盈利波动性 | 随着季报季进入高潮,期权市场为波动性做准备

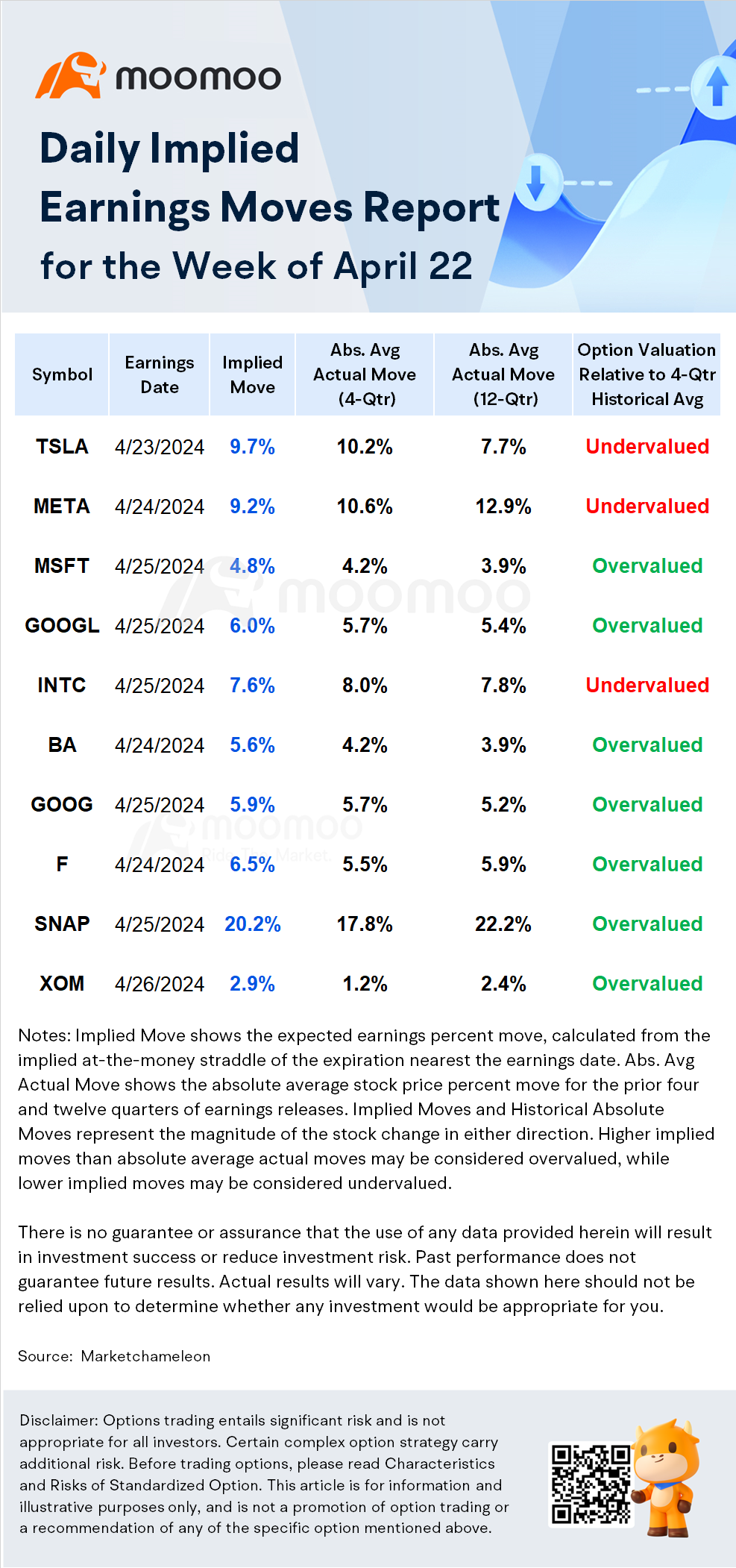

在财报季节,股票价格可能会出现比平时更大的波动,这可能是期权交易者感兴趣的时机。 对于希望根据这些波动进行交易的投资者,您应始终注意财报后期权可能会如何变化。以下是本周的头等财报和波动。

