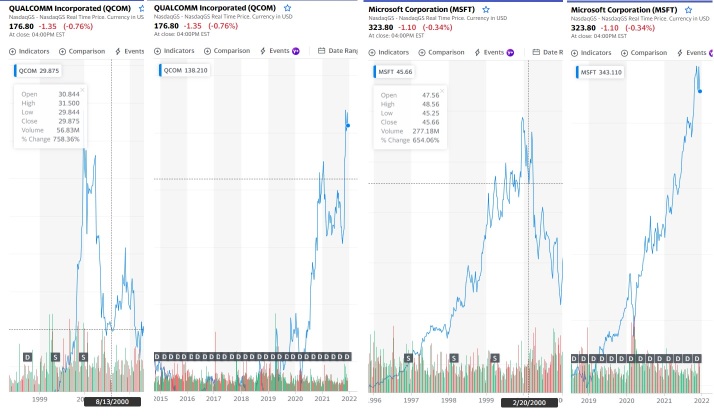

$高通 (QCOM.US)$ $微软 (MSFT.US)$

I am sure most of us, if not already, have been reading some analysts' reports about an almost similar situation of now vs 2000 dot.com/bust period. Many new investors here may not be faimilar with the dot.com burst. I was a local investor then as access to the US markets were very limited, and even in Singapore, the stocks followed similarly, especially the tech stocks.

First cavaet here is i am not spreading FUD, but this month's tech correction warrants a serious look at how next year shapes up, so I have to do more research on this. There are 3 signals which i thought warrant a good look.

1st - Very clear signal here is the dot.com crash happend in March 2000, when Alan Greenspan, then FED chair raised interest rates. If you can see what will happen next year, its that interest rate would be raise in March 2022.

2nd - The other signal is the unprecedented IPOs happend in 1999, when the bubble festered. The lock-in period of the institutions and owners is 6 months, and right after lock in, with rising interest rates, mass selling begin, resulting in the crash.

3rd - Many dot.com companies raise monies easily due to very low interest rates (easy money). Many were burning cash and had not reach profitability. In 2021, we too have many over-valued tech companies which haven't reach profitabilty yet are at unprecedented prices (although most have came down from their historical highs)

If you can read at the 3 signals above, won't you be worried?

I attached 2 companies that have survived the dot.com and boom. Similarly the prices fall is almost alarming. But we can see that they are profitabile and would be able to weather such storm. Value company like $可口可乐 (KO.US)$ went up instead

during the dot.com burst.

Of course, the situation then and now maybe different, as some tech corrections happened in Dec 21, and due to the Omicron issue, that may change the situation. But still, we need to be very nimble in our investments. Jan and Feb 2022, with quarterly reporting, may offer some window into the future to review if 2022 can continue this run.

I wish everyone a clear mind and even better focus. Don't get too emotional (a reminder to myself too) and cutting loss is not cutting a piece of flesh, its just an opportunity to come back better.

I am sure most of us, if not already, have been reading some analysts' reports about an almost similar situation of now vs 2000 dot.com/bust period. Many new investors here may not be faimilar with the dot.com burst. I was a local investor then as access to the US markets were very limited, and even in Singapore, the stocks followed similarly, especially the tech stocks.

First cavaet here is i am not spreading FUD, but this month's tech correction warrants a serious look at how next year shapes up, so I have to do more research on this. There are 3 signals which i thought warrant a good look.

1st - Very clear signal here is the dot.com crash happend in March 2000, when Alan Greenspan, then FED chair raised interest rates. If you can see what will happen next year, its that interest rate would be raise in March 2022.

2nd - The other signal is the unprecedented IPOs happend in 1999, when the bubble festered. The lock-in period of the institutions and owners is 6 months, and right after lock in, with rising interest rates, mass selling begin, resulting in the crash.

3rd - Many dot.com companies raise monies easily due to very low interest rates (easy money). Many were burning cash and had not reach profitability. In 2021, we too have many over-valued tech companies which haven't reach profitabilty yet are at unprecedented prices (although most have came down from their historical highs)

If you can read at the 3 signals above, won't you be worried?

I attached 2 companies that have survived the dot.com and boom. Similarly the prices fall is almost alarming. But we can see that they are profitabile and would be able to weather such storm. Value company like $可口可乐 (KO.US)$ went up instead

during the dot.com burst.

Of course, the situation then and now maybe different, as some tech corrections happened in Dec 21, and due to the Omicron issue, that may change the situation. But still, we need to be very nimble in our investments. Jan and Feb 2022, with quarterly reporting, may offer some window into the future to review if 2022 can continue this run.

I wish everyone a clear mind and even better focus. Don't get too emotional (a reminder to myself too) and cutting loss is not cutting a piece of flesh, its just an opportunity to come back better.

30

2

Trader10169406O

评论了

Bitcoin has no underlying value and no underlying asset. Bitcoin is not a company that can regenerate investments. Bitcoin has no underlying asset that people needs like Silver, Gold nor Oranges or Pork bellies. Bitcoin is just a transfer system of "real" money. However this system has huge maintenance costs and in the end systems that cost a lot of money without REAL return dies.

2

11 月 15 日 $摩根大通 (JPM.US)$ 已提起诉讼 $特斯拉 (TSLA.US)$ 为了 1.622 亿美元,指责埃隆·马斯克的电动汽车公司 “公然” 违反合同 这两家企业巨头在2014年就以下问题达成了协议 认股权证 特斯拉卖给了银行。

2014年,特斯拉向摩根大通出售了认股权证,如果认股权证于2021年6月和7月到期时,摩根大通的 “行使价” 低于特斯拉的股价,则该认股权证将获得回报。

马斯克在 2018 年 8 月 7 日发推文说他可能会 将特斯拉私有化 420 美元 该银行表示,每股并且 “资金有保障”,以及他随后在17天后宣布放弃该计划,这造成了股价的巨大波动。

在这两场比赛中,摩根大通 调整了行使价 “以保持相同的公允市场价值” 就像推文之前一样。

到今年认股权证到期时,特斯拉的股价上涨了约10倍,摩根大通表示,这要求特斯拉根据其合同交出其股票或现金。该银行说 特斯拉未能这样做相当于违约。

有什么想法吗?或者也许有人可以解释案子里发生了什么?

来源:

摩根大通以1.62亿美元起诉特斯拉,此前马斯克在推特上发布了恶化的认股权证协议

2014年,特斯拉向摩根大通出售了认股权证,如果认股权证于2021年6月和7月到期时,摩根大通的 “行使价” 低于特斯拉的股价,则该认股权证将获得回报。

马斯克在 2018 年 8 月 7 日发推文说他可能会 将特斯拉私有化 420 美元 该银行表示,每股并且 “资金有保障”,以及他随后在17天后宣布放弃该计划,这造成了股价的巨大波动。

在这两场比赛中,摩根大通 调整了行使价 “以保持相同的公允市场价值” 就像推文之前一样。

到今年认股权证到期时,特斯拉的股价上涨了约10倍,摩根大通表示,这要求特斯拉根据其合同交出其股票或现金。该银行说 特斯拉未能这样做相当于违约。

有什么想法吗?或者也许有人可以解释案子里发生了什么?

来源:

摩根大通以1.62亿美元起诉特斯拉,此前马斯克在推特上发布了恶化的认股权证协议

已翻译

56

8

$辉瑞 (PFE.US)$ Why the spike? I don’t understand why it went up to 5.83 this morning!?

9

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)