Little Excitement Around Zhongtong Guomai Communication Co., Ltd.'s (SHSE:603559) Earnings As Shares Take 26% Pounding

Little Excitement Around Zhongtong Guomai Communication Co., Ltd.'s (SHSE:603559) Earnings As Shares Take 26% Pounding

Zhongtong Guomai Communication Co., Ltd. (SHSE:603559) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

中通国脉通信有限公司。(上海证券交易所股票代码:603559)股东们不会高兴地看到股价经历了非常艰难的一个月,下跌了26%,抹去了前一段时间的积极表现。较长期的股东将为股价下跌感到后悔,因为在经历了几个充满希望的季度后,今年的股价几乎持平。

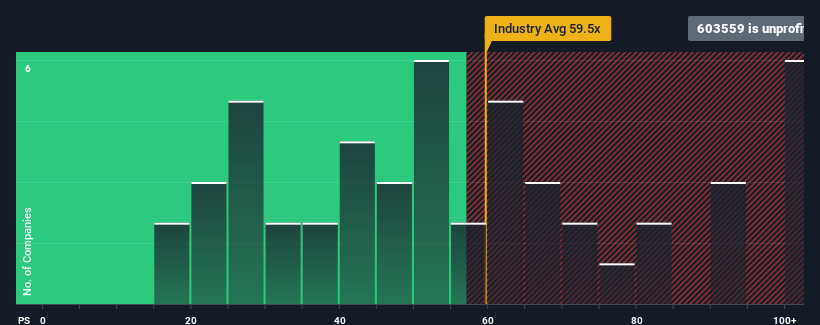

After such a large drop in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 36x, you may consider Zhongtong Guomai Communication as a highly attractive investment with its -8.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

在股价大幅下跌后,考虑到中国约有一半的公司的市盈率(P/E)在36倍以上,你可能会认为中通国脉通信的市盈率为-8.8倍,是一笔极具吸引力的投资。尽管如此,仅仅从面值来看待市盈率是不明智的,因为可能会有一个解释,为什么它如此有限。

With earnings growth that's exceedingly strong of late, Zhongtong Guomai Communication has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

随着最近收益增长异常强劲,中通国脉通信一直表现良好。这可能是因为许多人预计强劲的盈利表现将大幅下降,这抑制了市盈率。如果这不是最终的结果,那么现有股东有理由对未来股价的走势相当乐观。

See our latest analysis for Zhongtong Guomai Communication

查看我们对中通国脉传播的最新分析

Is There Any Growth For Zhongtong Guomai Communication?

中通国脉通信有没有增长?

In order to justify its P/E ratio, Zhongtong Guomai Communication would need to produce anemic growth that's substantially trailing the market.

为了证明其市盈率是合理的,中通国脉通信需要大幅落后于市场的增长乏力。

Taking a look back first, we see that the company grew earnings per share by an impressive 56% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

首先回顾一下,我们看到该公司去年的每股收益增长了令人印象深刻的56%。不过,该公司的长期表现没有那么强劲,三年每股收益增长总体上相对不存在。因此,公平地说,该公司最近的收益增长一直不一致。

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 44% shows it's noticeably less attractive on an annualised basis.

将最近的中期收益轨迹与大盘一年增长44%的预期进行比较,结果显示,按年率计算,它的吸引力明显下降。

With this information, we can see why Zhongtong Guomai Communication is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

有了这些信息,我们就可以理解为什么中通国脉通信的市盈率低于市场。似乎大多数投资者都预计,最近有限的增长率将持续到未来,他们只愿意为该股支付较低的价格。

What We Can Learn From Zhongtong Guomai Communication's P/E?

中通国脉通信市盈率对我们有何启示?

Shares in Zhongtong Guomai Communication have plummeted and its P/E is now low enough to touch the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

中通国脉通信股价暴跌,市盈率已低到触地。虽然市盈率不应该是你是否买入一只股票的决定性因素,但它是一个很好的盈利预期晴雨表。

As we suspected, our examination of Zhongtong Guomai Communication revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

正如我们所怀疑的那样,我们对中通国脉通信的调查显示,该公司三年来的盈利趋势是导致其低市盈率的原因之一,因为它们看起来比目前的市场预期更糟糕。在这个阶段,投资者认为盈利改善的潜力还不够大,不足以证明提高市盈率是合理的。如果近期的中期盈利趋势继续下去,在这种情况下,很难看到股价在不久的将来强劲上涨。

You need to take note of risks, for example - Zhongtong Guomai Communication has 2 warning signs (and 1 which is potentially serious) we think you should know about.

你需要注意风险,例如-中通国脉通信有2个警示信号(和1个潜在的严重问题)我们认为您应该知道。

If you're unsure about the strength of Zhongtong Guomai Communication's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不确定中通国脉通信的业务实力,为什么不探索我们的互动列表,为其他一些你可能没有达到预期的公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。