Shareholders Will Probably Hold Off On Increasing CosmoSteel Holdings Limited's (SGX:B9S) CEO Compensation For The Time Being

Shareholders Will Probably Hold Off On Increasing CosmoSteel Holdings Limited's (SGX:B9S) CEO Compensation For The Time Being

Under the guidance of CEO Jack Ong, CosmoSteel Holdings Limited (SGX:B9S) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 31 January 2023. However, some shareholders will still be cautious of paying the CEO excessively.

在首席执行官杰克·王的指导下, 宇宙钢铁控股有限公司 (SGX: B9S) 最近表现相当不错。鉴于这一表现,在股东将于2023年1月31日进入股东大会时,首席执行官薪酬可能不会成为他们的主要关注点。但是,一些股东仍会谨慎行事,不要向首席执行官支付过高的报酬。

See our latest analysis for CosmoSteel Holdings

查看我们对宇宙钢铁控股公司的最新分析

Comparing CosmoSteel Holdings Limited's CEO Compensation With The Industry

将CosmoSteel Holdings Limited的首席执行官

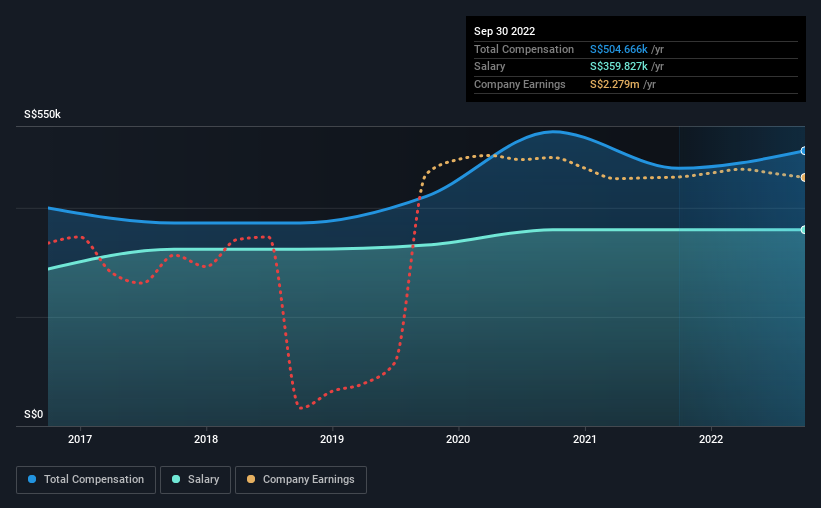

According to our data, CosmoSteel Holdings Limited has a market capitalization of S$35m, and paid its CEO total annual compensation worth S$505k over the year to September 2022. That's just a smallish increase of 6.8% on last year. We note that the salary portion, which stands at S$359.8k constitutes the majority of total compensation received by the CEO.

根据我们的数据,CosmoSteel Holdings Limited的市值为3500万新元,在截至2022年9月的一年中,其首席执行官的年度薪酬总额为50.5万新元。这仅比去年小幅增长了6.8%。我们注意到,工资部分为359.8万新元,占首席执行官获得的总薪酬的大部分。

On comparing similar-sized companies in the Singapore Energy Services industry with market capitalizations below S$264m, we found that the median total CEO compensation was S$332k. Accordingly, our analysis reveals that CosmoSteel Holdings Limited pays Jack Ong north of the industry median. Furthermore, Jack Ong directly owns S$4.7m worth of shares in the company, implying that they are deeply invested in the company's success.

在比较新加坡能源服务行业中市值低于2.64亿新元的类似规模的公司时,我们发现首席执行官的总薪酬中位数为33.2万新元。因此,我们的分析显示,CosmoSteel Holdings Limited向杰克·昂支付的款项超过了行业中位数。此外,Jack Ong直接拥有该公司价值470万新元的股份,这意味着他们为公司的成功投入了大量资金。

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | S$360k | S$360k | 71% |

| Other | S$145k | S$112k | 29% |

| Total Compensation | S$505k | S$472k | 100% |

| 组件 | 2022 | 2021 | 比例 (2022) |

| 工资 | 360 万新元 | 360 万新元 | 71% |

| 其他 | 14.5 万新元 | 11.2 万新元 | 29% |

| 总薪酬 | 505 万新元 | 472 万新元 | 100% |

On an industry level, around 77% of total compensation represents salary and 23% is other remuneration. There isn't a significant difference between CosmoSteel Holdings and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

在行业层面上,总薪酬的77%左右代表工资,23%是其他薪酬。就整体薪酬待遇的薪资分配而言,CosmoSteel Holdings与整个市场之间没有显著差异。如果工资在总薪酬中占主导地位,则表明首席执行官的薪酬不太倾向于可变部分,而可变部分通常与绩效挂钩。

CosmoSteel Holdings Limited's Growth

宇宙钢铁控股有限公司的发展

CosmoSteel Holdings Limited has reduced its earnings per share by 3.4% a year over the last three years. Its revenue is up 17% over the last year.

在过去三年中,CosmoSteel Holdings Limited的每股收益每年减少3.4%。其收入比去年增长了17%。

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

投资者会对每股收益较低的公司持谨慎态度,但另一方面,收入增长强劲,这表明前景更加光明。现在很难就业务表现得出结论。这可能是值得关注的。虽然我们没有分析师对公司的预测,但股东们可能想看看这张详细的收益、收入和现金流历史图表。

Has CosmoSteel Holdings Limited Been A Good Investment?

CosmoSteel 控股有限公司是一项不错的投资吗?

Boasting a total shareholder return of 58% over three years, CosmoSteel Holdings Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

CosmoSteel Holdings Limited在三年内实现了58%的股东总回报,在股东中表现良好。因此,他们可能根本不担心首席执行官的薪水是否会超过相同规模的公司的正常报酬。

In Summary...

总而言之...

Although the company has performed relatively well, we still think there are some areas that could be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

尽管该公司的表现相对不错,但我们仍然认为有一些领域有待改进。我们仍然认为,在每股收益增长改善之前,一些股东会对提高首席执行官薪酬犹豫不决,因为他们的薪水已经高于该行业。

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for CosmoSteel Holdings you should be aware of, and 2 of them are a bit unpleasant.

首席执行官薪酬是值得你关注的重要领域,但我们也需要关注公司的其他属性。在我们的研究中,我们发现 宇宙钢铁控股的三个警告标志 你应该知道,其中有两个有点不愉快。

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

当然, 看一组不同的股票,你可能会发现一笔不错的投资。 所以来看看这个 免费的 有趣的公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧? 取得联系 直接和我们联系。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是一般性的。 我们仅使用不偏不倚的方法根据历史数据和分析师预测提供评论,我们的文章并非旨在提供财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能未将最新的价格敏感型公司公告或定性材料考虑在内。简而言之,华尔街对上述任何股票都没有头寸。