No Data

BDXB Becton, Dickinson and Co

- 48.400

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

10-K: FY2024 Annual Report

Wells Fargo Adjusts Becton, Dickinson and Co. Price Target to $275 From $280, Maintains Overweight Rating

Fill Finish Manufacturing Strategic Business Report 2023-2030 With Focus on 45+ Select Players Including Bausch+Strobel Maschinenfabrik Ilshofen, Becton, Dickinson and Co, & Gerresheimer Among Others - ResearchAndMarkets.com

10-Q: Q3 2024 Earnings Report

Express News | Becton, Dickinson and Co Files for Offering of $600 Mln 5.081% Notes Due 2029 - SEC Filing

Form 144 | Becton Dickinson & Co(BDX.US) Officer Proposes to Sell 775.5K in Common Stocks

SEC FILLINGS DISCLOSED/ May 15, $Becton Dickinson & Co(BDX.US)$、$Becton, Dickinson and Co(BDXB.US)$ Officer ROLAND FRIEDRICH CARL GOETTECHEMIN OCHE COMBE 4 intends to sell 3,300 shares of its common s

Comments

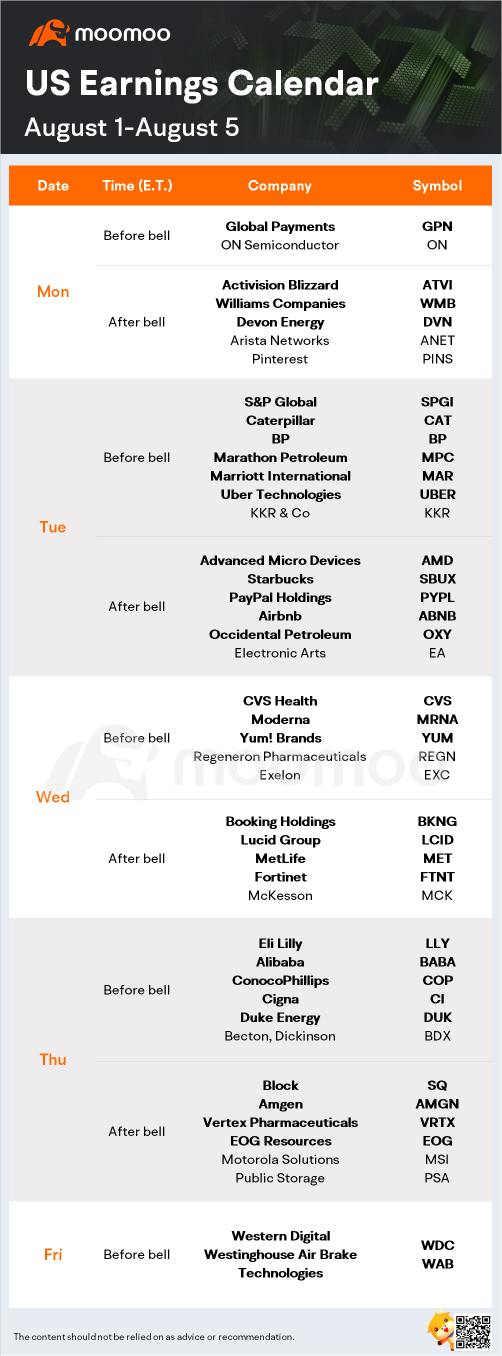

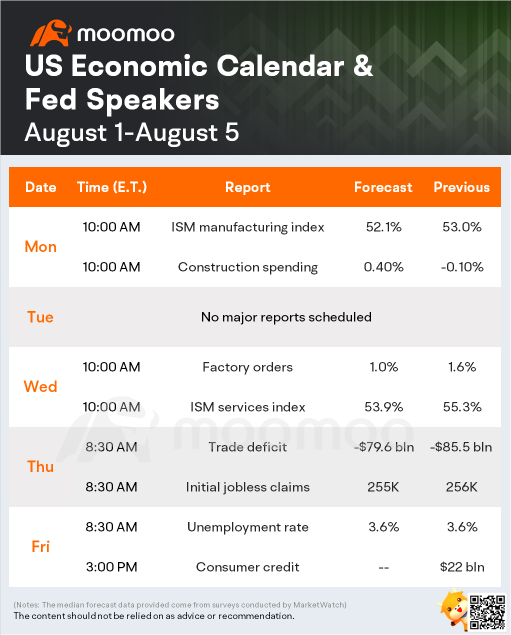

It's the peak stretch of second-quarter earnings season, with roughly 150 S&P 500 firms scheduled to report this week. The highlights on the economic calendar will be a pair of purchasing managers' index readings and jobs Friday.

