On December 18, the Hong Kong Securities and Futures Commission, under a fast-track licensing process, issued licenses to four applicants considered to be licensed virtual asset trading platforms (applicants considered to be licensed). Prior to this, following the introduction of an inspection plan in June of this year, the Securities and Futures Commission of Hong Kong conducted risk-based on-site inspections of all applicants considered to be licensed. According to the licensing conditions, they must complete corrective actions based on the on-site inspection feedback from the Securities and Futures Commission before they can operate within restricted business scope. They also need to undergo vulnerability assessments and penetration testing by independent third parties and obtain satisfactory results.

Due to the effectiveness of direct communication with the senior management and ultimate control persons of virtual asset trading platforms, the Hong Kong Securities and Futures Commission will continue this practice when appointing external evaluation experts for the second-stage evaluation of virtual asset trading platforms.

Specifically, the Hong Kong Securities and Futures Commission will supervise the entire second-stage evaluation process through signing tripartite agreements with the virtual asset trading platforms and their external evaluation experts, and lift the restrictions on business scope after the Securities and Futures Commission of Hong Kong accepts the completion of the second-stage evaluation. In this regard, the Securities and Futures Commission of Hong Kong issued a circular today outlining a clear roadmap for the licensing process of virtual asset trading platforms and providing further guidance on the second-stage evaluation.

Dr. Ivan Yeung, Executive Director of the Intermediaries Division of the Hong Kong Securities and Futures Commission"We have always taken the initiative to communicate with the senior management and ultimate controllers of virtual asset trading platforms. This helps us clarify the regulatory standards they should meet and expedite the licensing process of virtual asset trading platforms...

Due to the effectiveness of direct communication with the senior management and ultimate control persons of virtual asset trading platforms, the Hong Kong Securities and Futures Commission will continue this practice when appointing external evaluation experts for the second-stage evaluation of virtual asset trading platforms.

Specifically, the Hong Kong Securities and Futures Commission will supervise the entire second-stage evaluation process through signing tripartite agreements with the virtual asset trading platforms and their external evaluation experts, and lift the restrictions on business scope after the Securities and Futures Commission of Hong Kong accepts the completion of the second-stage evaluation. In this regard, the Securities and Futures Commission of Hong Kong issued a circular today outlining a clear roadmap for the licensing process of virtual asset trading platforms and providing further guidance on the second-stage evaluation.

Dr. Ivan Yeung, Executive Director of the Intermediaries Division of the Hong Kong Securities and Futures Commission"We have always taken the initiative to communicate with the senior management and ultimate controllers of virtual asset trading platforms. This helps us clarify the regulatory standards they should meet and expedite the licensing process of virtual asset trading platforms...

Translated

The Dow Jones Industrial Average (Dow) recently experienced its worst performance since 1978, falling for nine consecutive days, causing concern. On Tuesday, the Dow fell by 267.58 points, closing at 43449.90 points, a decrease of 0.61%. Meanwhile, the S&P 500 Index and the Nasdaq Composite Index also saw significant declines of 0.39% and 0.32% respectively. This trend has drawn widespread market attention, especially with the backdrop of the Federal Reserve's upcoming interest rate decision.

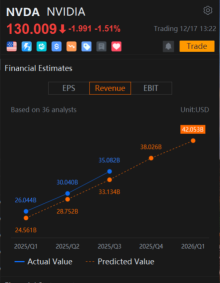

The main reason for this round of decline is the shift of funds towards technology stocks, triggering the selling of traditional economic sector stocks. These traditional stocks had performed strongly in November, but the current market sentiment shows investors are feeling uneasy about the future economic outlook. Despite a slight uptick of 0.15% in the technology sector index, newcomers to the Dow like NVIDIA are facing correction pressure, indicating market confidence in tech stocks is not stable.

David Russell, TradeStation's Global Market Strategy Director, stated that the market is gradually realizing that some events are not as favorable for the stock market as investors hoped. The strong performance of financial and industrial sector stocks since early November might now be impacted by higher interest rates and trade uncertainty. Additionally, the healthcare sector is facing significant risks, adding more uncertainty to the market.

As the Federal Reserve is about to hold an interest rate meeting, market expectations for interest rate policies are heating up again. According to the FedWatch tool of the CME Group...

