花样年华

赞了

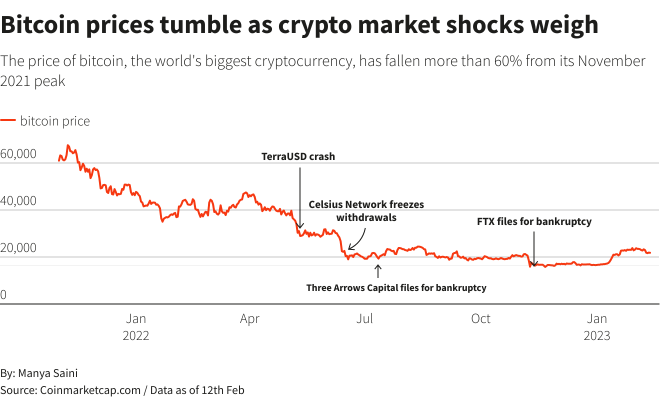

Shiba最近因其巨额回报而吸引了许多粉丝。现在,所有持有少量柴犬的人都变成了百万富翁。因此,一位投资者在2020年3月购买了价值8000美元的柴犬,目前价值约为57亿美元。但是我们知道,这些极端的收益必须杀死/摧毁某些东西才能获得这种收益。关于加密货币交易,有些事情我们知道但我们却一无所知。我们知道这是一个不受监管的市场,因此实际上每枚硬币的实际价值为零。那么,为什么这些人是百万富翁或亿万富翁呢?

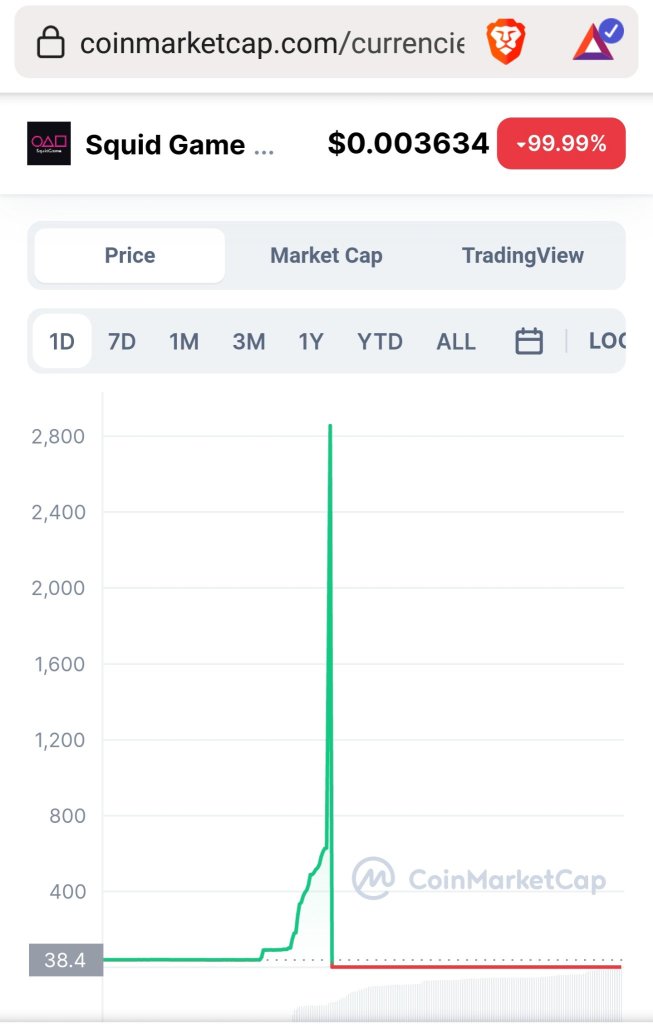

1。由于它是公开交易且不受监管的,因此很容易被操纵到达到难以想象的价值的地步。因此,即使硬币以更大的价值进行交易,也会产生一种错觉,即硬币价值该金额。但是,一旦其数量的很大一部分投放市场,并且所有买家都得到满足,它就会陷入困境。例如,最近发生的 SQUID 游戏代币,它是由 squid 游戏公司创作者创建的真正代币。这是个好主意,他们的网站上还有在线鱿鱼游戏。但是,创作者在市场上出售了他们的硬币,因为它达到了惊人的高额。许多新闻来源说,创作者退出了该项目。但是,我相信他们在离开之前就把它卖掉了。