财报日期: 4/23 收盘后

-盈利归一化估计: 美元 361.99亿,同比增长26.37%; 每股收益 4.32美元,同比增长96.32%

业绩催化剂

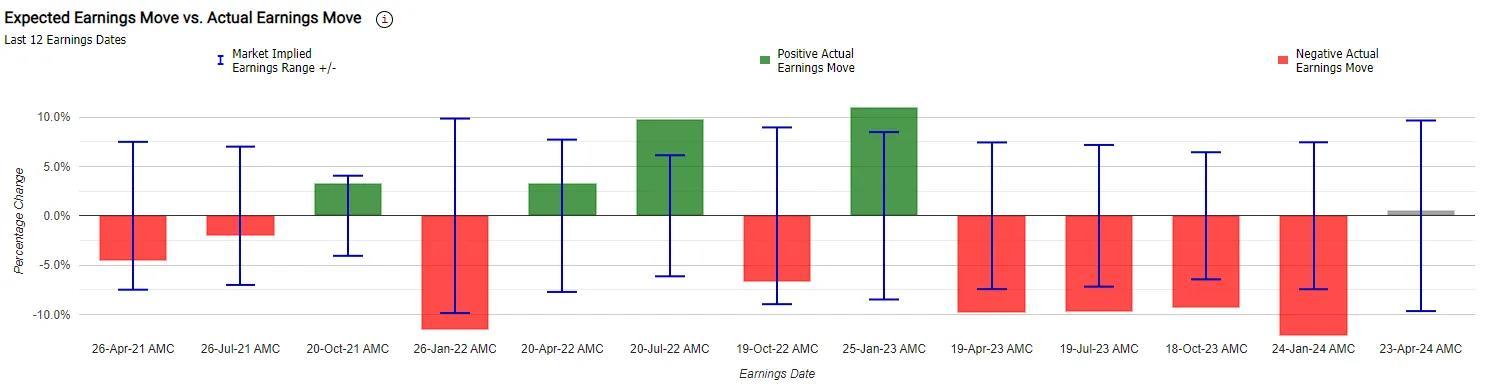

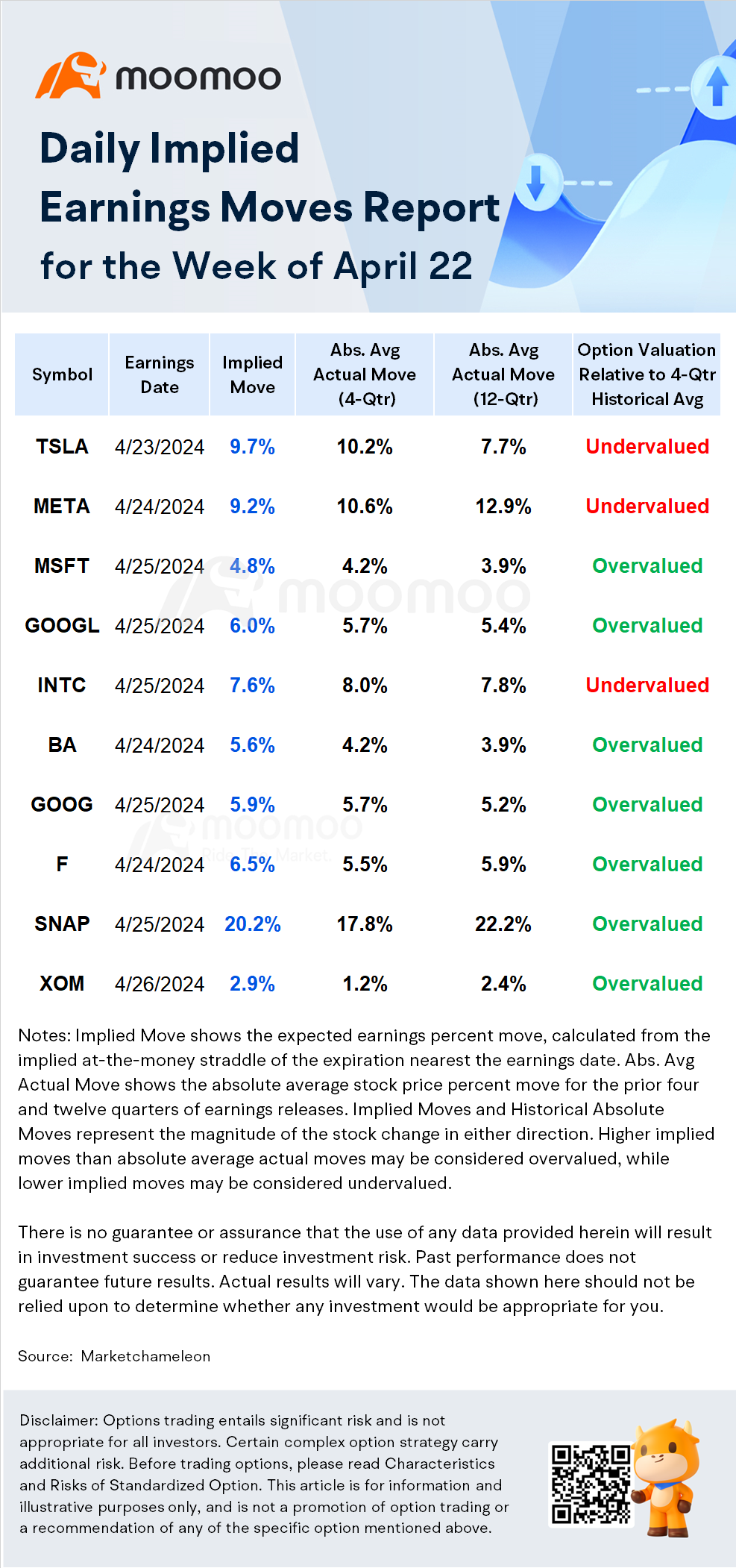

According to the options market, Tesla is currently facing an implied move of ±9.7%, suggesting that options traders are betting on a post-earnings one-day price swing of up to 9.7%. This points to a slight undervaluation of options prices. Historical analysis shows that in the past 12 earnings releases, Tesla's stock more frequently experienced declines post-earnings, with the last four quarters showing declines of -9.8%, -9.7%, -9.3%, and -12.1%, respectively.

