zzgundam

voted

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

1495

304

22

zzgundam

voted

Hey mooer! Attention AI enthusiasts, $NVIDIA (NVDA.US)$ GTC 2025 is coming! 🚀

NVIDIA GTC 2025 is returning to San Jose from March 17-21, bringing together industry leaders to explore the future of quantum computing and AI. This premier event offers a unique opportunity to dive deep into cutting-edge technologies that are shaping our future.

Highlights:

– Keynote speech by NVIDIA CEO Jensen Huang (March 18, 10:00 a.m. PT) on the topic "Driving t...

NVIDIA GTC 2025 is returning to San Jose from March 17-21, bringing together industry leaders to explore the future of quantum computing and AI. This premier event offers a unique opportunity to dive deep into cutting-edge technologies that are shaping our future.

Highlights:

– Keynote speech by NVIDIA CEO Jensen Huang (March 18, 10:00 a.m. PT) on the topic "Driving t...

GTC Keynote With NVIDIA CEO Jensen Huang

Mar 19 01:00

366

340

61

zzgundam

voted

The Chinese market has attracted increased attention in global markets, accompanied by rising volatility as more capital seeks to capitalize on potential opportunities largely driven by government measures. This environment led to a sharp rebound at the end of September, just before the National Holiday.

A specific example of this volatility: after two days of significant declines, the Chinese stock market rebounded...

A specific example of this volatility: after two days of significant declines, the Chinese stock market rebounded...

352

136

201

zzgundam

voted

Hi, mooers!

