Summary

For a typically volatile index like the Shanghai Composite, the 9.9% range it has traded in over the last six months is relatively narrow.

While the Shanghai Composite index has been lacking in vitality, smaller-cap Chinese stocks have been showing signs of life.

The ChiNext Index had a strong start to 2019, but quickly gave up most of its early gains.

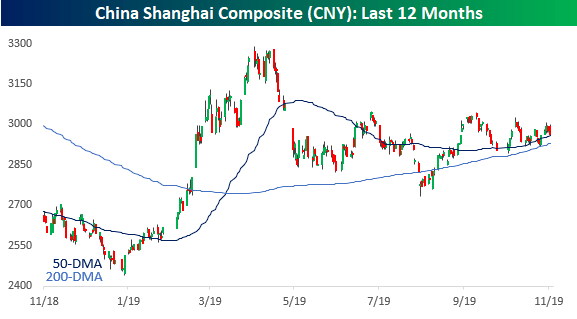

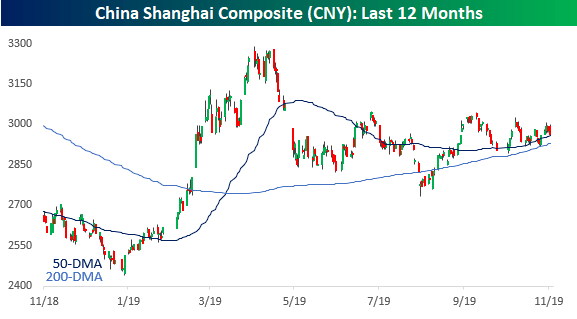

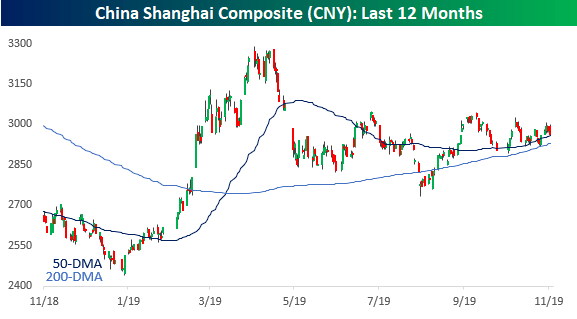

While US and Chinese trade talks are a constant in the news, you don't really hear much about Chinese equities these days. While the Shanghai Composite Index got off to a blistering start in 2019, it gave up a good share of those gains in the spring and has traded in a very tight range ever since even as global stocks break out. For a typically volatile index like the Shanghai Composite, the 9.9% range it has traded in over the last six months is relatively narrow. Since 1990, there have only been three other periods where the index's six-month trading range was in the single digits.

While US and Chinese trade talks are a constant in the news, you don't really hear much about Chinese equities these days. While the Shanghai Composite Index got off to a blistering start in 2019, it gave up a good share of those gains in the spring and has traded in a very tight range ever since even as global stocks break out. For a typically volatile index like the Shanghai Composite, the 9.9% range it has traded in over the last six months is relatively narrow. Since 1990, there have only been three other periods where the index's six-month trading range was in the single digits.

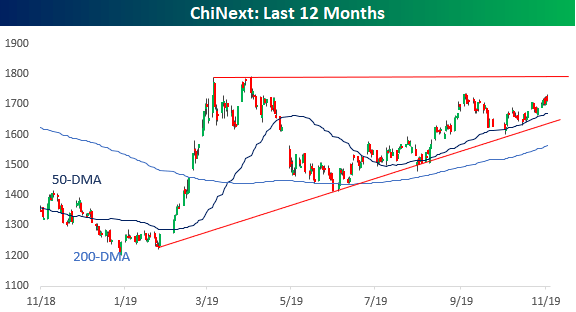

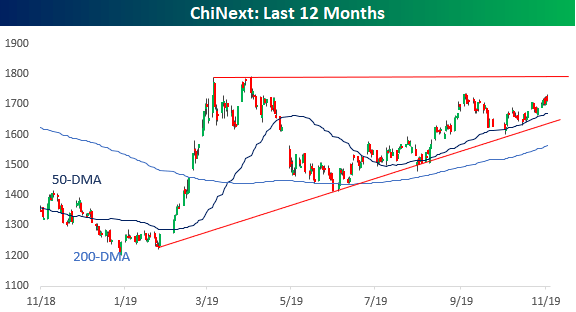

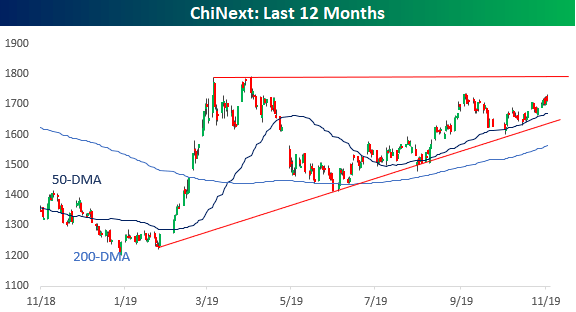

While the Shanghai Composite index has been lacking in vitality, smaller-cap Chinese stocks have been showing signs of life. The chart below shows the performance of the Chinese ChiNext Index, which is a segment of the Shenzhen stock exchange that is composed of smaller-cap Chinese companies. Companies in this index face less stringent listing requirements and are often considered to be earlier in their corporate life-cycle than more established companies. In simple terms, the ChiNext index is often referred to as the Nasdaq of China.

