Occidental Petroleum plus Institutional Tracking

Occidental Petroleum plus Institutional Tracking

Buffett’sinterest in Occidental shown in Berkshire’s 13F filings.

巴菲特的对……感兴趣伯克希尔哈撒韦公司13F文件中显示的西方石油公司。

On Aug19, Berkshire Hathaway, a corporation owned by Warren Buffett, won regulatory approval from the Federal Energy Regulatory Commission (FERC) to buy up to 50% of oil giant Occidental Petroleum’s common stock.

8月19日,沃伦·巴菲特旗下的伯克希尔哈撒韦公司获得了联邦能源管理委员会(FERC)的监管批准,将收购石油巨头西方石油公司普通股的50%。

This recent regulatory approvalhas increased speculation that Berkshire is about to buy Occidental. Shares of Occidental jumped 10% on the news to close at $71.29 apiece, pushing the company’s market value to around $66 billion.

最近的监管批准增加了人们对伯克希尔哈撒韦公司即将收购西方石油公司的猜测。消息传出后,西方石油的股价上涨了10%,收于每股71.29美元,将该公司的市值推高至约660亿美元。

The story between Buffet and Occidental dates back to as early as several months ago. Since March this year, Buffet has been steadily adding his stakes in Occidental.

巴菲特和西方的故事可以追溯到几个月前。自今年3月以来,巴菲特一直在稳步增持西方石油公司的股份。

His affection for the company is clearly demonstrated in the 13F filings published by Berkshire twice this year.

伯克希尔哈撒韦今年两次公布的13F文件清楚地表明了他对该公司的喜爱。

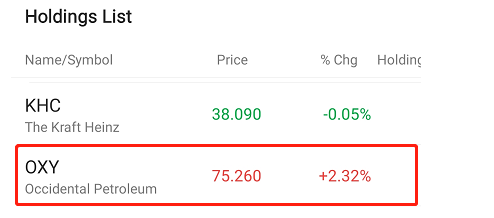

In Q1, Apple, Bank of America, American Express, Kraft Heinz, and Coca-Cola were among Berkshire’s five biggest stock holdings. Meanwhile, Berkshire bought an additional 5,887,618 shares of Occidental, with holdings in the oil industry worth over $40 billion.

在第一季度,苹果、美国银行、美国运通、卡夫亨氏和可口可乐是伯克希尔哈撒韦公司持有的五大股票之一。与此同时,伯克希尔哈撒韦公司又购买了588.7618股西方石油公司的股票,持有的石油行业股份价值超过400亿美元。

If you wish to check out more on institutional holdings, try 「Institutional Tracking」. Tap 「Quotes」 on the bottom navigation bar, then tap 「Explore」 on the top and swipe down, and there it is.

如果你想了解更多有关机构所持资产的信息,可以试试“机构追踪”。点击底部导航栏上的“报价”,然后点击顶部的“探索”并向下滑动,它就在那里。

(08/30/2022)

(08/30/2022)

Tap the pic to access Institutional Tracking (on app) directly

点击图片直接访问机构追踪(在APP上)

Institutional Tracking intuitively displays position details of institutions via charts, providing key data of industries, market value, position changes, etc. For more details, click the link below:(earn up to 300 points)

机构追踪通过图表直观展示机构持仓明细,提供行业、市值、仓位变动等关键数据,更多详情请点击下方链接:(最高可获得300分)

Back to Occidental Petroleum, it does live up to Buffet’s expectations. Since the beginning of this year, its revenue, driven by the booming crude oil market and Buffet’s operations, has surged by 129%. The earnings report(Occidental Petroleum(OXY) Financial Reports - Data and Analysis - Moomoo)shows that its net sales volume has reached $10.676 billion with a net profit of $3.755 billion, a year-on-year increase of 36 times, 16% higher than what analysts have expected. At the end of Q2, the cash flow generated by its operations stood at $5.329 billion, a record high among all quarters.

回到西方石油公司,它确实没有辜负巴菲特的期望。自今年年初以来,在蓬勃发展的原油市场和巴菲特业务的推动下,其收入飙升了129%。收益报告(西方石油(OXY)财务报告-数据与分析-moomoo)显示,其净销售额达到106.76亿美元,净利润为37.55亿美元,同比增长36倍,高于分析师预期的16%。截至第二季度末,其运营产生的现金流为53.29亿美元,创下所有季度的历史新高。

Will Occidental finally be part of Buffet’s commercial empire? Let’s wait and see!

西方航空最终会成为巴菲特商业帝国的一部分吗?让我们拭目以待!

Disclaimer:

免责声明:

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

本演示文稿仅供参考和教育之用,并不是对任何特定投资或投资战略的推荐或认可。本内容中提供的投资信息是一般性的,仅用于说明目的,可能并不适合所有投资者。它的提供不考虑个人投资者的财务成熟程度、财务状况、投资目标、投资时间范围或风险承受能力。在作出任何投资决定前,你应考虑该等资料的适当性,并考虑你的相关个人情况。过去的投资业绩并不预示或保证未来的成功。回报会有所不同,所有投资都有风险,包括本金损失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC). In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS).Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore. In Australia, financial products and services available through the moomoo app are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and Investment Commission (ASIC). Please read and understand our Financial Services Guide, Terms and Conditions, Privacy Policy and other disclosure documents which are available on our websites https://www.moomoo.com/au. Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd. and Futu Securities (Australia) Ltd are affiliated companies.

Moomoo是moomoo科技公司提供的一款金融信息和交易应用程序。在美国,通过moomoo应用程序提供的投资产品和服务是由moomoo金融公司提供的,moomoo金融公司是一家在美国证券交易委员会(SIC)注册的经纪自营商,也是金融业监管局/证券投资者保护公司(SIPC)的成员。在新加坡,通过moomoo应用提供的投资产品和服务是通过moomoo金融新加坡私人有限公司提供的。新加坡金融管理局(MAS)监管的Moomoo Financial新加坡有限公司。有限公司为资本市场服务牌照(牌照编号:CMS101000)持有者,具有豁免财务顾问身份。此广告未经新加坡金融管理局审核。在澳大利亚,通过moomoo应用程序提供的金融产品和服务由富途证券(澳大利亚)有限公司提供,该证券(澳大利亚)有限公司是受澳大利亚证券和投资委员会监管的澳大利亚金融服务许可证持有人(澳大利亚证券交易许可证编号224663)。请阅读和理解我们的金融服务指南、条款和条件、隐私政策和其他披露文件,这些文件可以在我们的网站https://www.moomoo.com/au.上找到Moomoo科技股份有限公司、moomoo金融股份有限公司、moomoo金融新加坡有限公司。有限公司与富途证券(澳大利亚)有限公司为联营公司。