在我创业投资时,我正在努力进行研究。一份来源表示未来5年有前景,而另一份则预测2024年可能出现崩盘。如果市场出现崩盘,我想知道是否有人在这样的经济低迷期开始投资。对于初次投资者来说,有哪些安全的公司或行业适合采取谨慎的投资方式,以应对市场走向的各种猜测? $标普500ETF-SPDR (SPY.US)$

已翻译

1

股票暴跌,收益飙升, 30年期拍卖以有史以来最大的尾随收盘,外国需求暴跌后停止

$纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500ETF-SPDR (SPY.US)$

$纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500ETF-SPDR (SPY.US)$

已翻译

1

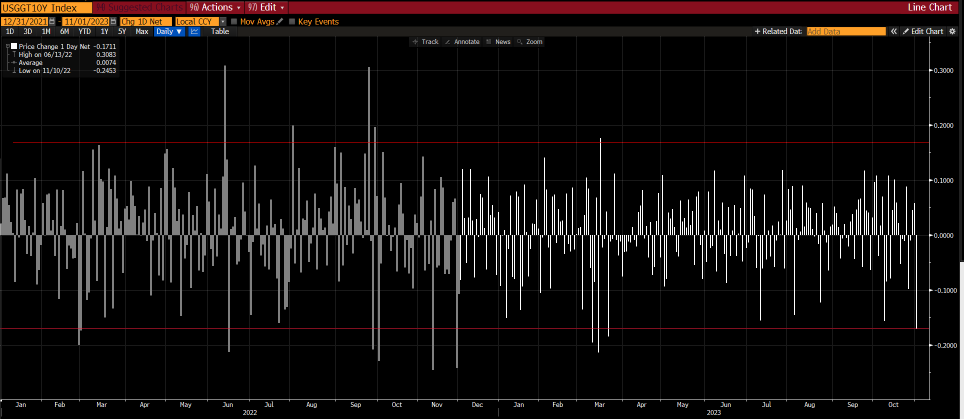

一些背景:自鲍威尔发表讲话以来,10年期实际收益率的下跌是一件大事,但并不是历史性的或exceptional。截至目前,在上一年度开始的加息周期中,有10次更大幅度的日度下跌,以基本点计算。

$道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$ $标普500指数 (.SPX.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500ETF-SPDR (SPY.US)$

$道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$ $标普500指数 (.SPX.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500ETF-SPDR (SPY.US)$

已翻译

1

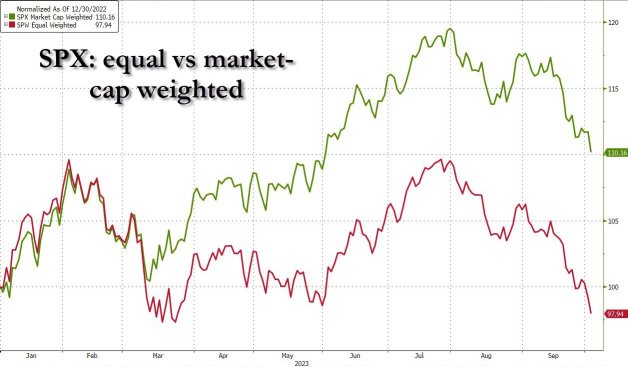

The $标普500指数 (.SPX.US)$ 等权指数今年下跌了近3%。

仅仅3个月前,标准普尔500等权指数上涨了10%。

本月它将跌破3月区域型银行危机的低点。

与此同时,标准普尔500指数今年上涨了8%,抹去了一半以上的涨幅。

随着S&P 7这一最大的科技股继续急剧下跌。

科技股的崩盘意味着市场的崩溃。

科技股就是市场。

仅仅3个月前,标准普尔500等权指数上涨了10%。

本月它将跌破3月区域型银行危机的低点。

与此同时,标准普尔500指数今年上涨了8%,抹去了一半以上的涨幅。

随着S&P 7这一最大的科技股继续急剧下跌。

科技股的崩盘意味着市场的崩溃。

科技股就是市场。

已翻译

大多数2022年的空头在短暂做空QQQ,SPY,特别是NVDA股票后都破产了,从1月份的底部或最后变成了多头。情况似乎还可以……收益不错,大多数人不认为市场会进一步下跌。

牛市开多,杠杆买入是所有人的默认操作模式。

每个人都说十月总是市场的底部,十一月/十二月是神奇的反弹月份。

我不知道...

