WhiteRose89

赞了

$辉瑞(PFE.US$ 辉瑞将向英国再提供250万个疗程的 COVID-19 口服药物 Paxlovid。辉瑞表示,预计到2022年,将向英国交付275万个疗程的Paxlovid。上个月,辉瑞表示计划在欧洲寻求Paxlovid的批准。此外,美国将以53亿美元的价格购买1000万剂Paxlovid。

已翻译

18

WhiteRose89

赞了

$辉瑞(PFE.US$ 辉瑞曾预测,冠状病毒疫情将持续到2024年,这意味着在未来两年中,人类仍将与该病毒作斗争。除了加强疫苗接种外,最近在 COVID-19 药物研发方面取得的进展将为高危人群提供重要的额外保护。根据辉瑞的最新数据,该公司的 COVID-19 口服抗病毒药物可以将严重感染 COVID-19 的风险降低近90%。

已翻译

14

1

WhiteRose89

赞了

$瑞银(UBS.US$ $辉瑞(PFE.US$ $Moderna(MRNA.US$ 瑞银表示,Omicron是经济的短期障碍。

欧洲国家正在采取更多措施来应对冠状病毒感染的激增,包括在荷兰重新实行封锁,以及在假日旺季更严格的旅行限制。

同时,关于该病毒的新菌株的影响是否小于其前身,以及如何有效地对抗突变菌株的争论仍在继续。

“病毒本身的经济影响相对有限。对经济产生影响的是对病毒的恐惧,” 瑞银集团首席经济学家多诺万说。“这是第一种带有社交媒体主题标签的病毒,它增加了对该病毒的恐惧并影响了经济。“我们现在必须意识到的是,随着疫苗接种的普及,恐惧程度已经下降了很多。”

欧洲国家正在采取更多措施来应对冠状病毒感染的激增,包括在荷兰重新实行封锁,以及在假日旺季更严格的旅行限制。

同时,关于该病毒的新菌株的影响是否小于其前身,以及如何有效地对抗突变菌株的争论仍在继续。

“病毒本身的经济影响相对有限。对经济产生影响的是对病毒的恐惧,” 瑞银集团首席经济学家多诺万说。“这是第一种带有社交媒体主题标签的病毒,它增加了对该病毒的恐惧并影响了经济。“我们现在必须意识到的是,随着疫苗接种的普及,恐惧程度已经下降了很多。”

已翻译

11

WhiteRose89

赞了

In 2021, moomoo became the place where investors could share their opinions and communicate freely with each other. The frequent interactions between the enthusiastic mooers have positively impacted the community.![]()

![]()

![]() Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

![]() ONE: Is investing in Trump's new merger a good idea?

ONE: Is investing in Trump's new merger a good idea?

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

![]() TWO: What do you think of meme stocks?

TWO: What do you think of meme stocks?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

![]() THREE: What can we learn from the big picture?

THREE: What can we learn from the big picture?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

![]() FOUR: Will the strong momentum of recovery stocks fade?

FOUR: Will the strong momentum of recovery stocks fade?

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

![]()

![]() FIVE: EV stocks skyrocketing: Good buy or goodbye?

FIVE: EV stocks skyrocketing: Good buy or goodbye?

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

![]() SIX: How do you decide when to buy/sell?

SIX: How do you decide when to buy/sell?

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

![]() SEVEN: How do you know when to stop loss / take profit?

SEVEN: How do you know when to stop loss / take profit?

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

![]() EIGHT: What urges you to press the "trade" button?

EIGHT: What urges you to press the "trade" button?

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

![]() NINE: How to build a portfolio with a windfall of $1 million?

NINE: How to build a portfolio with a windfall of $1 million?

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

![]() TEN: How to profit from short-selling?

TEN: How to profit from short-selling?

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

![]() Bonus

Bonus![]()

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

445

39

WhiteRose89

赞了

$辉瑞(PFE.US$ $Moderna(MRNA.US$ 冠状病毒正在变异,即使在接种疫苗之后,仍然令人担忧。此外,疫苗接种率不足以实现群体免疫(70%)。根据梅奥诊所的数据,美国约有60%的成年人已完全接种疫苗。结果,美国仍在从病毒中恢复过来,疫情的压力正在影响消费者的信心。

已翻译

21

WhiteRose89

赞了

上周美国各州失业救济金的申请下降至 这是自1969年以来的最低水平,说明了根据季节性影响调整原始数据的困难。

最初的失业救济申请总数 184,000 在结束的一周内 12月4日,比上期下降了43,000人,劳工部周四的数据显示。彭博社对经济学家的调查的中位数估计为22万份申请。

最初的失业救济申请总数 184,000 在结束的一周内 12月4日,比上期下降了43,000人,劳工部周四的数据显示。彭博社对经济学家的调查的中位数估计为22万份申请。

已翻译

218

26

WhiteRose89

赞了

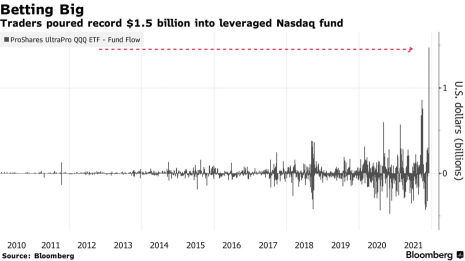

对于在高辛烷值科技赌注中投入创纪录的15亿美元的ETF交易者来说,股市的快速反弹是个好消息。

随着 $纳斯达克100指数(.NDX.US$ 周二和周三飙升,对于涌入该股的投资者来说,这似乎是正确的 $3倍做多纳指ETF-ProShares(TQQQ.US$ 在周五的溃败中集体出击。

什么是 TQQQ?

