Luiz小财神

参与了投票

$英伟达 (NVDA.US)$股票下跌7%,至103.73美元,大幅跑赢 $纳斯达克综合指数 (.IXIC.US)$1.3%的下跌,创下自5月23日以来的最低收盘价。 股票现在下跌 26% 从其6月份超过每股140美元的峰值下跌。

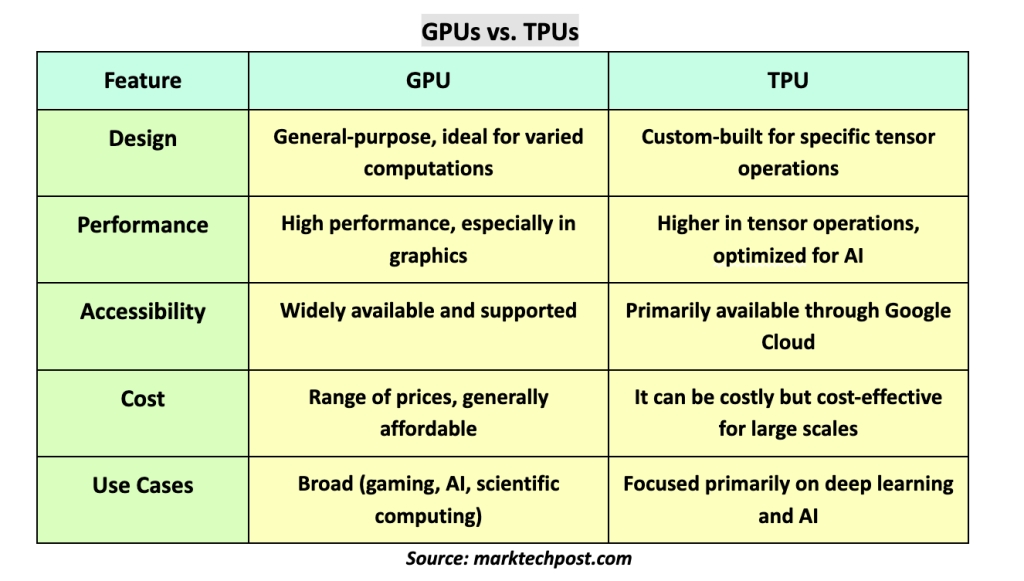

苹果将使用Google芯片而非英伟达来训练人工智能模型。

苹果宣布其Apple Intelligence系统的AI模型使用谷歌的Tensor P…进行预训练

苹果将使用Google芯片而非英伟达来训练人工智能模型。

苹果宣布其Apple Intelligence系统的AI模型使用谷歌的Tensor P…进行预训练

已翻译

32

1

46

Luiz小财神

评论了

我和我的股票没有爱恨关系,因为我只会在喜欢它们的时候买。如果它们是绿色的,我很开心。如果它们是红色的,我会买更多,并且我很开心

就像我的 $探索频道-A (DISCA.US)$一下子就爱上它了,多亏了Bill Hwang的崩盘。跌了超过50%,买啊啊啊啊啊啊。买的时候是在43美元,然后它又跌到了20美元区间。所以我还买了更多![]()

![]() 花了大约9个月才最终转向

花了大约9个月才最终转向

就像我的 $探索频道-A (DISCA.US)$一下子就爱上它了,多亏了Bill Hwang的崩盘。跌了超过50%,买啊啊啊啊啊啊。买的时候是在43美元,然后它又跌到了20美元区间。所以我还买了更多

已翻译

加载中...

33

10

3

Luiz小财神

赞了

Didi Global rises 5.6% in US premarket trading after its holder Tencent reports 7.4% passive stake at Dec 31.

腾讯控股报告称截至2021年12月31日,持有滴滴7.4%被动股份。滴滴(DIDI.N)盘前拉升涨5.6%。

$腾讯控股 (00700.HK)$

$腾讯控股(ADR) (TCEHY.US)$

$滴滴(已退市) (DIDI.US)$

腾讯控股报告称截至2021年12月31日,持有滴滴7.4%被动股份。滴滴(DIDI.N)盘前拉升涨5.6%。

$腾讯控股 (00700.HK)$

$腾讯控股(ADR) (TCEHY.US)$

$滴滴(已退市) (DIDI.US)$

7

Luiz小财神

参与了投票

感恩节是一个食物、朋友和家人的时刻。也是一个停下来,反思我们的生活,并思考我们对什么表示感激的时刻。

在这个感恩节,我们想问你——在你的投资旅程中,你感激什么? 这些是你想要支持的家人吗?你的投资伙伴?你赚钱的股票?你读过的书?也许是一位专家?清单还有很多。有很多事情我们深深感激并对之心存感激之情。为什么不趁此机会表达你的感谢呢!?

