Summary

The yield curve still seems to be following the bearish timeline.

The true measure of inversion isn't a slope of zero. At the zero lower bound, it is a slope of a little more than 1% (10 year minus Fed Funds), which declines as the base yield rises.

If the Fed drops its target rate too slowly, long-term rates will tend to stabilize but not rise, and this usually ends in some sort of contraction.

If the Fed gets ahead of the dropping short-term rate, then long-term yields will pop up like they did a couple times in the 1990s, and contraction will be avoided.

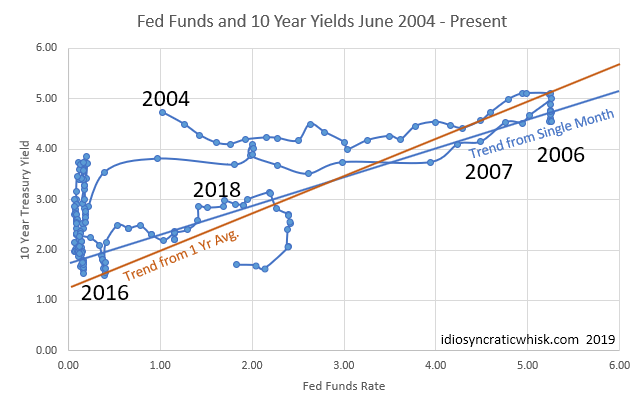

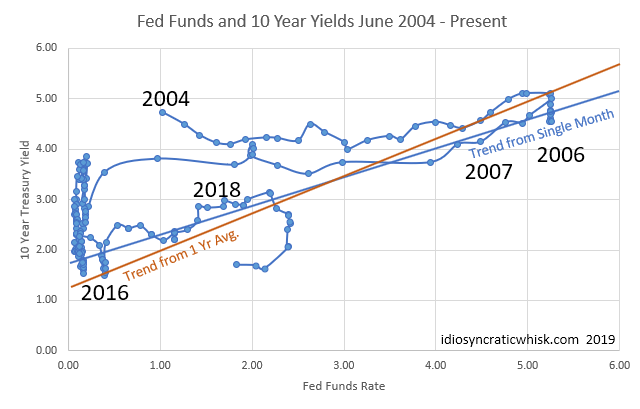

The yield curve still seems to be following the bearish timeline. My axioms here are:

1) The true measure of inversion isn't a slope of zero. At the zero lower bound, it is a slope of a little more than 1% (10 year minus Fed Funds), which declines as the base yield rises. (At about 5%, meaningful inversion happens at a slope of zero, and higher than that, the slope will tend to become more negative the higher yields are.)

2) The neutral rate is a moving target. If the Fed drops its target rate too slowly, long-term rates will tend to stabilize but not rise, and this usually ends in some sort of contraction. If the Fed gets ahead of the dropping short-term rate, then long-term yields will pop up like they did a couple times in the 1990s, and contraction will be avoided. So, if the scatterplot keeps moving to the left as it did this month, that's bearish. If it moves up, that's bullish.

