melkee

评论了

New energy & New trend

Countries have advocated low-carbon plans to avoid damaging the environment in recent years.

您支持低碳生活吗?

随着投资者对环境意识增强, 绿色投资日益流行.

您有没有考虑过 购买低碳etf以造福地球?

![]()

![]()

![]() 参加交易测验 ,并获得奖品!

参加交易测验 ,并获得奖品!

从学习 "什么是etf?" and then judge if it really does good to your portf...

Countries have advocated low-carbon plans to avoid damaging the environment in recent years.

您支持低碳生活吗?

随着投资者对环境意识增强, 绿色投资日益流行.

您有没有考虑过 购买低碳etf以造福地球?

从学习 "什么是etf?" and then judge if it really does good to your portf...

已翻译

95

988

39

melkee

赞了

1. 沃伦·巴菲特:经受住时间考验的大师

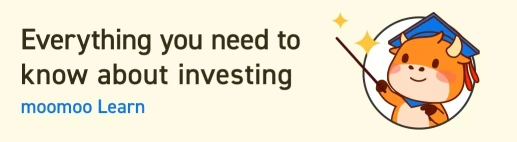

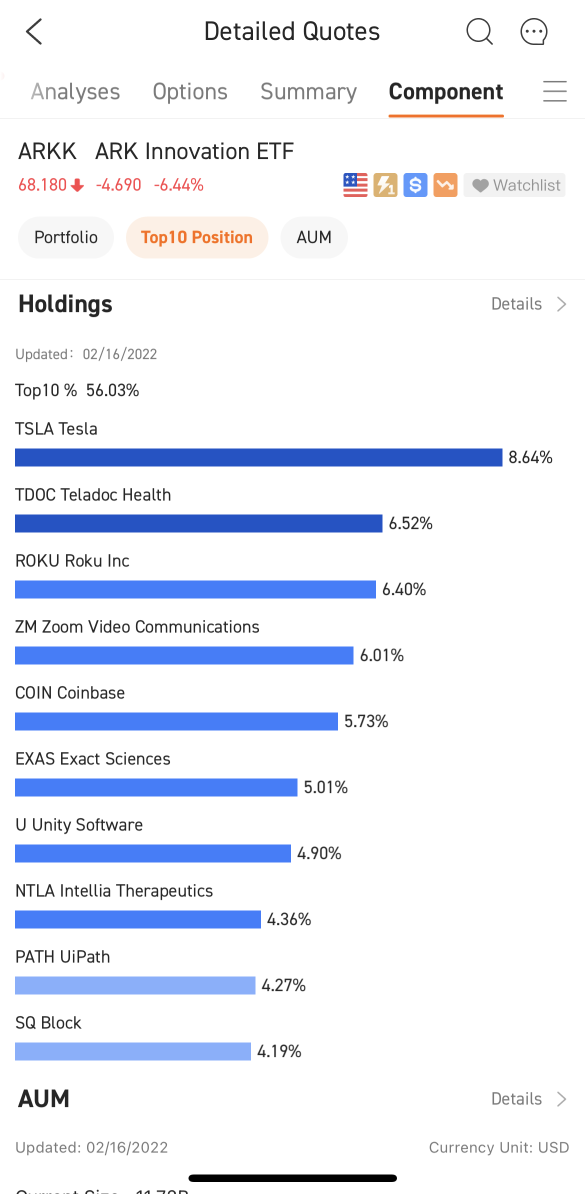

你可能已经看到下面的图表,这是沃伦·巴菲特的伯克希尔·哈撒韦和凯西·伍德的ark etf合集回报之间的鲜明对比。

是的,在2021年你也许无法相信,但现在这是真的。moomoo的ARK ETF合集曾经是零售投资者追捧的对象。

伍德和巴菲特有非常不同的投资风格。但是在过去的两年里,他们的投资者收益几乎一样...