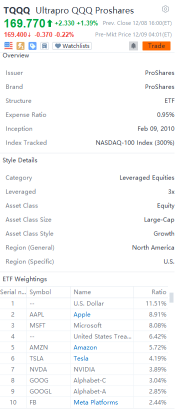

$3倍做多纳指ETF-ProShares(TQQQ.US$ 是追踪该指数的最大杠杆ETF之一 $纳斯达克100指数(.NDX.US$。该指数侧重于科技、医疗保健、工业、非必需消费品和电信领域的大型国际和美国公司。TQQQ使用衍生品和债务来增加投资者的回报。

由于美联储的鹰派倾向和对omicron变体的担忧,该基金使用期权来实现基准的三倍业绩,该基金在上周暴跌后成为市场领导者之一。

由于该基金的结算方式,流量数据延迟了1天。该数据显示,投资者在上周末增加了前所未有的14.7亿美元。TQQQ超过130亿美元的股票在该交易日易手,下跌了5%。

更高的利率 做所谓的 成长型股票的吸引力不大 因为它们的大部分价值与潜在的未来收益有关,如果收益率高或上升,则潜在的未来收益的吸引力就会降低。尽管如此,对科技巨头的押注很少有回报。诸如此类 $苹果(AAPL.US$ 和 $微软(MSFT.US$ 仍然在他们的行业中占据主导地位,而在出现经济疑虑时,投资者往往会急于寻求大盘股的安全。

作为杠杆基金,TQQQ适用于短期交易。然而,这就是大型科技公司的力量,在过去五年中一直留在原地的投资者本可以看到将近1,500%的ETF回报率。

来源:彭博社、Investopedia

随着 $纳斯达克100指数(.NDX.US$ 周二和周三飙升,对于涌入该股的投资者来说,这似乎是正确的 $3倍做多纳指ETF-ProShares(TQQQ.US$ 在周五的溃败中集体出击。

什么是 TQQQ?

$3倍做多纳指ETF-ProShares(TQQQ.US$ 是追踪该指数的最大杠杆ETF之一 $纳斯达克100指数(.NDX.US$。该指数侧重于科技、医疗保健、工业、非必需消费品和电信领域的大型国际和美国公司。TQQQ使用衍生品和债务来增加投资者的回报。

由于美联储的鹰派倾向和对omicron变体的担忧,该基金使用期权来实现基准的三倍业绩,该基金在上周暴跌后成为市场领导者之一。

由于该基金的结算方式,流量数据延迟了1天。该数据显示,投资者在上周末增加了前所未有的14.7亿美元。TQQQ超过130亿美元的股票在该交易日易手,下跌了5%。

更高的利率 做所谓的 成长型股票的吸引力不大 因为它们的大部分价值与潜在的未来收益有关,如果收益率高或上升,则潜在的未来收益的吸引力就会降低。尽管如此,对科技巨头的押注很少有回报。诸如此类 $苹果(AAPL.US$ 和 $微软(MSFT.US$ 仍然在他们的行业中占据主导地位,而在出现经济疑虑时,投资者往往会急于寻求大盘股的安全。

作为杠杆基金,TQQQ适用于短期交易。然而,这就是大型科技公司的力量,在过去五年中一直留在原地的投资者本可以看到将近1,500%的ETF回报率。

来源:彭博社、Investopedia

已翻译

26

4

WhiteRose89

赞了

嗨,mooers 们,

![]()

![]() 再见 11 月。你好 12 月。

再见 11 月。你好 12 月。 ![]()

![]() 我们正式进入2021年的最后一个月。 如果有人问你 11 月份的交易情况如何,你会怎么回答?

我们正式进入2021年的最后一个月。 如果有人问你 11 月份的交易情况如何,你会怎么回答?![]()

![]() 不能一口气得出结论?别担心!只要给他们看你在这里写的东西就行了!

不能一口气得出结论?别担心!只要给他们看你在这里写的东西就行了!