如果有人毫不费力地持有在借来的区块链网络(币安网络)上免费创建的资产的30-50%。他们为什么不以每枚硬币2800美元的价格出售,而他们实际上是用0美元赚的。

你可能会想到谁来承担损失?

买方交易这枚硬币的人从0.1美元到最高2799.99美元不等。

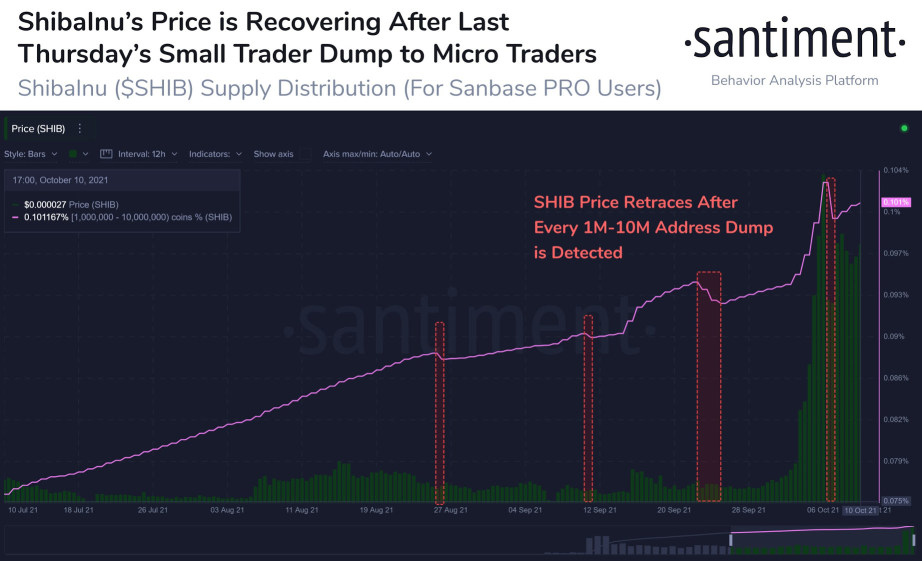

Shiba Inu 也在创造类似的环境,但规模更大。从那以后,他们称购买和持有硬币的人为 “柴军”。这造成了对市场的错误解释,因为无论谁持有 shiba inu,都将成为或将成为百万富翁。例如,就在 shiba 达到 0.00009 左右时,有人抛售了数十亿枚代币,价格仅接近数百万美元(与 shiba 市值相比)

10月28日,你可以看到从0.000089的价值急剧下跌至0.000058,那时出售shib的人最少,赚了数百万美元。但是由于 shib 的持续促销和 FOMO 在人们中造成的 FOMO,SHIB 得以回到 0.000071。这使柴犬的市值达到约400亿美元,超过了USDC和doge。

我预计,如果一个持有价值数十亿美元柴犬的人因为恐惧或任何可能的原因而将其抛售市场。我相信 SHIB 也将像 SQUID 代币一样暴跌,使在 SHIB 市场上处于买入头寸的人和持有该头寸的人破产。

但是,我确实相信,由于柴犬军队的持续广告和努力,SHIB将能够突破0.0001大关。但我预计,在那之后过长时间持有硬币会有一些主要的缺点。

请理解,交易不像农业,那里的钱纯粹是产生的。交易是二级市场,资金只是易手。它转手的资产会随着价值的增加或减少,这不是该资产的普遍价格,因为10%的股票或加密货币不会以相同的价格出售,但100%的小麦可以出售。通用价格是在初级市场中定义的,例如大宗商品或工厂(生产、技术和创意)。股票被认为是次要的,但来自初级(生产某些东西)或拥有技术和想法的行业。因此,股票可以成为货币增长的好选择,但不是加密资产。我在之前的文章中已经提到了USDT硬币,比如他们如何确保它由美元支持,但他们甚至没有数千美元的系绳储蓄后端。

