Zephyr1974

voted

2024 has been an extraordinary year, filled with milestones that I can only describe as rewarding. From hitting personal investment highs to building meaningful connections, here’s a look at the moments that truly made the journey special:

Rewarding Portfolio![]()

![]()

![]()

The most rewarding highlight of my investment journey this year was achieving a YTD return of 87%. As someone who typically prefers caution and doesn’t like to jinx or overly cel...

Rewarding Portfolio

The most rewarding highlight of my investment journey this year was achieving a YTD return of 87%. As someone who typically prefers caution and doesn’t like to jinx or overly cel...

+11

70

11

1

Zephyr1974

voted

Spoiler: Stay tuned until the end for a chance to earn bonus points!

Hello mooers,

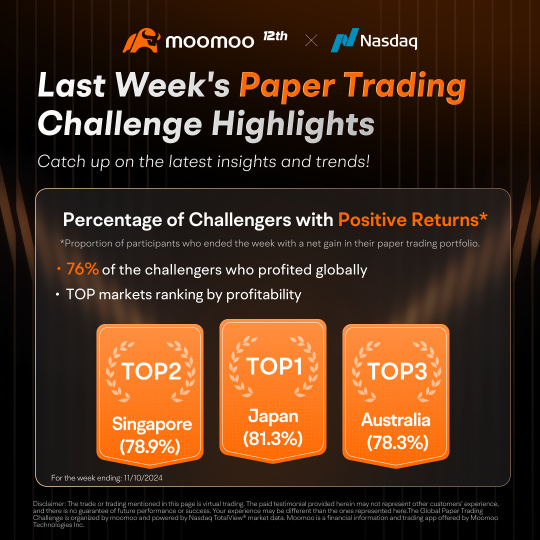

As we conclude the exhilarating final week of our Global Paper Trading Challenge, it's been a phenomenal journey observing the robust engagement and strategic prowess displayed by our participants. Let's dive into this week's wrap-up, which brings some exciting twists and opportunities for a strong finish!

Final Push with Props and Rewards

This i...

Hello mooers,

As we conclude the exhilarating final week of our Global Paper Trading Challenge, it's been a phenomenal journey observing the robust engagement and strategic prowess displayed by our participants. Let's dive into this week's wrap-up, which brings some exciting twists and opportunities for a strong finish!

Final Push with Props and Rewards

This i...

+2

73

54

3

Zephyr1974

voted

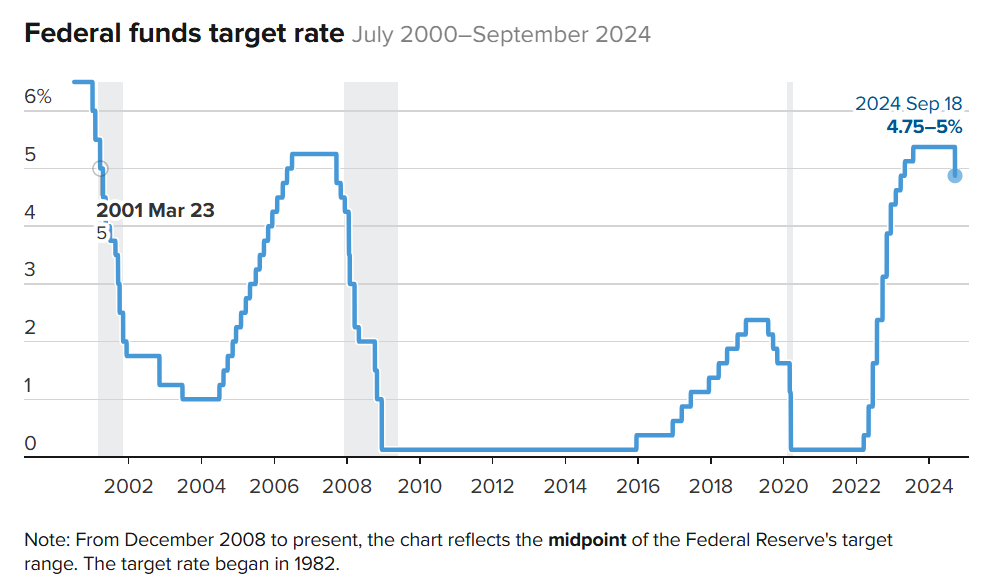

Next week could be one of the most exciting times for global stock markets! Two major events— the U.S. election and the US Fed FOMC meeting - could significantly impact market trends.