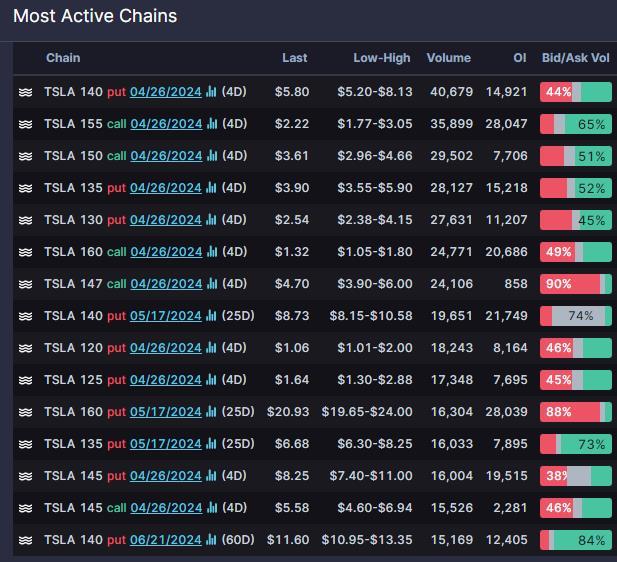

For Tesla, the options market is painting a picture of investor caution; puts expiring this week are marked by higher implied volatility, reflecting a bearish sentiment as evidenced by the volatility skew. Amidst this wary outlook, there's noteworthy activity on Tesla's options chain: puts at the $140 strike price and calls at strike prices of $155 and $150 expiring this Friday are seeing a surge in trading volume, signaling a mix of hedging and speculative plays as traders position themselves ahead of the earnings announcement.