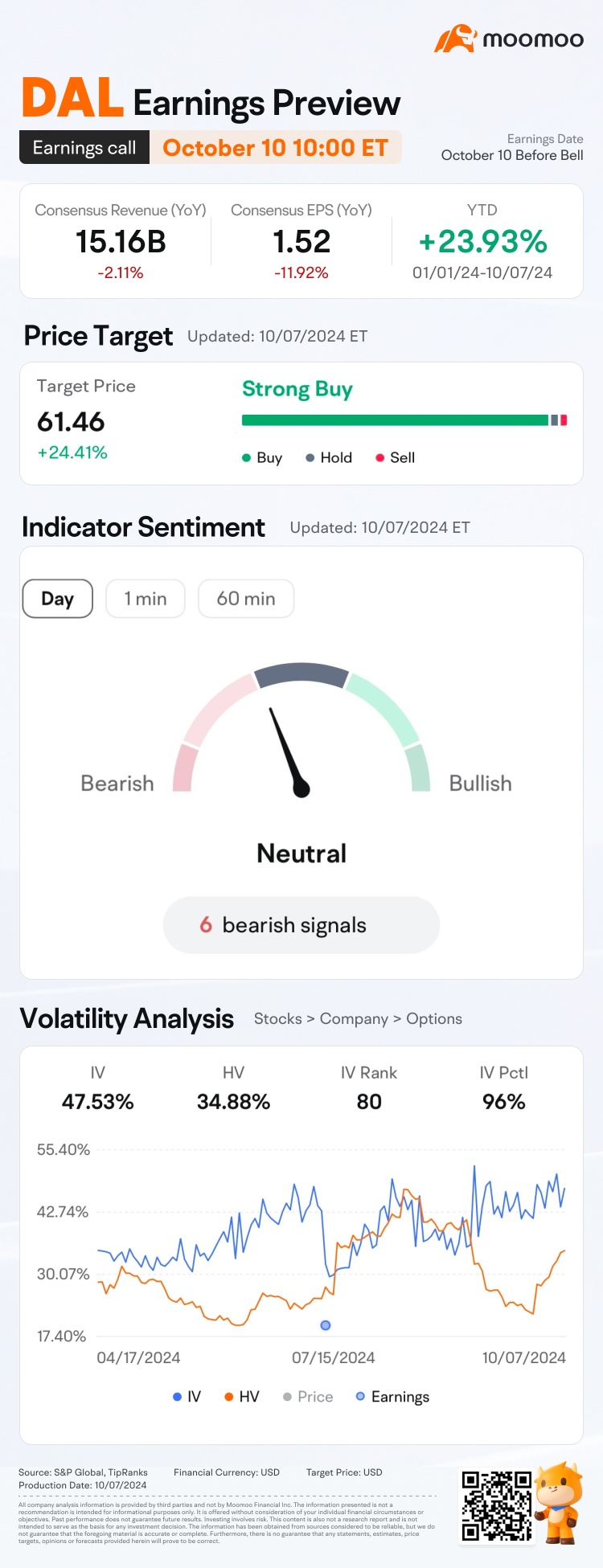

$Delta Air Lines (DAL.US)$ is releasing its Q3 2024 earnings on October 10 before the bell. Unlock insights with DAL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Delta Air Lines (DAL.US)$ have seen an increase of 15.42%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: Fo...

$Delta Air Lines (DAL.US)$ is releasing its Q3 2024 earnings on October 10 before the bell. Unlock insights with DAL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Delta Air Lines (DAL.US)$ have seen an increase of 15.42%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: Fo...

Expand

Expand 51

91

10

zzgundam

voted

Since late September, a series of favorable economic policies from the Chinese government have propelled related markets upward.

The $Hang Seng Index (800000.HK)$ has rose 10.2% this week, hitting a two-and-a-half-year high, while the $NASDAQ Golden Dragon China (.HXC.US)$ climbed 11.85%.

Many analysts believe that the Chinese market still holds significant upside potential, with Chinese concept stocks, Hong Kong Stocks, and China A-s...

The $Hang Seng Index (800000.HK)$ has rose 10.2% this week, hitting a two-and-a-half-year high, while the $NASDAQ Golden Dragon China (.HXC.US)$ climbed 11.85%.

Many analysts believe that the Chinese market still holds significant upside potential, with Chinese concept stocks, Hong Kong Stocks, and China A-s...