Before these events, we have an important economic announcement this Friday: the U.S. October Non-Farm Payroll (NFP) report.

1. Why is this Non-Farm Payroll report important?

2. What indicators should investors pay attention to?

3. How should t...

Before these events, we have an important economic announcement this Friday: the U.S. October Non-Farm Payroll (NFP) report.

1. Why is this Non-Farm Payroll report important?

2. What indicators should investors pay attention to?

3. How should t...

292

136

43

Zephyr1974

voted

Hi mooers! ![]()

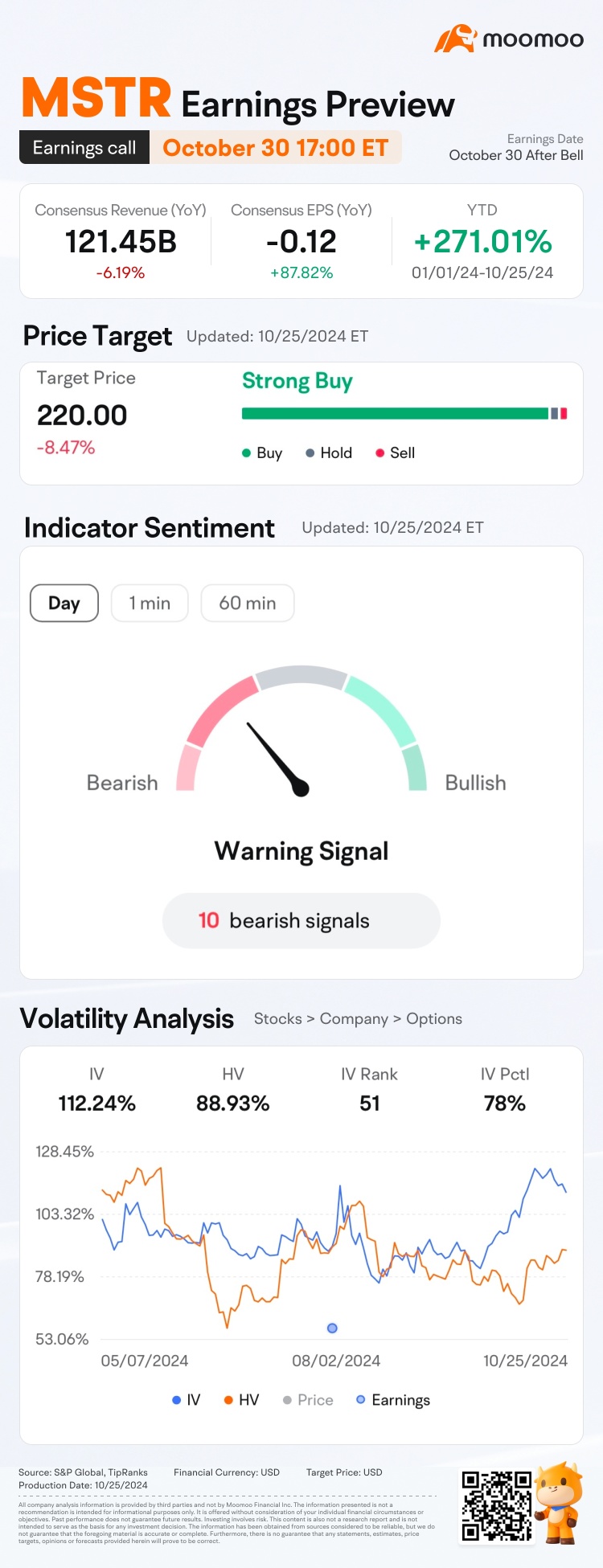

$MicroStrategy (MSTR.US)$ is releasing its Q3 earnings on October 30 after the bell. Unlock insights with MSTR Earnings Hub>>

$MicroStrategy (MSTR.US)$'s share price has risen 304.26% this year![]() , as of October 28. The recent crypto stocks and 'Trump Trade' heat has driven MSTR's price to a new high. What guidance will the MSTR management provide? Subscribe to @Moo Live and book the conference call!