Tesla's stock has fallen over 40% since the beginning of the year, impacted by Q1 deliveries that are vastly missing expectations and layoffs. Earlier this month, Tesla announced Q1 deliveries of 386,800 vehicles worldwide, significantly below forecasts and marking the first quarter-over-quarter decline since 2020.

Investors will be looking to hear from Elon Musk during the earnings call for reasons behind cost-cutting measures, future strategies, product roadmaps, and overall vision to weather the potential storm of weakening global demand in 2024, as per Dan Ives, an analyst at Wedbush.

财报日期: 4/24 After the bell

-预计营业收入正常化估计: 美元指数361.99亿,同比增长26.37%; 每股收益4.32美元,同比增长96.32%

业绩催化剂

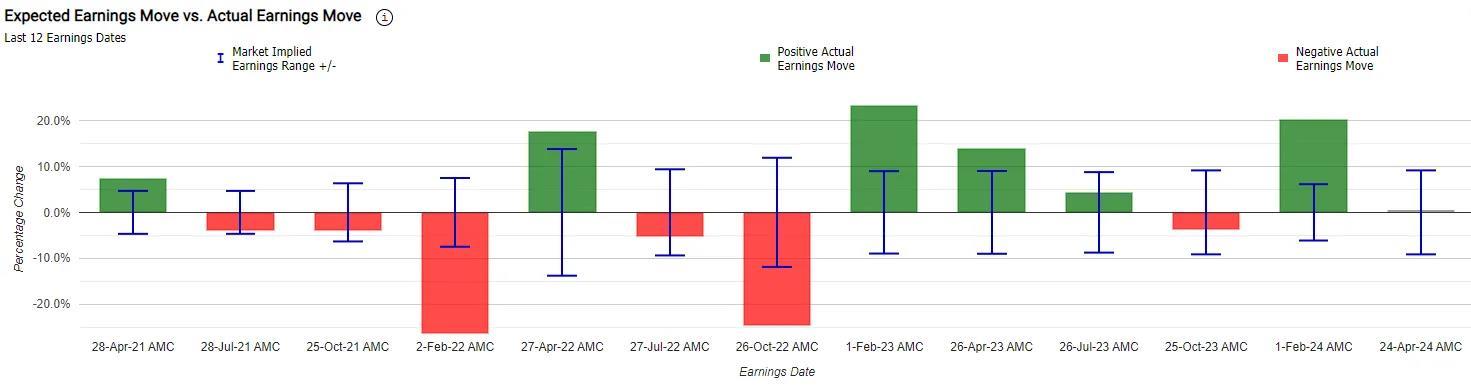

Meta的隐含波动幅度为±9.2%,与历史业绩后股价波动相比较小,表明期权定价略显低估。过去12次业绩后报告后,该股的平均波动接近±13%。自2023年以来,Meta在业绩发布日表现良好,2023年和2024年的年度报告发布后,股价均上涨超过20%,仅 2023年10月25日有例外。

分析师们关注Meta强劲的广告营收增长。CFRA分析师预计Q1业绩报告将显示广告收入增长26%,“可能达到增速峰值”。

Meta拥有30亿用户,将人工智能广泛整合到其全球广告业务中,为用户提供新的人工智能驱动广告交付模式,有助于股价最近创下历史新高。截至目前,Meta股价已上涨36%,华尔街平均目标价为553.7美元,表明潜在上涨空间为15%。

财报日期: 特斯拉的业绩会在美国股市收盘后举行

-盈利归一化估计: 美元指数为608.57亿美元,同比增长15.14%;每股收益为2.83美元,同比增长15.43%

业绩催化剂

微软的期权数据暗示着一个±4.8%的波动,略高于过去12个季度平均波动的±3.9%。历史业绩日表现显示,在业绩公布后,微软股价涨跌几乎有相等的概率,最大涨幅为7.2%(2023年第2季度),最大跌幅为-7.7%(2022年第3季度)