+2

24

14

46

zzgundam

voted

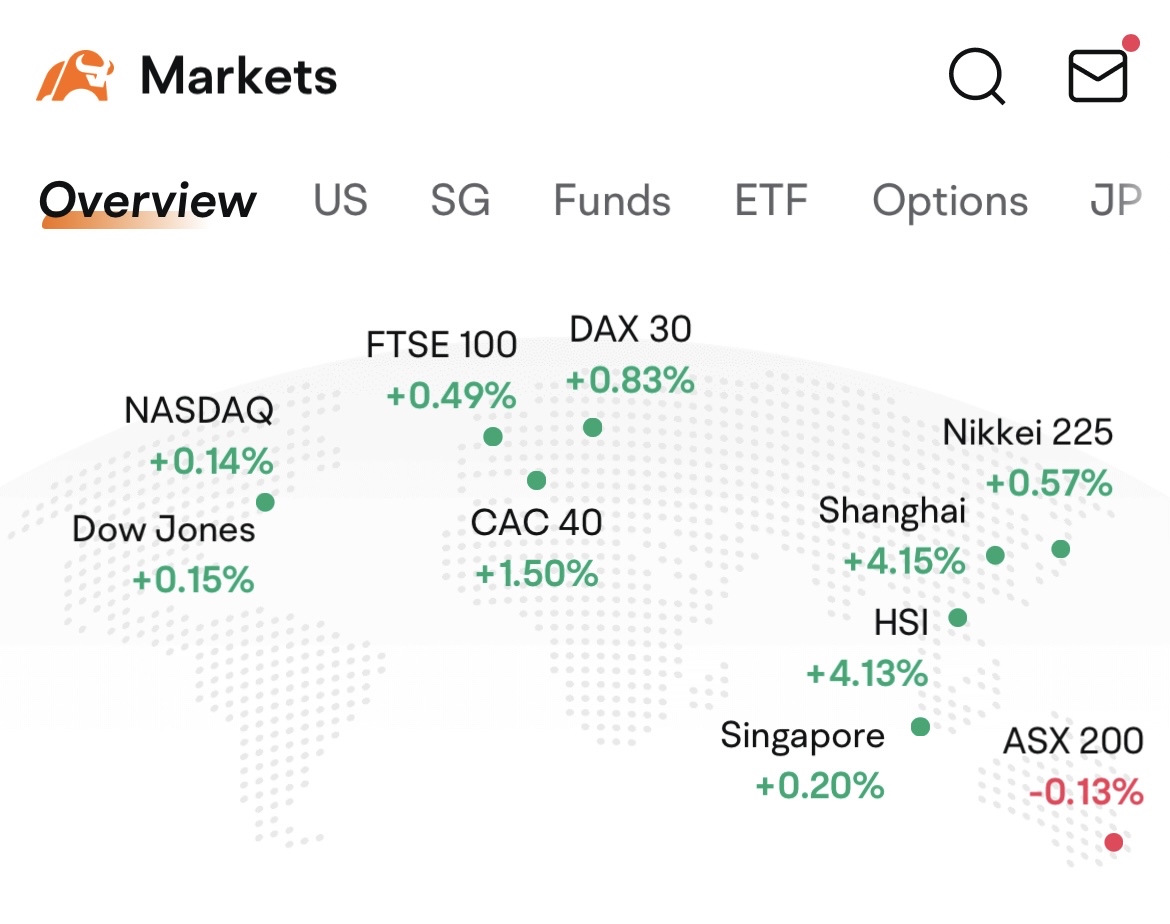

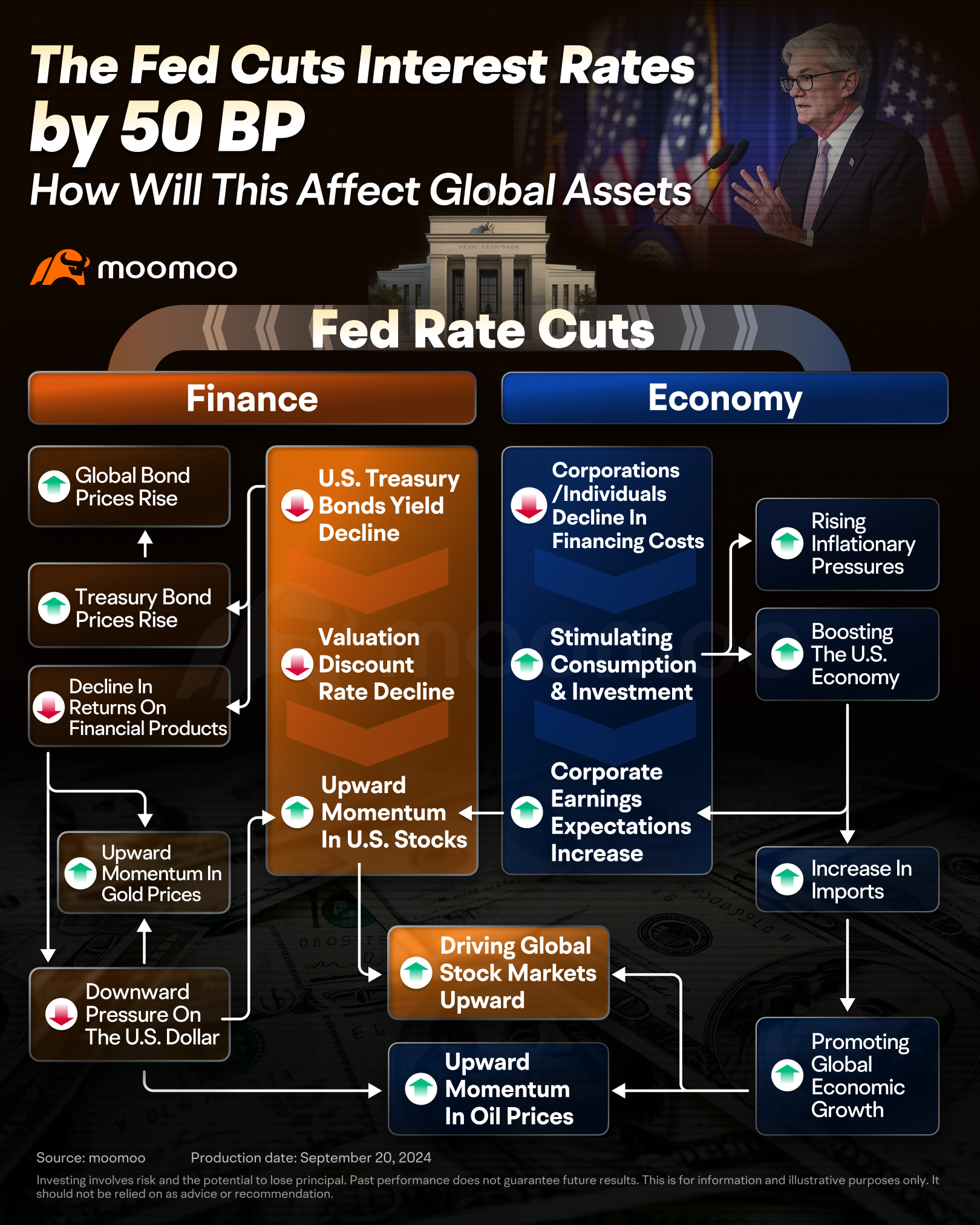

The US Federal Reserve initiated its easing cycle with 50 basis points rate cut last week. This week, Chinese markets joined the trend on Tuesday by cutting the rate by 50 basis points. This decision sparked a rally, with the $Hang Seng Index (800000.HK)$ and $SSE Composite Index (000001.SH)$ rising more than 4% in a single day. On the same day, the Reserve Bank of Australia left its cash rate unchanged at 4.35%. Howe...

+2

350

145

76

zzgundam

commented on and voted

TSM is releasing its Q2 earnings on July 18 before the bell.

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

Expand

Expand 154

260

29

zzgundam

voted

Hey there, mooers! Welcome back to "What's new in moomoo"!

This latest update brings improvements to our ETF features – great news for ETF users!

Notably, we’ve recently added an ETF section under “Markets> ETFs” where you can find Index ETFs, ETF Heat Map, Featured List, and Leveraged & Inverse ETFs. Already checked it out? Tell us what you think in the comments!