, as of October 28. The recent crypto stocks and 'Trump Trade' heat has driven MSTR's price to a new high. What guidance will the MSTR management provide? Subscribe to @Moo Live and book the conference call!

For the details of...

$MicroStrategy (MSTR.US)$ is releasing its Q3 earnings on October 30 after the bell. Unlock insights with MSTR Earnings Hub>>

$MicroStrategy (MSTR.US)$'s share price has risen 304.26% this year

For the details of...

55

80

11

Zephyr1974

voted

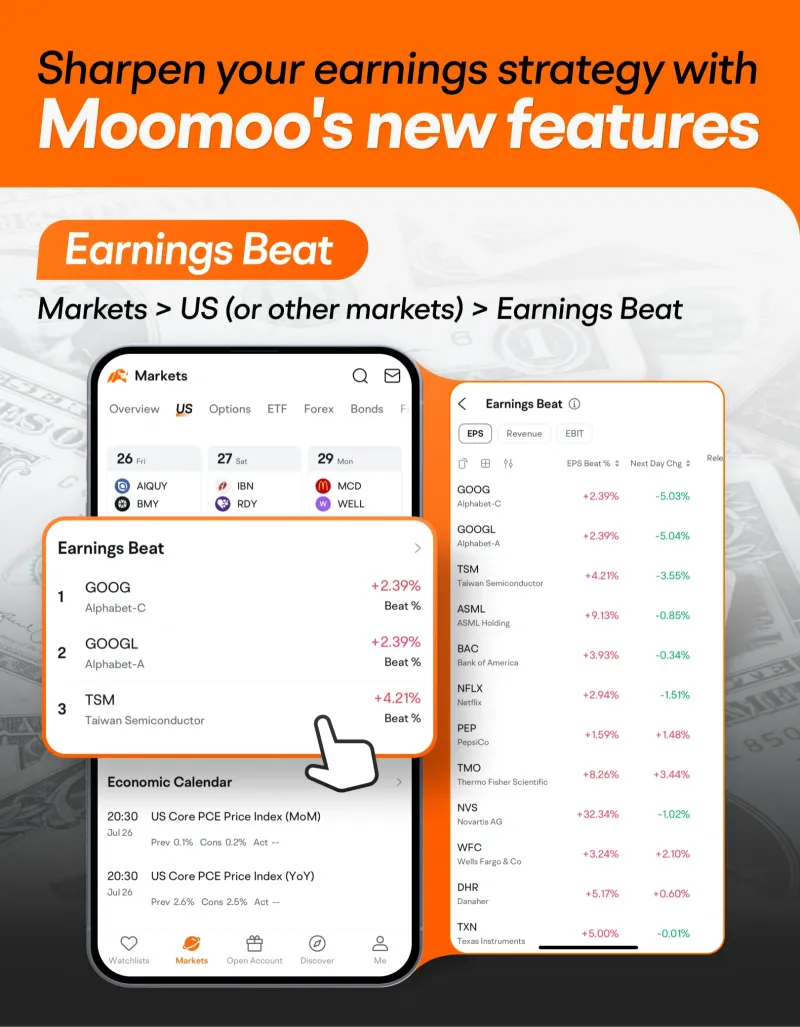

Were you tuned into our "Invest with Sarge" livestream which demystifies the art of trending stocks? If not, no worries — we've got a balanced recap to keep you in the loop and ready to tackle the market trends like a pro!

Insights into Trending Stocks

In our recent session, Sarge explored the dynamics of trending stocks such as $NVIDIA (NVDA.US)$ and $Tesla (TSLA.US)$. These stocks often gain significant attention and can present opportunitie...

66

13

16

Zephyr1974

voted

Good morning, traders. Happy Tuesday, October 15th. The market is climbing barely; bank stocks pulled in more earnings that came in above expectations, but tech and healthcare service earnings were pulling down indexes from recent records.

My name is Kevin Travers; here stonks and stories you have to know about on Wall Street Today.

$Citigroup (C.US)$ reported Q3 earnings Tuesday of $1.51 per diluted share, down...

My name is Kevin Travers; here stonks and stories you have to know about on Wall Street Today.

$Citigroup (C.US)$ reported Q3 earnings Tuesday of $1.51 per diluted share, down...

