Guizhou Zhongyida Co., Ltd (SHSE:900906) Screens Well But There Might Be A Catch

Guizhou Zhongyida Co., Ltd (SHSE:900906) Screens Well But There Might Be A Catch

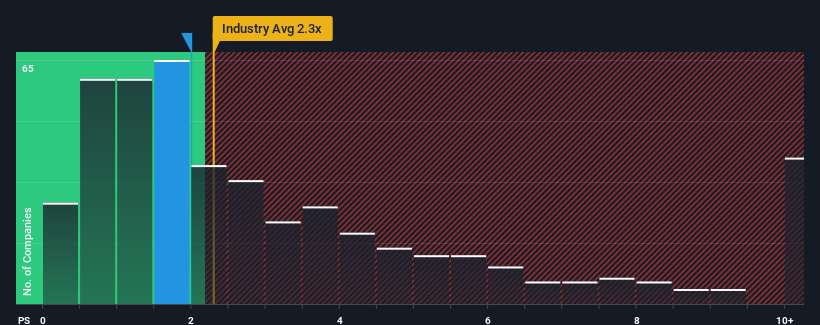

It's not a stretch to say that Guizhou Zhongyida Co., Ltd's (SHSE:900906) price-to-sales (or "P/S") ratio of 2x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in China, where the median P/S ratio is around 2.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

这么说一点也不牵强贵州中益达股份有限公司(上海证券交易所股票代码:900906)2倍的市销率(或“P/S”)对于中国化工行业的公司来说似乎相当“中间”,那里的P/S比率中值约为2.3倍。尽管这可能不会令人惊讶,但如果P/S比率不合理,投资者可能会错过潜在的机会,或者忽视迫在眉睫的失望情绪。

See our latest analysis for Guizhou Zhongyida

查看我们对贵州中怡达的最新分析

How Has Guizhou Zhongyida Performed Recently?

贵州中怡达最近表现如何?

For example, consider that Guizhou Zhongyida's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

例如,考虑到贵州中益达最近的财务表现不佳,因为其收入一直在下降。一种可能性是,S的市盈率是温和的,因为投资者认为,该公司在不久的将来可能仍会采取足够的措施,与更广泛的行业保持一致。如果你喜欢这家公司,你至少会希望情况是这样的,这样你就可以在它不太受欢迎的时候买入一些股票。

How Is Guizhou Zhongyida's Revenue Growth Trending?

贵州中怡达的收入增长趋势如何?

The only time you'd be comfortable seeing a P/S like Guizhou Zhongyida's is when the company's growth is tracking the industry closely.

唯一能让你放心地看到像贵州中怡达这样的P/S的时候,就是该公司密切跟踪行业发展的时候。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.8%. Still, the latest three year period has seen an excellent 206% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

回顾过去一年的财务状况,我们沮丧地看到该公司的收入下降到了3.8%。不过,尽管短期表现不尽如人意,但在最近三年的时间里,该公司的整体营收增长了206%。因此,我们可以从确认该公司在这段时间内总体上在收入增长方面做得非常好开始,尽管在此过程中出现了一些小问题。

Comparing that to the industry, which is only predicted to deliver 28% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

相比之下,该行业预计在未来12个月内只会实现28%的增长,从最近的中期年化收入结果来看,该公司的增长势头更强劲。

In light of this, it's curious that Guizhou Zhongyida's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

有鉴于此,令人好奇的是,贵州中益达的P/S与大多数其他公司并驾齐驱。显然,一些股东认为最近的表现已经到了极限,并一直在接受较低的售价。

What Does Guizhou Zhongyida's P/S Mean For Investors?

贵州中怡达P/S对投资者意味着什么?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

仅仅用市销率来决定你是否应该出售你的股票是不明智的,但它可以成为公司未来前景的实用指南。

We didn't quite envision Guizhou Zhongyida's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

考虑到过去三年的收入增长高于当前的行业前景,我们并没有完全想象到贵州中益达的P/S与整个行业保持一致。可能存在一些未被察觉的收入威胁,阻碍了P/S比率与这一积极表现的匹配。一些人似乎确实预计收入不稳定,因为最近这些中期状况的持续通常会提振股价。

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Guizhou Zhongyida with six simple checks.

一家公司的资产负债表中可能隐藏着许多潜在风险。您可以通过我们的免费贵州中益大的资产负债表分析,六个简单的检查。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是确保你寻找的是一家伟大的公司,而不仅仅是你遇到的第一个想法。因此,如果不断增长的盈利能力符合你对一家伟大公司的看法,不妨看看这一点免费近期收益增长强劲(市盈率较低)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。