Yvonne87

liked

$Apple (AAPL.US)$ has lagged its fellow "Magnificent 7" stocks for so long that market pundit Jim Cramer has said to "own it, don't trade it." But recently, the stock broke out of a technical pattern known as an "ascending triangle" – a potentially bullish sign.

What does AAPL's technical and fundamental analysis say might happen next? Let's that a look:

Apple's Fundamental Analysis

Is Apple's future all about its new AI-capable feature...

What does AAPL's technical and fundamental analysis say might happen next? Let's that a look:

Apple's Fundamental Analysis

Is Apple's future all about its new AI-capable feature...

11

Yvonne87

voted

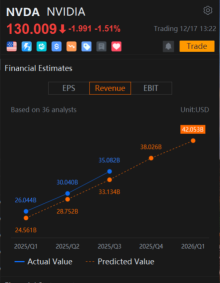

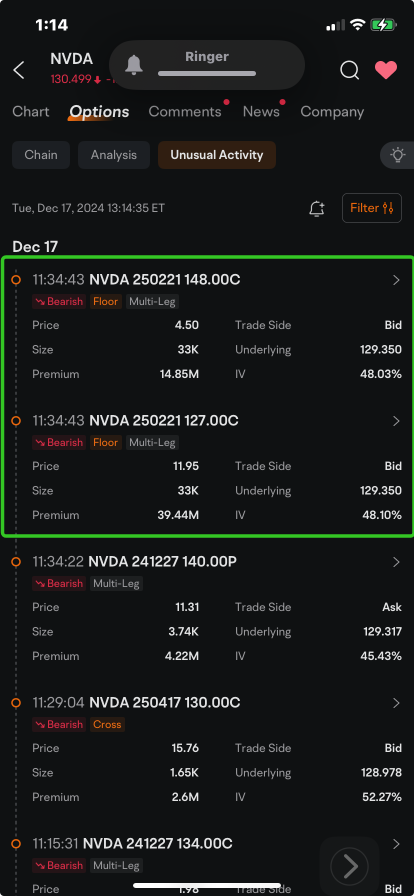

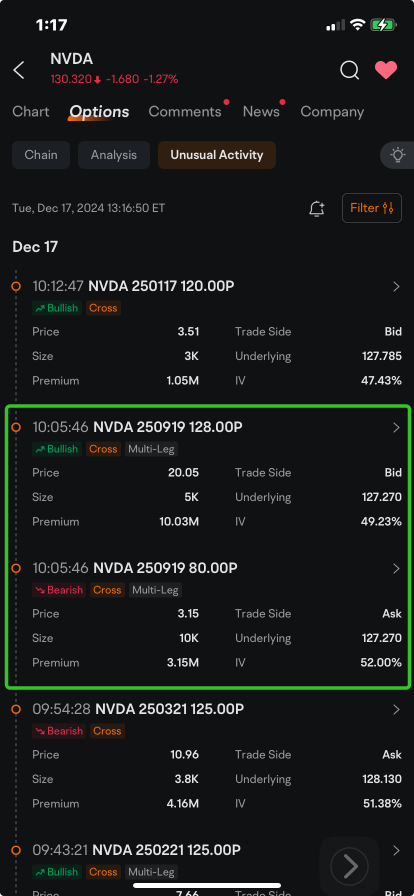

$NVIDIA (NVDA.US)$ bears are selling millions of dollars in call options that could be profitable if the stock stays on a downward trajectory through early 2025.

On Monday, Nvidia logged its seventh decline in eight sessions, taking its losses from a record close to more than 10%. That meets the technical definition of a correction. The market leader in chips that power artificial intelligence applications (AI) extended its losses,...

On Monday, Nvidia logged its seventh decline in eight sessions, taking its losses from a record close to more than 10%. That meets the technical definition of a correction. The market leader in chips that power artificial intelligence applications (AI) extended its losses,...

44

23

57

Yvonne87

liked

$SIA (C6L.SG)$ : Based on last dividends of 38 cents and coming dividends of 10 cents, that's a total of 48 cents per annum. And based on the current price of $6.34. I calculated it, and it is giving a whopping 7.57% return, where bank interest is only about 1%.

Comparatively, I think it is much worthwhile investing in SIA, isn't it !

But, surprisingly, not many institutional funds are interested. Unless SIA is doing $8.70, then the return is 5.50%, which is not worth buying.

To attract more in...

Comparatively, I think it is much worthwhile investing in SIA, isn't it !

But, surprisingly, not many institutional funds are interested. Unless SIA is doing $8.70, then the return is 5.50%, which is not worth buying.

To attract more in...

7

6

Yvonne87

liked

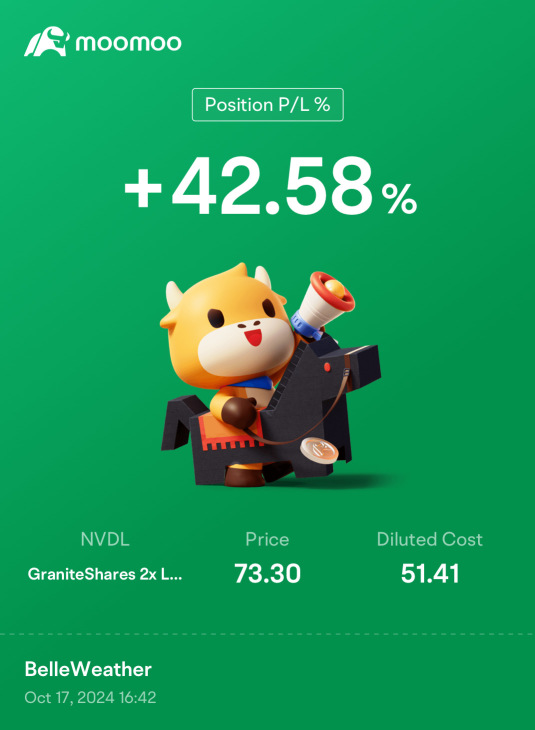

Another slightly down day in the competition, though less than 1%. Several limit orders weren’t filled, though it appears they remain active after hours. If they arent filled, I hope to be fully fake invested by tomorrow. A longterm hold in one real life portfolio, which I added to Moo Moo and the paper trade challenge:

Also, IonQ continued apace today.

