Just after noon on Wednesday, the $S&P 500 Index (.SPX.US)$ hit 5,600 for the first time, up about 0.46% on the day, and 22% in the past six months.

周三中午刚过,道琼斯指数首次攀升至5600点左右,日涨幅约0.46%,六个月内累计上涨22%。$标普500指数 (.SPX.US)$总体来看,股市 7200 只股票上涨,而 3500 只股票下跌。

As a general recap, the $Nasdaq Composite Index (.IXIC.US)$also hit all time highs Tuesday, up about 0.60%, while the $Dow Jones Industrial Average (.DJI.US)$ climbed 0.37%.

作为一般性回顾,在周二,纳斯达克指数也创下历史新高,日涨幅约0.6%,而标准普尔指数则上涨0.37%。$纳斯达克综合指数 (.IXIC.US)$作为一般性回顾,在周二,纳斯达克指数也创下历史新高,日涨幅约0.6%,而标准普尔指数则上涨0.37%。$道琼斯指数 (.DJI.US)$总体来看,股市 7200 只股票上涨,而 3500 只股票下跌。

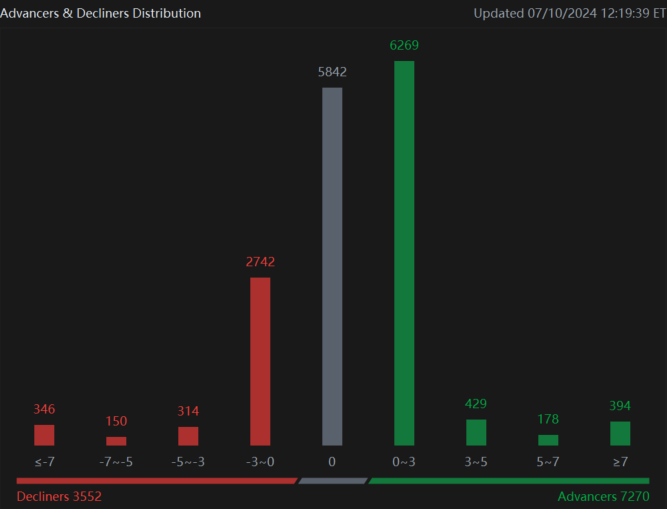

Overall 7200 equities climbed, while 3500 fell.

总体来看,股市 7200 只股票上涨,而 3500 只股票下跌。

In macroeconomics this week, investors can watch for CPI data on Thursday, expected at 3.1% and Core at 3.4%. PPI comes out Friday, expected at 0.2% core.

在宏观经济方面,本周投资者可以关注周四发布的CPI数据,预计为3.1%,核心CPI为3.4%。周五发布的生产者物价指数预计为0.2%核心。

Tuesday, Federal Reserve Chair Jerome Powell said he would like more data supporting rate cuts, but the Fed keeps its options open.

周二,美联储主席杰罗姆·鲍威尔表示,他希望有更多数据支持降息,但美联储仍然保持其期权开放。

"We know that reducing policy restraint too soon or too much could stall or even reverse the progress we have seen on inflation," Powell said. "In light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face."

“我们知道,过早或过多地减少政策限制可能会使我们在控制通货膨胀方面所取得的进展停滞甚至逆转。”鲍威尔表示。“鉴于过去两年中降低通货膨胀和冷静劳动市场方面所取得的进展,高通胀并不是我们面临的唯一风险。”

Powell pointed to rising unemployment numbers over the past three months as an example of a cooling market. The unemployment rate most recently peaked at 4.1% in June, he said, while payrolls have shown an increase of 222,000 a month for the past six months. He attributed the fall in the jobs-to-workers gap to increased labor participation and strong immigration numbers.

鲍威尔指出,过去三个月失业率的上升是劳动力市场冷却的一个例子。他说,失业率在6月最近达到4.1%,工资单在过去六个月中每月增加了22.2万份。他将工人空缺的下降归因于劳动力参与率的提高和强大的移民数字。

He said that, compared to two years ago, the labor market had cooled significantly to just above where it sat in 2019, and that inflation was not the Fed's only concern.

他说,与两年前相比,劳动力市场已经显著冷却,仅略高于2019年的情况,而通胀不是联邦储备的唯一问题。

"Reducing policy restraint too late or too little could unduly weaken economic activity and employment," Powell said.

“过晚或过少地减少政策限制可能会过度削弱经济活动和就业,”鲍威尔说。

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

Mooer们,你今天在观察什么?在下方评论,我可能会在明天介绍你的评论!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

免责声明:此内容仅供信息使用,不是任何特定投资或策略的推荐或认可。指数未经管理,不能直接投资。“投资涉及风险,可能导致本金损失。此内容中提供的投资信息为一般性质,仅供举例说明,并可能不适合所有投资者。它是在不考虑个体投资者的财务状况、投资目标、投资时间表或风险容忍度的情况下提供的。在考虑个人相关情况之前,请先考虑此信息的适用性,然后再做出任何投资决策。过去的表现并不预示或保证未来的成功。Moomoo不对上述内容的足够性或适时性作出任何声明或保证。提供的数据和信息是从被认为是可靠的来源获得的,但是Moomoo并不保证前述材料准确无误。有关更多信息,请参见Moovers社区发帖。link有关更多信息,请参见Moovers社区发帖中的链接。

In macroeconomics this week, investors can watch for CPI data on Thursday, expected at 3.1% and Core at 3.4%. PPI comes out Friday, expected at 0.2% core.

In macroeconomics this week, investors can watch for CPI data on Thursday, expected at 3.1% and Core at 3.4%. PPI comes out Friday, expected at 0.2% core.