlo...

38

2

4

Yap Ooi Leong

voted

Hey, mooers!

Curious about ETFs and trading? If you've heard about ETFs but aren't quite clear on what they are or how they differ from other investments, you're in the right place. Looking for a simple way to navigate market ups and downs, invest worldwide, tap into specific sectors, and skip the stress of picking stocks one by one? Learning about ETFs is a great start.

We've put together an easy-to-follow guide to get you from E...

Curious about ETFs and trading? If you've heard about ETFs but aren't quite clear on what they are or how they differ from other investments, you're in the right place. Looking for a simple way to navigate market ups and downs, invest worldwide, tap into specific sectors, and skip the stress of picking stocks one by one? Learning about ETFs is a great start.

We've put together an easy-to-follow guide to get you from E...

235

79

44

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)