melgohjd

评论了

点击 加入! ![]()

点击 喜欢我。![]() (这个 )

(这个 )

![]()

![]()

![]()

$富途控股 (FUTU.US)$ $特斯拉 (TSLA.US)$ $苹果 (AAPL.US)$ $AMC院线 (AMC.US)$ $游戏驿站 (GME.US)$ $3B家居 (BBBY.US)$ $黑莓 (BB.US)$ $奈飞 (NFLX.US)$ $新加坡航空公司 (C6L.SG)$ $海庭 (S51.SG)$ $凯德商用新加坡信托 (C38U.SG)$ $ARK Innovation ETF (ARKK.US)$ $Imperial Petroleum (IMPP.US)$ $阿里巴巴 (BABA.US)$ $比特币 (BTC.CC)$ $以太坊 (ETH.CC)$ $S&P/ASX 200 VIX Index (.XVI.AU)$ $S&P/ASX 200 (.XJO.AU)$ $道琼斯指数 (.DJI.US)$ $标普500指数 (.SPX.US)$ $SPDR 标普500指数ETF (SPY.US)$ $纳斯达克综合指数 (.IXIC.US)$ $罗素3000ETF-iShares (IWV.US)$ $iShares安硕罗素中盘ETF (IWR.US)$ $恒生指数 (800000.HK)$ $富时新加坡海峡指数 (.STI.SG)$ $上证指数 (000001.SH)$

点击 喜欢我。

$富途控股 (FUTU.US)$ $特斯拉 (TSLA.US)$ $苹果 (AAPL.US)$ $AMC院线 (AMC.US)$ $游戏驿站 (GME.US)$ $3B家居 (BBBY.US)$ $黑莓 (BB.US)$ $奈飞 (NFLX.US)$ $新加坡航空公司 (C6L.SG)$ $海庭 (S51.SG)$ $凯德商用新加坡信托 (C38U.SG)$ $ARK Innovation ETF (ARKK.US)$ $Imperial Petroleum (IMPP.US)$ $阿里巴巴 (BABA.US)$ $比特币 (BTC.CC)$ $以太坊 (ETH.CC)$ $S&P/ASX 200 VIX Index (.XVI.AU)$ $S&P/ASX 200 (.XJO.AU)$ $道琼斯指数 (.DJI.US)$ $标普500指数 (.SPX.US)$ $SPDR 标普500指数ETF (SPY.US)$ $纳斯达克综合指数 (.IXIC.US)$ $罗素3000ETF-iShares (IWV.US)$ $iShares安硕罗素中盘ETF (IWR.US)$ $恒生指数 (800000.HK)$ $富时新加坡海峡指数 (.STI.SG)$ $上证指数 (000001.SH)$

已翻译

103

145

melgohjd

评论了

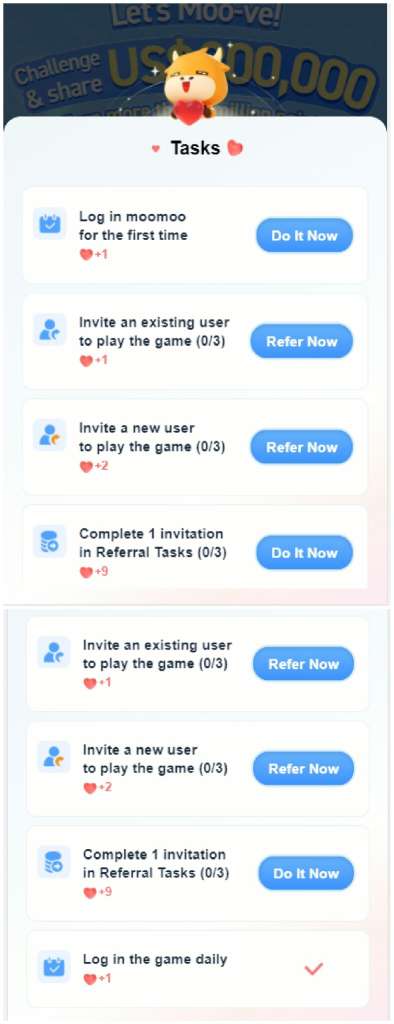

富途的第九周年庆挑战游戏 最近刚刚推出。在如此短的通知内,它吸引了大量的用户热情参与游戏。

对于新参与者来说,很难操作我们的英雄穿过游戏。如果在游戏中无法上升到排名榜上,可能会失去获得200,000美元的最终奖金的机会。 moomoo别担心!我们给出了优秀的指南来帮助您开始控件。 奖金池 20,000美元的最终奖金。

现在就加入我们的游戏吧! 这里有一些有用的技巧,可以指导你完成游戏。

提示1: 请记住额外的生命可能大大提高获胜的机会。 要获得额外的生命,您可以完成列出的任务,以获得更多玩游戏的机会,并争取更高的分数和更好的奖励。请尽量尽快完成任务。

