最新

热门

$硅谷银行 (SIVB.US)$ $星展集团控股 (D05.SG)$ $华侨银行 (O39.SG)$ $大华银行 (U11.SG)$ $Signature Bank (SBNY.US)$

新加坡银行系统仍然存在 “健全而有弹性” 新加坡金融管理局(MAS)周一表示,在最近硅谷银行(SVB)和其他几家小银行倒闭的情况下。

分析师还预计 SVB的后果对新加坡银行的影响有限,鉴于基本差异...

新加坡银行系统仍然存在 “健全而有弹性” 新加坡金融管理局(MAS)周一表示,在最近硅谷银行(SVB)和其他几家小银行倒闭的情况下。

分析师还预计 SVB的后果对新加坡银行的影响有限,鉴于基本差异...

已翻译

1

$星展集团控股 (D05.SG)$ $华侨银行 (O39.SG)$ $大华银行 (U11.SG)$ $硅谷银行 (SIVB.US)$

“我们今天的新加坡银行资本充足,有充足的准备金来应对任何减记需求,并且在世界排名和基准中名列最强和最安全的银行之列。”

“我们认为,当今新加坡银行股价的任何下跌都是 “积累” 的机会 如:

![]() 银行挤兑的传染效应不应蔓延到新加坡,因为...

银行挤兑的传染效应不应蔓延到新加坡,因为...

“我们今天的新加坡银行资本充足,有充足的准备金来应对任何减记需求,并且在世界排名和基准中名列最强和最安全的银行之列。”

“我们认为,当今新加坡银行股价的任何下跌都是 “积累” 的机会 如:

已翻译

1

沃伦·巴菲特的伯克希尔·哈撒韦可能在短短三个交易日内看到了大约 80亿美元 消失在其金融股票的价值上,这是在硅谷银行的崩溃引发了这个板块的抛售之后。

这位著名投资者的公司在去年12月末拥有约 740 billion美元 当时看到了大约的投资组合中持有银行、保险和金融服务股票的比例,该数据是最新的数据。

这位著名投资者的公司在去年12月末拥有约 740 billion美元 当时看到了大约的投资组合中持有银行、保险和金融服务股票的比例,该数据是最新的数据。

已翻译

$硅谷银行 (SIVB.US)$ $星展集团控股 (D05.SG)$ $华侨银行 (O39.SG)$ $大华银行 (U11.SG)$

分析师仍然存在 红润的 关于新加坡银行的前景,他们认为有几个根本的差异使本地贷款机构与SVB截然不同:

马来亚银行证券新加坡研究主管Thilan Wickramasinghe:

![]() “(SVB的倒闭)与其说是真正的解决方案,不如说是一场老式的流动性危机...

“(SVB的倒闭)与其说是真正的解决方案,不如说是一场老式的流动性危机...

分析师仍然存在 红润的 关于新加坡银行的前景,他们认为有几个根本的差异使本地贷款机构与SVB截然不同:

马来亚银行证券新加坡研究主管Thilan Wickramasinghe:

已翻译

1

$硅谷银行 (SIVB.US)$ $星展集团控股 (D05.SG)$ $华侨银行 (O39.SG)$ $大华银行 (U11.SG)$

自2008年全球金融危机(GFC)以来,SVB成为最大的美国银行倒闭银行股上周四(3月9日)开始下跌,蔓延到其他美国和欧洲银行。

在该银行宣布计划进行资本筹集不到48小时后,该银行经历了一波提款潮

自2008年全球金融危机(GFC)以来,SVB成为最大的美国银行倒闭银行股上周四(3月9日)开始下跌,蔓延到其他美国和欧洲银行。

在该银行宣布计划进行资本筹集不到48小时后,该银行经历了一波提款潮

已翻译

2

在过去的一周里,美国的整个金融体系受到质疑。我们有美国第16大银行,名为硅谷银行,处于破产管理之下,由于资金紧张,许多初创公司正在经营业务。

如果这些初创企业和存款人无法收回未投保的存款,这将严重影响我们的创新。一些监管机构最终会为该系统做点什么,我并不感到惊讶。可能不适合硅谷银行 但是对于...

如果这些初创企业和存款人无法收回未投保的存款,这将严重影响我们的创新。一些监管机构最终会为该系统做点什么,我并不感到惊讶。可能不适合硅谷银行 但是对于...

已翻译

硅谷银行(SVB)的新任CEO tim Mayopoulos向客户发送了一封电子邮件 该银行已重新开放,业务如常,新银行存款和现有存款均由联邦存款保险公司(FDIC)保护。

该电子邮件提到 FDIC已将SVB的储蓄和资产转移到新的临时银行。 所有在3月9日或10日放置但尚未处理的电汇已被取消,将...

该电子邮件提到 FDIC已将SVB的储蓄和资产转移到新的临时银行。 所有在3月9日或10日放置但尚未处理的电汇已被取消,将...

已翻译

3

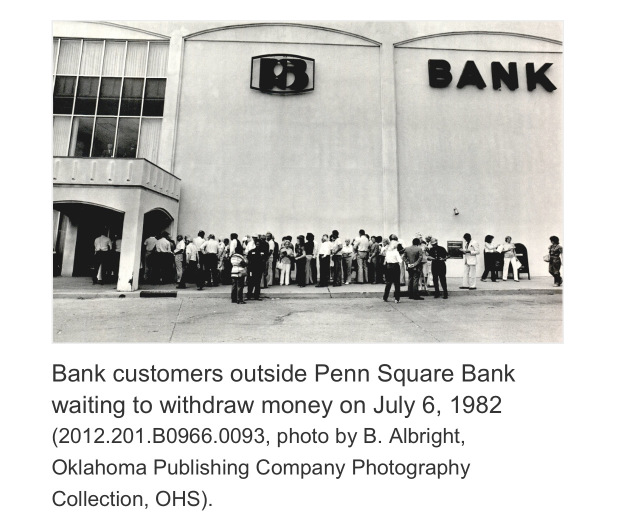

When Penn Square Bank was shut down by the Feds in ‘81 depositors lost 163 million dollars in uninsured accounts.

Seattle First National Bank (Seafirst) in Washington was one of the first failures to result from losses on the participations. Soon after, Continental Illinois National Bank and Trust Company in Chicago, which had participated in the loans in the amount of almost $1 billion, became the largest bank failure in U.S. history up to that time.

By the late 1...

Seattle First National Bank (Seafirst) in Washington was one of the first failures to result from losses on the participations. Soon after, Continental Illinois National Bank and Trust Company in Chicago, which had participated in the loans in the amount of almost $1 billion, became the largest bank failure in U.S. history up to that time.

By the late 1...