你可能已经看到下面的图表,这是沃伦·巴菲特的伯克希尔·哈撒韦和凯西·伍德的ark etf合集回报之间的鲜明对比。

是的,在2021年你也许无法相信,但现在这是真的。moomoo的ARK ETF合集曾经是零售投资者追捧的对象。

伍德和巴菲特有非常不同的投资风格。但是在过去的两年里,他们的投资者收益几乎一样...

已翻译

+3

145

28

47

melkee

赞了

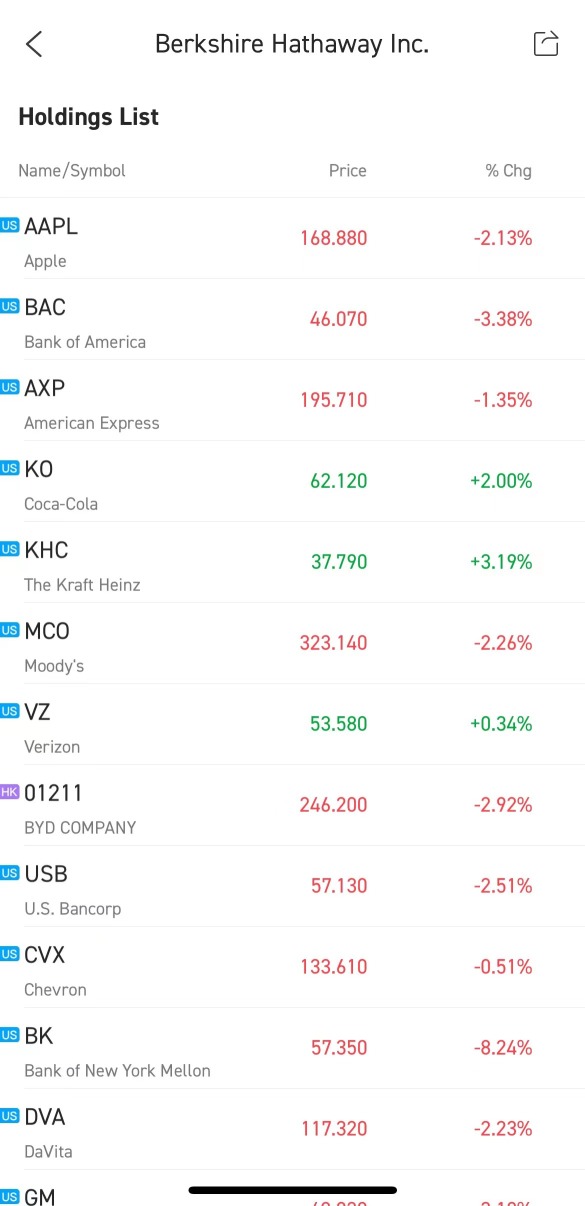

时光飞逝!您已经完成了另一段旅程。 共智:哪些习惯能帮助您成为更好的交易者。 感谢所有人的参与!![]() 在这个话题中,大多数mooer们提到了 害怕错失良机、恐慌和错误。新手进入市场时,他们盲目跟风,不明白自己在做什么,并因为被情绪左右而亏损。

在这个话题中,大多数mooer们提到了 害怕错失良机、恐慌和错误。新手进入市场时,他们盲目跟风,不明白自己在做什么,并因为被情绪左右而亏损。![]()

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.![]() Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

![]()

![]()

![]() 现在是本期获胜名单的时候了。让我们一起享受这些亮点时刻吧!祝贺所有获胜的mooer们。 $福特汽车 (F.US)$ 和 $ContextLogic (WISH.US)$ 股票!

现在是本期获胜名单的时候了。让我们一起享受这些亮点时刻吧!祝贺所有获胜的mooer们。 $福特汽车 (F.US)$ 和 $ContextLogic (WISH.US)$ 股票!