Economic data out this week will include the Institute for Supply Management's Manufacturing Purchasing Managers' Index for July on Monday, followed by the Services PMI on Wednesday. Both me...

U.S. stock futures rose slightly in overnight trading on Sunday as investors readied for the first trading of November. Market participants are gearing up for another week of corporate earnings, a key Federal Reserve meeting on Wednesday and October’s jobs report.

Stocks closed out the month of October on Friday and all three major averages closed at record highs. The $S&P 500 Index (.SPX.US)$and $Nasdaq Composite Index (.IXIC.US)$clinched their best months since November 2020.

Corporate earnings season dominated October amid solid earnings even with global supply chain concerns. About half of the S&P 500 companies have reported quarterly results and more than 80% of them beat earnings estimates from Wall Street analysts, according to Refinitiv.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

There will be a lot on investors' radar this week, as third-quarter earnings season continues, October jobs numbers come out, and the Federal Reserve's policy committee potentially details its bond purchase reduction plans.

Some 160 S&P 500 companies are scheduled to report, plus dozens of small and mid cap firms.

The main event on the market calendar this week will be the conclusion of the Federal Open Market Committee's October monetary-policy meeting on Wednesday. Officials have strongly signalled that they will announce their plans to begin tapering the central bank's $120 billion in monthly asset purchases at the meeting. Interest-rate increases are still far off.

Monday 11/1

$Arista Networks (ANET.US)$, $Clorox (CLX.US)$, $Franklin Resources (BEN.US)$, $McKesson (MCK.US)$, $NXP Semiconductors (NXPI.US)$, $Public Storage (PSA.US)$, $SBA Communications Corp (SBAC.US)$, and $Simon Property Group Acquisition (SPGS.US)$release quarterly results.

The Census Bureau reports construction spending for September. Consensus estimate is for a 0.4% month-over-month increase to a seasonally adjusted annual rate of $1.59 trillion.

The Institute for Supply Management releases its Manufacturing Purchasing Managers Index for October. Expectations are for a 60.1 reading, slightly less than the September figure.

Tuesday 11/2

$Activision Blizzard (ATVI.US)$, $Amgen (AMGN.US)$, $ConocoPhillips (COP.US)$, $Eaton (ETN.US)$, $Estee Lauder (EL.US)$, $Ferrari (RACE.US)$, $Match group (MTCH.US)$, $Mondelez International (MDLZ.US)$, $Pfizer (PFE.US)$, and $T-Mobile US (TMUS.US)$US report earnings.

It's Election Day in an off-year headlined by gubernatorial contests in New Jersey and Virginia.

Wednesday 11/3

The FOMC announces its monetary-policy decision. The Fed is all but certain to maintain the federal-funds rates near zero and is expected to announce it will begin tapering its $120 billion in monthly asset purchases.

$Coca-Cola (KO.US)$holds a conference call to discuss its ESG initiatives.

$Booking Holdings (BKNG.US)$, $CVS Health (CVS.US)$, $Electronic Arts Inc (EA.US)$, $Emerson Electric (EMR.US)$, $Marriott International (MAR.US)$, $MetLife (MET.US)$, $MGM Resorts International (MGM.US)$, and $Qualcomm (QCOM.US)$announce quarterly results.

ISM releases its Services PMI for October. Economists forecast a 61.5 reading, roughly even with the September number.

ADP releases its National Employment Report for October. Consensus estimate is for private-sector employment to gain 472,500 jobs, after a 568,000 rise in September.

Thursday 11/4

$Airbnb (ABNB.US)$, $Becton, Dickinson and Co (BDXB.US)$, $Expedia (EXPE.US)$, $Illumina (ILMN.US)$, $Kellanova (K.US)$, $Moderna (MRNA.US)$, $NRG Energy (NRG.US)$, $Block (SQ.US)$, $ViacomCBS (VIAC.US)$, $Uber Technologies (UBER.US)$, and $Zoetis (ZTS.US)$hold conference calls to discuss earnings.

Friday 11/5

$Dominion Energy Inc (DCUE.US)$, $DraftKings (DKNG.US)$, and $Sempra Energy (SRE.US)$release quarterly results.

The Bureau of Labor Statistics releases the jobs report for October. Economists forecast a 435,000 gain for nonfarm payrolls and for the unemployment rate to remain unchanged at 4.8%. In September, the economy added 194,000 jobs, about 300,000 short of estimates. Both August and September had large shortfalls compared with expectations, as the labor shortage has persisted longer than many economists expected, despite a near-record level of job openings.

Source: CNBC, Barron's

Analysis

Price Target

No Data

No Data

71415167 :

Hodlers Scorn : Thank you.