即使是以太坊也被疯狂地定价过高。正如建议的交易价格所证明的那样。例如,一笔bitfinex交易的成本约为3,300万美元,仅转账10万美元。这是交易哈希作为证据。

https://etherscan.io/tx/0x2c9931793876db33b1a9aad123ad4921dfb9cd5e59dbb78ce78f277759587115

想一想,投资新的加密货币或一些模因币是一种阴暗的玩法。但是,如果你在里面有大约数百万甚至数千美元,那就在为时已晚之前兑现即可。

万圣节快乐,大家交易快乐!

1。由于它是公开交易且不受监管的,因此很容易被操纵到达到难以想象的价值的地步。因此,即使硬币以更大的价值进行交易,也会产生一种错觉,即硬币价值该金额。但是,一旦其数量的很大一部分投放市场,并且所有买家都得到满足,它就会陷入困境。例如,最近发生的 SQUID 游戏代币,它是由 squid 游戏公司创作者创建的真正代币。这是个好主意,他们的网站上还有在线鱿鱼游戏。但是,创作者在市场上出售了他们的硬币,因为它达到了惊人的高额。许多新闻来源说,创作者退出了该项目。但是,我相信他们在离开之前就把它卖掉了。

如果有人毫不费力地持有在借来的区块链网络(币安网络)上免费创建的资产的30-50%。他们为什么不以每枚硬币2800美元的价格出售,而他们实际上是用0美元赚的。

你可能会想到谁来承担损失?

买方交易这枚硬币的人从0.1美元到最高2799.99美元不等。

Shiba Inu 也在创造类似的环境,但规模更大。从那以后,他们称购买和持有硬币的人为 “柴军”。这造成了对市场的错误解释,因为无论谁持有 shiba inu,都将成为或将成为百万富翁。例如,就在 shiba 达到 0.00009 左右时,有人抛售了数十亿枚代币,价格仅接近数百万美元(与 shiba 市值相比)

10月28日,你可以看到从0.000089的价值急剧下跌至0.000058,那时出售shib的人最少,赚了数百万美元。但是由于 shib 的持续促销和 FOMO 在人们中造成的 FOMO,SHIB 得以回到 0.000071。这使柴犬的市值达到约400亿美元,超过了USDC和doge。

我预计,如果一个持有价值数十亿美元柴犬的人因为恐惧或任何可能的原因而将其抛售市场。我相信 SHIB 也将像 SQUID 代币一样暴跌,使在 SHIB 市场上处于买入头寸的人和持有该头寸的人破产。

但是,我确实相信,由于柴犬军队的持续广告和努力,SHIB将能够突破0.0001大关。但我预计,在那之后过长时间持有硬币会有一些主要的缺点。

请理解,交易不像农业,那里的钱纯粹是产生的。交易是二级市场,资金只是易手。它转手的资产会随着价值的增加或减少,这不是该资产的普遍价格,因为10%的股票或加密货币不会以相同的价格出售,但100%的小麦可以出售。通用价格是在初级市场中定义的,例如大宗商品或工厂(生产、技术和创意)。股票被认为是次要的,但来自初级(生产某些东西)或拥有技术和想法的行业。因此,股票可以成为货币增长的好选择,但不是加密资产。我在之前的文章中已经提到了USDT硬币,比如他们如何确保它由美元支持,但他们甚至没有数千美元的系绳储蓄后端。

即使是以太坊也被疯狂地定价过高。正如建议的交易价格所证明的那样。例如,一笔bitfinex交易的成本约为3,300万美元,仅转账10万美元。这是交易哈希作为证据。

https://etherscan.io/tx/0x2c9931793876db33b1a9aad123ad4921dfb9cd5e59dbb78ce78f277759587115

想一想,投资新的加密货币或一些模因币是一种阴暗的玩法。但是,如果你在里面有大约数百万甚至数千美元,那就在为时已晚之前兑现即可。

万圣节快乐,大家交易快乐!