The main reason for this round of decline is the shift of funds towards technology stocks, triggering the selling of traditional economic sector stocks. These traditional stocks had performed strongly in November, but the current market sentiment shows investors are feeling uneasy about the future economic outlook. Despite a slight uptick of 0.15% in the technology sector index, newcomers to the Dow like NVIDIA are facing correction pressure, indicating market confidence in tech stocks is not stable.

David Russell, TradeStation's Global Market Strategy Director, stated that the market is gradually realizing that some events are not as favorable for the stock market as investors hoped. The strong performance of financial and industrial sector stocks since early November might now be impacted by higher interest rates and trade uncertainty. Additionally, the healthcare sector is facing significant risks, adding more uncertainty to the market.

As the Federal Reserve is about to hold an interest rate meeting, market expectations for interest rate policies are heating up again. According to the FedWatch tool of the CME Group...

Translated

9

Zhang Luna

commented on

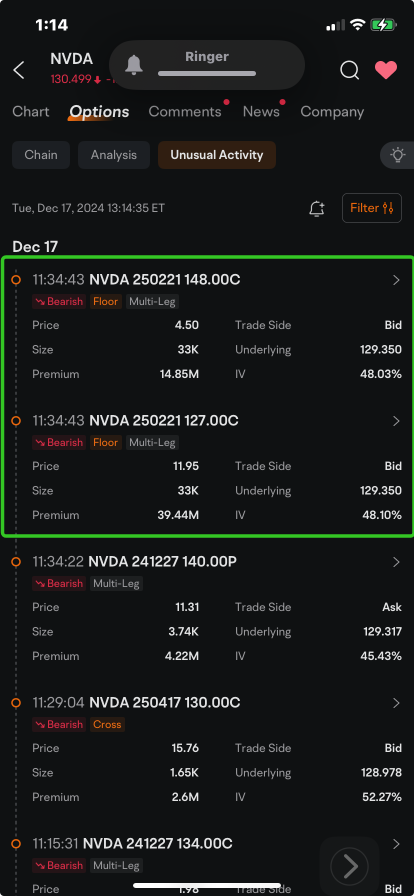

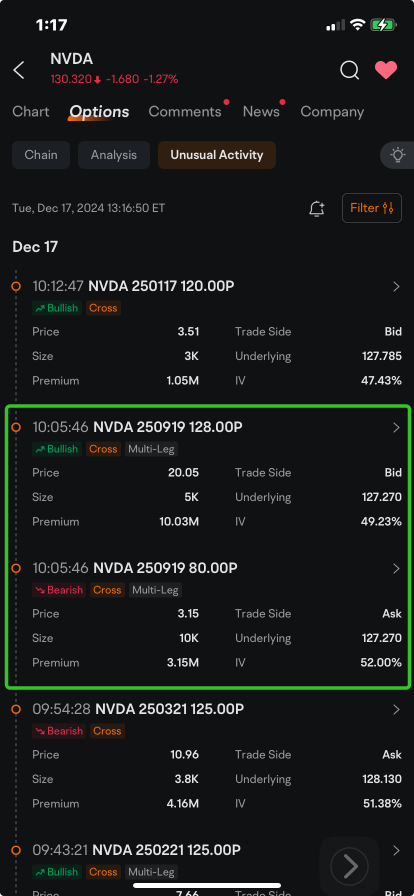

$NVIDIA (NVDA.US)$ bears are selling millions of dollars in call options that could be profitable if the stock stays on a downward trajectory through early 2025.

On Monday, Nvidia logged its seventh decline in eight sessions, taking its losses from a record close to more than 10%. That meets the technical definition of a correction. The market leader in chips that power artificial intelligence applications (AI) extended its losses,...

On Monday, Nvidia logged its seventh decline in eight sessions, taking its losses from a record close to more than 10%. That meets the technical definition of a correction. The market leader in chips that power artificial intelligence applications (AI) extended its losses,...

41

21

57

Zhang Luna

commented on

$Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares (DRIP.US)$ for the life of me I can't figure out what happened with this ETF.

I was pounding the table and I still believe in this ETF as a Trump trade.

Trump made it very clear drill baby drill he said it countless times while he was campaigning.

November 5th we have our new president elect November 6th oil prices declined we were $72 over the next week and a half two weeks we went down to 68 and change and this ETF traded down.

it ta...

I was pounding the table and I still believe in this ETF as a Trump trade.

Trump made it very clear drill baby drill he said it countless times while he was campaigning.

November 5th we have our new president elect November 6th oil prices declined we were $72 over the next week and a half two weeks we went down to 68 and change and this ETF traded down.

it ta...

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)