查看您的交易以赢取免费股票

![]() 在我们宣布获奖者之前,我们要感谢所有致力于撰写交易评论并认为评论是成为更好交易者的绝佳方式的mooers,并向他们致以最美好的祝愿。 我们确实认为对您的交易进行一致的评论非常必要。

在我们宣布获奖者之前,我们要感谢所有致力于撰写交易评论并认为评论是成为更好交易者的绝佳方式的mooers,并向他们致以最美好的祝愿。 我们确实认为对您的交易进行一致的评论非常必要。

![]()

![]() 恭喜我们的获奖者

恭喜我们的获奖者 ![]()

![]()

![]()

![]() $福特汽车(F.US$ 分享赢家:

$福特汽车(F.US$ 分享赢家:![]()

![]()

@Moo Top是一位活跃的审阅者和高级moomoo notes用户。他对moomoo上的工具非常熟悉,这些工具可以帮助他记录每笔交易的细节,他的想法和感受。你注意到他了吗 带有 moomoo 笔记的帖子收到越来越多的点赞和评论?请看看什么做对了!

@Jamesim几乎每个交易日都写了评论。他分享了自己对市场和热门话题的理解,并不断在帖子中附上当前的位置和新增的行情信息。Jamesim还详细分享了利润和亏损,以记录幸福时刻并在亏损发生时进行分析。 这就是成为一名优秀交易者的秘诀。 共享快照如下所示:

@steady Pom pipi是办理登机手续的榜样。他记录了盈亏以及他对交易和整个市场的看法。给我们留下最深刻印象的是,即使遇到缺点,他仍然保持乐观。他说 如果我们错过了火车,不要太沮丧,因为另一列火车即将到来。保持积极的态度将帮助我们度过艰难时期。立即查看他的个人资料!

![]()

![]() $ContextLogic(WISH.US$分享赢家:

$ContextLogic(WISH.US$分享赢家:![]()

![]()

@MONDAY86对基本面和新闻充满了敏锐的见解。

@doctorpot1刚刚开始使用 moomoo 笔记功能。干得好,继续努力!

@钱包君你要振作起来在交易模因股票方面非常活跃 $Phunware(PHUN.US$ $Digital World Acquisition Corp(DWAC.US$ $Sienna Senior Living Inc(SIA.CA$ $Camber Energy(CEI.US$ 在回顾自己的交易时,他总是情绪激动。

@JP GO @笨犇犇犇犇牛 @102678535 @AM5945你的评论也给人留下了深刻的印象!

再次感谢大家参加本次活动。 对于错过免费分享的参与者,如果您的评论符合我们的标准,您仍然可以在奖励俱乐部中找到积分奖励。 查看活动规则 这里.

![]()

![]() 最后一句话

最后一句话

我们想重申本次签到活动的目的:帮助您了解撰写交易评论的重要性,并鼓励您采用交易评论的强大工具成为高级交易者。moomoo notes 功能旨在成为一种便捷的工具,使您能够撰写评论。查看 moomoo 提供的服务 这里 现在就为你最喜欢的功能投票!

没看到你最喜欢的吗?发表评论告诉我们!

查看您的交易以赢取免费股票

@Moo Top是一位活跃的审阅者和高级moomoo notes用户。他对moomoo上的工具非常熟悉,这些工具可以帮助他记录每笔交易的细节,他的想法和感受。你注意到他了吗 带有 moomoo 笔记的帖子收到越来越多的点赞和评论?请看看什么做对了!

@Jamesim几乎每个交易日都写了评论。他分享了自己对市场和热门话题的理解,并不断在帖子中附上当前的位置和新增的行情信息。Jamesim还详细分享了利润和亏损,以记录幸福时刻并在亏损发生时进行分析。 这就是成为一名优秀交易者的秘诀。 共享快照如下所示:

@steady Pom pipi是办理登机手续的榜样。他记录了盈亏以及他对交易和整个市场的看法。给我们留下最深刻印象的是,即使遇到缺点,他仍然保持乐观。他说 如果我们错过了火车,不要太沮丧,因为另一列火车即将到来。保持积极的态度将帮助我们度过艰难时期。立即查看他的个人资料!

@MONDAY86对基本面和新闻充满了敏锐的见解。

@doctorpot1刚刚开始使用 moomoo 笔记功能。干得好,继续努力!

@钱包君你要振作起来在交易模因股票方面非常活跃 $Phunware(PHUN.US$ $Digital World Acquisition Corp(DWAC.US$ $Sienna Senior Living Inc(SIA.CA$ $Camber Energy(CEI.US$ 在回顾自己的交易时,他总是情绪激动。

@JP GO @笨犇犇犇犇牛 @102678535 @AM5945你的评论也给人留下了深刻的印象!

再次感谢大家参加本次活动。 对于错过免费分享的参与者,如果您的评论符合我们的标准,您仍然可以在奖励俱乐部中找到积分奖励。 查看活动规则 这里.

我们想重申本次签到活动的目的:帮助您了解撰写交易评论的重要性,并鼓励您采用交易评论的强大工具成为高级交易者。moomoo notes 功能旨在成为一种便捷的工具,使您能够撰写评论。查看 moomoo 提供的服务 这里 现在就为你最喜欢的功能投票!

没看到你最喜欢的吗?发表评论告诉我们!

已翻译

+1

278

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)