已翻译

+1

30

3

花样年华

赞了

How to use the star institutions in the most effective way possible with the data provided by Moomoo

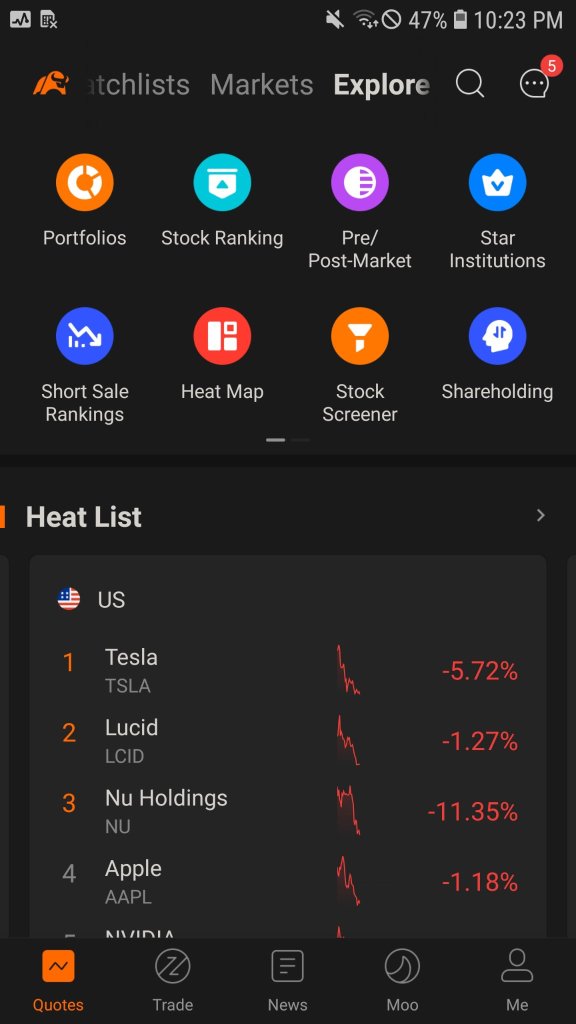

First let's see where we can find star institutions. if you are in the main page in moomoo you can see the top is scrollable on left side, which has few more options.

Here when you click on the explore option you will see star institutions AMC(Asset Management Companies) not the stock amc.

