SGrobin

评论了

您是否曾希望在交易完成后很长一段时间内,能够降低您购买股票的价格,而不仅仅是以更好的价格增加头寸以降低您的平均进场点?

这个问题适用于所有人,但我主要针对新手期权交易者和投资者。如果投资者学会同时交易股票和股票期权,他/她可以将两者结合起来,从而在事后潜在地降低一只股票的平均价格("净成本基础)"。

这个问题适用于所有人,但我主要针对新手期权交易者和投资者。如果投资者学会同时交易股票和股票期权,他/她可以将两者结合起来,从而在事后潜在地降低一只股票的平均价格("净成本基础)"。

已翻译

79

17

56

SGrobin

赞了

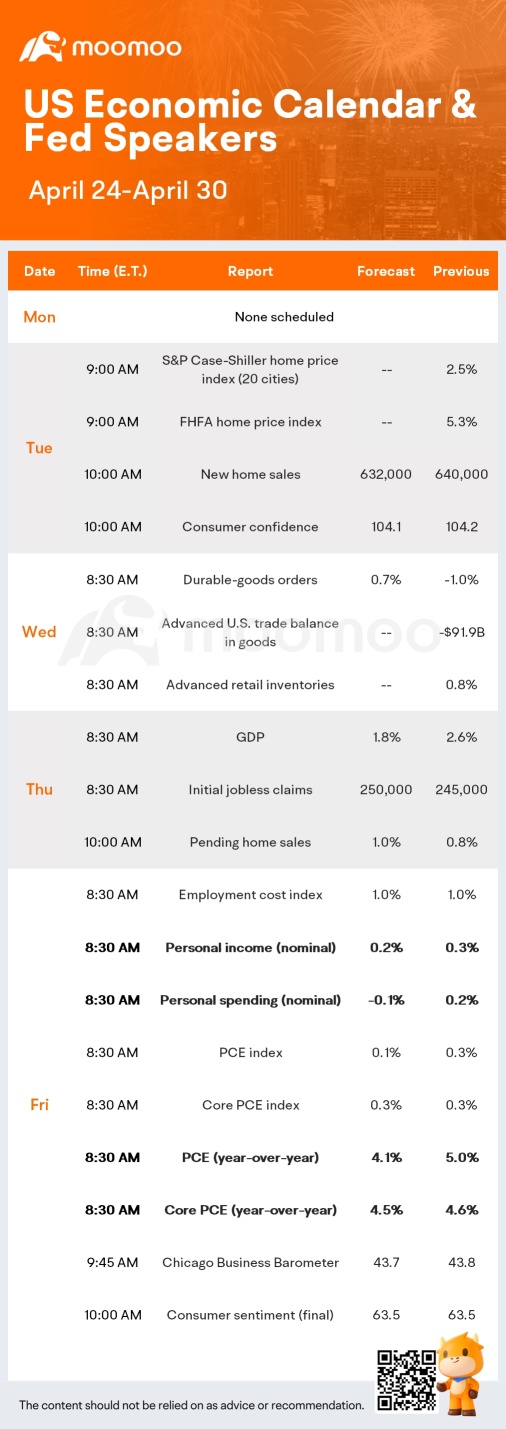

第一季度盈利季节将在本周加剧,预计有170家标普500公司将报告业绩,其中包括市场上许多最大的公司。经济数据发布将包括企业和消费者支出数据,以及第一季度国内生产总值统计的初步预览。

$可口可乐 (KO.US)$ 和 $第一共和银行 (FRC.US)$ 周一的盈利亮点将是: $3M (MMM.US)$, ...

$可口可乐 (KO.US)$ 和 $第一共和银行 (FRC.US)$ 周一的盈利亮点将是: $3M (MMM.US)$, ...

已翻译

+3

23

1

19

SGrobin

赞了

牢记以下内容对成为成功的日间交易者至关重要

了解市场需要了解市场心理

股市日内模式-所有时间均为东部标准时间!

当日交易美国股市时,您可能会注意到特定模式,根据一天中的时间,这些模式比不发生的情况更频繁。这些模式或倾向发生的频率足够高,以至于专业日间交易者以它们为基础进行交易。

上午9:30: 股市开盘,出现了初期推动向一方向的情况。波动性很高!

早上9:45:初始推送往往会出现明显的逆转或回调。这通常只是一个短期的转变,然后原来的趋势再次显现。

早上10:00:如果从早上9:30开始的趋势仍在持续发展,往往会在这个时间遇到挑战。这往往是另一个出现明显逆转或回调的时间。

早上11:15-11:30:市场进入午餐时间,伦敦准备收市。这通常是一个几个小时内波动率逐渐消失的时候,但通常在这个时间会对每日的高点或低点进行测试。欧洲交易员通常会在结束工作前平仓或积累仓位。无论高点还是低点是否被测试,市场往往会在接下来的一小时或更长时间内“漂移”。

中午11:45-下午1:30:这是纽约的午餐时间,再加上一点时间缓冲。通常,这是一天中最安静的时间,很多日内交易者喜欢避开这个时段。

下午1:30-2:00:如果午餐时间很平静,那么可以预期在午餐时间期间建立的范围将出现突破。通常,市场会试图沿着午餐时间之前的交易方向移动。

下午2:00-2:45:离收盘时间越来越近,许多交易者按趋势交易,并认为趋势将继续到收盘。虽然可能会发生这种情况,但在这个时候预计会出现一些明显的逆转,因为另一方面,很多交易者更倾向于获利或将他们的追踪止损单接近当前价格。