Also, IonQ continued apace today.

6

Yvonne87

voted

It has been an amazing 2 years since I have joined moomoo platform! And I must say so far I have been very impressed by the returns generated by $Fullerton SGD Cash Fund (SG9999005961.MF)$!![]()

In the past few months I have been adding fresh funds into cash plus whenever there are new events or promotions organized by moomoo![]()

But lately I have noticed the yield of money market funds have been declining and so I have look into other funds with high...

In the past few months I have been adding fresh funds into cash plus whenever there are new events or promotions organized by moomoo

But lately I have noticed the yield of money market funds have been declining and so I have look into other funds with high...

+1

33

4

1

Yvonne87

voted

I am preparing to deploy my war chest to acquire more stocks as interest rates are falling and I see opportunities arising. In the meantime, I will enjoy what I can from money market funds like $Fullerton SGD Cash Fund (SG9999005961.MF)$ .

@aoimizu @阿哒 @费北敬 @Benji_123 @9333 @SSS AhHuatKopi SSS @小虎发大财 @phady05 @cslee1288 @ch0717 @Ch0501 @snoopee

@aoimizu @阿哒 @费北敬 @Benji_123 @9333 @SSS AhHuatKopi SSS @小虎发大财 @phady05 @cslee1288 @ch0717 @Ch0501 @snoopee

46

23

2

Yvonne87

voted

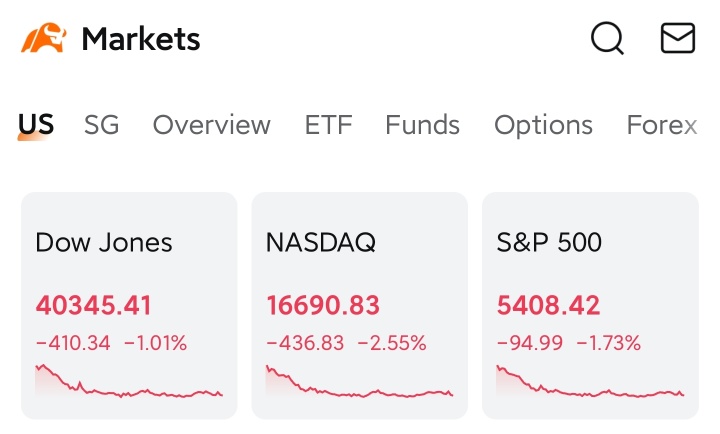

Last week, the U.S. ADP report and non-farm payroll data for August were released, indicating a slowdown in the labor market.

– Private employment: 99k (Actual), 145k (Expected);

– Non farm payrolls: 142k (Actual), 165k (Expected);

– Unemployment rate: 4.2% (2024/8) , 3.7% (2023/8).

Investor concerns about a potential recession in the U.S. have intensified, leading to a collective decline in the three major U.S. stock...

– Private employment: 99k (Actual), 145k (Expected);

– Non farm payrolls: 142k (Actual), 165k (Expected);

– Unemployment rate: 4.2% (2024/8) , 3.7% (2023/8).

Investor concerns about a potential recession in the U.S. have intensified, leading to a collective decline in the three major U.S. stock...

+3

360

184

61

Yvonne87

voted

Have u heard? They are increasing the public transport price again![]() Considering walking or cycling to save moolah and reduce carbon footpront

Considering walking or cycling to save moolah and reduce carbon footpront![]()

1. High electric bills due to climate change causing hot weather which results in more usage of aircons![]() Solution: Try to buy electrical appliances with at least 4✓ using climate vouchers courtesy of the government

Solution: Try to buy electrical appliances with at least 4✓ using climate vouchers courtesy of the government![]() Stack it with CDC supermarket vouchers if u still haven't use it

Stack it with CDC supermarket vouchers if u still haven't use it![]()

Never pay full price, add items to ...

1. High electric bills due to climate change causing hot weather which results in more usage of aircons

Never pay full price, add items to ...

48

41

2

Yvonne87

voted

So fast round #4 Liao, just 1 more round to go! This time round is divendend paying funds, previously I have tried out $Allianz Income and Growth MDis (LU0943347566.MF)$ fund and the result was not bad, usuaully for this kind of MDis funds every month u will receive dividend in the form of cash and then the fund nav dips a bit![]()

Anyway for now let us compare the other similar class income funds performances!![]()

By using the VS feature found under wealth→VS, we can easi...

Anyway for now let us compare the other similar class income funds performances!

By using the VS feature found under wealth→VS, we can easi...

37

2

2

Yvonne87

voted

Unless you also have a chauffeur, its more productive when taking public transport, you can work on the go.

Unless you are not using your own money![]() , annual depreciation should be no more than 20% of your annual income.

, annual depreciation should be no more than 20% of your annual income.

Unless you are not using your own money

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)