25

3

11

Zephyr1974

voted

The Chinese market has attracted increased attention in global markets, accompanied by rising volatility as more capital seeks to capitalize on potential opportunities largely driven by government measures. This environment led to a sharp rebound at the end of September, just before the National Holiday.

A specific example of this volatility: after two days of significant declines, the Chinese stock market rebounded...

A specific example of this volatility: after two days of significant declines, the Chinese stock market rebounded...

353

133

201

Zephyr1974

voted

As we sail into October, the market is a mixed bag of opportunities and challenges. Recent tensions in the Middle East have caused significant fluctuations in international oil prices. Meanwhile, China's economic stimulus measures have yet to provide sustained market momentum. With the U.S. presidential election drawing near, investors are also digesting a slew of post-rate-cut economic data. On a brighter note, the Nobel Prizes in P...

38

6

15

Zephyr1974

voted

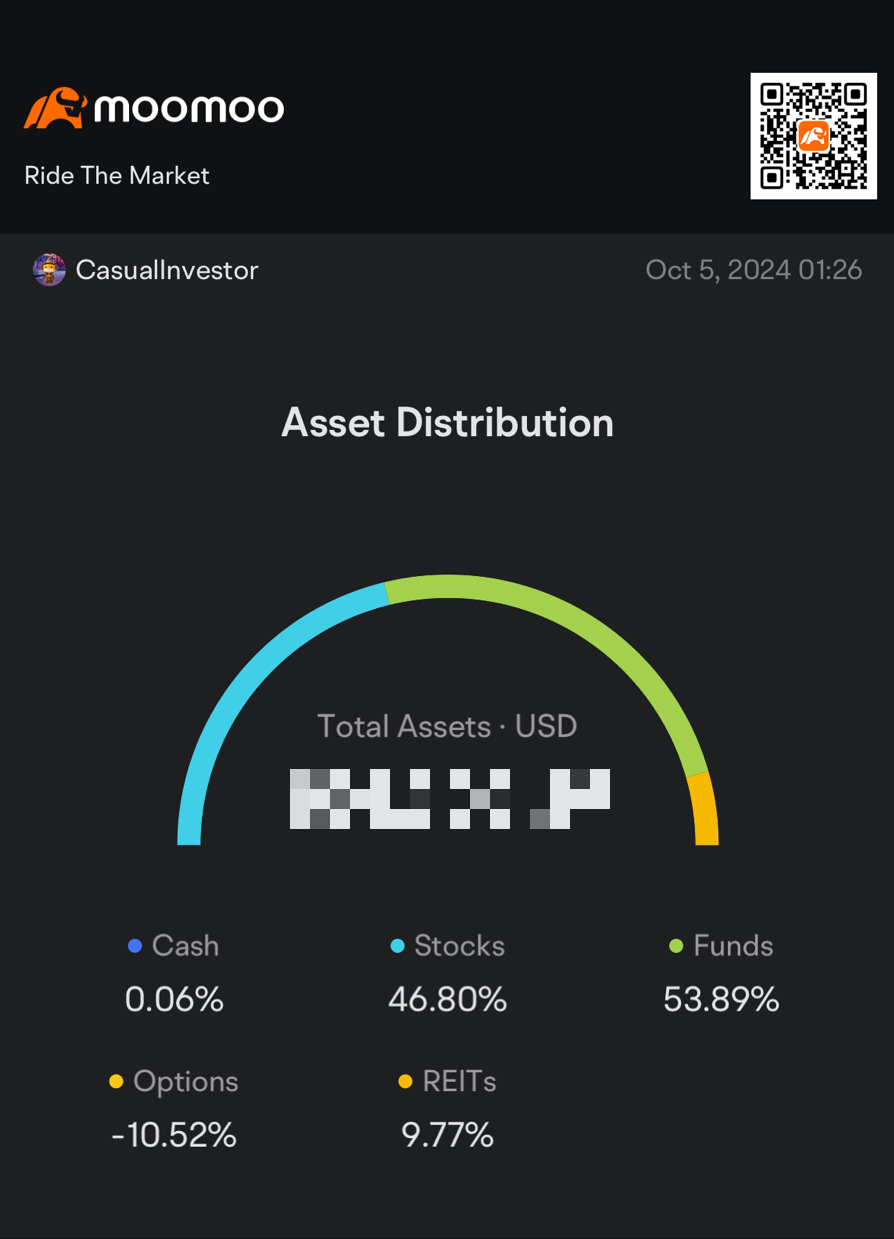

I always remind myself to review my trades and strategies each quarter. ![]()

It helps me to be disciplined, to check my positions and make adjustments timely.![]()

Securities Position: Looking good with gradual profits![]()

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .![]()

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.![]()

YTD Return:

56% So ...

