Time To Seize The European Small-Cap Equity Opportunity

Time To Seize The European Small-Cap Equity Opportunity

Summary

摘要

Green Shoots Appearing in European Economic Data

欧洲经济数据中出现复苏萌芽

Macroeconomic data in Europe has been weak since the start of 2018. Global macro headwinds linked to the U.S. - trade wars with China, coupled with domestic structural issues such as tightening of emission regulations - are to blame.

宏观经济自2018年初以来,欧洲的数据一直疲软。与美国有关的全球宏观逆风-与中国的贸易战,加上国内结构性问题,如收紧排放法规-是罪魁祸首。

Sentiment toward European equities is a weak point, shown by the record outflows of $8.1 billion from European-linked exchange-traded funds in the first 10 months of 2019.1

对欧洲股市的情绪是一个薄弱环节,与欧洲挂钩的交易所交易基金(ETF)在2019年前10个月创纪录地流出81亿美元。1

We believe investors' loss of confidence is probably overdone.

我们认为投资者信心的丧失可能有些过头了。

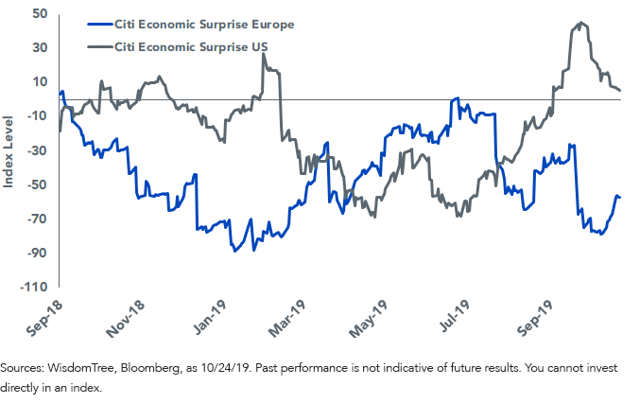

Notably, European economic data is starting to stage a turnaround.

值得注意的是,欧洲经济数据开始出现转机。

Figure 1: European Economic Data Starts to Improve

图1:欧洲经济数据开始改善

For definitions of Indexes referenced in the chart, please visit our glossary.

有关图表中引用的指数的定义,请访问我们的词汇表.

Early Lead of Small-Caps'; Price Performance Could Signal Further Upside in Macroeconomic Data

早期销售线索小型股‘;价格表现可能预示宏观经济数据进一步上行

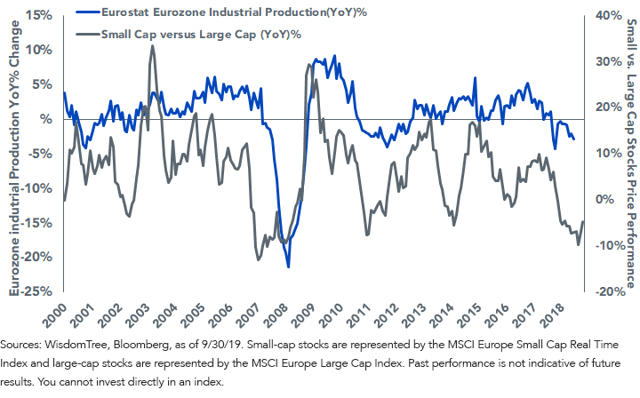

European small-cap stocks have historically tracked the annual change in eurozone industrial production since 2000.

从历史上看,欧洲小盘股一直跟踪欧洲股市的年度变化欧元区2000年以来的工业生产。

The chart below illustrates the annual change of industrial production in the eurozone with a three-month lag plotted against the performance of small- versus large-cap European stocks.

下面的图表显示了欧元区工业生产的年度变化,与欧洲小盘股和大盘股的表现相比,有三个月的滞后。

Figure 2: Small vs. Large Cap Stock Performance Compared to EU Industrial Production (3-month lag)

图2:与欧盟工业生产相比,小盘股与大盘股的表现(3个月滞后)

The industrial sector constitutes the highest sector weight across European small caps (22%) in comparison to large caps (11%). The improvement in price performance of small- versus large caps European stocks has historically signaled a rebound in eurozone industrial production.