To thank you for your feedback, we’re giving out 88 points to...

This latest update brings improvements to our ETF features – great news for ETF users!

Notably, we’ve recently added an ETF section under “Markets> ETFs” where you can find Index ETFs, ETF Heat Map, Featured List, and Leveraged & Inverse ETFs. Already checked it out? Tell us what you think in the comments!

To thank you for your feedback, we’re giving out 88 points to...

Expand

Expand 56

58

9

zzgundam

reacted to

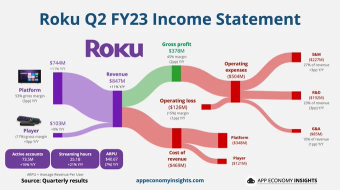

$Roku Inc (ROKU.US)$ Roku Q2 FY23:

• Active accounts +16% Y/Y to 73.5M.

• Streaming hours +21% Y/Y to 25.1B.

• ARPU -7% Y/Y to $40.67 TTM.

• Revenue +11% Y/Y to $847M ($72M beat).

• Operating margin -15% (-1pp Y/Y).

• EPS -$0.76 ($0.51 beat).

Q3 FY23 Revenue guidance $815M (+7% Y/Y).

• Active accounts +16% Y/Y to 73.5M.

• Streaming hours +21% Y/Y to 25.1B.

• ARPU -7% Y/Y to $40.67 TTM.

• Revenue +11% Y/Y to $847M ($72M beat).

• Operating margin -15% (-1pp Y/Y).

• EPS -$0.76 ($0.51 beat).

Q3 FY23 Revenue guidance $815M (+7% Y/Y).

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)