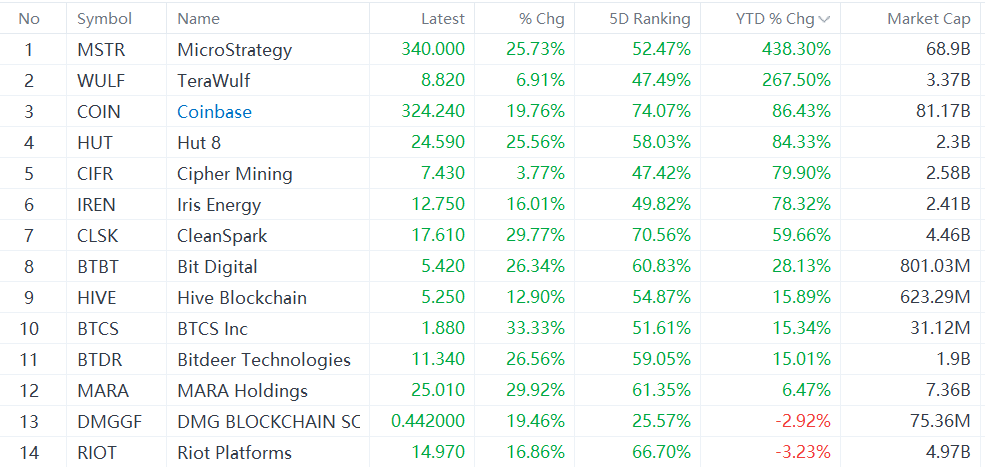

Its stock has surged 86% this year, influenced not only by Bitcoin's price fluctuations but also by overall market activity, investor sentiment, and regulatory policy. When the broader cryptocurrency market performs well and trading activity increases, Coinbase's transaction volume and revenue are likely to rise, potentially driving its stock price higher.

105742796 Learner :![合十 [合十]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)