*奖品将在15个工作日内发放给获胜者,按字母顺序排序。

第一部分:高质量帖子收藏

@Dadacai 成为更好的交易者的习惯

成功的关键习惯之一是 制定一个交易计划正如本杰明·富兰克林所说,如果你未能制定计划,那么你就是在计划失败。不要屈服于错失良机的恐惧。通过实践和毅力,我们都可以成为成功的交易者!

@iSpyderTrader 建立良好的交易习惯

不要试图复制别人的想法,因为那对他们有效 您需要深入了解并自行尝试。熟能生巧。要认真做好尽职调查(研究、文章、新闻等)。带着积极的态度进行交易。不要贪婪,要赚取利润。

@JP GO 制定适合您生活方式的规则

交易必须 与生活方式相连,并制定规则 更重要的是将这视为一个习惯。我从小额开始测试我的想法/规则是否适用于我,并进行一些调整。我只允许自己使用3/4的资金,为自己留下最后一个选择,这样我在看到红色数字时也不会害怕。

@mooboo 让我成为更好交易者的习惯

对于我的价值投资,在开始任何股票头寸之前,我会做一定量的分析。每次恐慌时,我都会抑制冲动。情绪是股市中最大的敌人。最后, 尽职调查 良好的风险管理 管理好你的风险.

@TraderPeter 要机械!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels 确定您的买入和卖出价格。您必须要有纪律。不要太贪心。

@Ganar Poco良好习惯将使您成为持续赢家

交易心理学 是交易的心理层面。它涉及诸如如何控制情绪,如FOMO等的事情。在你控制了自己的情绪并学会了风险管理的重要性之后,将为交易提供优势的下一个重要方面就是策略。

@Moo Top 我117天的经历

在Moomoo的117天后,我仍在思考我的投资和交易计划是什么。然而,以下是我从经验中获得的信息:投资或交易。 制定一个退出计划 如果交易价值、成长或者meme股,交易并不是一切。拥有自己的生活。

@Zann56 战胜情绪

当涉及投资时,人类情感(恐惧和贪婪)是不可避免的。由于屈从于情绪,过去曾有过亏损。为了避免这样的错误,我现在学会采取3种策略。 投资于我坚信的事物。分批成本平均。多元化投资。

@甜心0121 我的习惯

对我个人来说,我坚持这4个习惯,以确保交易的一致性。 设定目标。管理风险。研究,研究以及研究 并且研究。限制时间,拥有生活。

![]() 要获取更有吸引力的发帖,请点击 Co-Wise:什么习惯可以帮助您成为更好的交易者? 查看。不要忘记留下你的评论,告诉mooer们你学到了什么!

要获取更有吸引力的发帖,请点击 Co-Wise:什么习惯可以帮助您成为更好的交易者? 查看。不要忘记留下你的评论,告诉mooer们你学到了什么!![]()

第Ⅱ部分:对“导师Moo”称号进行投票

是时候投票了!让我们为候选人投票,看看谁会赢得"导师moo“标题。你认为哪位用户的帖子最棒?你的投票对他们来说意义重大!

情绪和责任可能会影响您的思维。推理和客观性可能导致冲动和非理性的决策,进而造成更多损失。 基于情感或谣言进行交易是无效的。 分析和研究应该是交易的基础。情绪交易可能带来一些收益,但理性交易才是您长期生存的方式。通过交易提升您的生活方式,并将遵守规则作为一种习惯。磨练是成功的关键。![]()

免责声明: 所有投资都涉及风险。富途公司、富途SG公司和moomoo都不认可任何特定的投资策略。在决定投资策略时,您应仔细考虑您的投资目标和目的。过去的业绩不能保证未来的结果。

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.

*奖品将在15个工作日内发放给获胜者,按字母顺序排序。

第一部分:高质量帖子收藏

@Dadacai 成为更好的交易者的习惯

成功的关键习惯之一是 制定一个交易计划正如本杰明·富兰克林所说,如果你未能制定计划,那么你就是在计划失败。不要屈服于错失良机的恐惧。通过实践和毅力,我们都可以成为成功的交易者!

