Japanese Equities: Still In The Doldrums

Japanese Equities: Still In The Doldrums

Summary

摘要

Japanese equities have been the star performer since September - rising more dramatically than their global peers in a response to a perceived thaw in U.S.-China trade tensions. Yet we maintain our underweight on Japanese equities: They are particularly vulnerable to a growth slowdown in China, and we see no sustained letup in the protectionist push. Yet the recent rally offers a preview of the potential upside in Japanese equities if trade tensions were to fade substantively and growth to reaccelerate.

自9月份以来,日本股市一直是表现最好的股市-涨幅比全球股市更大,这是对美中贸易紧张局势解冻的回应。然而,我们仍然减持日本股票:它们特别容易受到中国经济增长放缓的影响,我们认为保护主义努力不会持续减弱。然而,最近的反弹预示着,如果贸易紧张局势实质性消退,增长重新加速,日本股市可能会上行。

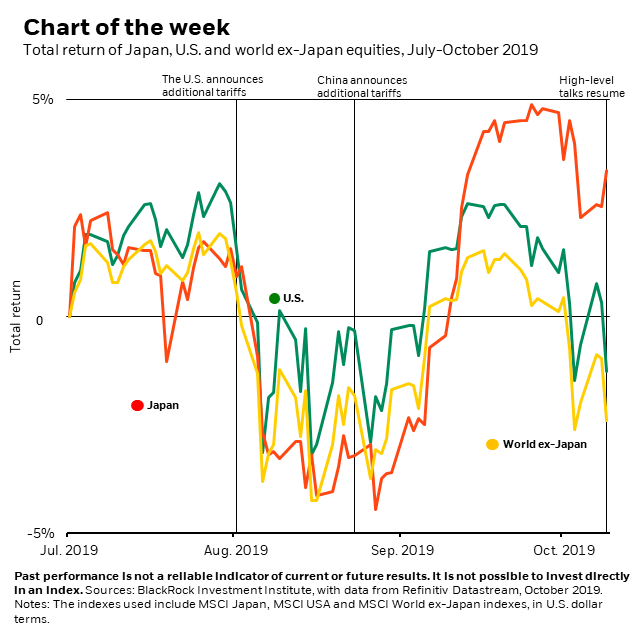

Japan has been the best performer in major equity markets since midyear. The MSCI Japan index has led both U.S. and global markets (ex-Japan) after a significant climb in September, as the chart shows. The main driver? A perceived easing in U.S.-China trade tensions that led to a shift by investors into unloved assets such as value equities, including beaten-down Japanese stocks. We do not see this rotation having staying power though. In the near term we see potential for further bouts of market volatility, as fallout from the trade war is reflected in weak economic data. See an earlier weekly commentary for details. Yet the recent rebound in Japanese equities offers a preview of the potential market reaction should the global economy reaccelerate in 2020. Japanese equities' cheapness could exaggerate any such move. The price-to-earnings ratio of the blue-chip Nikkei 225 Index has fallen to a historical low of 12.

自年中以来,日本一直是主要股市中表现最好的国家。摩根士丹利资本国际日本指数(MSCI Japan Index)在9月份大幅攀升后,一直领跑美国和全球市场(不包括日本),如图所示。主要司机是谁?美中贸易紧张局势明显缓解,导致投资者转向价值股票等不受欢迎的资产,包括遭受重创的日本股票。不过,我们看不到这种轮换有持久力。短期内,我们认为市场可能会进一步波动,因为贸易战的影响反映在疲弱的经济数据中。看见早些时候的每周评论了解更多细节。然而,日本股市最近的反弹为人们提供了一个预览,即如果全球经济在2020年重新加速,市场可能会做出什么反应。日本股市的便宜可能会夸大任何此类走势。蓝筹股日经225指数的市盈率已降至历史低点12倍。

Trade disputes and geopolitical frictions have become key drivers of the global economy and markets, as we outlined in the recent update to our Global investment outlook. Trade dynamics play an outsized role in Japanese equities: As much as half of the revenues of Nikkei 225 companies come from international sales, even though exports' contribution to Japan's GDP is at a much lower 15%. China is the largest market for Japan's exported goods, and orders from China for machines and electronics parts have collapsed since November 2018. We see a lull in China's growth due to the fallout of U.S. tariffs. China's policy stance is likely to ease further to help stabilize growth, yet an incremental boost to growth seems unlikely, in our view. Japan's leverage to global trade leaves it vulnerable to any further downdrafts tied to the protectionist push.

