What's Changed?

What's Changed?

Summary

摘要

By Jack P. McIntyre, CFA

杰克·P·麦金太尔(Jack P.McIntyre),CFA

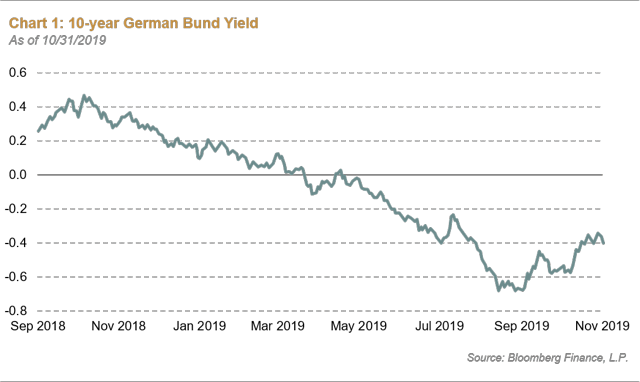

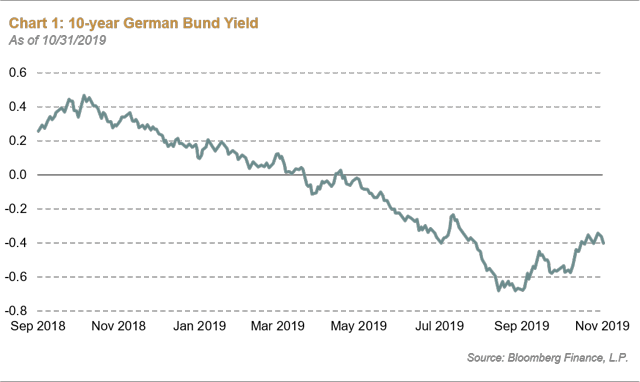

Over the last year, 10-year German Bund yields have gradually declined, while investor sentiment deteriorated over the course of this period as the U.S.-China trade dispute dragged on, taking global growth down with it. Policymakers failed to adequately address the consequences from these events, and German Bund yields partly reflect the lingering effects of this risk-off overhang. However, one year later, information risk is starting to dissipate, which we think may improve the odds for a positive fat-tail risk event in 2020. We think there are six factors that complement each other to potentially produce a surprise to the upside over the next year.

过去一年,10年期德国国债收益率逐渐下降,而在此期间,随着美中贸易争端的拖延,投资者情绪恶化,拖累了全球经济增长。政策制定者未能充分解决这些事件的后果,德国国债收益率在一定程度上反映了这种避险情绪的挥之不去的影响。然而,一年后,信息风险开始消散,我们认为这可能会提高2020年出现正向肥尾风险事件的几率。我们认为,有六个因素相辅相成,有可能在明年给上行带来惊喜。

1. U.S.-China Trade

1.美中贸易

We'll be continuing to monitor whether any tangible progress is made between the two countries. Although relations have started to thaw, the nuance was enough to catch Federal Reserve (Fed) Chair Jerome Powell's attention and time at his October 30 press conference. Policymakers and investors just need China and the U.S. to keep moving the ball forward, even if progress is incremental. We would expect the risk-on environment to return if the scheduled December tariffs don't go through.

我们将继续关注两国之间是否取得了任何切实的进展。尽管两国关系已经开始解冻,但这种细微差别足以引起美联储主席杰罗姆·鲍威尔(Jerome Powell)在10月30日的新闻发布会上的注意和时间。政策制定者和投资者只需要中国和美国继续向前推进,即使进展是渐进的。我们预计,如果12月份的关税不能通过,风险环境将会回归。

2. Fed Policy

2.美联储政策

While we can't call it quantitative easing, the Fed has resumed balance sheet expansion and has left the door open for future rate cuts. Since Powell has insisted that U.S. monetary policy isn't on a preset course, we'll expect more flexibility from the Fed in how it responds to developments in trade, global and domestic growth, and inflation.