@iSpyderTrader 建立良好的交易习惯

不要试图复制别人的想法,因为那对他们有效 您需要深入了解并自行尝试。熟能生巧。要认真做好尽职调查(研究、文章、新闻等)。带着积极的态度进行交易。不要贪婪,要赚取利润。

@JP GO 制定适合您生活方式的规则

交易必须 与生活方式相连,并制定规则 更重要的是将这视为一个习惯。我从小额开始测试我的想法/规则是否适用于我,并进行一些调整。我只允许自己使用3/4的资金,为自己留下最后一个选择,这样我在看到红色数字时也不会害怕。

@mooboo 让我成为更好交易者的习惯

对于我的价值投资,在开始任何股票头寸之前,我会做一定量的分析。每次恐慌时,我都会抑制冲动。情绪是股市中最大的敌人。最后, 尽职调查 良好的风险管理 管理好你的风险.

@TraderPeter 要机械!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels 确定您的买入和卖出价格。您必须要有纪律。不要太贪心。

@Ganar Poco良好习惯将使您成为持续赢家

交易心理学 是交易的心理层面。它涉及诸如如何控制情绪,如FOMO等的事情。在你控制了自己的情绪并学会了风险管理的重要性之后,将为交易提供优势的下一个重要方面就是策略。

@Moo Top 我117天的经历

在Moomoo的117天后,我仍在思考我的投资和交易计划是什么。然而,以下是我从经验中获得的信息:投资或交易。 制定一个退出计划 如果交易价值、成长或者meme股,交易并不是一切。拥有自己的生活。

@Zann56 战胜情绪

当涉及投资时,人类情感(恐惧和贪婪)是不可避免的。由于屈从于情绪,过去曾有过亏损。为了避免这样的错误,我现在学会采取3种策略。 投资于我坚信的事物。分批成本平均。多元化投资。

@甜心0121 我的习惯

对我个人来说,我坚持这4个习惯,以确保交易的一致性。 设定目标。管理风险。研究,研究以及研究 并且研究。限制时间,拥有生活。

第Ⅱ部分:对“导师Moo”称号进行投票

是时候投票了!让我们为候选人投票,看看谁会赢得"导师moo“标题。你认为哪位用户的帖子最棒?你的投票对他们来说意义重大!

情绪和责任可能会影响您的思维。推理和客观性可能导致冲动和非理性的决策,进而造成更多损失。 基于情感或谣言进行交易是无效的。 分析和研究应该是交易的基础。情绪交易可能带来一些收益,但理性交易才是您长期生存的方式。通过交易提升您的生活方式,并将遵守规则作为一种习惯。磨练是成功的关键。

免责声明: 所有投资都涉及风险。富途公司、富途SG公司和moomoo都不认可任何特定的投资策略。在决定投资策略时,您应仔细考虑您的投资目标和目的。过去的业绩不能保证未来的结果。

已翻译

长图

长图 72

29

16

melkee

赞了

$美国超微公司 (AMD.US)$ $Cloudflare (NET.US)$ 所以我几个月前问了这个问题,得到了一些非常有趣的回答,很多人选择了AMD、Cloudfare等等。总的来说,人们的选择表现得非常好,让我很惊讶,我想知道大家对未来10年都喜欢什么,特别是因为行业革命或者你认为被严重低估的股票,有最大上涨潜力的股票。

已翻译

24

melkee

赞了

只要你睁开双眼👀(还有我们的moomoo应用),就能随处找到绝佳的投资机会!找到你的完美匹配![]() 使用我们的选股器,它是交易者和投资者必备的工具。无论是找到具有强劲上升动能的股票,还是在盈利季找到热度榜上的热门股票,你可以筛选成千上万只股票,并找到符合你标准的股票。

