How to decide on buying a stock:

(i) Like the saying – Time in the market vs timing the market. Everyone would definitely wish to buy a stock at the extreme lowest – best at $0.10/share and it rises x1000000000000000000 ASAP isn’t it? It is difficult to decide when to enter/buy a stock as time factor is unpredictable.

(ii) How much do you understand the stock – understanding and believing in the organisation.

(iii) Trend within that week or around that period – what’s the hype? Igniting the crowd to buy as it is rising or buying the dip?

How to decide on selling a stock:

(i) Setting goal/aim on % in earnings. Some people have troubles parting with their stocks. Probably set a % of gains/profits you would be satisfied with the earnings.

(ii) If one needs the money for a more attractive opportunity. It is quite painful having to let go a stock – be it whether it is bearish or bullish as it’s either parting with money you’ve lost which you might recoup or you might be receiving higher gains, but nobody knows the future.

Lastly, having to review in time to time (2 weeks to 1 month) – check if there’s need to make adjustments to what was set initially and do a follow up!

Not adding stock code as its really a generic topic to debate! Everyone has different perspectives on each stocks!![]()

![]()

(i) Like the saying – Time in the market vs timing the market. Everyone would definitely wish to buy a stock at the extreme lowest – best at $0.10/share and it rises x1000000000000000000 ASAP isn’t it? It is difficult to decide when to enter/buy a stock as time factor is unpredictable.

(ii) How much do you understand the stock – understanding and believing in the organisation.

(iii) Trend within that week or around that period – what’s the hype? Igniting the crowd to buy as it is rising or buying the dip?

How to decide on selling a stock:

(i) Setting goal/aim on % in earnings. Some people have troubles parting with their stocks. Probably set a % of gains/profits you would be satisfied with the earnings.

(ii) If one needs the money for a more attractive opportunity. It is quite painful having to let go a stock – be it whether it is bearish or bullish as it’s either parting with money you’ve lost which you might recoup or you might be receiving higher gains, but nobody knows the future.

Lastly, having to review in time to time (2 weeks to 1 month) – check if there’s need to make adjustments to what was set initially and do a follow up!

Not adding stock code as its really a generic topic to debate! Everyone has different perspectives on each stocks!

3

3

Cathie Wood's Ark Investment Management continued its selling spree of $特斯拉 (TSLA.US)$ stock after the investment management firm offloaded $270 million worth of the electric vehicle maker's shares Tuesday.

Three of Wood's exchange-traded funds - $ARK Innovation ETF (ARKK.US)$ , $ARK Autonomous Technology & Robotics ETF (ARKQ.US)$ , and $ARK Next Generation Internet ETF (ARKW.US)$ - cumulatively sold more than 340,000 Tesla shares Tuesday, according to its daily trading update.

Social Capital founder and CEO Chamath Palihapitiya also revealed that he sold his Tesla position for capital to invest in other investment ideas. He said he exited his bet on the Elon Musk-led electric vehicle company “in the last year or so” as the high prices allowed him to generate cash to fund his other ideas.

Are they trying to avoid some risks that we're not aware of? Or maybe we should stop over-interpreting their moves?

Source:

Cathie Wood dumps biggest chunk of Tesla stock in her recent string of sales

Three of Wood's exchange-traded funds - $ARK Innovation ETF (ARKK.US)$ , $ARK Autonomous Technology & Robotics ETF (ARKQ.US)$ , and $ARK Next Generation Internet ETF (ARKW.US)$ - cumulatively sold more than 340,000 Tesla shares Tuesday, according to its daily trading update.

Social Capital founder and CEO Chamath Palihapitiya also revealed that he sold his Tesla position for capital to invest in other investment ideas. He said he exited his bet on the Elon Musk-led electric vehicle company “in the last year or so” as the high prices allowed him to generate cash to fund his other ideas.

Are they trying to avoid some risks that we're not aware of? Or maybe we should stop over-interpreting their moves?

Source:

Cathie Wood dumps biggest chunk of Tesla stock in her recent string of sales

44

13

The $标普500指数 (.SPX.US)$ 延续了九月份的抛售,科技股表现不佳,经济敏感型公司表现优异。 $纳斯达克100指数 (.NDX.US)$ 跌幅创下三月以来新高。 美国十年期国债收益率及三十年期国债收益率 消费上涨了。 10个基点. The 美元。 股市上涨。

没什么好说的,让我们来看一下指数:

我们都知道它要来了,问题是:“这是它的日子吗?"?

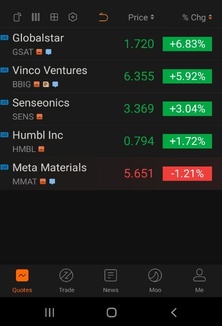

在评论区展示您的投资组合的截图 我猜我们认识的受苦的人越多,我们就会越舒适![]()

![]()

![]()

没什么好说的,让我们来看一下指数:

我们都知道它要来了,问题是:“这是它的日子吗?"?

在评论区展示您的投资组合的截图 我猜我们认识的受苦的人越多,我们就会越舒适

已翻译

57

14

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Chyna Chianne : 你买照片和视频吗