在欧洲小盘股中,工业板块的权重最高(22%),而大盘股(11%)的权重最高。小型VS的性价比提升大盘股欧洲股市历来暗示欧元区工业生产回升。

Brexit and German Fiscal Boost - The Next Catalysts for European Small Caps

英国退欧德国财政提振--欧洲小盘股的下一个催化剂

- Improvement in Organization for Economic Co-operation and Development (OECD) lead indicators

- Additional fiscal easing from Germany

- Easing of Brexit-related uncertainty as the odds of a no-deal exit reduces.

- 在以下方面有所改进经济合作与发展组织(经合组织)领先指标

- 来自德国的额外财政宽松政策

- 随着无法达成协议退出的可能性降低,与英国退欧相关的不确定性有所缓解。

Brexit has been a considerable drag on small-cap performance. The U.K. is the largest and oldest small-cap market in Europe, representing 33% of the small-cap universe in Europe. As we receive more clarity on the path U.K. might follow in its departure from the EU, this removes one major challenge to investor sentiment.

英国退欧对小盘股表现构成相当大的拖累。英国是欧洲最大、历史最悠久的小盘股市场,占整个欧洲小盘股市场的33%。随着我们对英国退出欧盟可能遵循的道路变得更加清晰,这消除了投资者情绪面临的一个主要挑战。

The next largest small-cap region is in Germany, at 11% of the European small-cap market share. Europe's largest economy has been hit hardest by trade, the Chinese slowdown, and the ongoing U.S.-China trade wars. Germany has a continent-wide supply chain that accounts for 29% of eurozone GDP. Its government recently announced a €54 billion ($59 billion) climate spending package aimed at reaching the 2030 emissions reduction target on September 20, 2019. This is expected to be financed from existing surpluses in the energy and climate fund, implying a minor net fiscal net boost of less than 1.6% of GDP.

第二大小盘股地区在德国,占欧洲小盘股市场份额的11%。欧洲最大的经济体受到贸易、中国经济放缓以及正在进行的美中贸易战的重创。德国拥有覆盖整个欧洲大陆的供应链,占欧元区的29%国内生产总值。该国政府最近宣布了一项540亿欧元(590亿美元)的气候支出方案,旨在2019年9月20日实现2030年减排目标。预计这笔资金将来自能源和气候基金的现有盈余,这意味着财政净提振不到GDP的1.6%。

We believe this is far from sufficient to fight the German economy's downturn. We expect the recent run of weak German economic data releases to eventually persuade the country to unleash a more meaningful round of fiscal stimulus.

我们认为,这远远不足以对抗德国经济的低迷。我们预计,最近发布的一连串疲弱的德国经济数据,最终将说服该国推出更有意义的一轮财政刺激。

Small-Cap Stocks Are Not a Value Trap

小盘股不是价值陷阱

Further, European small-cap stocks are attractively valued compared to large caps. The price-to-earnings ratio (P/E) of small- versus large-cap European stocks is trading at a 7% discount compared to its average since 2007. The estimated dividend yields for the MSCI Europe Small Cap Real Time Index at 2.97% is in line with the average since 2007.

此外,与大盘股相比,欧洲小盘股的估值更具吸引力。这个市盈率(P/E)与2007年以来的平均水平相比,欧洲小盘股和大盘股的交易价格有7%的折让。估计股息收益率对于摩根士丹利资本国际欧洲小型股实时指数为2.97%,与2007年以来的平均水平一致。

With the cautious outlook on Europe, investors have crowded into defensive sectors, which constitute a larger proportion of large caps compared to small caps.2

