Summary

The recent rise in Treasury yields has largely been a rising breakeven inflation story.

Admittedly, it was not a large move, but the 10-year breakeven appears to have bounced off the 1.5% level.

The current level (near 1.7%) is in the middle of the range of observed inflation rates for the past decade.

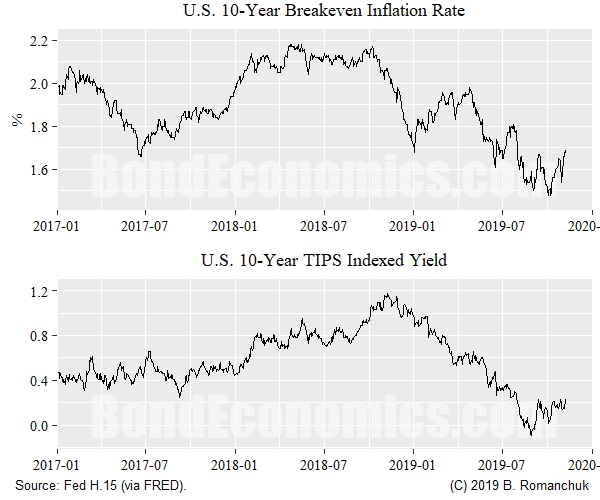

The recent rise in Treasury yields has largely been a rising breakeven inflation story. Admittedly, it was not a large move, but the 10-year breakeven appears to have bounced off the 1.5% level.

(The 10-year breakeven inflation rate is the nominal Treasury yield less the quoted yield on the 10-year index-linked TIPS. The breakeven inflation rate is [approximately] the inflation rate required for the 10-year TIPS total return to match the 10-year conventional Treasury total return. This should match forecast average expected inflation under the assumption of market efficiency. My book Breakeven Inflation Analysis provides a deep dive into the issues around this concept.)

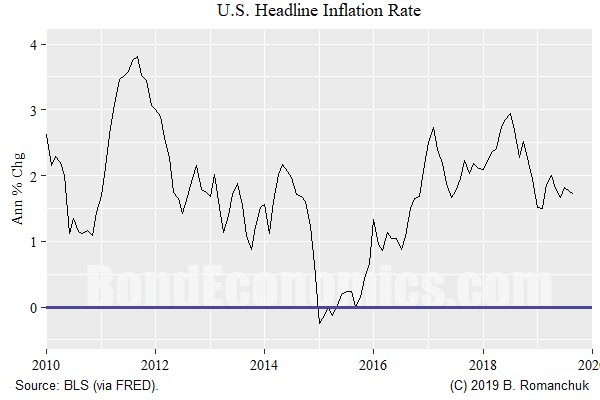

It seems clear that recession risks are being taken out of Treasury market pricing. The previous low of 1.5% breakeven inflation seems to have been somewhat aggressive when compared to inflation performance over the past decade (shown below).

There is certainly no significant inflation risk premium embedded in the breakeven inflation curve. The current level (near 1.7%) is in the middle of the range of observed inflation rates for the past decade. This is perhaps somewhat surprising this far into an decade-long expansion, but recession fears have meant that risks are seen as symmetric.

Looking forward, it seems likely that breakeven inflation rate movements will explain most of the changes in nominal yields, under the assumption that yield movements are not large. Breakeven inflation rates are still well below their average of recent years, and thus, might "re-normalise" closer to 2% if the Treasury bear market continues.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

The recent rise in Treasury yields has largely been a rising breakeven inflation story.

美国国债收益率最近的上升在很大程度上是一个不断上升的盈亏平衡通胀故事。

Admittedly, it was not a large move, but the 10-year breakeven appears to have bounced off the 1.5% level.

诚然,这不是一个很大的变动,但10年期盈亏平衡似乎已经从1.5%的水平反弹。

The current level (near 1.7%) is in the middle of the range of observed inflation rates for the past decade.

目前的水平(接近1.7%)处于过去10年观察到的通胀率区间的中间。

The recent rise in Treasury yields has largely been a rising breakeven inflation story. Admittedly, it was not a large move, but the 10-year breakeven appears to have bounced off the 1.5% level.

美国国债收益率最近的上升在很大程度上是一个不断上升的盈亏平衡通胀故事。诚然,这不是一个很大的变动,但10年期盈亏平衡似乎已经从1.5%的水平反弹。

(The 10-year breakeven inflation rate is the nominal Treasury yield less the quoted yield on the 10-year index-linked TIPS. The breakeven inflation rate is [approximately] the inflation rate required for the 10-year TIPS total return to match the 10-year conventional Treasury total return. This should match forecast average expected inflation under the assumption of market efficiency. My book Breakeven Inflation Analysis provides a deep dive into the issues around this concept.)

(10年期盈亏平衡通胀率是名义国债收益率减去10年期与指数挂钩的TIPS的报价收益率。盈亏平衡通货膨胀率是[大约]10年期TIPS总回报所需的通货膨胀率,才能与10年期常规国债总回报相匹配。在市场效率的假设下,这应该与预测的平均预期通胀率相符。我的书盈亏平衡通货膨胀分析深入探讨了围绕这一概念的问题。)

It seems clear that recession risks are being taken out of Treasury market pricing. The previous low of 1.5% breakeven inflation seems to have been somewhat aggressive when compared to inflation performance over the past decade (shown below).

似乎很明显,衰退风险正在从国债市场定价中剔除。与过去十年的通胀表现(如下所示)相比,之前1.5%的盈亏平衡通胀率低点似乎有些咄咄逼人。

There is certainly no significant inflation risk premium embedded in the breakeven inflation curve. The current level (near 1.7%) is in the middle of the range of observed inflation rates for the past decade. This is perhaps somewhat surprising this far into an decade-long expansion, but recession fears have meant that risks are seen as symmetric.

盈亏平衡通胀曲线中肯定没有明显的通胀风险溢价。目前的水平(接近1.7%)处于过去10年观察到的通胀率区间的中间。在长达十年的扩张中,这可能有点令人惊讶,但对经济衰退的担忧意味着,人们认为风险是对称的。

Looking forward, it seems likely that breakeven inflation rate movements will explain most of the changes in nominal yields, under the assumption that yield movements are not large. Breakeven inflation rates are still well below their average of recent years, and thus, might "re-normalise" closer to 2% if the Treasury bear market continues.

展望未来,在假设收益率变动幅度不大的情况下,盈亏平衡通胀率变动似乎将解释名义收益率的大部分变动。盈亏平衡通胀率仍远低于近几年的平均水平,因此,如果美国国债熊市继续下去,通胀率可能会“重新正常化”,接近2%。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

编者注:本文的摘要项目符号是由寻找Alpha编辑选择的。