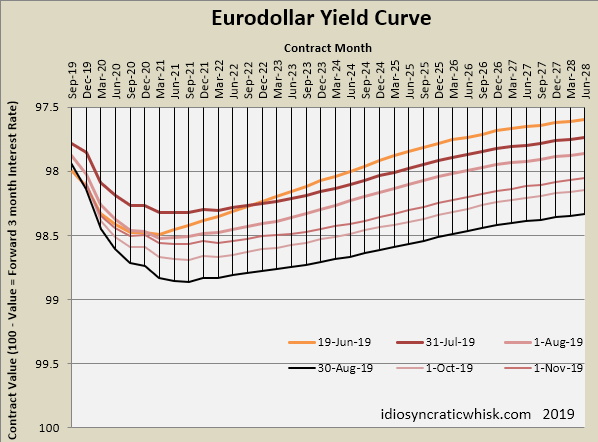

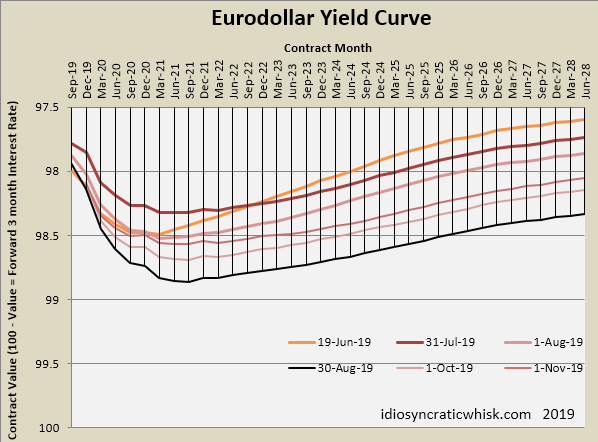

The second graph is the Eurodollar yield curve, which continues to move up and down a bit but with a negative short-term slope and a pretty flat long-term slope. I expect the short end of this curve to eventually drop below where it was in late August. It will be good news if it doesn't.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

The yield curve still seems to be following the bearish timeline.

The true measure of inversion isn't a slope of zero. At the zero lower bound, it is a slope of a little more than 1% (10 year minus Fed Funds), which declines as the base yield rises.

反转的真正衡量标准不是零的斜率。在零下限,它的斜率略高于1%(10年期减去联邦基金),随着基础收益率的上升而下降。

If the Fed drops its target rate too slowly, long-term rates will tend to stabilize but not rise, and this usually ends in some sort of contraction.

如果美联储下调目标利率的速度太慢,长期利率将趋于稳定,但不会上升,这通常会以某种收缩告终。

If the Fed gets ahead of the dropping short-term rate, then long-term yields will pop up like they did a couple times in the 1990s, and contraction will be avoided.

如果美联储领先于下降的短期利率,那么长期收益率将像上世纪90年代的几次那样飙升,收缩将被避免。

The yield curve still seems to be following the bearish timeline. My axioms here are:

1) The true measure of inversion isn't a slope of zero. At the zero lower bound, it is a slope of a little more than 1% (10 year minus Fed Funds), which declines as the base yield rises. (At about 5%, meaningful inversion happens at a slope of zero, and higher than that, the slope will tend to become more negative the higher yields are.)

1)反演的真正度量不是零的斜率。在零下限,它的斜率略高于1%(10年期减去联邦基金),随着基础收益率的上升而下降。(在大约5%的情况下,有意义的反转发生在0的斜率上,高于5%的斜率往往会变得更负,产量越高。)

2) The neutral rate is a moving target. If the Fed drops its target rate too slowly, long-term rates will tend to stabilize but not rise, and this usually ends in some sort of contraction. If the Fed gets ahead of the dropping short-term rate, then long-term yields will pop up like they did a couple times in the 1990s, and contraction will be avoided. So, if the scatterplot keeps moving to the left as it did this month, that's bearish. If it moves up, that's bullish.

2)中性利率是一个移动的目标。如果美联储下调目标利率的速度太慢,长期利率将趋于稳定,但不会上升,这通常会以某种收缩告终。如果美联储领先于下降的短期利率,那么长期收益率将像上世纪90年代的几次那样飙升,收缩将被避免。因此,如果散点图像本月那样继续向左移动,那就是看跌。如果上涨,那就是看涨。

The second graph is the Eurodollar yield curve, which continues to move up and down a bit but with a negative short-term slope and a pretty flat long-term slope. I expect the short end of this curve to eventually drop below where it was in late August. It will be good news if it doesn't.

第二张图是欧洲美元收益率曲线,该曲线继续上下移动,但短期斜率为负值,长期斜率相当平坦。我预计这条曲线的短端最终将跌破8月下旬的水平。如果不是这样,那将是个好消息。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者注:本文的摘要项目符号是由寻找Alpha编辑选择的。