Drodrigues

赞了

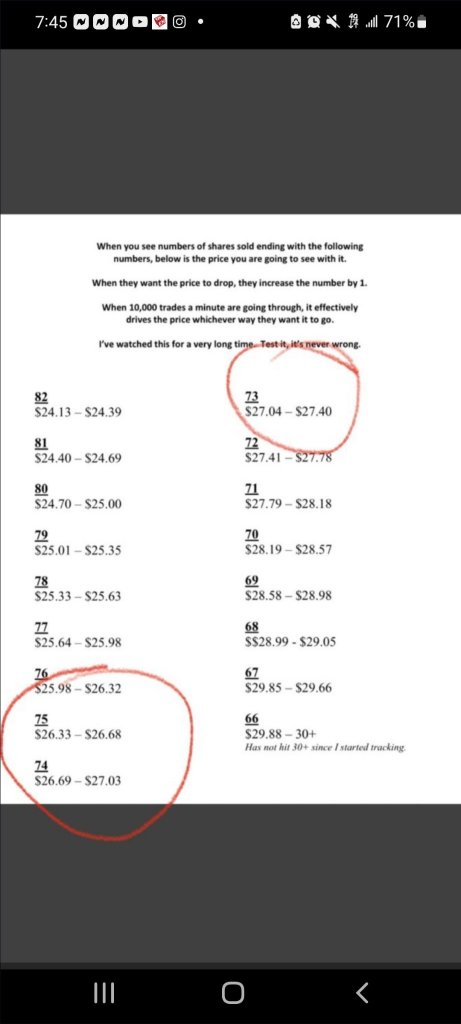

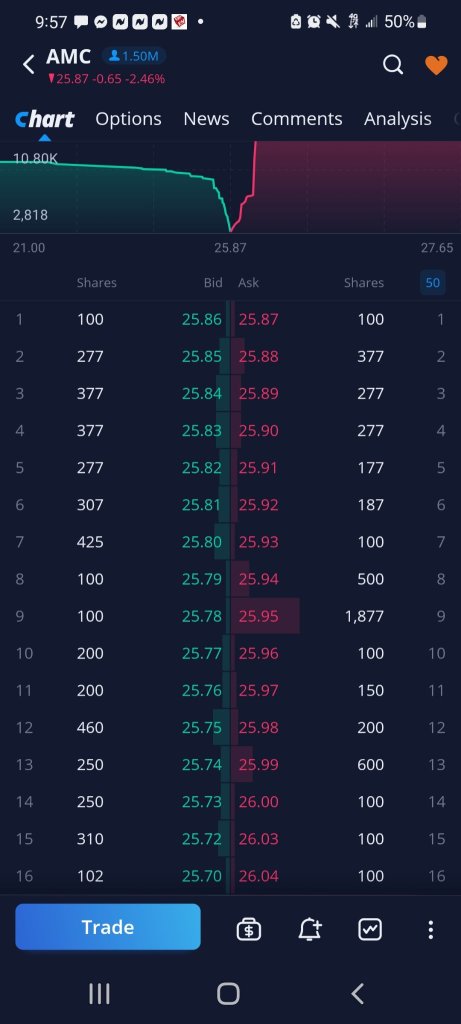

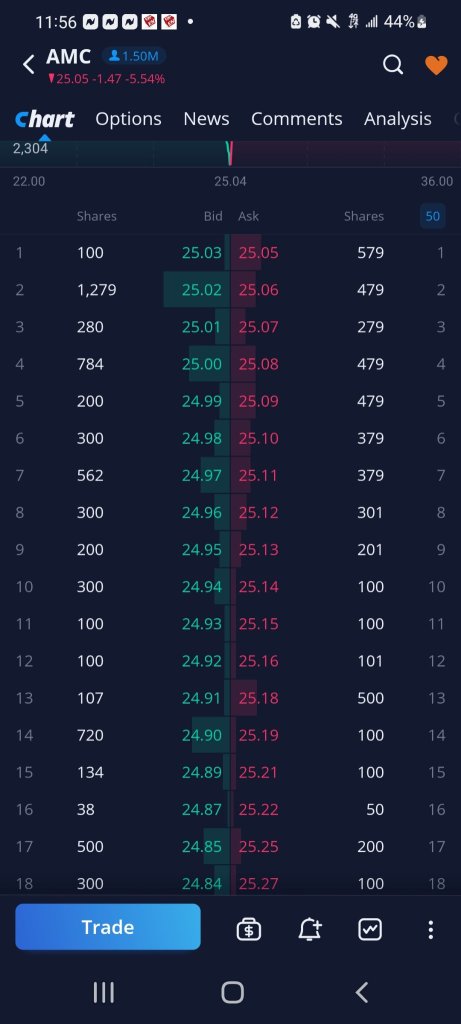

$AMC院线 (AMC.US)$ $游戏驿站 (GME.US)$ $SNDL Inc (SNDL.US)$ 蛋糕上还有更多锦上添花该死的数字差不多!!你自己看看布丁里有证据!!👀👀👀 #manipulation 🦍🦍🦍💎💎💎🖐🏿🖐🏿🖐🏿

