最新

热门

• Last week, data released were mixed.

• Conference Board Consumer Index exceeded expectations, reaching 103.3 in August (vs consensus 100.7).

• While labor market conditions worsened as July’s labor market differential revised down to 17.1% and further declining to 16.4% in August, jobless claims remained steady, indicating no sudden worsening in job market conditions.

• Additionally, US real GDP growth for the second quarter was adjusted upwards by 0.2 per...

• Conference Board Consumer Index exceeded expectations, reaching 103.3 in August (vs consensus 100.7).

• While labor market conditions worsened as July’s labor market differential revised down to 17.1% and further declining to 16.4% in August, jobless claims remained steady, indicating no sudden worsening in job market conditions.

• Additionally, US real GDP growth for the second quarter was adjusted upwards by 0.2 per...

16

- 📈 The Dow Jones and S&P 500 indices recorded their most impressive performance in two weeks, securing significant gains for investors.

- 💰 Despite a lackluster 7-year Treasury note auction, the stock market received a boost from a decline in Treasury yields, contributing to its upward trajectory.

- 🛢️ A notable retreat in oil prices further bolstered the market's positive outlook, alleviating concerns related to inflation.

- 📊 Technology stocks demonstrated resilience...

- 💰 Despite a lackluster 7-year Treasury note auction, the stock market received a boost from a decline in Treasury yields, contributing to its upward trajectory.

- 🛢️ A notable retreat in oil prices further bolstered the market's positive outlook, alleviating concerns related to inflation.

- 📊 Technology stocks demonstrated resilience...

5

2

$新加坡航空公司 (C6L.SG)$ 文章揭示,经济学家对新加坡经济增长的预期已经变得不那么乐观,大多数人预计全年增长率将为1.0%。在2023年第二季度,经济学家预计2023年的国内生产总值增长率为1.5%。

新加坡经济增长放缓将对股市产生负面影响。尽管基本面良好,但是在宏观经济状况不佳的情况下,新加坡航空公司股票价格将面临下行压力。

新加坡经济增长放缓将对股市产生负面影响。尽管基本面良好,但是在宏观经济状况不佳的情况下,新加坡航空公司股票价格将面临下行压力。

已翻译

5

已翻译

15

🇺🇸 美国债务:$33.1万亿

🇺🇸 美国国内生产总值:$27万亿

🇬🇧 英国债务:$3.79万亿

🇬🇧 英国国内生产总值:$3.47万亿

🇷🇺 俄罗斯债务:$4270亿

🇷🇺 俄罗斯 GDP:$2.19万亿 $标普500指数 (.SPX.US)$ $纳斯达克综合指数 (.IXIC.US)$ $道琼斯指数 (.DJI.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $SPDR 标普500指数ETF (SPY.US)$

🇺🇸 美国国内生产总值:$27万亿

🇬🇧 英国债务:$3.79万亿

🇬🇧 英国国内生产总值:$3.47万亿

🇷🇺 俄罗斯债务:$4270亿

🇷🇺 俄罗斯 GDP:$2.19万亿 $标普500指数 (.SPX.US)$ $纳斯达克综合指数 (.IXIC.US)$ $道琼斯指数 (.DJI.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $SPDR 标普500指数ETF (SPY.US)$

已翻译

7

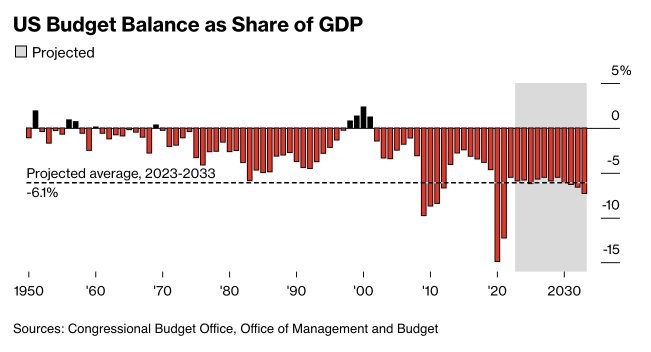

The US is now spending 44% of GDP per year, the same levels as World War 2.