使用我们的选股器,它是交易者和投资者必备的工具。无论是找到具有强劲上升动能的股票,还是在盈利季找到热度榜上的热门股票,你可以筛选成千上万只股票,并找到符合你标准的股票。

发现为什么苛求有回报

与我们联系、关注并进行对话。

Facebook | Instagram

发现为什么苛求有回报

与我们联系、关注并进行对话。

Facebook | Instagram

已翻译

127

33

9

melkee

赞了

作为投资者,我们有各种投资选择。分红股票通常是具有良好分红历史的老牌公司。分红投资是在新加坡进行投资的一种流行方式。

什么是分红投资?

分红投资是购买支付股息的股票以从投资中获得持续的收入。分红是公司赚取利润或盈余时支付给股东的比例。绝大多数新加坡公司每季度支付股息。例如,REIT是一种众所周知的公司类型,它会支付股息。

什么是REITs?

房地产投资信托(REITs)是追求稳定收入的投资者中最受欢迎的选择之一。REITs是拥有、经营或资助产生收入的房地产的企业,可以提供投资机会,投资于一揽子由专业管理的房地产资产,并在交易所上市和交易。

新加坡是亚洲最大的房地产投资信托中心。目前,新加坡交易所上市了43个房地产投资信托和房地产商业信托,总市值超过1100亿美元,占新加坡总市值的约12%。以下数据显示REITs在新加坡从不同维度上蓬勃发展。

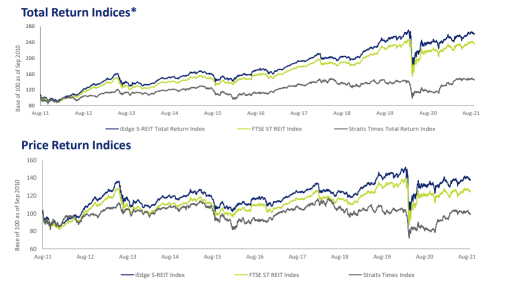

从历史模式来看,REITs的回报率稳步增长,从2011年到2021年增长了三倍,如图1所示。

图表1:三年平均年化总回报率为13.4%

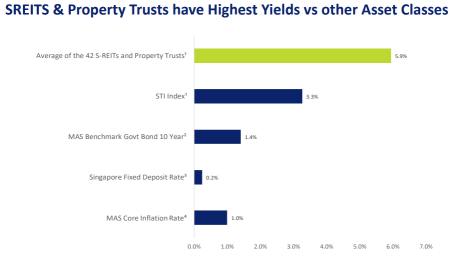

图表2显示,2021年新加坡房地产投资信托及房地产信托的平均回报率为5.9%,高于其他资产类别。

图表2:新加坡房地产投资信托及房地产投资信托 vs.其他资产类别

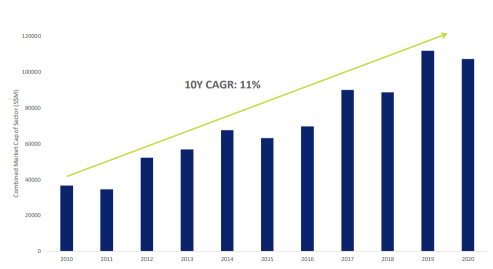

自2010年以来,新加坡交易所的房地产投资信托和房地产信托的复合年增长率达到了11%,如图3所示。

图表3:新加坡交易所的房地产投资信托和房地产信托:十年复合年增长率达到11%

如何评估股息股票?