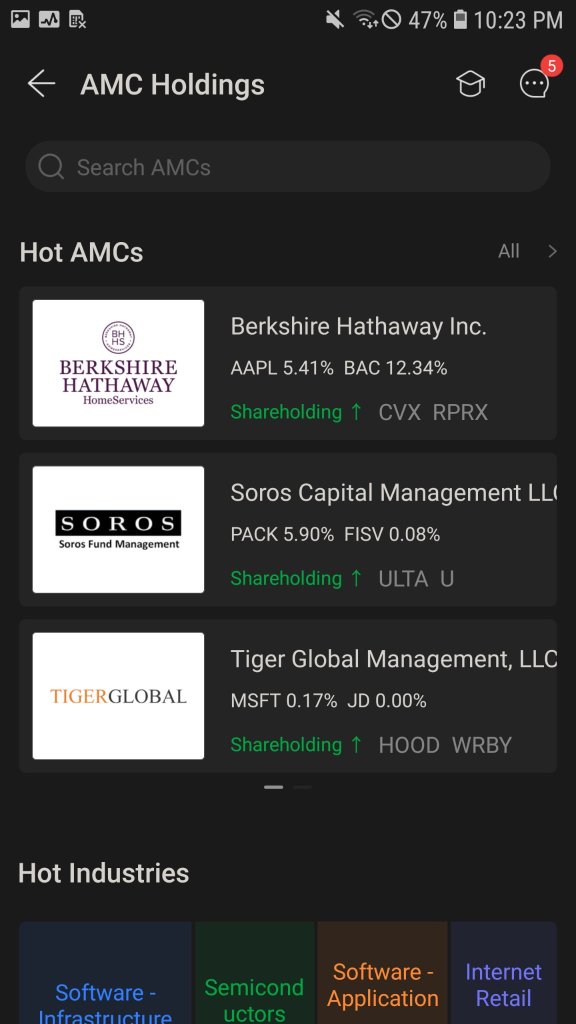

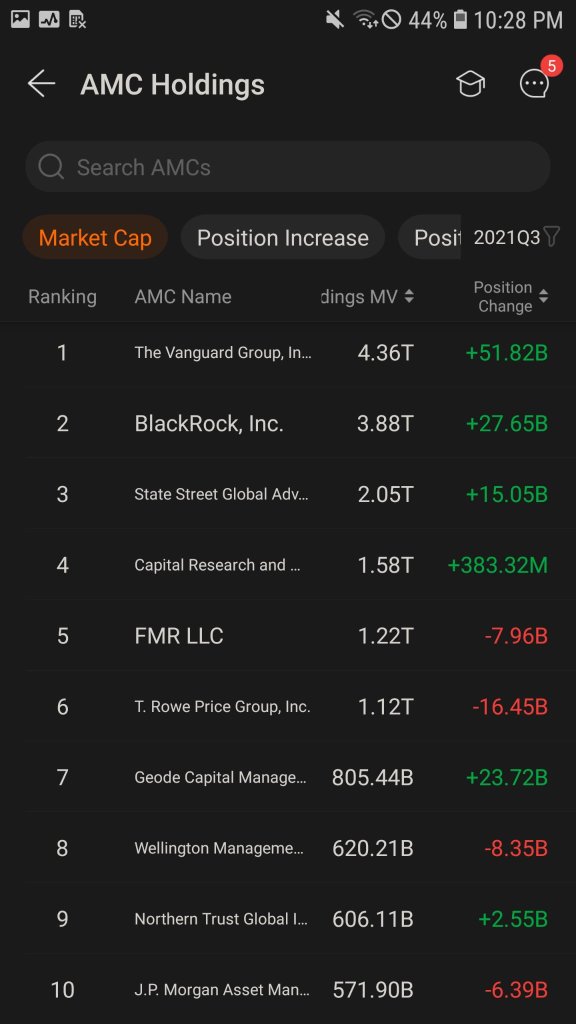

Here you will see the top AMC holdings and their investment option. There is a small option "All" on the top right corner of the hot AMCs. You can click and open that option.

if you scroll down a bit lower you will be able to see the top AMC of United states with their holdings and their position changes with their total investment funds, Normally it is in trillions.

Here we can have the maximum use of this option. After scrolling down, you can see the top 10 institutions. These top institutions have tens of trillions of dollars which can practically move the market in any direction. We know the basic knowledge that the stock increases when the money flows in and decreases when the money flows out.

So, If you can study these top institutional positional changes of stocks you can predict the actions the company is taking and can make use it to your advantage in buying/selling stock or buying /selling options.

let's take the vanguard fund as an example.

if you click on the vanguard group in AMC list you will see the current percent holdings of vanguard group. From here if you scroll a bit left you will see the prior proportion and the current proportion of the stock in this fund. We can see that the fund increased the number of stocks in thoer portfolio, example $苹果(AAPL.US$ and $微软(MSFT.US$. From here we can assume the fund is securing shares of these companies, that indicates they will most probably go up in price, because of shortage of stocks in market. since vanguard fund's 0.14% change is equal to $5 billion(calculated by multiplying it with vanguard market cap) in stocks of Apple. which can make a huge impact in the stock supply. which in turn increases the demand and price of the stock.

