Kennythematics

参与了投票

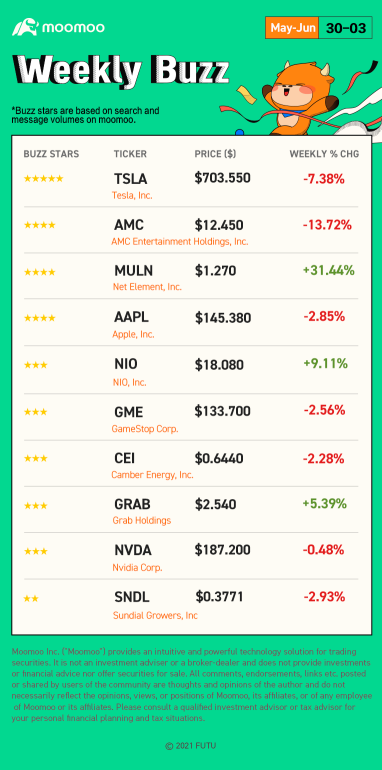

上周(截至2022年9月16日)的股票热度榜如下::

在这篇发帖的结尾,您有机会赢取积分!

周一快乐, mooer们欢迎回来! Weekly Buzz在这里,我们将根据moomoo平台上上周搜索和消息量选定的热门股票,回顾新闻、表现和社区情绪!(小型市值股被排除在外。)

第一部分:做出你的选择

第二部分:热门股票清单与mooer们的评论

三大指数走势 上涨,罗素2000指数上涨...

在这篇发帖的结尾,您有机会赢取积分!

周一快乐, mooer们欢迎回来! Weekly Buzz在这里,我们将根据moomoo平台上上周搜索和消息量选定的热门股票,回顾新闻、表现和社区情绪!(小型市值股被排除在外。)

第一部分:做出你的选择

第二部分:热门股票清单与mooer们的评论

三大指数走势 上涨,罗素2000指数上涨...

已翻译

39

63

美国回购创纪录水平

美国公司在第一季度宣布回购金额超过3000亿美元,其中3月份同比增长强劲,表明回购活动近期保持强劲,根据金融数据公司EPFR和Informa Financial Intelligence的数据。 3000亿美元 根据金融数据公司EPFR和Informa Financial Intelligence的数据,今年第一季度宣布的新回购达到约

3月份宣布的新回购约达到 740 billion美元,比2021年3月的540亿美元增长,Informa Financial Intelli...

美国公司在第一季度宣布回购金额超过3000亿美元,其中3月份同比增长强劲,表明回购活动近期保持强劲,根据金融数据公司EPFR和Informa Financial Intelligence的数据。 3000亿美元 根据金融数据公司EPFR和Informa Financial Intelligence的数据,今年第一季度宣布的新回购达到约

3月份宣布的新回购约达到 740 billion美元,比2021年3月的540亿美元增长,Informa Financial Intelli...

已翻译

48

6

Kennythematics

赞并参与了投票

在周六, 沃伦·巴菲特 , 可能是全球最受关注的投资者之一,发布了备受期待的年度股东信。

其对冲基金, $伯克希尔-A (BRK.A.US)$ ,在2021年表现出色。年度增长率 29.6% 胜过 $标普500指数 (.SPX.US)$ 的 28.7%. 看上去,随着美联储准备提高利率期货,2022年可能会进一步变得更好。

然而,在过去的十年里,巴菲特的投资哲学已经变得过时。

其对冲基金, $伯克希尔-A (BRK.A.US)$ ,在2021年表现出色。年度增长率 29.6% 胜过 $标普500指数 (.SPX.US)$ 的 28.7%. 看上去,随着美联储准备提高利率期货,2022年可能会进一步变得更好。

然而,在过去的十年里,巴菲特的投资哲学已经变得过时。

已翻译

33

5

3

Kennythematics

赞并参与了投票

美国股指在这个缩短的交易周中收盘上涨, $标普500指数 (.SPX.US)$ 创下新高。

标准普尔500指数上涨了0.6%,或29.23点,达到其第68个。 4725.79, 个。

2021年创下了历史最高纪录周四上涨,连续第三天增长,紧随周三的强劲交易

经济数据的利好有助于缓解投资者对Covid-19和通胀风险的担忧。

这家以科技为重点的 $纳斯达克综合指数 (.IXIC.US)$ 上涨了0.85%,或131.48点,达到15653.37点。该 $道琼斯指数 (.DJI.US)$ 又增加了0.55%,或196.67点,至35950.56。

标准普尔500指数上涨了0.6%,或29.23点,达到其第68个。 4725.79, 个。

2021年创下了历史最高纪录周四上涨,连续第三天增长,紧随周三的强劲交易

经济数据的利好有助于缓解投资者对Covid-19和通胀风险的担忧。

这家以科技为重点的 $纳斯达克综合指数 (.IXIC.US)$ 上涨了0.85%,或131.48点,达到15653.37点。该 $道琼斯指数 (.DJI.US)$ 又增加了0.55%,或196.67点,至35950.56。

已翻译

40

让我们来看看本周最大的活跃股。![]()

![]()

前十个活跃股 大型市值股![]()

![]()

大盘增值股票:大盘公司的股票,比其他大盘股便宜或增长较慢。增值是根据低估值(低价格比率和高股息率)以及增长缓慢(盈利、销售额、账面价值和现金流的增长率低)来定义的。

美国股权市场市值排名前70%的股票被定义为大盘。

前十个活跃股 大型增长股![]()

![]()

大盘公司的股票,预计增长速度比其他大盘股快。增长是根据快速增长(盈利、销售额、账面价值和现金流的增长率高)以及高估值(高价格比率和低股息率)来定义的。

前十个活跃股 大型核心股票![]()