虽然我们不能称之为量化宽松,但美联储已经恢复了资产负债表的扩张,并为未来的降息敞开了大门。由于鲍威尔坚持认为美国的货币政策不是在预设的路线上,我们预计美联储在如何应对贸易、全球和国内增长以及通胀的发展方面会有更大的灵活性。

3. Global Monetary Policy

3.全球货币政策

Central banks around the world are in the midst of a wave of rate cuts to stimulate economic growth and inflation. While developed market central banks might be running out of runway to ease, emerging markets have the room in terms of real rates and a benign inflation backdrop to continue loosening policy.

全球央行正处于一波降息浪潮中,以刺激经济增长和通胀。尽管发达市场央行可能已经走出了宽松政策的跑道,但新兴市场在实际利率和温和的通胀背景方面仍有继续放松政策的空间。

4. Fiscal Stimulus

4.财政刺激

We're increasingly hearing that monetary policy alone won't be enough to cause a rebound in regional and global growth, particularly if enough progress isn't made with respect to the trade dispute. Both the incoming and outgoing European Central Bank presidents have invoked bloc members with twin surpluses to implement fiscal stimulus. Are the odds of Germany delivering a fiscal package increasing? Maybe. Low rates mean that debt servicing costs will be extremely low, but officials will need to think about how either the cost of servicing debt or total debt ratios would look against scenarios of low/contractionary, moderate, or high gross domestic product growth. Regardless, it will be hard for certain countries - like Germany - to justify the extra expenditures.

我们越来越多地听到,仅靠货币政策不足以导致地区和全球经济增长反弹,特别是如果在贸易争端方面没有取得足够的进展。即将上任的欧洲央行(ECB)行长和即将离任的欧洲央行(ECB)行长都呼吁拥有双盈余的欧元区成员国实施财政刺激。德国出台财政一揽子计划的可能性在增加吗?也许吧。低利率意味着偿债成本将极低,但官员们将需要考虑,无论是偿债成本还是总负债率,在国内生产总值(GDP)低/收缩、适度或高增长的情况下,如何看待这一点。无论如何,某些国家--比如德国--很难证明这些额外支出是合理的。

5. Global Consumer Optimism

5.全球消费者乐观情绪

Fed Chair Powell also highlighted the strength of U.S. households in his recent press conference - a trend that is also globally applicable. Wages are rising for the lower socioeconomic echelons while labor markets tighten. Consumers still have reasons to remain optimistic. Consumer confidence will become particularly salient if a trade deal is reached and the slowdown in global growth reaches an inflection point, because these factors collectively may give businesses a reason to resume investment.

美联储主席鲍威尔在最近的新闻发布会上也强调了美国家庭的实力-这一趋势也适用于全球。在劳动力市场收紧的同时,较低社会经济阶层的工资正在上涨。消费者仍有理由保持乐观。如果达成贸易协议,全球增长放缓达到拐点,消费者信心将变得尤为突出,因为这些因素加在一起可能会给企业提供恢复投资的理由。

6. Brexit

6.英国退欧

While the idea of a December snap election may seem like a gamble, Prime Minister Boris Johnson's last-minute negotiations with the European Union and the resulting January 31 "flextension" have significantly reduced the probability of a hard Brexit. For us, a hard Brexit has been one of the more bearish outcomes of this three-year ordeal.

虽然12月提前选举的想法可能看起来像是一场赌博,但英国首相鲍里斯·约翰逊(Boris Johnson)在最后一刻与欧盟(EU)的谈判,以及由此导致的1月31日的“延期”,大大降低了英国硬退欧的可能性。对我们来说,硬退欧是这三年磨难带来的较为悲观的结果之一。

These six areas have the opportunity to create some positive catalysts in 2020, either in standalone scenarios or in complement to each other. We'll be watching the 10-year Bund yield closely, because any inflection could suggest that the idea for a positive surprise to the upside may be gaining traction with investors. The recent backup in yields could be an early sign of that upside surprise.

这六个领域有机会在2020年创造一些积极的催化剂,无论是在独立的情景中,还是在相辅相成的情况下。我们将密切关注10年期德国国债收益率,因为任何转折都可能表明,给上行带来积极惊喜的想法可能正在吸引投资者。最近收益率的回升可能是这种上行惊喜的早期迹象。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者注:本文的摘要项目符号是由寻找Alpha编辑选择的。

By Jack P. McIntyre, CFA

By Jack P. McIntyre, CFA