提示2:如果您是iPhone用户,可以关闭低电量模式或者在电池充满的情况下开始游戏。 高刷新率模式将是理想的,因为它可以在游戏中实现更高的帧率,从而使您的游戏体验更加顺畅,并可能提高您的表现。

提示 3: 当你跳跃时,最好一次跳过一个障碍物。 由于每次跳到中心点都会获得一个点,如果你一次跳过多个障碍物,你将只获得一个点。此外,一次跳过多个障碍物要困难得多。

提示 4: 随着你进入下一个级别,赢得游戏变得更加困难。 前三个级别是最容易的。请尽力练习跳跃到障碍物之间的中心点,充分利用这些级别。通过更多的练习,你可能会更容易适应更难的模式。

提示 5: 游戏通关的次数越多,障碍物就越多,难度也越大。 请注意,更多的风险可能导致更高的分数。克服障碍后,你将获得额外的积分,因此跳过更多的障碍可以帮助你累积更多的积分。这样一来,在更高级别中你可能获得更高的分数,但当风险增加时,你仍需谨慎。

提示 6: 对于游戏新手来说,如果他们对自己到达中心点的能力不自信, 你可以首先小步走到障碍物的前面,然后跳过去。 尽管你需要走更多的步数,但这种方式更安全。

提示7:根据收集的数据,游戏中最频繁的失败发生在转角处。 在通过转角时,一定要小心地走小步。

提示 8:快速前进并不总是带来成功。 在游戏和投资旅程中保持自己的步调会带来更多安全和成功。

![]() 有了这些提示,现在可以放心地使用 现在可以与mooer们竞争了!

有了这些提示,现在可以放心地使用 现在可以与mooer们竞争了!

对于新参与者来说,很难操作我们的英雄穿过游戏。如果在游戏中无法上升到排名榜上,可能会失去获得200,000美元的最终奖金的机会。 moomoo别担心!我们给出了优秀的指南来帮助您开始控件。 奖金池 20,000美元的最终奖金。

现在就加入我们的游戏吧! 这里有一些有用的技巧,可以指导你完成游戏。

提示1: 请记住额外的生命可能大大提高获胜的机会。 要获得额外的生命,您可以完成列出的任务,以获得更多玩游戏的机会,并争取更高的分数和更好的奖励。请尽量尽快完成任务。

提示2:如果您是iPhone用户,可以关闭低电量模式或者在电池充满的情况下开始游戏。 高刷新率模式将是理想的,因为它可以在游戏中实现更高的帧率,从而使您的游戏体验更加顺畅,并可能提高您的表现。

提示 3: 当你跳跃时,最好一次跳过一个障碍物。 由于每次跳到中心点都会获得一个点,如果你一次跳过多个障碍物,你将只获得一个点。此外,一次跳过多个障碍物要困难得多。

提示 4: 随着你进入下一个级别,赢得游戏变得更加困难。 前三个级别是最容易的。请尽力练习跳跃到障碍物之间的中心点,充分利用这些级别。通过更多的练习,你可能会更容易适应更难的模式。

提示 5: 游戏通关的次数越多,障碍物就越多,难度也越大。 请注意,更多的风险可能导致更高的分数。克服障碍后,你将获得额外的积分,因此跳过更多的障碍可以帮助你累积更多的积分。这样一来,在更高级别中你可能获得更高的分数,但当风险增加时,你仍需谨慎。

提示 6: 对于游戏新手来说,如果他们对自己到达中心点的能力不自信, 你可以首先小步走到障碍物的前面,然后跳过去。 尽管你需要走更多的步数,但这种方式更安全。

提示7:根据收集的数据,游戏中最频繁的失败发生在转角处。 在通过转角时,一定要小心地走小步。

提示 8:快速前进并不总是带来成功。 在游戏和投资旅程中保持自己的步调会带来更多安全和成功。

已翻译

+2

101

60

melgohjd

赞了

$谷歌-C (GOOG.US)$ $谷歌-A (GOOGL.US)$ Good news for shareholders. Former Google Cloud chief, Diane Greene, understandably wanted to pursue U.S. federal government Cloud contracts, but, she had to fight Sundar Pichai on this score -- Pichai having indefensibly backed Google employees' nonsensical, infantile and indefensible opposition to their company doing business with the U.S. government. Can you imagine? These infants are reaping the fruits of peace, liberty and prosperity, working for a company that could have only been created in the U.S., yet, they're unwilling to help their country's government, when it needs assistance in technology matters.

I'm glad that Thomas Kurian is pursuing Cloud business opportunities wherever they lie. To not bid on U.S. federal government contracts is sheer foolishness.

I'm glad that Thomas Kurian is pursuing Cloud business opportunities wherever they lie. To not bid on U.S. federal government contracts is sheer foolishness.