Like the Shanghai Composite Index, the ChiNext Index had a strong start to 2019, but quickly gave up most of its early gains. Unlike the Shanghai Composite Index, though, the ChiNext index has recouped much of its losses from the spring and is now just 4.5% below its 2019 high compared to the Shanghai Composite Index which is still down just under 10% from its YTD high. If the ChiNext can take out both its recent high from August and the highs from earlier in the year, Chinese equities, in general, will likely follow suit.

Original post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

For a typically volatile index like the Shanghai Composite, the 9.9% range it has traded in over the last six months is relatively narrow.

对于上证综指这样一个典型的波动指数来说,过去六个月9.9%的波动区间相对较窄。

While the Shanghai Composite index has been lacking in vitality, smaller-cap Chinese stocks have been showing signs of life.

尽管上证综指一直缺乏活力,但中国小盘股已显示出复苏迹象。

The ChiNext Index had a strong start to 2019, but quickly gave up most of its early gains.

创业板指数2019年开局强劲,但很快回吐了早盘的大部分涨幅。

While US and Chinese trade talks are a constant in the news, you don't really hear much about Chinese equities these days. While the Shanghai Composite Index got off to a blistering start in 2019, it gave up a good share of those gains in the spring and has traded in a very tight range ever since even as global stocks break out. For a typically volatile index like the Shanghai Composite, the 9.9% range it has traded in over the last six months is relatively narrow. Since 1990, there have only been three other periods where the index's six-month trading range was in the single digits.

虽然美国和中国的贸易谈判在新闻中屡见不鲜,但这些天你真的很少听到关于中国股市的消息。尽管上证综指在2019年开局火爆,但它在春季回吐了很大一部分涨幅,自那以来一直在非常狭窄的区间内交易,尽管全球股市爆发了。对于上证综指这样一个典型的波动指数来说,过去六个月9.9%的波动区间相对较窄。自1990年以来,该指数的6个月交易区间仅有另外三个时期位于个位数。

While the Shanghai Composite index has been lacking in vitality, smaller-cap Chinese stocks have been showing signs of life. The chart below shows the performance of the Chinese ChiNext Index, which is a segment of the Shenzhen stock exchange that is composed of smaller-cap Chinese companies. Companies in this index face less stringent listing requirements and are often considered to be earlier in their corporate life-cycle than more established companies. In simple terms, the ChiNext index is often referred to as the Nasdaq of China.

尽管上证综指一直缺乏活力,但中国小盘股已显示出复苏迹象。下图显示了中国创业板指数(China ChiNext Index)的表现,该指数是深圳证券交易所的一部分,由规模较小的中国公司组成。该指数中的公司面临不那么严格的上市要求,通常被认为比更成熟的公司更早进入公司生命周期。简而言之,创业板指数通常被称为中国的纳斯达克(Nasdaq)。

Like the Shanghai Composite Index, the ChiNext Index had a strong start to 2019, but quickly gave up most of its early gains. Unlike the Shanghai Composite Index, though, the ChiNext index has recouped much of its losses from the spring and is now just 4.5% below its 2019 high compared to the Shanghai Composite Index which is still down just under 10% from its YTD high. If the ChiNext can take out both its recent high from August and the highs from earlier in the year, Chinese equities, in general, will likely follow suit.

与上证综指一样,创业板指数2019年开局强劲,但很快回吐了大部分早盘涨幅。不过,与上证综指不同的是,创业板指数已经收复了今年春季的大部分失地,目前仅比2019年的高点低4.5%,而上证综指仍比年初高点下跌了不到10%。如果创业板能够同时跌破8月份的近期高点和今年早些时候的高点,中国股市总体上可能会效仿。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者按:本文的摘要项目符号是由寻求Alpha编辑选择的。

While US and Chinese trade talks are a constant in the news, you don't really hear much about Chinese equities these days. While the Shanghai Composite Index got off to a blistering start in 2019, it gave up a good share of those gains in the spring and has traded in a very tight range ever since even as global stocks break out. For a typically volatile index like the Shanghai Composite, the 9.9% range it has traded in over the last six months is relatively narrow. Since 1990, there have only been three other periods where the index's six-month trading range was in the single digits.

While US and Chinese trade talks are a constant in the news, you don't really hear much about Chinese equities these days. While the Shanghai Composite Index got off to a blistering start in 2019, it gave up a good share of those gains in the spring and has traded in a very tight range ever since even as global stocks break out. For a typically volatile index like the Shanghai Composite, the 9.9% range it has traded in over the last six months is relatively narrow. Since 1990, there have only been three other periods where the index's six-month trading range was in the single digits.