下午3:00-3:30:这些是重要的“洗盘”点,因为它们会迫使很多交易者退出他们的持仓。如果在这个时间发生了先前趋势的逆转,那么价格很可能会朝相反的方向迅速而强势地移动。即使先前的趋势在这些时段内持续存在,也要预计会出现一些迅速且有规模的逆势行动。

作为日内交易者,最好灵活应对,不要被困在一个持仓或方向中。很多交易者只交易每天的第一个小时和最后一个小时,因为这些时段是最具有波动性的。

下午3:30到4:00:市场在下午4点收盘。之后,除非是非常活跃的股票和etf,否则几乎所有股票和etf的流动性都会枯竭。通常情况下,在收盘铃响一分钟或更早之前,人们会平掉所有仓位,除非你已经挂了以收盘竞价或“交叉”方式平仓的订单。

💰我不确定“日内交易的技巧”活动在哪里,否则我会把这个发到那里🍻 @moomoo Event @moomoo Lily

希望这能为日内交易提供一些明晰!

$Energy Focus (EFOI.US)$

了解市场需要了解市场心理

股市日内模式-所有时间均为东部标准时间!

当日交易美国股市时,您可能会注意到特定模式,根据一天中的时间,这些模式比不发生的情况更频繁。这些模式或倾向发生的频率足够高,以至于专业日间交易者以它们为基础进行交易。

上午9:30: 股市开盘,出现了初期推动向一方向的情况。波动性很高!

早上9:45:初始推送往往会出现明显的逆转或回调。这通常只是一个短期的转变,然后原来的趋势再次显现。

早上10:00:如果从早上9:30开始的趋势仍在持续发展,往往会在这个时间遇到挑战。这往往是另一个出现明显逆转或回调的时间。

早上11:15-11:30:市场进入午餐时间,伦敦准备收市。这通常是一个几个小时内波动率逐渐消失的时候,但通常在这个时间会对每日的高点或低点进行测试。欧洲交易员通常会在结束工作前平仓或积累仓位。无论高点还是低点是否被测试,市场往往会在接下来的一小时或更长时间内“漂移”。

中午11:45-下午1:30:这是纽约的午餐时间,再加上一点时间缓冲。通常,这是一天中最安静的时间,很多日内交易者喜欢避开这个时段。

下午1:30-2:00:如果午餐时间很平静,那么可以预期在午餐时间期间建立的范围将出现突破。通常,市场会试图沿着午餐时间之前的交易方向移动。

下午2:00-2:45:离收盘时间越来越近,许多交易者按趋势交易,并认为趋势将继续到收盘。虽然可能会发生这种情况,但在这个时候预计会出现一些明显的逆转,因为另一方面,很多交易者更倾向于获利或将他们的追踪止损单接近当前价格。

下午3:00-3:30:这些是重要的“洗盘”点,因为它们会迫使很多交易者退出他们的持仓。如果在这个时间发生了先前趋势的逆转,那么价格很可能会朝相反的方向迅速而强势地移动。即使先前的趋势在这些时段内持续存在,也要预计会出现一些迅速且有规模的逆势行动。

作为日内交易者,最好灵活应对,不要被困在一个持仓或方向中。很多交易者只交易每天的第一个小时和最后一个小时,因为这些时段是最具有波动性的。

下午3:30到4:00:市场在下午4点收盘。之后,除非是非常活跃的股票和etf,否则几乎所有股票和etf的流动性都会枯竭。通常情况下,在收盘铃响一分钟或更早之前,人们会平掉所有仓位,除非你已经挂了以收盘竞价或“交叉”方式平仓的订单。

💰我不确定“日内交易的技巧”活动在哪里,否则我会把这个发到那里🍻 @moomoo Event @moomoo Lily

希望这能为日内交易提供一些明晰!

$Energy Focus (EFOI.US)$

已翻译

113

3

11

SGrobin

赞了

$福特汽车 (F.US)$ 福特汽车证实,首款电动皮卡F150 Lightning目前已经有近20万个零售预订。F-150 Lightning自今年9月开始试生产,按计划将于2022年春季正式推出,并预计于2022年下半年交付。

今年早些时候,福特发布了F-150 Lightning,这是该公司最畅销皮卡的全电动版本。

由于F-150已经是美国市场上最畅销的乘用车,因此该车有望大大加速电动车在美国的普及。

今年早些时候,福特发布了F-150 Lightning,这是该公司最畅销皮卡的全电动版本。

由于F-150已经是美国市场上最畅销的乘用车,因此该车有望大大加速电动车在美国的普及。

已翻译

32

6

2

SGrobin

赞了

$赛富时 (CRM.US)$ 几年前某公司就开始强制基层用Salesforce,更多是出于向上管理的内部需求而不是提高企业业绩的考量。结局是内部基层员工浪费大量时间在Salesforce 输入“垃圾”信息应付上面,而没有人关心多少潜在客户转化为真正的客户。道琼工业指数把CRM纳入真是缺乏远见,真正好公司 $英伟达 (NVDA.US)$ $美国超微公司 (AMD.US)$ 却不在其列。

13

SGrobin

赞了

已翻译

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

SGrobin : 封面电话