最新

热门

🇺🇸 US CPI Report:

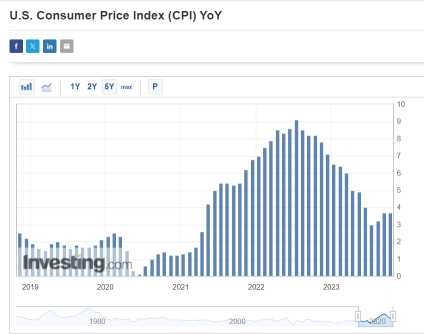

📈 CPI: +0.4% (Sep vs. Aug) & +3.7% (YoY) 📊

🔮 Economists Missed Projections! 🔍

📉 Core Inflation: +0.3% (Sep) & +4.1% (YoY) ✅

📈 PPI Surpasses Expectations! 💹

📈 Chance of Dec. Rate Hike: ↑ 28% ➡ 38%

🏦 Market Still Sees No Rate Change - Oct 31 to Nov 1 $纳斯达克综合指数 (.IXIC.US)$ $道琼斯指数 (.DJI.US)$ $标普500指数 (.SPX.US)$ $SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$

📈 CPI: +0.4% (Sep vs. Aug) & +3.7% (YoY) 📊

🔮 Economists Missed Projections! 🔍

📉 Core Inflation: +0.3% (Sep) & +4.1% (YoY) ✅

📈 PPI Surpasses Expectations! 💹

📈 Chance of Dec. Rate Hike: ↑ 28% ➡ 38%

🏦 Market Still Sees No Rate Change - Oct 31 to Nov 1 $纳斯达克综合指数 (.IXIC.US)$ $道琼斯指数 (.DJI.US)$ $标普500指数 (.SPX.US)$ $SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$

6

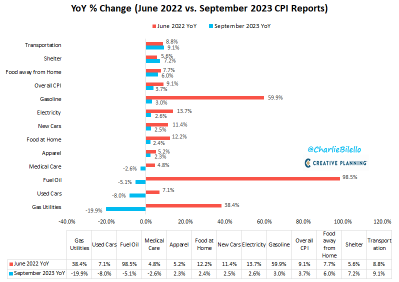

US CPI has moved down from a peak of 9.1% in June 2022 to 3.7% today.

What's driving that decline? Lower rates of inflation in Gas Utilities, Used Cars, Fuel Oil, Medical Care, Apparel, Food at Home, New Cars, Electricity, Gasoline, and Food away from Home.

Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022.

$纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $SPDR 标普500指数ETF (SPY.US)$ $标普500指数 (.SPX.US)$ $道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$

What's driving that decline? Lower rates of inflation in Gas Utilities, Used Cars, Fuel Oil, Medical Care, Apparel, Food at Home, New Cars, Electricity, Gasoline, and Food away from Home.

Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022.

$纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $SPDR 标普500指数ETF (SPY.US)$ $标普500指数 (.SPX.US)$ $道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$

2

Key Takeaway: Sticky and persistent in...

3

早上好,mooer们!以下是你们需要了解今天市场的重要事项:

●美股下跌,通胀数据后结束连胜

●石油价格中期将保持较高水平

●关注工业生产

●经济学家称有针对性的补贴将帮助马来西亚的财政改革

●SSF Home在ACE市场平平淡淡地上市

●关注的股票:IJm,Capital A

-moomoo 资讯 MY

华尔街摘要

周四主要股指下跌...

●美股下跌,通胀数据后结束连胜

●石油价格中期将保持较高水平

●关注工业生产

●经济学家称有针对性的补贴将帮助马来西亚的财政改革

●SSF Home在ACE市场平平淡淡地上市

●关注的股票:IJm,Capital A

-moomoo 资讯 MY

华尔街摘要

周四主要股指下跌...

已翻译

6

Benoit Anne and Venkat Balakrishnan express persistent inflation concerns, amidst rising Treasury yields weighing on stocks. Gene Goldman expects improvement in corporate earnings and economy resilience.

The article revealed that minutes from the Fed's September meeting, released Wednesday, reflected divisions within the rate-setting Federal Open Market Committee. The meeting concluded with the committee opting not to raise interest rates, but the summary showed lingering concern about inflation and worries that upside risks remain.

There's still fear that Fed may raise interest rate sooner than expected.

Quote:

The consumer price index, ...

There's still fear that Fed may raise interest rate sooner than expected.

Quote:

The consumer price index, ...

Umm, did the stock market just crash? lol. Nah, people are selling all around the board and I think because the report on persistent inflation. Any thoughts?

FARAMARZ AKBARY 楼主 :![爱心 [爱心]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)