![]()

大盘核心股票:大盘公司的股票,既不以增长特征为主,也不以价值特征为主。

来源:moomoo,晨星

前十个活跃股 大型市值股

大盘增值股票:大盘公司的股票,比其他大盘股便宜或增长较慢。增值是根据低估值(低价格比率和高股息率)以及增长缓慢(盈利、销售额、账面价值和现金流的增长率低)来定义的。

美国股权市场市值排名前70%的股票被定义为大盘。

前十个活跃股 大型增长股

大盘公司的股票,预计增长速度比其他大盘股快。增长是根据快速增长(盈利、销售额、账面价值和现金流的增长率高)以及高估值(高价格比率和低股息率)来定义的。

前十个活跃股 大型核心股票

大盘核心股票:大盘公司的股票,既不以增长特征为主,也不以价值特征为主。

来源:moomoo,晨星

已翻译

75

3

By Julianna

Investors appear to be losing patience with Ark Investment Management's genomics fund.![]()

![]()

$ARK生物基因科技革新主动型ETF (ARKG.US)$ is an actively managed ETF that focus on health care, information technology, materials, energy, and consumer discretionary.

Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

- according to ARKG fund description.

However, ARKG is down 30% this year as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, this ETF is faring far worse than the broader biotech sector, with the $道琼斯美国生物技术指数 (.DJUSBT.US)$up 11.35% this year.![]()

![]()

ARKG is currently trading at $65.16 a share, 43% lower from its peak in this February. The genomics fund has also seen the largest outflows among Ark's ETFs this year.![]()

![]()

It's interesting that typically loyal Ark investors have been bailing on the ETF.

The fund's assets have been chopped in half since February. While I don't believe the ETF is experiencing some of sort of 'doom loop,' clearly the outflows are putting downward price pressure on the underlying holdings and testing the will of remaining fund owners.

- said Nate Geraci, president of The ETF Store, an advisory firm.

![]()

![]() FOLLOW ME to know more about ETFs

FOLLOW ME to know more about ETFs

PLZ leave your comments and likes below![]()

ARKG's top two holdings, $Teladoc Health (TDOC.US)$and $精密科学 (EXAS.US)$, heavily impact its performance, with drops of 47% and 33.5% this year, respectively.![]()

![]()

![]()

The recent outflows may be due to investors looking for shorter-term opportunities into the year-end and freeing up cash.

- said Sylvia Jablonski, chief investment officer at Defiance ETFs.

Ark Chief Executive Officer Cathie Wood is well-known for prioritizing longer term investments over short-term gains.![]()

![]()

This is a 5-10 year hold. AI in health care is going to change the way that we can predict, treat and manage the most difficult diseases like cancer, and the Ark fund gives investors access to the companies who are on the cutting edge of that research.

- Jablonski added.

Have you ever invested in the Biotechnology sector? Do you agree with Jablonski's opinion?![]()

![]()

Source: Bloomberg

Investors appear to be losing patience with Ark Investment Management's genomics fund.

$ARK生物基因科技革新主动型ETF (ARKG.US)$ is an actively managed ETF that focus on health care, information technology, materials, energy, and consumer discretionary.

Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

- according to ARKG fund description.

However, ARKG is down 30% this year as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, this ETF is faring far worse than the broader biotech sector, with the $道琼斯美国生物技术指数 (.DJUSBT.US)$up 11.35% this year.

ARKG is currently trading at $65.16 a share, 43% lower from its peak in this February. The genomics fund has also seen the largest outflows among Ark's ETFs this year.

It's interesting that typically loyal Ark investors have been bailing on the ETF.

The fund's assets have been chopped in half since February. While I don't believe the ETF is experiencing some of sort of 'doom loop,' clearly the outflows are putting downward price pressure on the underlying holdings and testing the will of remaining fund owners.

- said Nate Geraci, president of The ETF Store, an advisory firm.

PLZ leave your comments and likes below

ARKG's top two holdings, $Teladoc Health (TDOC.US)$and $精密科学 (EXAS.US)$, heavily impact its performance, with drops of 47% and 33.5% this year, respectively.

The recent outflows may be due to investors looking for shorter-term opportunities into the year-end and freeing up cash.

- said Sylvia Jablonski, chief investment officer at Defiance ETFs.

Ark Chief Executive Officer Cathie Wood is well-known for prioritizing longer term investments over short-term gains.

This is a 5-10 year hold. AI in health care is going to change the way that we can predict, treat and manage the most difficult diseases like cancer, and the Ark fund gives investors access to the companies who are on the cutting edge of that research.

- Jablonski added.

Have you ever invested in the Biotechnology sector? Do you agree with Jablonski's opinion?

Source: Bloomberg

+1

128

25

的结果 $Twitter(已退市) (TWTR.US)$ 民意调查者 $特斯拉 (TSLA.US)$首席执行官埃隆·马斯克(Elon Musk)是决赛,他的大多数追随者表示他应该出售公司10%的股票。

周六,马斯克在推特上发布了一项民意调查,要求他的追随者对他的决定进行投票,他说 调查是为了回应人们对未实现收益是富人逃避纳税的一种方式的担忧。

3519,252张选票的最终结果是,57.9%的人支持出售,而42.1%的人反对。马斯克周日在推特上说,他承认了结果。

周六,马斯克在推特上发布了一项民意调查,要求他的追随者对他的决定进行投票,他说 调查是为了回应人们对未实现收益是富人逃避纳税的一种方式的担忧。

3519,252张选票的最终结果是,57.9%的人支持出售,而42.1%的人反对。马斯克周日在推特上说,他承认了结果。

已翻译

4

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)