This May Be The Time For Value Investors

This May Be The Time For Value Investors

Summary

摘要

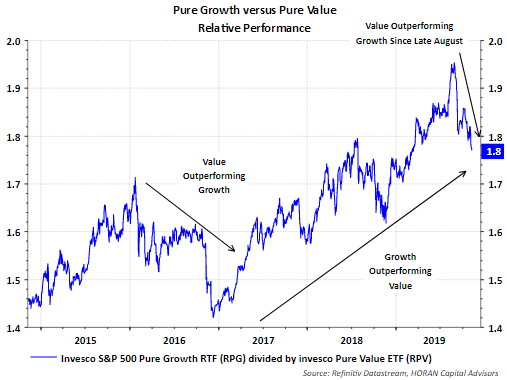

Since late August, value style equities have outperformed their growth counterparts. Except for a few brief periods over much of the last six years, the growth style has dominated the value style. In late 2015 through late 2016, value dominated growth as seen in the below chart. In a post I wrote several years ago, 2015 Was A Year For Growth Stocks And Only A Handful Were Needed, I also noted how dominant the growth style had been and the possibility of a value style rebound. As fate would have it, the pure value style did outperform pure growth in 2016 by more than 15 percentage points.

自8月下旬以来,价值型股票的表现优于成长型股票。在过去六年的大部分时间里,除了几个短暂的时期外,增长风格一直主导着价值风格。从2015年末到2016年末,价值主导了增长,如下图所示。在我几年前写的一篇文章中,2015年是成长型股票的一年,只需要少数几只股票,我还指出了增长风格的主导地位,以及价值风格反弹的可能性。命中注定,2016年,纯价值风格的表现确实比纯增长高出15个百分点以上。

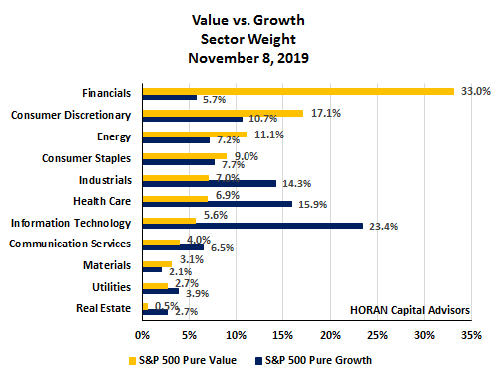

As 2019 seems to be coming to an end quickly, value is outperforming growth again, and this might be sustainable into 2020. For value to have an edge over growth though, financials and consumer discretionary stocks will likely need to be strong performers. As the below table shows, financials and consumer discretionary stocks, as a group, account for 50% of the Pure Value Index (RPV). In 2016 these two sectors accounted for more than half of value's outperformance and at that time the two sectors were 40% of the Pure Value Index. Additionally, on a relative basis, if technology and healthcare stocks are laggards in 2020, this will benefit the Pure Value style as the two sectors are underweight in the pure value style relative to the pure growth style.

由于2019年似乎即将结束,价值再次超过增长,这可能会持续到2020年。不过,要想让价值超过增长,金融类股和非必需消费品类股可能需要表现强劲。如下表所示,金融类股和非必需消费品类股作为一个整体,占Pure Value Index(RPV)。2016年,这两个板块占Value表现优异的一半以上,当时这两个板块占Pure Value Index的40%。此外,在相对基础上,如果科技和医疗保健类股在2020年表现落后,这将有利于纯价值风格,因为相对于纯增长风格,这两个板块在纯价值风格中的权重偏低。

With an economy that seems poised to avoid a recession in the coming year and a steepening yield curve, both the consumer and financial sectors would benefit in that kind of environment. If this does play out, value just might be an outperforming strategy over the next year or so.

鉴于经济似乎有望在未来一年避免衰退,收益率曲线趋陡,消费者和金融部门都将在这种环境中受益。如果这真的发生了,在未来一年左右的时间里,价值可能只是一种表现更好的策略。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者按:本文的摘要项目符号是由寻求Alpha编辑选择的。