如前所述,股息股票通常是具有良好盈利历史的知名企业。以下三个参数可以帮助您区分股票。

股息率

股息率是公司每年支付的股息金额,与股价有关。房地产投资信托(REITs)通常支付高于平均水平的股息。股息率越高,则越好。此外,股息的增长应与公司的长期盈利保持一致。

支付比率

支付比率是指公司支付的股息占总收益的百分比。高支付比率,特别是超过100%,可能会引发对股票长期可持续性的质疑。相反,低支付比率可能表明公司正在将大部分收益重新投资以扩大其业务。换句话说,投资者应该对支付比率持批判态度,无论其高低如何。

股息历史

具有最佳长期股息支付记录的公司通常多年来保持稳定的支付比率。公司的股息分配是否不断增加?公司向股东支付股息已有多长时间?

如何进行分红投资?

(1)以高股息率为目标

短期投资者可以关注缓慢增长且现金流丰富的公司,这些公司可能支付可观的股息。

(2)选择高股利增长

长期投资者应该集中购买那些正在快速扩张但支付低于平均水平股息的公司的股票。虽然回报在短期内可能看起来较小,但随着公司的扩大,股息率应该稳步增加。

为了评估特定股票的潜力,投资者可以查看包含各种图表的报告,以了解其过去的表现。下面的WLMIY(Wilmar International Limited)的条形图显示了股息增长的预测,基于其历史记录。假设年股息增长率为 $丰益国际 (F34.SG)$ %,那么Wilmar的分红将每4.7年翻一番。

分红投资的几点注意事项

任何公司的分红金额都不是固定的,随时可以进行调整。

成熟和规模较大的公司通常提供增长率适度的分红。

假设投资者只关注有丰厚分红的公司,那么他们可能错过了尚未开始支付分红或支付少量分红的高成长公司。

Futu限时活动

如果投资者在2021年11月5日至2021年11月16日(两个日期都包含在内)的认购期内最低认购4,000新加坡元的UOb APAC Green REIT ETF,并在认购截止日期前未撤回认购,将获得价值18.8新加坡元的现金券,可用于moomoo平台交易。

立即参与>>

免责声明:

moomoo是由Moomoo Inc.提供的交易平台。在新加坡,moomoo上的资本市场产品和服务是由受新加坡金融管理局(MAS)监管的富途新加坡私人有限公司提供的。

所有内容仅供教育和信息用途。所使用的信息和数据仅供说明目的。此处的任何内容均不应被视为证券、期货或其他投资产品的要约、征求或推荐。它不考虑您的投资目标、财务状况或特殊需求。所有信息和数据(如果有)仅供参考,过去的表现不应被视为未来结果的指标。这不是未来结果的保证。股票、期权、etf和其他工具的投资均面临风险,可能损失投资金额。投资价值可能会波动,因此客户可能会损失投资价值。在保证金账户交易时,客户可能会损失超过其原始投资。请咨询您的财务顾问以确定任何投资的合适性。

什么是分红投资?

分红投资是购买支付股息的股票以从投资中获得持续的收入。分红是公司赚取利润或盈余时支付给股东的比例。绝大多数新加坡公司每季度支付股息。例如,REIT是一种众所周知的公司类型,它会支付股息。

什么是REITs?

房地产投资信托(REITs)是追求稳定收入的投资者中最受欢迎的选择之一。REITs是拥有、经营或资助产生收入的房地产的企业,可以提供投资机会,投资于一揽子由专业管理的房地产资产,并在交易所上市和交易。

新加坡是亚洲最大的房地产投资信托中心。目前,新加坡交易所上市了43个房地产投资信托和房地产商业信托,总市值超过1100亿美元,占新加坡总市值的约12%。以下数据显示REITs在新加坡从不同维度上蓬勃发展。

从历史模式来看,REITs的回报率稳步增长,从2011年到2021年增长了三倍,如图1所示。

图表1:三年平均年化总回报率为13.4%

图表2显示,2021年新加坡房地产投资信托及房地产信托的平均回报率为5.9%,高于其他资产类别。

图表2:新加坡房地产投资信托及房地产投资信托 vs.其他资产类别

自2010年以来,新加坡交易所的房地产投资信托和房地产信托的复合年增长率达到了11%,如图3所示。

图表3:新加坡交易所的房地产投资信托和房地产信托:十年复合年增长率达到11%

如何评估股息股票?

