The Fed Cuts Rates Again. Is A Pause Next?

The Fed Cuts Rates Again. Is A Pause Next?

Summary

摘要

The U.S. Federal Reserve (the Fed) cut interest rates again today - its third such move in as many meetings - lowering its benchmark rate to a target range of 1.50% to 1.75%. At 75 basis points, the current easing cycle now matches the degree of insurance that the Fed provided around similar slowdowns in 1995 and 1998. This cut to overnight interest rates also serves to effectively un-invert the entirety of the Treasury yield curve and bolster the Fed's confidence that its monetary policy stance is indeed accommodative, even when accounting for the headwinds from the China-U.S. trade war.

美国联邦储备委员会(美联储/FED)今天再次降息--这是美联储多次会议以来的第三次降息--将基准利率降至1.50%至1.75%的目标区间。目前的宽松周期为75个基点,与美联储在1995年和1998年类似放缓前后提供的保险程度相当。隔夜利率的下调还有效地逆转了美国国债收益率曲线的整体,并增强了美联储的信心,即即使考虑到中美贸易战的不利因素,美联储的货币政策立场也确实是宽松的。

Bond yields, as evidenced by the yield on the 10-year U.S. Treasury note, moved higher in the minutes around the announcement. The biggest surprise driving the re-pricing in yields was the softening of forward guidance. Since June, the Fed has messaged that it will act as appropriate to sustain the expansion. This line was removed and replaced with blander language stating simply that the Committee will assess the appropriate path of interest rates.

债券收益率,从10年期美国国债收益率来看,在声明发布前后的几分钟内走高。推动收益率重新定价的最大意外是前瞻性指引的软化。自6月份以来,美联储已发出信号,表示将采取适当行动维持经济扩张。此行已删除,并且替换为空白语言简单地说,委员会将评估适当的利率路径。

Translation: The Federal Open Market Committee (FOMC) thinks its three rate cuts are now sufficient to push back against the downside risks from the trade war. The hurdle for further action from here is much higher.

译文:联邦公开市场委员会(FOMC)认为,它的三次降息现在足以抵御贸易战带来的下行风险。从现在开始采取进一步行动的障碍要高得多。

Model Strategies

模型策略

Is a prolonged pause next?

接下来是长时间的停顿吗?

Our baseline has been that the Fed would cut in July, September and October and then go on a prolonged pause. That baseline forecast, if anything, has simply been reinforced by today's developments. When we consider the risks around this view, it still looks to us as though there's an asymmetry, in that the Fed is more likely to cut than hike rates through the end of 2020. This thinking is motivated by two key insights:

我们的基线一直是,美联储将在7月、9月和10月降息,然后长时间暂停。如果说有什么不同的话,那就是这一基线预测只是被今天的事态发展所强化。当我们考虑到围绕这一观点的风险时,在我们看来,似乎存在一种不对称,因为到2020年底,美联储更有可能降息而不是加息。这种想法是由两个关键的洞察力推动的:

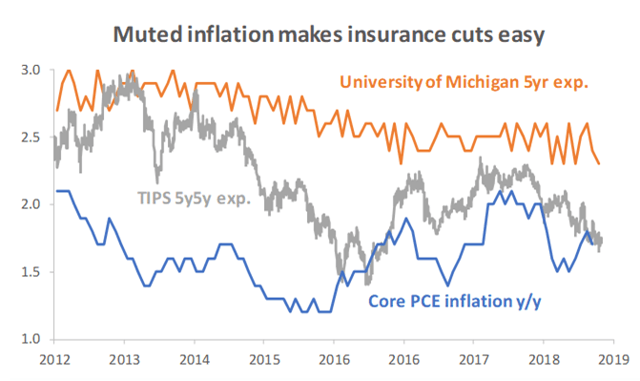

- First, inflation expectations are below levels that would be consistent with the Fed's 2% price stability objective over the medium-term. For example, the gray line in the chart below shows 5-year, 5-year forward inflation expectations embedded in the pricing of Treasury Inflation Protected Securities (TIPS) are trading at just 1.7%. We and the Fed would want to see TIPS pricing closer to 2.25% to be more confident in core personal consumption expenditure (PCE) inflation holding at the 2% objective.

