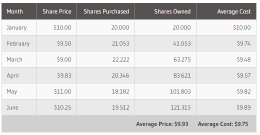

Automatic investing, often called dollar-cost averaging, is a simple, effective way to invest. Once you select an investment, you decide how much you will invest and how often. Then, you set up an automatic plan to invest a specific amount each month, by authorizing withdrawals from your bank account.

By investing regularly in up and down markets, you will buy more shares when prices are low and fewer when prices are high. This reduces your average cost per share and provides a simple way to invest a portion of your paycheck each month. It also removes the guesswork of trying to time the market.

A dollar-cost averaging strategy can reduce the risk of investing a lump sum in the market on a single day. By investing periodically, you spread your purchase price risk over multiple market periods.

Invest RegularlyAutomatic Investing

By investing regularly in up and down markets, you will buy more shares when prices are low and fewer when prices are high. This reduces your average cost per share and provides a simple way to invest a portion of your paycheck each month. It also removes the guesswork of trying to time the market.

A dollar-cost averaging strategy can reduce the risk of investing a lump sum in the market on a single day. By investing periodically, you spread your purchase price risk over multiple market periods.

Invest RegularlyAutomatic Investing

Elizabeth

留下了心情

What Is a Cyclical Stock?

A cyclical stock refers to an equity security whose price is affected by macroeconomic, systematic changes in the overall economy. Cyclical stocks are known for following the cycles of an economy through expansion, peak, recession, and recovery. Most cyclical stocks belong to companies that sell discretionary items consumers can afford to buy more of during a booming economy. These stocks are also from companies that consumers choose to spend less with and cut back on during a recession.

Understanding Cyclical Stocks

Companies whose stocks are cyclical include car manufacturers, airlines, furniture retailers, clothing stores, hotels, and restaurants. When the economy is doing well, people can afford to buy new cars, upgrade their homes, shop, and travel. When the economy does poorly, these discretionary expenses are som

A cyclical stock refers to an equity security whose price is affected by macroeconomic, systematic changes in the overall economy. Cyclical stocks are known for following the cycles of an economy through expansion, peak, recession, and recovery. Most cyclical stocks belong to companies that sell discretionary items consumers can afford to buy more of during a booming economy. These stocks are also from companies that consumers choose to spend less with and cut back on during a recession.

Understanding Cyclical Stocks

Companies whose stocks are cyclical include car manufacturers, airlines, furniture retailers, clothing stores, hotels, and restaurants. When the economy is doing well, people can afford to buy new cars, upgrade their homes, shop, and travel. When the economy does poorly, these discretionary expenses are som

3

Elizabeth

赞了

An important debate among investors is whether the stock market is efficient—that is, whether it reflects all the information made available to market participants at any given time. The efficient market hypothesis (EMH) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all market participants possess equally.

Financial theories are subjective. In other words, there are no proven laws in finance. Instead, ideas try to explain how the market works. Here, we take a look at where the efficient market hypothesis has fallen short in terms of explaining the stock market's behavior. While it may be easy to see a number of deficiencies in the theory

Financial theories are subjective. In other words, there are no proven laws in finance. Instead, ideas try to explain how the market works. Here, we take a look at where the efficient market hypothesis has fallen short in terms of explaining the stock market's behavior. While it may be easy to see a number of deficiencies in the theory

1

1

Elizabeth

留下了心情

What Is the S&P 500 Index?

The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities. Other common U.S. stock market benchmarks include the Dow Jones Industrial Average or Dow 30 and the Russell 2000 Index, which represents the small-cap index.

The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities. Other common U.S. stock market benchmarks include the Dow Jones Industrial Average or Dow 30 and the Russell 2000 Index, which represents the small-cap index.

5

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Elizabeth : 这里有专家吗?

Elizabeth : 走高端路线?