由于对欧洲前景持谨慎态度,投资者纷纷涌入防御性板块,与小盘股相比,防御性板块在大盘股中所占比例更大。2

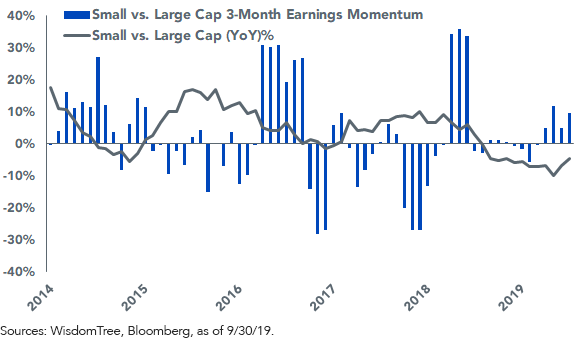

Interestingly, the relative earnings momentum of small- versus large-cap European stocks has started to improve over the second half of 2019, and this is clearly being reflected in the outperformance of small- versus large-cap European stocks, which we believe is still at a nascent stage.

有趣的是,相对收益动量2019年下半年,小盘股与大盘股的表现已经开始改善,这明显反映在小盘股与大盘股的优异表现上,我们认为欧洲小盘股与大盘股的表现仍处于初级阶段。

Figure 3: Small-Cap vs. Large-Cap European Price Performance vs. Earnings Momentum 3-Month % Change

图3:小盘股与大盘股欧洲股价表现与盈利势头3个月百分比变化

European small-cap stocks are known to be more inefficient than large caps, which offer a greater possibility of alpha generation.

众所周知,欧洲小盘股比大盘股效率更低,后者产生阿尔法的可能性更大。

While sentiment remains weak across Europe, favorable valuations, positive earnings momentum, coupled with a slowly improving macro backdrop, provide a timely opportunity to invest in European small caps.

虽然整个欧洲的人气仍然疲软,但有利的估值,正面的盈利势头,加上缓慢改善的宏观背景,为投资欧洲小盘股提供了适时的机会。

1Sources: WisdomTree, Bloomberg

1资料来源:WisdomTree,Bloomberg

2Small cap stocks are represented the MSCI Europe Small Cap Real Time Index and large-cap stocks are represented by the MSCI Europe Large Cap Index.

2摩根士丹利资本国际欧洲小盘股实时指数(MSCI Europe Small Cap Real Time Index)代表小盘股,摩根士丹利资本国际欧洲大盘指数代表大盘股。

Jeremy Schwartz, CFA, Executive Vice President, Global Head of Research

杰里米·施瓦茨(Jeremy Schwartz),CFA,执行副总裁兼全球研究主管

Jeremy Schwartz has served as our Executive Vice President, Global Head of Research since November 2018 and leads WisdomTree's investment strategy team in the construction of WisdomTree's equity indexes, quantitative active strategies and multi-asset model portfolios. Mr. Schwartz joined WisdomTree in May 2005 as a Senior Analyst, adding to his responsibilities in February 2007 as Deputy Director of Research and thereafter, from October 2008 to October 2018, as Director of Research. Prior to joining WisdomTree, he was head research assistant for Professor Jeremy Siegel and helped with the research and writing of Stocks for the Long Run and The Future for Investors. Mr. Schwartz also is co-author of the Financial Analysts Journal paper, What Happened to the Original Stocks in the S&P 500? He received his B.S. in Economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Mr. Schwartz is also a member of the CFA Society of Philadelphia.

Jeremy Schwartz自2018年11月以来一直担任我们的执行副总裁兼全球研究主管,并领导WisdomTree的投资策略团队构建WisdomTree的股票指数、量化主动策略和多资产模型投资组合。施瓦茨先生于2005年5月加入WisdomTree担任高级分析师,2007年2月加入WisdomTree担任研究副总监,之后于2008年10月至2018年10月加入WisdomTree担任研究总监。在加入WisdomTree之前,他是Jeremy Siegel教授的首席研究助理,并帮助投资者研究和撰写长期股票和未来股票。施瓦茨也是《金融分析师期刊》(Financial Analysts Journal)论文《标准普尔500指数(S&P500)的原始股票发生了什么?》(Financial Analysts Journal)的合著者。他获得了宾夕法尼亚大学沃顿商学院的经济学学士学位,并在天狼星XM132上主持沃顿商业广播节目“市场背后”。施瓦茨也是费城CFA协会的成员。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者注:本文的摘要项目符号是由寻找Alpha编辑选择的。