如前所述,股息股票通常是具有良好盈利历史的知名企业。以下三个参数可以帮助您区分股票。

股息率

股息率是公司每年支付的股息金额,与股价有关。房地产投资信托(REITs)通常支付高于平均水平的股息。股息率越高,则越好。此外,股息的增长应与公司的长期盈利保持一致。

支付比率

支付比率是指公司支付的股息占总收益的百分比。高支付比率,特别是超过100%,可能会引发对股票长期可持续性的质疑。相反,低支付比率可能表明公司正在将大部分收益重新投资以扩大其业务。换句话说,投资者应该对支付比率持批判态度,无论其高低如何。

股息历史

具有最佳长期股息支付记录的公司通常多年来保持稳定的支付比率。公司的股息分配是否不断增加?公司向股东支付股息已有多长时间?

如何进行分红投资?

(1)以高股息率为目标

短期投资者可以关注缓慢增长且现金流丰富的公司,这些公司可能支付可观的股息。

(2)选择高股利增长

长期投资者应该集中购买那些正在快速扩张但支付低于平均水平股息的公司的股票。虽然回报在短期内可能看起来较小,但随着公司的扩大,股息率应该稳步增加。

为了评估特定股票的潜力,投资者可以查看包含各种图表的报告,以了解其过去的表现。下面的WLMIY(Wilmar International Limited)的条形图显示了股息增长的预测,基于其历史记录。假设年股息增长率为 $丰益国际 (F34.SG)$ %,那么Wilmar的分红将每4.7年翻一番。

分红投资的几点注意事项

任何公司的分红金额都不是固定的,随时可以进行调整。

成熟和规模较大的公司通常提供增长率适度的分红。

假设投资者只关注有丰厚分红的公司,那么他们可能错过了尚未开始支付分红或支付少量分红的高成长公司。

Futu限时活动

如果投资者在2021年11月5日至2021年11月16日(两个日期都包含在内)的认购期内最低认购4,000新加坡元的UOb APAC Green REIT ETF,并在认购截止日期前未撤回认购,将获得价值18.8新加坡元的现金券,可用于moomoo平台交易。

立即参与>>

免责声明:

moomoo是由Moomoo Inc.提供的交易平台。在新加坡,moomoo上的资本市场产品和服务是由受新加坡金融管理局(MAS)监管的富途新加坡私人有限公司提供的。

所有内容仅供教育和信息用途。所使用的信息和数据仅供说明目的。此处的任何内容均不应被视为证券、期货或其他投资产品的要约、征求或推荐。它不考虑您的投资目标、财务状况或特殊需求。所有信息和数据(如果有)仅供参考,过去的表现不应被视为未来结果的指标。这不是未来结果的保证。股票、期权、etf和其他工具的投资均面临风险,可能损失投资金额。投资价值可能会波动,因此客户可能会损失投资价值。在保证金账户交易时,客户可能会损失超过其原始投资。请咨询您的财务顾问以确定任何投资的合适性。

已翻译

+1

167

8

41

melkee

赞了

嘿 mooer们 ![]()

![]()

![]() ,今天让我们学习如何使用移动平均线识别股票市场趋势,以帮助添加背景信息,支持决策并补充其他形式的分析。

,今天让我们学习如何使用移动平均线识别股票市场趋势,以帮助添加背景信息,支持决策并补充其他形式的分析。 ![]()

![]()

![]()

股票的技术分析借鉴了惯性定律,以理解和描述股票价格、股票买入和卖出及其走势之间的关系。在描述运动时,投资者借用了另一个物理学术语 “动量”,与物理学一样,这是运动量。作用于股票的 “力量” 是买入和卖出。而股票的 “走势” 通常被称为趋势。![]()

![]()