已翻译

+1

1

Drodrigues

赞了

Drodrigues

赞了

已翻译

9

3

Drodrigues

赞了

$AMC院线 (AMC.US)$ 当您看到各处都提示不要购买期权和股票时,这意味着您应该加大投资。您要么是看涨派,要么不是。现在所有的分析都在这里,您们应该立即加大投资,我已经三倍买入到1月到期的38期权。

已翻译

13

5

Drodrigues

评论了

亚洲股市预计稳步起步;原油、收益率上涨

亚洲股市在油价、国债收益率持续攀升、华尔街交易混合格局的影响下,周三看起来将稳步起步,交易员们权衡收紧货币政策以控制通胀的前景。

澳洲开盘上涨,日本和香港期货变动不大,美国期货小幅下跌。能源和金融股助力 $标普500指数 (.SPX.US)$ 继续攀升,而 $纳斯达克100指数 (.NDX.US)$ 则出现下滑。在美国交易的中国股票指数连续第二天下跌。

随着Gap和诺德斯特龙加剧供应担忧,购物中心品牌暴跌。

购物中心的主打品牌 $Gap Inc (GPS.US)$ 和 $诺德斯特龙 (JWN.US)$ 报告令人失望的业绩后,购物中心的代表性品牌跌至谷底,进一步加剧了对全球供应链危机的担忧。

纽约时间下午5时55分,Gap股价下跌17%,而诺德斯特龙股价暴跌23%。购物中心同行 $爱芬奇 (ANF.US)$在市场开盘前公布业绩的,周二下跌了13%。 $都市服饰 (URBN.US)$ 在其盈利报告后下跌了9%。

meme股经历自6月以来最糟糕的一天,风险情绪降温

包括meme股在内的 $游戏驿站 (GME.US)$ 和 $3B家居 (BBBY.US)$ 投资者抛售风险资产,转而青睐价值型公司,导致meme股周二下跌。

据彭博社追踪,37只零售投资者最爱的股票在周二下跌了5.5%,是自6月中旬以来该组股票的最大跌幅。

盈利公司抛弃了亏损股票。

再次获利真的很有回报。与那些亏损的同行相比,投资者正在奖励那些盈利率达到近二十年来最高的公司。

盈利公司的平均回报率在 $罗素3000ETF-iShares (IWV.US)$ 根据彭博社编制的数据显示,今年的收益率为36%,是亏损公司收益的三倍左右。

零售交易商在假期前又开始涌入小型生物科技公司。

这两家小型生物科技公司 $iSpecimen (ISPC.US)$ 和 $Longeveron (LGVN.US)$成为了最新一批被社交媒体推动的狂热所困扰的股票,而这正值美国的交易假期即将到来。

ISpecimen周二收盘上涨49%,开盘后翻倍并触发波动性暂停。该股票由个人持有大部分,约44%属于内部持有。

Rocket Lab首席执行官表示,不重复使用火箭的公司在制造"没有前途的产品"。

$Rocket Lab (RKLB.US)$ 首席执行官彼得·贝克对重新使用火箭的态度发生了很大变化,这一做法正变得越来越受欢迎,由埃隆·马斯克的SpaceX带头。

"我认为,此时未开发可重复使用的运载火箭的任何人,正在开发一种没有前途的产品,因为很明显,这是一种必须从一开始就融入的基本方法," 贝克周二表示。

spacex(临时代码)将发射一艘NASA太空飞船,将撞向一颗小行星

SpaceX(临时代码)计划在周三凌晨首次发射一项NASA的首个宇宙防御任务。"我们将撞向一颗小行星,"NASA的发射服务项目高级发射主任奥马尔·巴埃兹表示。

该任务被称为双小行星重新定向测试(或DART)。NASA正试图学习如何偏转一种威胁,如果它朝着地球而来的话。

苹果代表政府起诉一家以黑客iPhone知名的公司

$苹果 (AAPL.US)$ 正在起诉以色列公司NSO Group,该公司向政府机构和执法部门出售软件,使其能够黑客入侵iPhone。国际特赦组织今年早些时候表示,他们发现一些记者和人权律师的最新款iPhone感染了NSO Group的恶意软件。