牛市开多,杠杆买入是所有人的默认操作模式。

每个人都说十月总是市场的底部,十一月/十二月是神奇的反弹月份。

我不知道...

已翻译

2

是的,市场看起来非常健康,你们!

已翻译

1

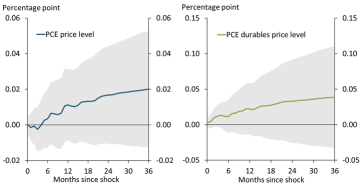

图表显示了对因工作停工导致折工人比例震荡的36个月后的个人消费支出(PCE)和耐用品个人消费支出(PCE)价格指数的影响。该震荡反映了2023年9月期间UAW工人罢工期间罢工人数达到2.5万人的规模,并反映了由于工作停工导致的折工人天数超出了过去12个月的通胀率、工资增长率、工业生产增长率和由于工作停工导致的折工人天数所预测的范围。

已翻译

1

1860年:$9.59

1870年:$3.86

1880年:$0.94

1890年:$0.77

1900年:$1.19

1910年:$0.61

1920年:$3.07

1930年:$1.19

1940年:$1.02

1950年:$2.51

1960年:2.88美元

1970年:3.18美元

1980年:21.59美元

1990年:20.03美元

2000年:26.72美元

2010年:74.71美元

2020年:36.86美元

2023年:88.59美元

$纳斯达克综合指数 (.IXIC.US)$ $道琼斯指数 (.DJI.US)$ $标普500指数 (.SPX.US)$

1870年:$3.86

1880年:$0.94

1890年:$0.77

1900年:$1.19

1910年:$0.61

1920年:$3.07

1930年:$1.19

1940年:$1.02

1950年:$2.51

1960年:2.88美元

1970年:3.18美元

1980年:21.59美元

1990年:20.03美元

2000年:26.72美元

2010年:74.71美元

2020年:36.86美元

2023年:88.59美元

$纳斯达克综合指数 (.IXIC.US)$ $道琼斯指数 (.DJI.US)$ $标普500指数 (.SPX.US)$

已翻译

星期四的美国CPI通胀报告表明11月暂停的可能性增加,但同时也增加了之后加息的概率。

截至周五早上,金融市场认为联邦储备委员会在11月将有91%的可能会维持当前利率水平。

至于12月份,市场预期有67%的可能会暂停加息,并有33%的可能会加息。

在高通胀持续存在的情况下,联邦储备委员会将会采取何种行动? $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500ETF-SPDR (SPY.US)$

截至周五早上,金融市场认为联邦储备委员会在11月将有91%的可能会维持当前利率水平。

至于12月份,市场预期有67%的可能会暂停加息,并有33%的可能会加息。

在高通胀持续存在的情况下,联邦储备委员会将会采取何种行动? $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500ETF-SPDR (SPY.US)$

已翻译

1

你可能还记得我之前关于提高债务上限的罕见文章,事实证明这篇文章的准确性令人震惊。

1。石油价格

石油面临上行压力,但没有人们所说的那么大。由于供应的变化,石油已经上涨了——供需公告仍将控制石油价格,而不是这场冲突。

2。通胀

向上压力...

1。石油价格

石油面临上行压力,但没有人们所说的那么大。由于供应的变化,石油已经上涨了——供需公告仍将控制石油价格,而不是这场冲突。

2。通胀

向上压力...

已翻译

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)