![]()

趋势可以朝三个方向形成: 向上, 向下,或 侧身。这些趋势,或描述股票走势的方式,是技术分析的基础知识之一。

让我们以苹果的图表为例![]()

![]()

![]() :

:

投资者趋势分析

与交易者相反,投资者通常会长期持有投资——几个月或几年。因此,在将趋势分析应用于投资时,使用与投资相一致的图表和时间框架非常重要。![]()

![]()

![]()

以下是这两条移动平均线如何帮助识别趋势。当5天移动平均线大于20天移动平均线时,AAPL处于上升趋势。当5天低于20天移动平均线时,AAPL处于下跌趋势。![]()

![]()

![]()

这个想法是在AAPL处于上升趋势时最大限度地提高利润。但是,当AAPL处于下跌趋势时,我们的想法是限制损失。

使用技术分析来识别趋势不是一门精确的科学;它有缺陷,也不是一个独立的投资策略。但是,诸如趋势分析之类的技术分析基础知识可以帮助添加背景信息,支持您的决策,并补充其他形式的分析,例如基本面、宏观经济和心理学。![]()

![]()

![]()

股票的技术分析借鉴了惯性定律,以理解和描述股票价格、股票买入和卖出及其走势之间的关系。在描述运动时,投资者借用了另一个物理学术语 “动量”,与物理学一样,这是运动量。作用于股票的 “力量” 是买入和卖出。而股票的 “走势” 通常被称为趋势。

趋势可以朝三个方向形成: 向上, 向下,或 侧身。这些趋势,或描述股票走势的方式,是技术分析的基础知识之一。

让我们以苹果的图表为例

投资者趋势分析

与交易者相反,投资者通常会长期持有投资——几个月或几年。因此,在将趋势分析应用于投资时,使用与投资相一致的图表和时间框架非常重要。

以下是这两条移动平均线如何帮助识别趋势。当5天移动平均线大于20天移动平均线时,AAPL处于上升趋势。当5天低于20天移动平均线时,AAPL处于下跌趋势。

这个想法是在AAPL处于上升趋势时最大限度地提高利润。但是,当AAPL处于下跌趋势时,我们的想法是限制损失。

使用技术分析来识别趋势不是一门精确的科学;它有缺陷,也不是一个独立的投资策略。但是,诸如趋势分析之类的技术分析基础知识可以帮助添加背景信息,支持您的决策,并补充其他形式的分析,例如基本面、宏观经济和心理学。

已翻译

94

14

41

melkee

赞了

在我们上次的活动中,moomoo收到了来自数千名投资者的喜爱和认可,特别是那些对这个应用还不太熟悉的人。

为了为每个moomoo投资者建立一个无缝的交易体验,我们准备了一份指南,涵盖了您在使用moomoo时可能遇到的几乎所有问题。![]() 从账户开设到资金结算,我们致力于解决您在投资旅程中遇到的每个问题!

从账户开设到资金结算,我们致力于解决您在投资旅程中遇到的每个问题!

moomoo课程:

...

为了为每个moomoo投资者建立一个无缝的交易体验,我们准备了一份指南,涵盖了您在使用moomoo时可能遇到的几乎所有问题。

moomoo课程:

...

已翻译

![[更新] moomoo课程目录:在投资之前找到你所需的一切](https://sgsnsimg.moomoo.com/16203792656495-77777015-web-555d65f83d449d48.jpg/thumb)

![[更新] moomoo课程目录:在投资之前找到你所需的一切](https://sgsnsimg.moomoo.com/moo-1620381448-77777015-iPhone-1-org.jpg/thumb)

![[更新] moomoo课程目录:在投资之前找到你所需的一切](https://sgsnsimg.moomoo.com/16203787721155-77777015-web-62b96ce14928333f.png/thumb)

+2

355

110

168

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

melkee : 1. B

2. C

3. A

4. B

5. A

6. D