59

melgohjd

赞了

$亚马逊 (AMZN.US)$ $苹果 (AAPL.US)$

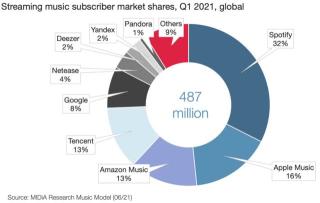

Amazon has a big advantage over Apple because of its retail platform which acts as a very strong anchor for Prime membership. This allows Amazon to add new services to Prime increasing the overall value proposition and also gives it the ability to increase the prices. Apple does not have any similar anchor service.

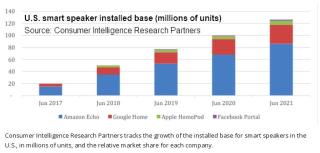

Apple Music has a good number of subscribers but Amazon Music has also a strong subscriber base. In addition to this, Amazon has a huge market share in the smart speaker segment through its Echo devices. Amazon has been selling Echo devices at rock bottom prices and also giving huge discounts to Amazon Music Unlimited customers who use this service on Echo devices.

Amazon can also monetize the users through other services. It has been reported that Echo users do higher purchases on Amazon's retail platform. Hence, Amazon can afford to give discounts for Echo devices and music streaming. This has also forced Apple to sell HomePod Mini in sub-$100 category. But Apple would not be able to give discounts on music services similar to Amazon because it will squeeze its margins. Apple also does not have other services through which it can monetize customers in the low-margin music streaming business.

The smart speaker segment can have a halo effect on many services. This segment also has a very loyal customer base because users generally prefer to have additional smart speakers from the same brand to get a seamless experience. Apple's market share is in low single-digit despite launching lower-priced devices. Amazon has also leveraged its dominant position in smart speaker devices to launch a wide variety of devices which now includes even a home robot.

Apple is trying to build a base service through Apple One which is good enough for customers to try other services like fitness+. But Apple's lack of anchor service will hurt the growth of Apple One. Apple would need to rapidly expand the attraction of its TV+ to make it an anchor service within Apple One. This would require massive investment. At the same time, other players like Disney (DIS), Netflix (NFLX), HBO Max (T), and Amazon are also increasing their investments in this segment which will make it difficult for Apple TV+ to gain a big following.

Takeway

Apple is now competing directly with Amazon in music, video, gaming, and many other services. Apple One does not have an anchor service to attract customers similar to the retail platform for Prime members. Amazon's subscription revenues are also growing at a faster pace compared to Apple's Services segment growth. Greater discounts for Amazon music and higher investments in video streaming can make Prime membership the ideal "good enough" service which will limit Apple's subscription growth.

Apple is already trading at a very high multiple and any decline in margins or slow growth in subscription business could severely hurt the sentiments towards the stock and lead to a big correction.

Amazon has a big advantage over Apple because of its retail platform which acts as a very strong anchor for Prime membership. This allows Amazon to add new services to Prime increasing the overall value proposition and also gives it the ability to increase the prices. Apple does not have any similar anchor service.

Apple Music has a good number of subscribers but Amazon Music has also a strong subscriber base. In addition to this, Amazon has a huge market share in the smart speaker segment through its Echo devices. Amazon has been selling Echo devices at rock bottom prices and also giving huge discounts to Amazon Music Unlimited customers who use this service on Echo devices.

Amazon can also monetize the users through other services. It has been reported that Echo users do higher purchases on Amazon's retail platform. Hence, Amazon can afford to give discounts for Echo devices and music streaming. This has also forced Apple to sell HomePod Mini in sub-$100 category. But Apple would not be able to give discounts on music services similar to Amazon because it will squeeze its margins. Apple also does not have other services through which it can monetize customers in the low-margin music streaming business.

The smart speaker segment can have a halo effect on many services. This segment also has a very loyal customer base because users generally prefer to have additional smart speakers from the same brand to get a seamless experience. Apple's market share is in low single-digit despite launching lower-priced devices. Amazon has also leveraged its dominant position in smart speaker devices to launch a wide variety of devices which now includes even a home robot.

Apple is trying to build a base service through Apple One which is good enough for customers to try other services like fitness+. But Apple's lack of anchor service will hurt the growth of Apple One. Apple would need to rapidly expand the attraction of its TV+ to make it an anchor service within Apple One. This would require massive investment. At the same time, other players like Disney (DIS), Netflix (NFLX), HBO Max (T), and Amazon are also increasing their investments in this segment which will make it difficult for Apple TV+ to gain a big following.

Takeway

Apple is now competing directly with Amazon in music, video, gaming, and many other services. Apple One does not have an anchor service to attract customers similar to the retail platform for Prime members. Amazon's subscription revenues are also growing at a faster pace compared to Apple's Services segment growth. Greater discounts for Amazon music and higher investments in video streaming can make Prime membership the ideal "good enough" service which will limit Apple's subscription growth.