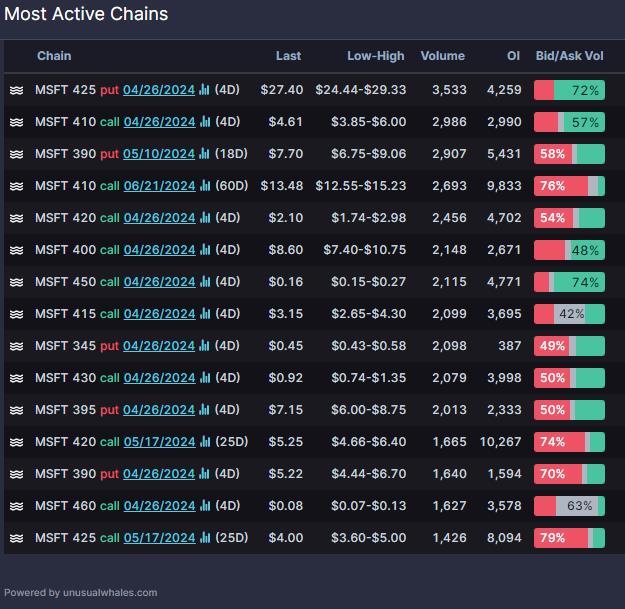

市场情绪似乎对微软看淡,根据波动率斜度。 本周五到期的最活跃的期权是$425、$390看跌和$410认购。

在考虑交易之前,请先了解“不要被财报击垮”。

了解IV Crush(隐含波动率崩溃)

在重大公司事件(如财报公告、产品发布或临床试验结果)之前,隐含波动率往往会增加。然而,在消息发布后,由于市场的突然明朗和股价对消息的反应,隐含波动率可能会大幅下降。这种现象被称为隐含波动率崩溃(IV crush)。

IV Crush和期权价格IV Crush可能导致期权价格下降,因为暗含波动率急剧降低。由于IV Crush导致期权价格下降,这对于购买期望股票价格大幅波动从而获利的期权交易者来说可能是一个风险。相反,如果期权被低估且股票价格大幅波动,则IV Crush可能不那么普遍,这对于期权卖方构成风险。交易者在考虑围绕重大公司事件进行期权交易时,需要注意IV Crush并将其纳入他们的交易策略中非常重要。

并不是所有的期权对IV Crush的影响都一样。IV Crush对短期期权价格的影响要大于对长期期权价格的影响。

尽管如此,需要注意的是,交易期权总是涉及风险,投资者在进行任何交易之前应该咨询一位财务顾问。

来源:道琼斯,Market Chameleon,彭博

免责声明:

期权交易涉及重大风险,不适合所有客户。投资者阅读是必要的。 标准期权的特点和风险 在进行任何期权交易策略之前,请三思。期权交易通常很复杂,并可能在相对较短的时间内损失全部投资。某些复杂的期权策略还存在额外的风险,包括可能超过初始投资额的损失。如有适用,对于任何声明的支持文档将应按要求提供。moomoo不保证投资结果的有利。一项安全或金融产品的过去业绩不能保证未来结果或回报。在投资期权之前,客户应仔细考虑他们的投资目标和风险。由于税收对所有期权交易的重要性,考虑期权的客户应咨询其税务顾问,了解税收如何影响每个期权策略的结果。

所提供的数据和信息来源可靠,但moomoo金融及其关联公司不保证上述材料的准确性或完整性。任何信息都不是所有可用数据的完整摘要或陈述,这些数据对做出投资决定所需的 全部数据,并不构成建议。

免责声明:此内容由Moomoo Technologies Inc.提供,仅用于信息交流和教育目的。

更多信息

评论

登录发表评论

FearGreed : 反弹周,Meta拯救市场。

73391169 : 帮我弄个机器人