你今年最感激哪些股票?相反,哪些股票给了你一个教训? 无论成功与否,我们总是有理由心存感激,因为这让我们变得更强大,更有经验的投资者。

交易或投资从来都不是一件容易的事情。幸运的是,我们的家人或朋友提供 在艰难时期提供情感支持, 在投资生涯的曲折中提供鼓励,以及被理解和接受的安慰,因为你想要用生活做些什么。

你有 在初始阶段指导你的导师吗 在您投资的旅程中,您是否发现了一些有用的书籍? 是什么书对您做决策有帮助?在您迷茫时,有无数在线课程和书籍可以帮助您。您想向谁表示感谢?

当我们决定投资并从头学习时,我们做出了一个勇敢的决定和艰难的选择。 不要忘记,我们是一个勇敢的人,我们应该为此感到感激。金钱买不到的东西

5 best posts 将获得 1,888 积分;

10个特色帖子 将获得 888 积分;

所有参与者将获得 88 积分。

持续时间现在至11月29日晚上11:59 (ET)

注意:

1. 仅限相关帖子 和那些添加话题 #对此,我感激计数。 (请在话题下发帖。) 2. 最低字数要求:

50个单词

获奖者将在12月2日公布。

谢谢,祝所有投资交易的人好运。在这里参与讨论时不要忘记附上你的感恩节晚餐的照片 #对此我感激不尽。

已翻译

253

30

9

Luiz小财神

赞了

此时,学习巴菲特的投资哲学更为重要。很多人在价值股飙升时开始学习巴菲特的投资哲学,然后投资一些价值股。无论价格高低,当价值暴跌时,他们说价值投资无效。这不是价值投资,而是因为涨跌而受情绪影响。那什么是价值投资者呢?首先,你必须了解一个公司(买入股票相当于经营做生意)。如果你知道一个公司价值100元,而当前价格只有30或50元,你会购买吗?当然会购买(因为那是便宜货)。这里有一个问题,那就是你如何知道这家公司价值100元?这就是巴菲特所说的安全边际。例如,我是一家汽车4S店的总经理。通过几个数据,我大致可以了解到我对汽车4S店的价值和这家4S店的价值。所以巴菲特的概念非常简单易懂。我们唯一需要提高的就是我们自身的安全边际。只有当安全边际增加时,你才能找到更好更便宜的公司。这样市场的波动会给你更多的机会。(也就是说,市场先生会给你买入优质公司和低价股票的机会),现在你不想看市场,而是花费大量时间思考(哪些行业或公司具有:心理垄断、纯需瘾、技术垄断、产品稀缺性、资源垄断、高频消费、未来增长)。如果你只是关注当前价格(无论是便宜还是贵)。 $腾讯控股(ADR) (TCEHY.US)$ $阿里巴巴 (BABA.US)$ $富途控股 (FUTU.US)$

已翻译

2

Luiz小财神

评论了

$腾讯控股 (00700.HK)$ $阿里巴巴-W (09988.HK)$ 多年来一直被封锁的互联网平台终于正式进行了沟通。目前,腾讯和阿里巴巴旗下的一些产品已经开放了外部链接。

除了淘宝不支持微信,阿里的大部分其他应用程序已经支持微信支付。微信还可以打开抖音链接和淘宝链接。

互联互通对于淘宝、微信和抖音都是有利的,但谁更有利?