Furthermore, the inflationary expectations of U.S. consumers have recently downshifted to an all-time low (orange line). The price for cutting rates late in the cycle is usually that it could risk an overshoot of inflation. However, right now a bit more inflation would actually be a welcome development. In our view, that makes the Fed's calculus skew in favor of a cut should risks to the outlook re-intensify.

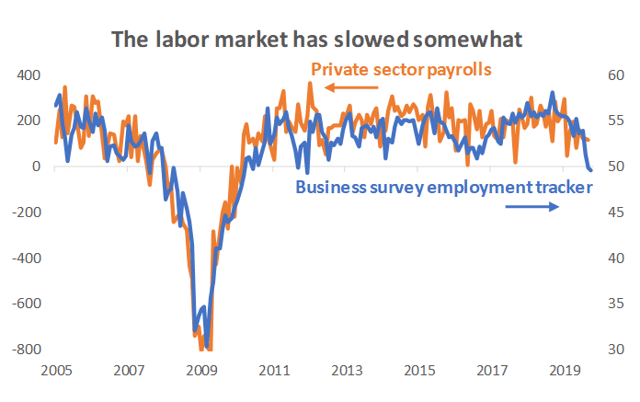

Source: Thomson Reuters Datastream, Russell Investments data as of October 29th 2019. - Second, the balance of risks to the global business cycle still skew modestly to the downside in our view. Manufacturing activity has downshifted to recessionary levels in the United States and across most of the developed markets. And while some high frequency manufacturing data for September and October points to a tentative stabilization at weak levels, the weakness itself will be a concern for policymakers. Additionally, the services sector and U.S. labor market (which typically lags manufacturing by a month or more) still show signs of potentially slowing further. Healthy employment growth and robust wage gains have supported the U.S. consumer. If the labor market slows and endangers the expansion, further rate cuts could be warranted.

Source: Bureau of Labor Statistics, Russell Investments data as of October 30th 2019. The business survey employment tracker is a custom composite indicator based on underlying data from Markit, the Institute for Supply Management, and the Federal Reserve System. Preliminary data for October is shown.

- 首先,通胀预期低于与美联储2%的中期物价稳定目标一致的水平。例如,下面图表中的灰线显示,包含在美国国债通胀保值证券(TIPS)定价中的5年、5年远期通胀预期目前仅为1.7%。我们和美联储都希望看到TIPS定价接近2.25%,以便对核心个人消费支出(PCE)通胀率保持在2%的目标更有信心。

此外,美国消费者的通胀预期最近已降至历史低点(橙线)。在周期后期降息的代价通常是,它可能会有通胀超调的风险。然而,目前更多的通胀实际上将是一个受欢迎的发展。在我们看来,如果前景面临的风险再次加剧,这将使美联储的计算偏向于支持降息。

来源:汤森路透数据流,罗素投资截至2019年10月29日的数据。 - 其次,在我们看来,全球商业周期的风险平衡仍适度偏向下行。在美国和大多数发达市场,制造业活动已经降至衰退水平。尽管9月和10月的一些高频制造业数据显示,疲软水平暂时企稳,但疲软本身将是政策制定者的担忧。此外,服务业和美国劳动力市场(通常落后于制造业一个月或更长时间)仍显示出可能进一步放缓的迹象。健康的就业增长和强劲的工资增长支撑了美国消费者。如果劳动力市场放缓并危及扩张,可能会有理由进一步降息。

来源:美国劳工统计局,罗素投资公司截至2019年10月30日的数据。商业调查就业跟踪器是一个定制的综合指标,基于Markit、供应管理研究所(Institute For Supply Management)和联邦储备系统(Federal Reserve System)的基础数据。10月份的初步数据显示。

The bottom line

底线是

Considering these risks to the outlook, current market pricing on the near-term path for interest rates (i.e., one more rate cut through the end of 2020) looks broadly appropriate to us, even though our baseline is for the Fed to remain on hold. With the expansion entering its eleventh year, we still think government bonds have an important diversifying role to play in multi-asset portfolios.