苹果公司表示,周二他们修复了导致NSO Group恶意软件入侵的漏洞,并会警告可能受到攻击的iPhone用户。

资料来源:彭博社,CNBC

亚洲股市在油价、国债收益率持续攀升、华尔街交易混合格局的影响下,周三看起来将稳步起步,交易员们权衡收紧货币政策以控制通胀的前景。

澳洲开盘上涨,日本和香港期货变动不大,美国期货小幅下跌。能源和金融股助力 $标普500指数 (.SPX.US)$ 继续攀升,而 $纳斯达克100指数 (.NDX.US)$ 则出现下滑。在美国交易的中国股票指数连续第二天下跌。

随着Gap和诺德斯特龙加剧供应担忧,购物中心品牌暴跌。

购物中心的主打品牌 $Gap Inc (GPS.US)$ 和 $诺德斯特龙 (JWN.US)$ 报告令人失望的业绩后,购物中心的代表性品牌跌至谷底,进一步加剧了对全球供应链危机的担忧。

纽约时间下午5时55分,Gap股价下跌17%,而诺德斯特龙股价暴跌23%。购物中心同行 $爱芬奇 (ANF.US)$在市场开盘前公布业绩的,周二下跌了13%。 $都市服饰 (URBN.US)$ 在其盈利报告后下跌了9%。

meme股经历自6月以来最糟糕的一天,风险情绪降温

包括meme股在内的 $游戏驿站 (GME.US)$ 和 $3B家居 (BBBY.US)$ 投资者抛售风险资产,转而青睐价值型公司,导致meme股周二下跌。

据彭博社追踪,37只零售投资者最爱的股票在周二下跌了5.5%,是自6月中旬以来该组股票的最大跌幅。

盈利公司抛弃了亏损股票。

再次获利真的很有回报。与那些亏损的同行相比,投资者正在奖励那些盈利率达到近二十年来最高的公司。

盈利公司的平均回报率在 $罗素3000ETF-iShares (IWV.US)$ 根据彭博社编制的数据显示,今年的收益率为36%,是亏损公司收益的三倍左右。

零售交易商在假期前又开始涌入小型生物科技公司。

这两家小型生物科技公司 $iSpecimen (ISPC.US)$ 和 $Longeveron (LGVN.US)$成为了最新一批被社交媒体推动的狂热所困扰的股票,而这正值美国的交易假期即将到来。

ISpecimen周二收盘上涨49%,开盘后翻倍并触发波动性暂停。该股票由个人持有大部分,约44%属于内部持有。

Rocket Lab首席执行官表示,不重复使用火箭的公司在制造"没有前途的产品"。

$Rocket Lab (RKLB.US)$ 首席执行官彼得·贝克对重新使用火箭的态度发生了很大变化,这一做法正变得越来越受欢迎,由埃隆·马斯克的SpaceX带头。

"我认为,此时未开发可重复使用的运载火箭的任何人,正在开发一种没有前途的产品,因为很明显,这是一种必须从一开始就融入的基本方法," 贝克周二表示。

spacex(临时代码)将发射一艘NASA太空飞船,将撞向一颗小行星

SpaceX(临时代码)计划在周三凌晨首次发射一项NASA的首个宇宙防御任务。"我们将撞向一颗小行星,"NASA的发射服务项目高级发射主任奥马尔·巴埃兹表示。

该任务被称为双小行星重新定向测试(或DART)。NASA正试图学习如何偏转一种威胁,如果它朝着地球而来的话。

苹果代表政府起诉一家以黑客iPhone知名的公司

$苹果 (AAPL.US)$ 正在起诉以色列公司NSO Group,该公司向政府机构和执法部门出售软件,使其能够黑客入侵iPhone。国际特赦组织今年早些时候表示,他们发现一些记者和人权律师的最新款iPhone感染了NSO Group的恶意软件。

苹果公司表示,周二他们修复了导致NSO Group恶意软件入侵的漏洞,并会警告可能受到攻击的iPhone用户。

资料来源:彭博社,CNBC

已翻译

104

5

Drodrigues

赞了

US yogurt brandChobani filed on November 17th with the SEC. It plans to list on the Nasdaq under the symbol CHO.

According to Renaissance Capital's estimation, the company could raise up to $1.5 billion. The joint bookrunners on the deal includes Goldman Sachs, BofA Securities, J.P. Morgan, Barclays,etc.

In July, the company confidentially filed for an IPO, and Reuters reported its valuation could exceed $10 billion.

Business Overview

Chobani, founded in 2005, is a leading Greek yogurt brand in the US. Since 2007, it has maintained its position as the #1 Greek yogurt brand. It also provides a portfolio of high-quality yogurt products.