Deficit spending alone is a massive 6% of GDP per year.

This means that after just ~8 years, the US deficit will grow by HALF of the US GDP.

Since the debt ceiling crisis, the US has been borrowing ~$14 billion PER DAY to cover deficit spending.

By 2033, Bloomberg projects deficit spending will be ~7% of GDP.

The US is spending like we are in a recession while calling for a "soft landing."

How does this make any sense?

$SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500指数 (.SPX.US)$ $道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$

Deficit spending alone is a massive 6% of GDP per year.

This means that after just ~8 years, the US deficit will grow by HALF of the US GDP.

Since the debt ceiling crisis, the US has been borrowing ~$14 billion PER DAY to cover deficit spending.

By 2033, Bloomberg projects deficit spending will be ~7% of GDP.

The US is spending like we are in a recession while calling for a "soft landing."

How does this make any sense?

$SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500指数 (.SPX.US)$ $道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$

5

An economy is about the production of goods and services in a country. In a market economy, the goods and services are mostly produced by companies.

The stock market generally comprising the better companies in an economy. If the economy does well you would expect these companies to do well and vice versa.

Of course, in the short term the stock market is affected by market sentiments. But in the long run you would expect the stock market to reflect...

The stock market generally comprising the better companies in an economy. If the economy does well you would expect these companies to do well and vice versa.

Of course, in the short term the stock market is affected by market sentiments. But in the long run you would expect the stock market to reflect...

Morgan Stanley has cut China's growth forecast for this year on the back of property woes. It now sees China's gross domestic product (GDP) growing a very slow 4.7% this year, down from an earlier forecast of 5%.

On the other hand, Morgan Stanley expects the U.S. to grow rapidly by 1.6% this year.

$标普500指数 (.SPX.US)$ $纳斯达克综合指数 (.IXIC.US)$ $通用汽车 (GM.US)$ $福特汽车 (F.US)$ $宝马汽车(ADR) (BMWYY.US)$ $MERCEDES-BENZ GROUP AG (MBGAF.US)$ $Stellantis NV (STLA.US)$ $Rivian Automotive (RIVN.US)$ $特斯拉 (TSLA.US)$ $比亚迪股份 (01211.HK)$ $BYD Co. (BYDDF.US)$ $蔚来 (NIO.US)$ $理想汽车 (LI.US)$ $小鹏汽车 (XPEV.US)$ $永科 (AWX.SG)$ $常青石油及天然气 (T13.SG)$ $REX国际 (5WH.SG)$ $天然煤矿集团 (RE4.SG)$ $中国恒大 (03333.HK)$ $碧桂园 (02007.HK)$

On the other hand, Morgan Stanley expects the U.S. to grow rapidly by 1.6% this year.

$标普500指数 (.SPX.US)$ $纳斯达克综合指数 (.IXIC.US)$ $通用汽车 (GM.US)$ $福特汽车 (F.US)$ $宝马汽车(ADR) (BMWYY.US)$ $MERCEDES-BENZ GROUP AG (MBGAF.US)$ $Stellantis NV (STLA.US)$ $Rivian Automotive (RIVN.US)$ $特斯拉 (TSLA.US)$ $比亚迪股份 (01211.HK)$ $BYD Co. (BYDDF.US)$ $蔚来 (NIO.US)$ $理想汽车 (LI.US)$ $小鹏汽车 (XPEV.US)$ $永科 (AWX.SG)$ $常青石油及天然气 (T13.SG)$ $REX国际 (5WH.SG)$ $天然煤矿集团 (RE4.SG)$ $中国恒大 (03333.HK)$ $碧桂园 (02007.HK)$

4

4