贸易争端和地缘政治摩擦已成为全球经济和市场的关键驱动因素,正如我们在最近更新的全球投资展望。贸易动态在日本股市中扮演着非常重要的角色:日经225指数成份股公司高达一半的收入来自国际销售,尽管出口对日本GDP的贡献率要低得多,只有15%。中国是日本出口商品的最大市场,自2018年11月以来,来自中国的机械和电子零部件订单暴跌。我们看到,由于美国关税的影响,中国的增长出现了停滞。中国的政策立场可能会进一步放松,以帮助稳定增长,但在我们看来,增量提振增长的可能性似乎不大。日本对全球贸易的影响力使其容易受到与保护主义努力相关的任何进一步下行的影响。

Japan also is faced with a number of domestic challenges. A recent sales tax increase could weigh on consumer spending and growth. The Bank of Japan (BoJ) may be running out of policy space. After years of ultra-loose monetary policy, the central bank's asset holdings have exceeded the country's total GDP - making the BoJ the biggest asset owner among key developed market central banks. We see room for only a modest rate cut by the BoJ at its policy meeting in late October. A potential wildcard: BoJ Governor Haruhiko Kuroda has spoken of the potential for greater coordination between monetary and fiscal policy, echoing the theme of our recent piece Dealing with the next downturn. Any growth slowdown induced by the hike in Japan's sales tax could be met with a fiscal stimulus in early 2020.

日本也面临着一些国内挑战。最近的销售税上调可能会拖累消费者支出和增长。日本央行(BoJ)的政策空间可能即将耗尽。在实施了多年的超宽松货币政策后,日本央行的资产持有量已超过日本国内生产总值(GDP)的总和--使日本央行成为主要发达市场央行中最大的资产所有者。我们认为,日本央行在10月下旬的政策会议上只有适度降息的空间。一个潜在的通配符:日本央行行长黑田东彦(Haruhiko Kuroda)谈到了货币政策和财政政策之间加强协调的潜力,呼应了我们最近这篇文章的主题应对下一次经济低迷。日本销售税上调导致的任何增长放缓,都可能在2020年初用财政刺激措施来应对。

Bottom Line

底线

We remain underweight Japanese equities for now. We still expect weakness in global growth data over the next few months, as easier monetary conditions slowly filter through to benefit the broader economy in the next six to 12 months. But if a prolonged trade truce between the U.S. and China were to take place and global manufacturing activities bottomed out, we would need to reassess our view on Japanese equities. Their close correlation with the health of global manufacturing activities and China's growth, as well as their beaten-down valuations, could make them attractive. Another positive in the background: Japanese firms are gradually improving their corporate governance, reflected in increased payouts to investors in the form of dividends and share buybacks.

目前,我们仍在减持日本股票。我们仍预计未来几个月全球增长数据将疲软,因为宽松的货币环境将在未来6至12个月内缓慢渗透,惠及更广泛的经济。但是,如果美国和中国之间的长期贸易休战发生,全球制造业活动触底,我们将需要重新评估我们对日本股市的看法。它们与全球制造业活动的健康状况和中国的增长密切相关,以及它们遭受重创的估值,可能会使它们变得有吸引力。背景中的另一个积极因素是:日本公司正在逐步改善其公司治理,这反映在以股息和股票回购的形式向投资者支付的更多股息。

This post originally appeared on the BlackRock Blog.

这开机自检最初出现在贝莱德的博客上。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者注:本文的摘要项目符号是由寻找Alpha编辑选择的。

Japanese equities have been the star performer since September - rising more dramatically than their global peers in a response to a perceived thaw in U.S.-China trade tensions. Yet we maintain our underweight on Japanese equities: They are particularly vulnerable to a growth slowdown in China, and we see no sustained letup in the protectionist push. Yet the recent rally offers a preview of the potential upside in Japanese equities if trade tensions were to fade substantively and growth to reaccelerate.

Japanese equities have been the star performer since September - rising more dramatically than their global peers in a response to a perceived thaw in U.S.-China trade tensions. Yet we maintain our underweight on Japanese equities: They are particularly vulnerable to a growth slowdown in China, and we see no sustained letup in the protectionist push. Yet the recent rally offers a preview of the potential upside in Japanese equities if trade tensions were to fade substantively and growth to reaccelerate.