Chobani's products come in single-serve, multi-serve, and/or multi-pack formats through approximately 95,000 retail locations in the US. Its key customers include Wal-Mart, Whole Foods, Amazon, Target, Kroger, Publix, Costco and Safeway/Albertsons. It also sells its products to various other national and regional retailers and has an international presence.

Chobani values innovation. Its trusted brand and expertise in the food value chain also helps it convert into new high-growth categories,including oat milk, coffee creamer, ready-to-drink coffee and plant-based probiotic beverage lines.

The U.S. oat milk market has experienced explosive growth in recent years and is the fastest growing segment within plant-based milk. In the 52 weeks ended October 16, 2021, it was a $376 million category, growing 79.6% year-over-year.

Chobani Oat entered the oat milk market in December 2019 and has grown to 15.1% of total Nielsen reported U.S. market share for the 13 weeks ended October 16, 2021, gaining share more quickly than it did in the yogurt category.

For the 13 weeks ended October 16, 2021, total Nielsen reported sales of Chobani Oat have grown 68% year-over year, ahead of the category and several incumbents.

Chobani's in-house production capabilities across its three plants with 1,900 dedicated people. It has a manufacturing facility in New Berlin, New York, a state-of-the-art multi-platform factory in Twin Falls, Idaho, and an additional facility in Melbourne, Australia.

It plans to add capacity to the Twin Falls, Idaho facility for yogurt, oat milk, creamer and coffee products due to increased demand for the products.

Financial Performance

Chobani's revenue grew 5.2% to $1.4 billion from 2019 to 2020. However, its net loss reached $58.7 million, as it invested back into its business.

For the nine months ended September 25, 2021, it generated net sales, net loss and Adjusted EBITDA of approximately $1,213.0 million, $24.0 million and $142.2 million, respectively.

It achieved year-over-year net sales growth of 13.8%, Adjusted EBITDA decrease of 6.2% and an increase in net loss of 12.1%.

Click to view the prospectus

$Chobani (CHO.US)$

According to Renaissance Capital's estimation, the company could raise up to $1.5 billion. The joint bookrunners on the deal includes Goldman Sachs, BofA Securities, J.P. Morgan, Barclays,etc.

In July, the company confidentially filed for an IPO, and Reuters reported its valuation could exceed $10 billion.

Business Overview

Chobani, founded in 2005, is a leading Greek yogurt brand in the US. Since 2007, it has maintained its position as the #1 Greek yogurt brand. It also provides a portfolio of high-quality yogurt products.

Chobani's products come in single-serve, multi-serve, and/or multi-pack formats through approximately 95,000 retail locations in the US. Its key customers include Wal-Mart, Whole Foods, Amazon, Target, Kroger, Publix, Costco and Safeway/Albertsons. It also sells its products to various other national and regional retailers and has an international presence.

Chobani values innovation. Its trusted brand and expertise in the food value chain also helps it convert into new high-growth categories,including oat milk, coffee creamer, ready-to-drink coffee and plant-based probiotic beverage lines.

The U.S. oat milk market has experienced explosive growth in recent years and is the fastest growing segment within plant-based milk. In the 52 weeks ended October 16, 2021, it was a $376 million category, growing 79.6% year-over-year.

Chobani Oat entered the oat milk market in December 2019 and has grown to 15.1% of total Nielsen reported U.S. market share for the 13 weeks ended October 16, 2021, gaining share more quickly than it did in the yogurt category.

For the 13 weeks ended October 16, 2021, total Nielsen reported sales of Chobani Oat have grown 68% year-over year, ahead of the category and several incumbents.

Chobani's in-house production capabilities across its three plants with 1,900 dedicated people. It has a manufacturing facility in New Berlin, New York, a state-of-the-art multi-platform factory in Twin Falls, Idaho, and an additional facility in Melbourne, Australia.

It plans to add capacity to the Twin Falls, Idaho facility for yogurt, oat milk, creamer and coffee products due to increased demand for the products.

Financial Performance

Chobani's revenue grew 5.2% to $1.4 billion from 2019 to 2020. However, its net loss reached $58.7 million, as it invested back into its business.

For the nine months ended September 25, 2021, it generated net sales, net loss and Adjusted EBITDA of approximately $1,213.0 million, $24.0 million and $142.2 million, respectively.

It achieved year-over-year net sales growth of 13.8%, Adjusted EBITDA decrease of 6.2% and an increase in net loss of 12.1%.

Click to view the prospectus

$Chobani (CHO.US)$

+3

60

6

Drodrigues

赞了

$AMC院线 (AMC.US)$ 有钱可以买更多的股票...一次大额买入 @ 38-39 或者如果跌至 40 以下,则进行大额购买。希望能做到哈哈

已翻译

16

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)