考虑到前景面临的这些风险,目前市场对短期利率路径(即到2020年底再降息一次)的定价看起来大致适合我们,尽管我们的基准是美联储保持不变。随着扩张进入第11个年头,我们仍然认为政府债券在多资产投资组合中具有重要的多元化作用。

On the upside, further evidence of progress toward a phase 1 deal between the U.S. and China, and importantly, an eventual removal of the tariffs that have been put in place, would be key to lifting the cloud of uncertainty hanging over the corporate sector and re-accelerating global fundamentals and risk markets in the year ahead.

从好的方面来看,美中两国在第一阶段协议方面取得进展的进一步证据,以及重要的是最终取消已经实施的关税,将是消除笼罩在企业部门上空的不确定性阴云,并在未来一年重新加速全球基本面和风险市场的关键。

Disclosures

披露

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page.

这些视图可能随时会根据市场或其他条件进行更改,并且截至页面顶部的日期是最新的。

Investing involves risk and principal loss is possible.

投资涉及风险,本金损失是可能的。

Past performance does not guarantee future performance.

过去的表现并不能保证未来的表现。

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

预测是指利用不同的分析数据对市场价格和/或成交量模式进行预测。它不代表对股票市场的预测,也不代表任何具体的投资。

This material is not an offer, solicitation or recommendation to purchase any security. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

本材料不是购买任何证券的要约、邀约或推荐。本材料中包含的任何内容都不打算构成法律、税务、证券或投资建议,也不是关于任何投资的适当性的意见,也不是任何类型的征集。

The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

未经注册专业人士提供具体的法律、税务和投资建议,不得对本出版物中包含的一般信息采取行动。本文中表达的信息、分析和意见仅供一般参考,并不打算为任何个别实体提供具体的意见或建议。

Please remember that all investments carry some level of risk. Although steps can be taken to help reduce risk it cannot be completely removed. They do no not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

请记住,所有的投资都有一定程度的风险。虽然可以采取措施帮助降低风险,但不能完全消除这种风险。它们通常不会以均匀的回报率增长,可能会经历负增长。与任何类型的投资组合结构一样,试图降低风险和提高回报,在某些时候可能会无意中降低回报。

Investments that are allocated across multiple types of securities may be exposed to a variety of risks based on the asset classes, investment styles, market sectors, and size of companies preferred by the investment managers. Investors should consider how the combined risks impact their total investment portfolio and understand that different risks can lead to varying financial consequences, including loss of principal. Please see a prospectus for further details.

根据投资经理喜欢的资产类别、投资风格、市场部门和公司规模,跨多种类型证券配置的投资可能面临各种风险。投资者应该考虑综合风险如何影响他们的总投资组合,并理解不同的风险会导致不同的财务后果,包括本金损失。详情请参阅招股说明书。

Indexes are unmanaged and cannot be invested in directly.

索引是非托管的,不能直接投资。

Russell Investments' ownership is composed of a majority stake held by funds managed by TA Associates with minority stakes held by funds managed by Reverence Capital Partners and Russell Investments' management.

罗素投资公司的所有权由TA Associates管理的基金持有多数股权,由Revience Capital Partners和罗素投资公司管理层管理的基金持有少数股权。

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the "FTSE RUSSELL" brand.

弗兰克·罗素公司是本材料中包含的罗素商标以及与罗素商标相关的所有商标权的所有者,罗素投资集团公司的成员在获得弗兰克·罗素公司的许可后可以使用这些商标。罗素投资集团公司的成员与弗兰克·罗素公司或以“富时罗素”品牌经营的任何实体没有任何关联。

Copyright © Russell Investments Group LLC 2019. All rights reserved.

版权所有©Russell Investments Group LLC 2019。版权所有。

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an "as is" basis without warranty.

本材料是专有的,未经罗素投资公司事先书面许可,不得以任何形式复制、转让或分发。它是在“原样”的基础上交付的,没有保修。

UNI-11555

UNI-11555

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者注:本文的摘要项目符号是由寻找Alpha编辑选择的。