Optimism for Zhiyang Innovation Technology (SHSE:688191) Has Grown This Past Week, Despite One-year Decline in Earnings

Optimism for Zhiyang Innovation Technology (SHSE:688191) Has Grown This Past Week, Despite One-year Decline in Earnings

It might be of some concern to shareholders to see the Zhiyang Innovation Technology Co., Ltd. (SHSE:688191) share price down 10% in the last month. But that doesn't change the fact that the returns over the last year have been pleasing. After all, the share price is up a market-beating 13% in that time.

股东可能会有一些担忧,因为他们看到智扬创新科技有限公司。(上海证券交易所:688191)上个月股价下跌了10%。但这并没有改变一个事实,即过去一年的回报一直令人满意。毕竟,在这段时间里,该公司股价上涨了13%,涨幅超过了市场。

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

在过去一周的强劲上涨之后,长期回报是否受到基本面改善的推动值得关注。

Check out our latest analysis for Zhiyang Innovation Technology

查看我们对智扬创新科技的最新分析

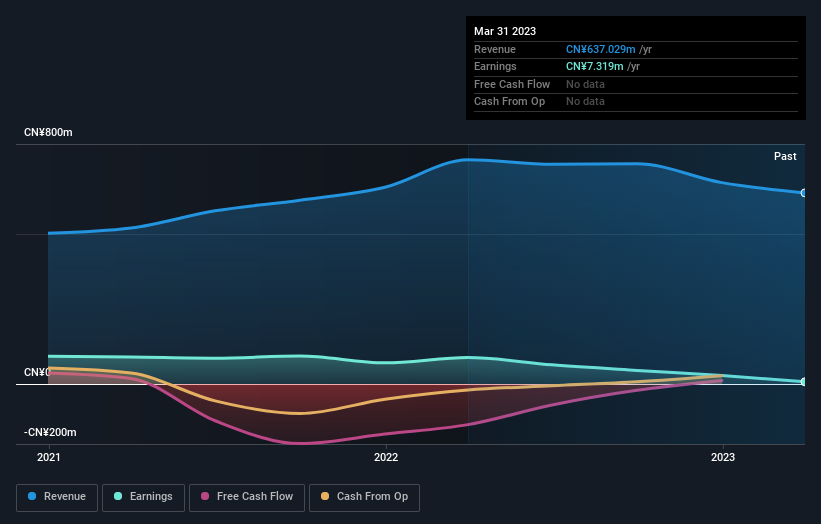

While Zhiyang Innovation Technology made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

虽然智扬创新科技实现了小幅盈利,但在过去的一年里,我们认为市场目前可能更关注营收增长。一般来说,我们会把这样的股票和亏损的公司放在一起考虑,原因很简单,因为利润的总量太低了。如果没有不断增长的收入,很难相信未来会有更有利可图的未来。

In the last year Zhiyang Innovation Technology saw its revenue shrink by 15%. The stock is up 13% in that time, a fine performance given the revenue drop. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

去年,智扬创新科技的收入缩水了15%。在此期间,该股上涨了13%,考虑到收入的下降,这是一个很好的表现。对我们来说,这意味着过去的收入表现和股价之间没有太大的相关性,但仔细看看分析师的预测和利润可能会解释很多事情。

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

你可以在下面看到收入和收入是如何随着时间的推移而变化的(点击图片可以发现确切的价值)。

If you are thinking of buying or selling Zhiyang Innovation Technology stock, you should check out this FREE detailed report on its balance sheet.

如果你正在考虑买卖智洋创新科技的股票,你应该看看这个。免费关于其资产负债表的详细报告。

A Different Perspective

不同的视角

Zhiyang Innovation Technology shareholders should be happy with the total gain of 14% over the last twelve months, including dividends. A substantial portion of that gain has come in the last three months, with the stock up 3.1% in that time. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Zhiyang Innovation Technology better, we need to consider many other factors. For example, we've discovered 4 warning signs for Zhiyang Innovation Technology (3 are concerning!) that you should be aware of before investing here.

智扬创新科技的股东应该为总计过去12个月的收益为14%,包括股息。其中很大一部分涨幅来自过去三个月,该股在此期间上涨了3.1%。这表明,该公司正在继续赢得新投资者的支持。跟踪股价的长期表现总是很有趣的。但要更好地理解智扬创新科技,我们还需要考虑许多其他因素。例如,我们发现智扬创新科技的4个警示信号(3个是有关的!)在这里投资之前你应该意识到这一点。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果你更愿意看看另一家公司--一家财务状况可能更好的公司--那么不要错过这一点免费已证明自己能够实现盈利增长的公司名单。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

请注意,本文引用的市场回报反映了目前在中国交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。