Zoyoyo

liked and commented on

Good morning mooers! Here are things you need to know about today's Singapore:

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

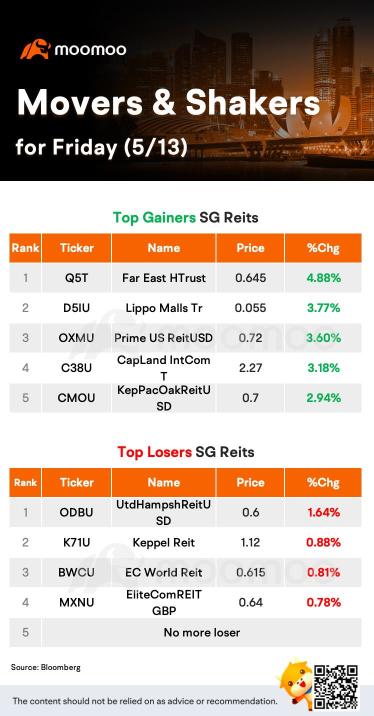

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

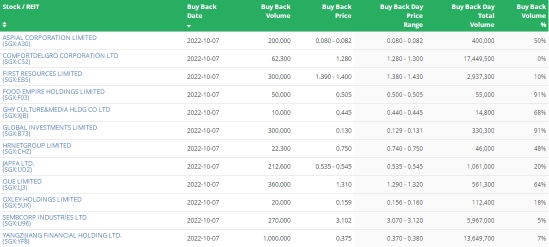

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

1446

1387

Zoyoyo

liked and commented on

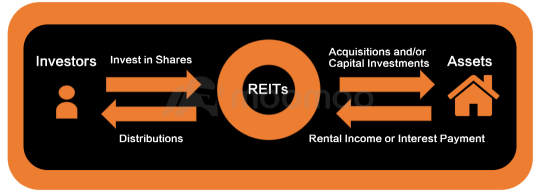

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

1537

1277

Zoyoyo

liked

Buffet has this saying that those who diversify get average returns, if you want supernormal returns, you must go heavy on the winners. This would mean that we instead of going the risk-adverse route of investing with ETFs and index funds, we should be picking stocks that has the potential to multi-bag. Right now, i think that the crypo is up for another bull run, and given that the stock2flow model has been proven correct 4/4 times, i'm going all into crypto.

Following this logic, I would allocate a significant portion of my funds into crypo assets, which includes the actual coins (BTC(20%) ETH(10%) SHIB(20%)), Crypto miners ( $MARA Holdings (MARA.US)$ 20%. $Hut 8 (HUT.US)$ 10%, $Riot Platforms (RIOT.US)$ 10%, $Hive Blockchain (HIVE.US)$ 10%).

If you backtest it portfolio, and had bought this at the start of the year, you would be multibagging right now.

Following this logic, I would allocate a significant portion of my funds into crypo assets, which includes the actual coins (BTC(20%) ETH(10%) SHIB(20%)), Crypto miners ( $MARA Holdings (MARA.US)$ 20%. $Hut 8 (HUT.US)$ 10%, $Riot Platforms (RIOT.US)$ 10%, $Hive Blockchain (HIVE.US)$ 10%).

If you backtest it portfolio, and had bought this at the start of the year, you would be multibagging right now.

17

6

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Zoyoyo : Gg