Snap Chart - Converging Yields

Snap Chart - Converging Yields

Summary

发明内容

We are at a tricky place with fixed income. On October 30th, the Federal Reserve (Fed) reduced short-term interest rates for a third time this year, as expected. Fed Chairman Jay Powell characterized the 25bp move in the benchmark funds rate to 1.50% from 1.75% as a "midcycle adjustment" in a maturing economic expansion. He also indicated that there would be a higher bar for more easing in the future.

我们在一个有固定收入的棘手的地方。10月30日,美联储(Fed)今年第三次下调短期利率,正如预期的那样。美联储主席杰伊·鲍威尔(Jay Powell)将基准基金利率从1.75%上调至1.50%,这是成熟经济扩张中的“中期调整”。他还表示,未来会有更高的放松门槛。

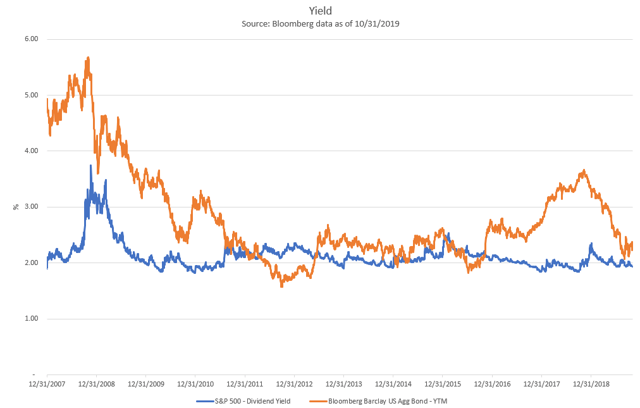

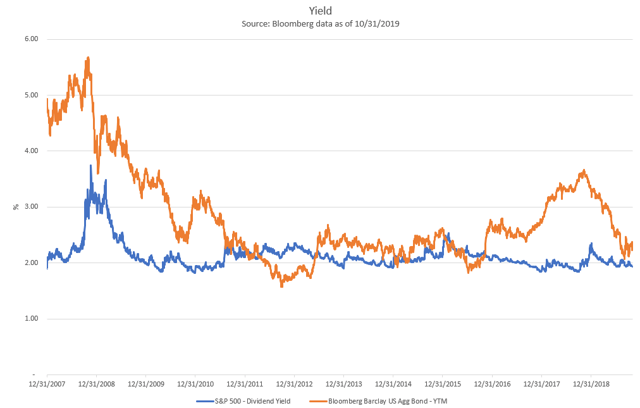

So that leaves us with super-low rates again. Complicating matters is that yields on equities and fixed income are quite close to one another. And when the yield on the S&P 500 Index (1.94%) and the Bloomberg Barclays U.S. Aggregate Bond Index (2.33%) meet, an important question surfaces: Where should investors allocate their "income" bucket?

因此,我们再次面临超低利率。使问题复杂化的是,股票和固定收益的收益率彼此相当接近。当标准普尔500指数(S&P500 Index)的收益率(1.94%)和彭博巴克莱美国综合债券指数(Bloomberg Barclays U.S.Aggregate Bond Index)(2.33%)的收益率相遇时,一个重要的问题浮出水面:投资者应该把他们的“收入”桶分配到哪里?

Fixed income typically offers relative safety and diversification. But this environment's a little different: yields are so low - almost historically low - and principal could be lost when yields eventually rise. In addition, with fixed income and equity yields so close, it's reasonable to wonder if the value of equities and fixed income investments decline in tandem when yields turn higher. A breakdown in the historical relationship between fixed income and equity, and for how long that anomaly persists, could leave investors thirsty for yields.

固定收益通常提供相对安全和多样化。但这种环境略有不同:收益率如此之低--几乎处于历史低位--当收益率最终上升时,本金可能会流失。此外,由于固定收益和股票收益率如此接近,我们有理由怀疑,当收益率上升时,股票和固定收益投资的价值是否会同时下降。固定收益和股本之间历史关系的崩溃,以及这种异常持续多久,可能会让投资者对收益率产生渴望。

In the equity world, bond proxies like REITs, MLPs and Utilities are among the higher-yielding strategies to consider, and could help income-focused investors meet their mandates. But performance likely depends on where we are in the business cycle. Then again, the market remains resilient and risks appear to be softening, particularly with signs of a possible trade deal with China forming.

在股市领域,REITs、MLP和Utilities等债券代理是要考虑的收益率较高的策略,并可能帮助专注于收入的投资者完成他们的任务。但业绩可能取决于我们在商业周期中所处的位置。话又说回来,市场仍然具有弹性,风险似乎正在软化,特别是在与中国可能达成贸易协议的迹象下。

Footnotes:

脚注:

S&P 500 Total Return Index: The index includes 500 leading U.S. companies and captures approximately 80% coverage of available market capitalization.

标准普尔500总回报指数:该指数包括500家领先的美国公司,涵盖了大约80%的可用市值。

Bloomberg Barclays U.S. Aggregate Bond Index: The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through), ABS and CMBS (agency and non-agency).

彭博巴克莱美国综合债券指数:彭博巴克莱美国综合债券指数是一个基础广泛的基准,衡量投资级、美元计价的固定利率应税债券市场。该指数包括美国国债,政府相关证券和公司证券,MBS(机构固定利率和混合ARM传递),ABS和CMBS(机构和非机构)。

Carefully consider the Fund's investment objectives, risks, and charges and expenses before investing. This and other information can be found in the Fund's summary or full prospectuses, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting www.globalxetfs.com. Please read the prospectus carefully before investing.

在投资前仔细考虑基金的投资目标、风险和费用。这一信息和其他信息可以在基金的摘要或完整招股说明书中找到,这些说明书可以通过拨打1-888-GX-Fund-1(1.888.493.8631)或访问www.globalxetfs.com获得。投资前请仔细阅读招股说明书。

Index returns are for illustrative purposes only and do not represent actual fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

指数回报仅供说明之用,并不代表基金的实际表现。指数回报不反映任何管理费、交易成本或费用。指数是非托管的,不能直接投资于指数。过去的表现不能保证未来的结果。

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit or guarantee against a loss. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

投资涉及风险,包括可能的本金损失。多元化并不能确保利润或保证不会出现亏损。此信息不是个人或个人化投资或税务建议,不应用于交易目的。有关您的投资和/或税务情况的更多信息,请咨询财务顾问或税务专业人员。

Information provided by Global X Management Company, LLC (Global X) and SEI Investments Distribution Co. (SIDCO). Global X and SIDCO are not affiliated.

Global X Management Company,LLC(Global X)和SEI Investments Distribution Co.提供的信息。(SIDCO)。Global X和SIDCO没有附属关系。

原创帖子

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者按:本文的摘要项目符号是通过寻找Alpha编辑来选择的。