Apple is already trading at a very high multiple and any decline in margins or slow growth in subscription business could severely hurt the sentiments towards the stock and lead to a big correction.

12

4

melgohjd

赞了

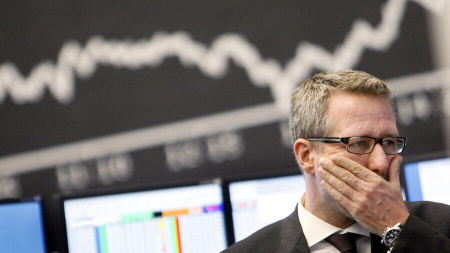

Investing is heavily dependent on expectation where "Stocks are bought on expectations, not facts" quoted from Gerald Loeb. ![]()

The expectations of investors are in turn driven by the numbers raised during the earnings announcement, how much surprise/dismay arise based on the announced figures?

Will the profitability of the company be continuous based on the earnings Y-T-Y growth? For this, the growth rate is key 🔑.

Let's take a retrospective look at one of the smart money's favourites: $奇波雷墨西哥烧烤 (CMG.US)$

For this example, the positive surprise in earnings growth led to a reaction from the market catapulting the stock price to 1800 & 1900 range from the 1600 range. Lo' and behold, this was considered "expensive" to some given its trading P/E multiple of 40 in Jan 2020.

$奇波雷墨西哥烧烤 (CMG.US)$

The "high" P/E multiple is justified based on the growth of the company's earnings and the fast company expansion results in such P/E multiple where investors are willing to buy at the current level as they expect the earnings to grow in comparison to other low growth companies.

Besides numbers, how could earnings release be complete without Guidance?

To put it simply, guidance are projections be it for sales, drivers to sales etc.![]()

A classic example: $奈飞 (NFLX.US)$

The market reacted negatively (-7.40%) simply based on guidance that subscriber growth would be dampen, bearing in mind the driver for $奈飞 (NFLX.US)$'s earnings growth.

The market is a vibrant place where not all companies are equal![]() hence guidance release for other companies would differ, e.g. $特斯拉 (TSLA.US)$ focuses on vehicle deliveries

hence guidance release for other companies would differ, e.g. $特斯拉 (TSLA.US)$ focuses on vehicle deliveries ![]()

So earnings is truly one key event to a stock price, without doubt. The volatility surging (based on possible erratic up or down stock movement) is expected during the earning period which to some is another window of opportunity.![]()

Trade safe everyone! None of the above is financial advice and should not be taken as one.![]()

$亚马逊 (AMZN.US)$ earnings 28 Oct 21

$Phunware (PHUN.US)$ earnings 8 Nov 21

$AMC院线 (AMC.US)$ earnings 1 Nov 21

$游戏驿站 (GME.US)$ earnings 14 Dec 21

Source: Nasdaq.com

A short poll: Do you trade during earnings?

The expectations of investors are in turn driven by the numbers raised during the earnings announcement, how much surprise/dismay arise based on the announced figures?

Will the profitability of the company be continuous based on the earnings Y-T-Y growth? For this, the growth rate is key 🔑.

Let's take a retrospective look at one of the smart money's favourites: $奇波雷墨西哥烧烤 (CMG.US)$

For this example, the positive surprise in earnings growth led to a reaction from the market catapulting the stock price to 1800 & 1900 range from the 1600 range. Lo' and behold, this was considered "expensive" to some given its trading P/E multiple of 40 in Jan 2020.

$奇波雷墨西哥烧烤 (CMG.US)$

The "high" P/E multiple is justified based on the growth of the company's earnings and the fast company expansion results in such P/E multiple where investors are willing to buy at the current level as they expect the earnings to grow in comparison to other low growth companies.

Besides numbers, how could earnings release be complete without Guidance?

To put it simply, guidance are projections be it for sales, drivers to sales etc.

A classic example: $奈飞 (NFLX.US)$

The market reacted negatively (-7.40%) simply based on guidance that subscriber growth would be dampen, bearing in mind the driver for $奈飞 (NFLX.US)$'s earnings growth.

The market is a vibrant place where not all companies are equal

So earnings is truly one key event to a stock price, without doubt. The volatility surging (based on possible erratic up or down stock movement) is expected during the earning period which to some is another window of opportunity.

Trade safe everyone! None of the above is financial advice and should not be taken as one.

$亚马逊 (AMZN.US)$ earnings 28 Oct 21

$Phunware (PHUN.US)$ earnings 8 Nov 21

$AMC院线 (AMC.US)$ earnings 1 Nov 21

$游戏驿站 (GME.US)$ earnings 14 Dec 21

Source: Nasdaq.com

A short poll: Do you trade during earnings?

+2

21

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)