对于抖音来说,继续制作高质量内容,从微信等平台获得更多流量,比如快手的下沉市场用户。

对于淘宝来说,可从微信和抖音平台获取站外流量。虽然长期来看,流量港可能会留在抖音和微信上,但短期内的好处是显而易见。这就是阿里巴巴香港股票暴涨的原因。

对于微信来说,商家将把淘宝和抖音的流量引流至微信,并通过私域运营保持与用户的关系,从而提高回购率和变现效率。

如果真的完全开放,上述逻辑是合理的。抖音和淘宝都获得了新的增量,微信的社交关系将更加稳定,微信支付的份额可能很快超过支付宝。

当然,对于抖音和淘宝的链接只能分享到微信且可打开,但显示效果不是很好。

互联网产品最重要的部分是用户体验。没有良好的体验,即使开放了,用户可能不会经常使用。

例如,微信现在打开淘宝产品链接时,不会直接打开,而是先提示外部链接的风险,然后登录淘宝账户才能进入查看产品。

在微信打开抖音链接后的情况与淘宝类似。它也会在打开视频之前提示外部链接的风险。

然而,抖音和淘宝的情况仍然有所不同。抖音可以直接跳转至抖音APP,而淘宝必须登录,否则无法进行任何后续操作。

在这样的用户体验下,微信链接进入淘宝购物的体验真的没直接开淘宝APP方便。

与京东相比,京东链接可以直接打开,并且可以直接授权通过微信登录。京东和拼多多也支持直接跳转。

是因为阿里巴巴不希望用户在微信上有很好的用户体验吗?还是腾讯仍然不愿意完全开放?这个问题仍不明朗。

在短期内完全开放对阿里巴巴有利,但长远来看,如果在微信上的用户体验太好,用户可能会养成通过微信打开淘宝的习惯。淘宝平台的价值在哪里?

无论如何,在外链全开放后,确实可以解决部分流量垄断问题,但无论竞争多激烈,总归是有利于头部公司。

除了淘宝不支持微信,阿里的大部分其他应用程序已经支持微信支付。微信还可以打开抖音链接和淘宝链接。

互联互通对于淘宝、微信和抖音都是有利的,但谁更有利?

对于抖音来说,继续制作高质量内容,从微信等平台获得更多流量,比如快手的下沉市场用户。

对于淘宝来说,可从微信和抖音平台获取站外流量。虽然长期来看,流量港可能会留在抖音和微信上,但短期内的好处是显而易见。这就是阿里巴巴香港股票暴涨的原因。

对于微信来说,商家将把淘宝和抖音的流量引流至微信,并通过私域运营保持与用户的关系,从而提高回购率和变现效率。

如果真的完全开放,上述逻辑是合理的。抖音和淘宝都获得了新的增量,微信的社交关系将更加稳定,微信支付的份额可能很快超过支付宝。

当然,对于抖音和淘宝的链接只能分享到微信且可打开,但显示效果不是很好。

互联网产品最重要的部分是用户体验。没有良好的体验,即使开放了,用户可能不会经常使用。

例如,微信现在打开淘宝产品链接时,不会直接打开,而是先提示外部链接的风险,然后登录淘宝账户才能进入查看产品。

在微信打开抖音链接后的情况与淘宝类似。它也会在打开视频之前提示外部链接的风险。

然而,抖音和淘宝的情况仍然有所不同。抖音可以直接跳转至抖音APP,而淘宝必须登录,否则无法进行任何后续操作。

在这样的用户体验下,微信链接进入淘宝购物的体验真的没直接开淘宝APP方便。

与京东相比,京东链接可以直接打开,并且可以直接授权通过微信登录。京东和拼多多也支持直接跳转。

是因为阿里巴巴不希望用户在微信上有很好的用户体验吗?还是腾讯仍然不愿意完全开放?这个问题仍不明朗。

在短期内完全开放对阿里巴巴有利,但长远来看,如果在微信上的用户体验太好,用户可能会养成通过微信打开淘宝的习惯。淘宝平台的价值在哪里?

无论如何,在外链全开放后,确实可以解决部分流量垄断问题,但无论竞争多激烈,总归是有利于头部公司。

已翻译

1

Luiz小财神

评论了

尽管整体趋势仍然向上,但我今天一直在观察市场。根据挂单,我们可以看到今天许多买单是小单,而许多卖单是大单。在上涨过程中,阻力一直很大,所以我预计明天阻力还会很大,跌幅可能会略微增加。从技术指标来看,kdj和macd有些不同,kdj明天将达到一个高点,而macd还没有出现。红线,也许macd会直接跟随第二波绿线,整体macd的上升趋势有点弱,只有当kdj和macd共鸣时,上涨才会更强(个人真实经验),整体目前受到布林中轨的压制,再加上节假日,明天不会有被动收水。在过去两天,被动收水买入相当多。所以总体而言,我认为明天跌幅的概率很高。 $腾讯控股 (00700.HK)$ 尽管整体趋势仍然向上,但我今天一直在观察市场。根据挂单,我们可以看到今天许多买单是小单,而许多卖单是大单。在上涨过程中,阻力一直很大,所以我预计明天阻力还会很大,跌幅可能会略微增加。从技术指标来看,kdj和macd有些不同,kdj明天将达到一个高点,而macd还没有出现。红线,也许macd会直接跟随第二波绿线,整体macd的上升趋势有点弱,只有当kdj和macd共鸣时,上涨才会更强(个人真实经验),整体目前受到布林中轨的压制,再加上节假日,明天不会有被动收水。在过去两天,被动收水买入相当多。所以总体而言,我认为明天跌幅的概率很高。

已翻译

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)