Similarly we can look at the top 5 (top 10 for more precision in your results) to have their positional changes on a particular stock. If we multiply these changes of the particular stock with the fund's marketcap we will get a final result.

Important: some increases their positions and some decreases their positions, Hence we add the increasing positions and subtract the decreasing positional changes.

Finally, it will be a good idea to also look at the market cap of the stock for example microsoft has a market cap of 1.6T and thus having a change of 5 billion can have a normal impact on the stock. However, stocks with smaller marketcap but the positional changes in billions can have a very high impact of stock prices.

Or if you dont want to work too hard. In the hot AMC page, if you scroll a bit low you will see the hot stocks and their positional changes in the amc. Here you can directly choose to pick the stocks to buy or stock in the market.

Happy trading

Here when you click on the explore option you will see star institutions AMC(Asset Management Companies) not the stock amc.

Here you will see the top AMC holdings and their investment option. There is a small option "All" on the top right corner of the hot AMCs. You can click and open that option.

if you scroll down a bit lower you will be able to see the top AMC of United states with their holdings and their position changes with their total investment funds, Normally it is in trillions.

Here we can have the maximum use of this option. After scrolling down, you can see the top 10 institutions. These top institutions have tens of trillions of dollars which can practically move the market in any direction. We know the basic knowledge that the stock increases when the money flows in and decreases when the money flows out.

So, If you can study these top institutional positional changes of stocks you can predict the actions the company is taking and can make use it to your advantage in buying/selling stock or buying /selling options.

let's take the vanguard fund as an example.

if you click on the vanguard group in AMC list you will see the current percent holdings of vanguard group. From here if you scroll a bit left you will see the prior proportion and the current proportion of the stock in this fund. We can see that the fund increased the number of stocks in thoer portfolio, example $苹果(AAPL.US$ and $微软(MSFT.US$. From here we can assume the fund is securing shares of these companies, that indicates they will most probably go up in price, because of shortage of stocks in market. since vanguard fund's 0.14% change is equal to $5 billion(calculated by multiplying it with vanguard market cap) in stocks of Apple. which can make a huge impact in the stock supply. which in turn increases the demand and price of the stock.

Similarly we can look at the top 5 (top 10 for more precision in your results) to have their positional changes on a particular stock. If we multiply these changes of the particular stock with the fund's marketcap we will get a final result.

Important: some increases their positions and some decreases their positions, Hence we add the increasing positions and subtract the decreasing positional changes.

Finally, it will be a good idea to also look at the market cap of the stock for example microsoft has a market cap of 1.6T and thus having a change of 5 billion can have a normal impact on the stock. However, stocks with smaller marketcap but the positional changes in billions can have a very high impact of stock prices.

Or if you dont want to work too hard. In the hot AMC page, if you scroll a bit low you will see the hot stocks and their positional changes in the amc. Here you can directly choose to pick the stocks to buy or stock in the market.

Happy trading

+1

26

3

花样年华

赞了

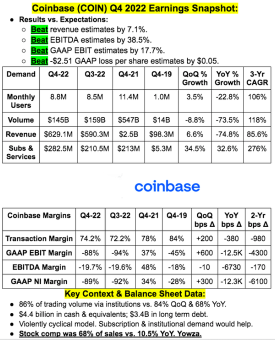

$Coinbase(COIN.US$ reported a fourth-quarter loss on Tuesday, as trading volume at the cryptocurrency exchange came under pressure from an industry-wide downturn triggered by a string of high-profile bankruptcies.

The digital assets market suffered from dour sentiment over the last year, but the biggest blow to the sector came from the bankruptcy of Sam Bankman-Fried's major crypto exchange FTX in November.

"In the wake of FT...

The digital assets market suffered from dour sentiment over the last year, but the biggest blow to the sector came from the bankruptcy of Sam Bankman-Fried's major crypto exchange FTX in November.

"In the wake of FT...

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)