Double Your Returns: Seize The AI And Tech Boom With This Unique 2X Leverage Fund

Double Your Returns: Seize The AI And Tech Boom With This Unique 2X Leverage Fund

Direxion Daily Robotics, Artificial Intelligence & Automation Index Bull 2X Shares (NYSE:UBOT) was trading over 3% higher on Friday after closing Thursday's session up 3.92%.

Direxion Daily Robotics、人工智能和自动化指数牛市 2X 股 纽约证券交易所代码:UBOT)在周四收盘上涨3.92%后,周五上涨了3%以上。

AI and tech stocks have experienced a strong rally recently as automation becomes more advanced and integrated into people's daily lives.

随着自动化变得越来越先进并融入人们的日常生活,人工智能和科技股最近经历了强劲的上涨。

UBOT is a double-leveraged fund that offers 2x daily leverage to bullish movements across a variety of stocks in the robotics, AI and automation sector.

UBOT是一家双杠杆基金,为机器人、人工智能和自动化领域各种股票的看涨走势提供2倍的每日杠杆率。

The ETF tracks a number of stocks through its holdings, with companies such as NVIDIA Corporation (NASDAQ:NVDA) weighted at 8.91%, Intuitive Surgical, Inc (NASDAQ:ISRG) weighted at 8.34% and a number of other foreign-listed companies within the sector.

该ETF通过其持有的股票追踪了多只股票,例如 英伟达公司 (纳斯达克股票代码:NVDA)的加权为8.91%, 直觉外科公司 纳斯达克股票代码:ISRG)的权重为8.34%,该行业还有其他一些外国上市公司。

It should be noted that leveraged ETFs are meant to be used as a trading vehicle as opposed to long-term investments by experienced traders. Leveraged ETFs should never be used by an investor with a buy-and-hold strategy or those who have low-risk appetites.

应该指出的是,杠杆ETF旨在用作交易工具,而不是由经验丰富的交易者进行长期投资。采用买入并持有策略的投资者或具有低风险偏好的投资者不应使用杠杆ETF。

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

想要直接分析?在 BZ Pro 休息室找我!点击此处免费试用。

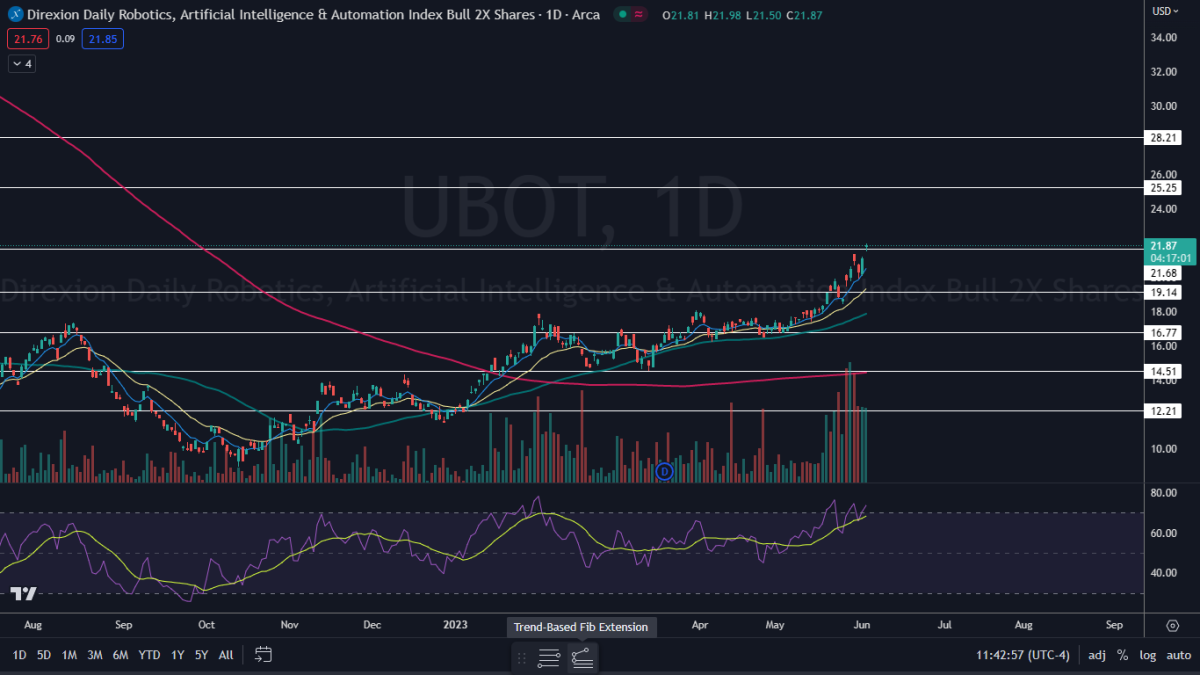

The UBOT Chart: UBOT gapped up to open Friday's trading session and was trading near its opening price. The trading action had the ETF looking to print a doji candlestick, which could indicate the local top has occurred and UBOT will retrace on Monday.

UBOT 图表: UBOT 突然开启了周五的交易时段,交易价格接近开盘价。该交易行动使ETF希望打印十字星蜡烛图,这可能表明局部顶部已经出现,UBOT将在周一回落。

- The ETF has been trading in a fairly consistent uptrend since March 15, making a series of higher highs and higher lows. UBOT's most recent higher low within the pattern was formed on Wednesday at $19.93 and the most recent confirmed higher high was printed at the $21.38 mark the day prior.

- A pullback, at least for the ETF to print another higher low is likely to come over the next few trading days because UBOT's relative strength index (RSI) is measuring in at about 73%. When a stock or ETF's RSI reaches or exceeds the 70% mark, it becomes overbought, which can be a sell signal for technical traders.

- UBOT has resistance above at $25.25 and $28.21 and support below at $21.68 and $19.14.

- 自3月15日以来,该ETF一直处于相当稳定的上涨趋势中,创出了一系列更高的高点和更高的低点。UBOT在该模式内的最新较高低点于周三形成,为19.93美元,最近确认的更高高点在前一天印在21.38美元大关。

- 由于UBOT的相对强弱指数(RSI)约为73%,因此在接下来的几个交易日内,至少ETF可能会再次出现回调。当股票或ETF的RSI达到或超过70%大关时,它将变为超买,这对于技术交易者来说可能是卖出信号。

- UBOT的阻力位在25.25美元和28.21美元上方,支撑位在21.68美元和19.14美元下方。

Read Next: Which Stocks Are Responding To The Strong Jobs Report? 10 Top Movers

Read Next: Which Stocks Are Responding To The Strong Jobs Report? 10 Top Movers

继续阅读:哪些股票对强劲的就业报告做出了回应?10 大推动者