Sea Unusual Options Activity For May 22

Sea Unusual Options Activity For May 22

A whale with a lot of money to spend has taken a noticeably bearish stance on Sea.

一只有很多钱可以花的鲸鱼对它采取了明显的看跌立场 海。

Looking at options history for Sea (NYSE:SE) we detected 13 strange trades.

查看Sea(纽约证券交易所代码:SE)的期权历史记录,我们发现了13笔奇怪的交易。

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 69% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,30%的投资者以看涨的预期开仓,69%的投资者以看跌的预期开盘。

From the overall spotted trades, 9 are puts, for a total amount of $509,400 and 4, calls, for a total amount of $344,955.

在全部现货交易中,有9笔是看跌期权,总金额为509,400美元,4笔是看涨期权,总金额为344,955美元。

What's The Price Target?

目标价格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $105.0 for Sea over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼的目标价格似乎在60.0美元至105.0美元之间。

Volume & Open Interest Development

成交量和未平仓合约发展

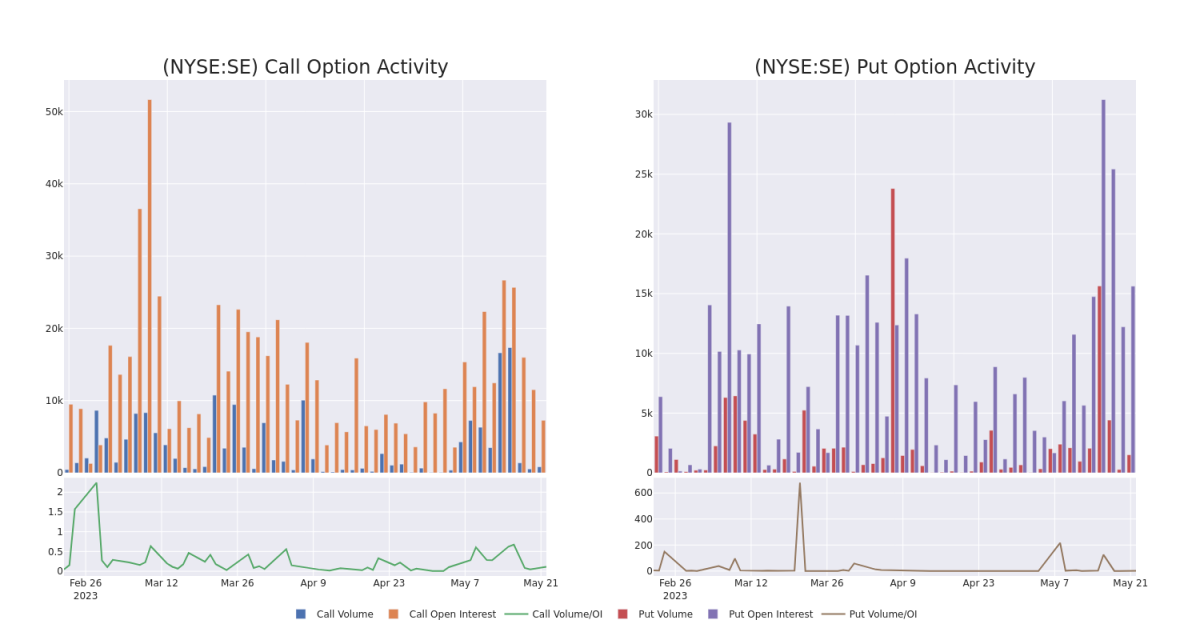

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Sea's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Sea's whale trades within a strike price range from $60.0 to $105.0 in the last 30 days.

在交易期权时,查看交易量和未平仓合约是一个强有力的举措。这些数据可以帮助您追踪给定行使价下Sea期权的流动性和利息。下面,我们可以观察到过去30天内在行使价从60.0美元到105.0美元范围内的所有Sea's whale交易的看涨期权和看跌期权交易量和未平仓合约的变化情况。

Sea Option Volume And Open Interest Over Last 30 Days

过去 30 天海洋期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| SE | CALL | TRADE | BEARISH | 08/18/23 | $70.00 | $212.7K | 658 | 305 |

| SE | PUT | TRADE | BULLISH | 11/17/23 | $60.00 | $161.4K | 743 | 557 |

| SE | PUT | SWEEP | BEARISH | 07/21/23 | $70.00 | $88.2K | 202 | 230 |

| SE | CALL | SWEEP | BEARISH | 01/17/25 | $105.00 | $71.3K | 6.4K | 71 |

| SE | PUT | SWEEP | NEUTRAL | 06/16/23 | $70.00 | $64.1K | 8.3K | 437 |

| 符号 | 看跌/看跌 | 交易类型 | 情绪 | Exp。日期 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|

| SE | 呼叫 | 贸易 | 粗鲁的 | 08/18/23 | 70.00 美元 | 212.7 万美元 | 658 | 305 |

| SE | 放 | 贸易 | 看涨 | 11/17/23 | 60.00 美元 | 161.4 万美元 | 743 | 557 |

| SE | 放 | 扫 | 粗鲁的 | 07/21/23 | 70.00 美元 | 88.2 万美元 | 202 | 230 |

| SE | 呼叫 | 扫 | 粗鲁的 | 01/17/25 | 105.00 美元 | 71.3 万美元 | 6.4K | 71 |

| SE | 放 | 扫 | 中立 | 06/16/23 | 70.00 美元 | 64.1 万美元 | 8.3K | 437 |

Where Is Sea Standing Right Now?

海现在在哪里?

- With a volume of 3,835,981, the price of SE is down -1.31% at $68.53.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 85 days.

- SE的交易量为3,835,981美元,下跌了-1.31%,至68.53美元。

- RSI 指标暗示,标的股票目前在超买和超卖之间保持中立。

- 下一份财报预计将在85天后公布。

What The Experts Say On Sea:

专家在海上怎么说:

- HSBC has decided to maintain their Buy rating on Sea, which currently sits at a price target of $94.

- B of A Securities has decided to maintain their Neutral rating on Sea, which currently sits at a price target of $90.

- Benchmark downgraded its action to Buy with a price target of $105

- 汇丰银行已决定维持其对Sea的买入评级,该评级目前的目标股价为94美元。

- B of A Securities已决定维持其对Sea的中性评级,该评级目前的目标股价为90美元。

- Benchmark将其行动评级下调至买入,目标股价为105美元

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险更高的资产,但它们的获利潜力更高。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

If you want to stay updated on the latest options trades for Sea, Benzinga Pro gives you real-time options trades alerts.

如果您想随时了解Sea的最新期权交易,Benzinga Pro会为您提供实时期权交易提醒。