It helps me to be disciplined, to check my positions and make adjustments timely.

Securities Position: Looking good with gradual profits

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.

YTD Return:

56% So ...

+3

38

13

Zephyr1974

voted

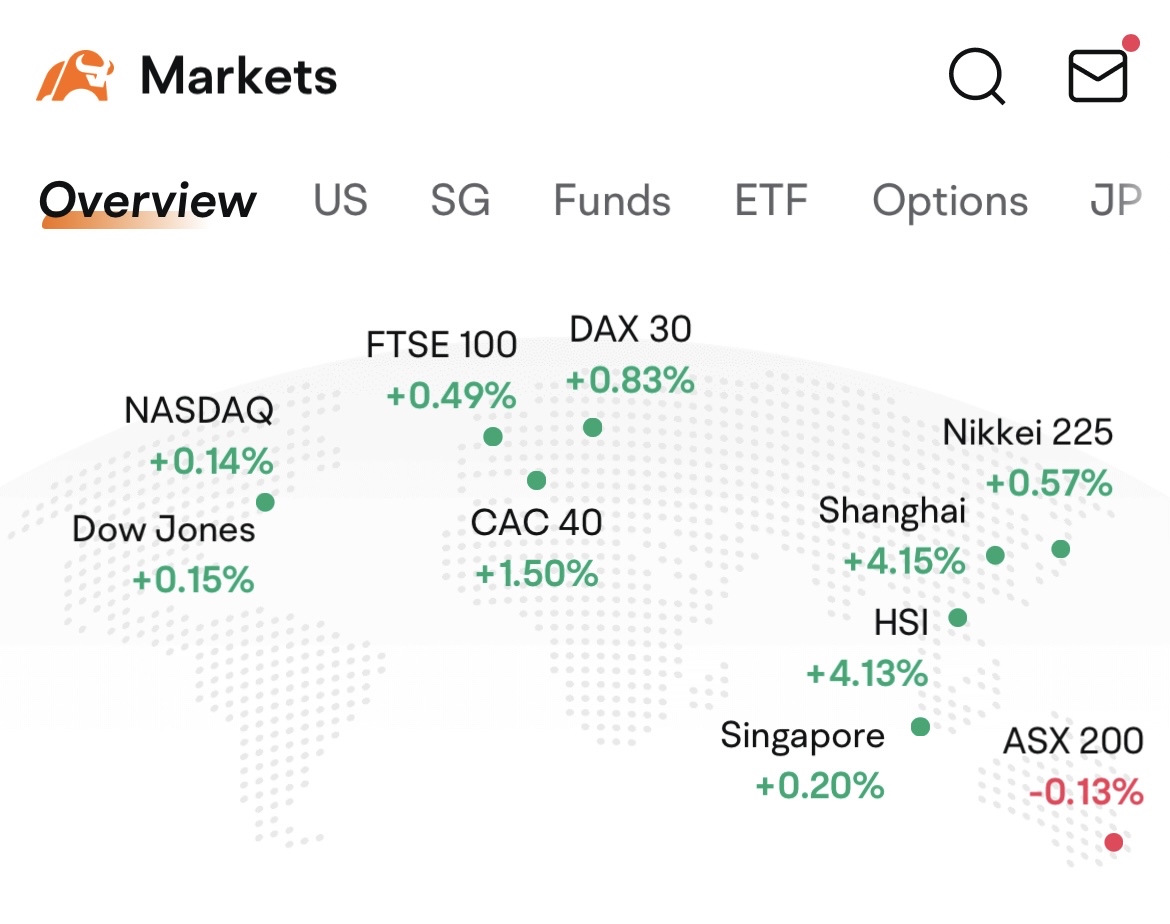

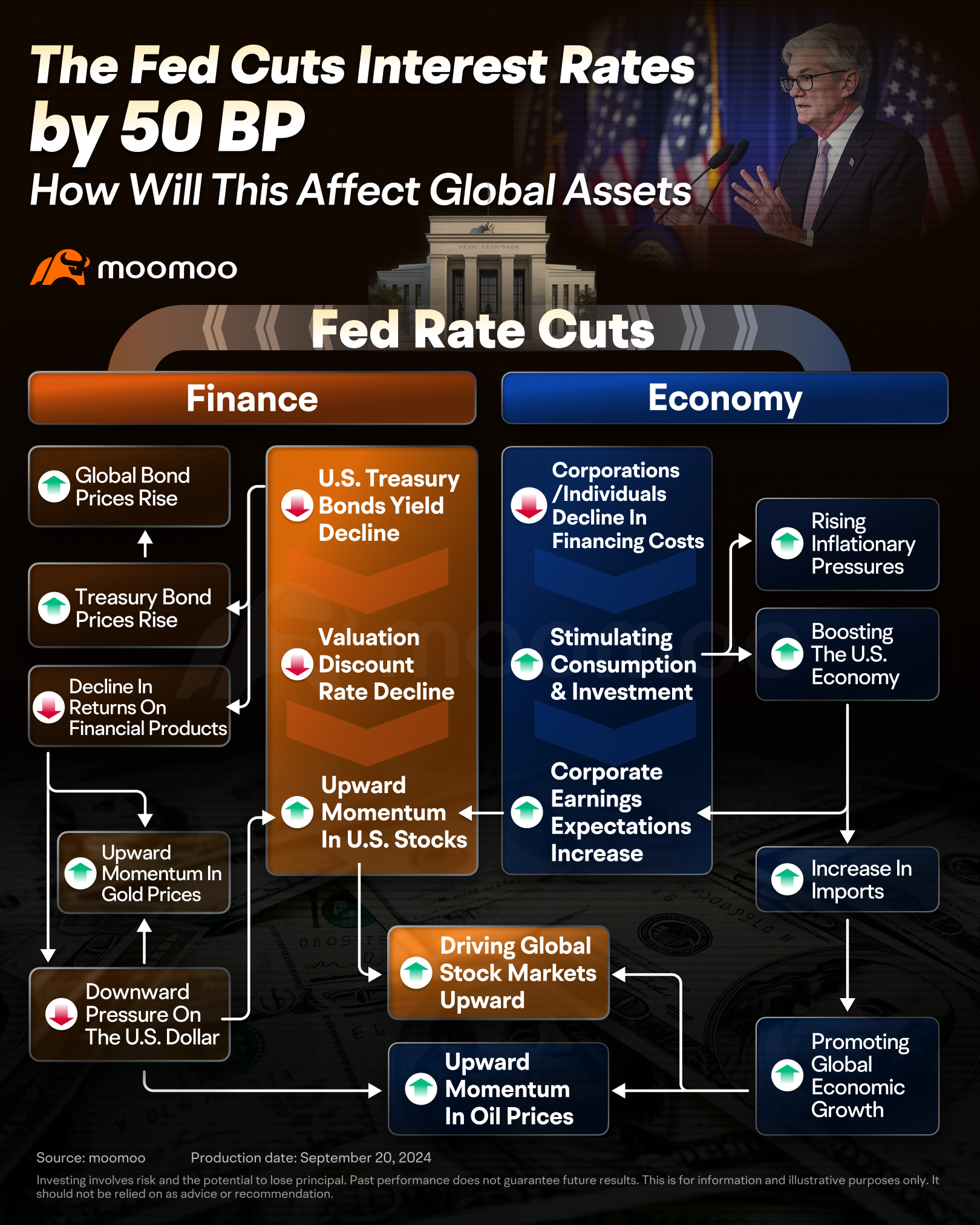

The US Federal Reserve initiated its easing cycle with 50 basis points rate cut last week. This week, Chinese markets joined the trend on Tuesday by cutting the rate by 50 basis points. This decision sparked a rally, with the $Hang Seng Index (800000.HK)$ and $SSE Composite Index (000001.SH)$ rising more than 4% in a single day. On the same day, the Reserve Bank of Australia left its cash rate unchanged at 4.35%. Howe...

+2

350

146

76

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)