Optimism for Nanjing Railway New TechnologyLtd (SZSE:301016) Has Grown This Past Week, Despite One-year Decline in Earnings

Optimism for Nanjing Railway New TechnologyLtd (SZSE:301016) Has Grown This Past Week, Despite One-year Decline in Earnings

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. To wit, the Nanjing Railway New Technology Co.,Ltd. (SZSE:301016) share price is 33% higher than it was a year ago, much better than the market decline of around 8.9% (not including dividends) in the same period. So that should have shareholders smiling. We'll need to follow Nanjing Railway New TechnologyLtd for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

如今,简单地购买指数基金很容易,而且你的回报应该(大致)与市场相匹配。但是,您可以通过选择高于平均水平的股票来显著提高回报。也就是说, 南京铁道新技术有限公司, Ltd. (深交所代码:301016)股价比一年前上涨了33%,远好于同期约8.9%的市场跌幅(不包括股息)。因此,这应该让股东们微笑。我们需要关注南京铁路新技术有限公司一段时间,才能更好地了解其股价走势,因为它上市的时间还没有特别长。

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

在连续7天表现稳健的背景下,让我们来看看公司的基本面在推动长期股东回报方面发挥了什么作用。

Check out our latest analysis for Nanjing Railway New TechnologyLtd

查看我们对南京铁道新技术有限公司的最新分析

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

用本杰明·格雷厄姆的话来说:从短期来看,市场是一台投票机器,但从长远来看,它是一台称重机。研究市场情绪如何随着时间的推移而变化的一种方法是研究公司股价与其每股收益(EPS)之间的相互作用。

Over the last twelve months, Nanjing Railway New TechnologyLtd actually shrank its EPS by 35%.

在过去的十二个月中,南京铁路新技术有限公司的每股收益实际上缩减了35%。

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

因此,我们认为投资者对每股收益的关注并不过多。事实上,当每股收益下降但股价上涨时,这通常意味着市场正在考虑其他因素。

We are skeptical of the suggestion that the 0.9% dividend yield would entice buyers to the stock. Unfortunately Nanjing Railway New TechnologyLtd's fell 19% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

我们对0.9%的股息收益率会吸引买家购买该股的说法持怀疑态度。不幸的是,南京铁路新技术有限公司的股价在十二个月内下跌了19%。因此,使用关键业务指标的快照并不能让我们很好地了解市场为何出价该股。

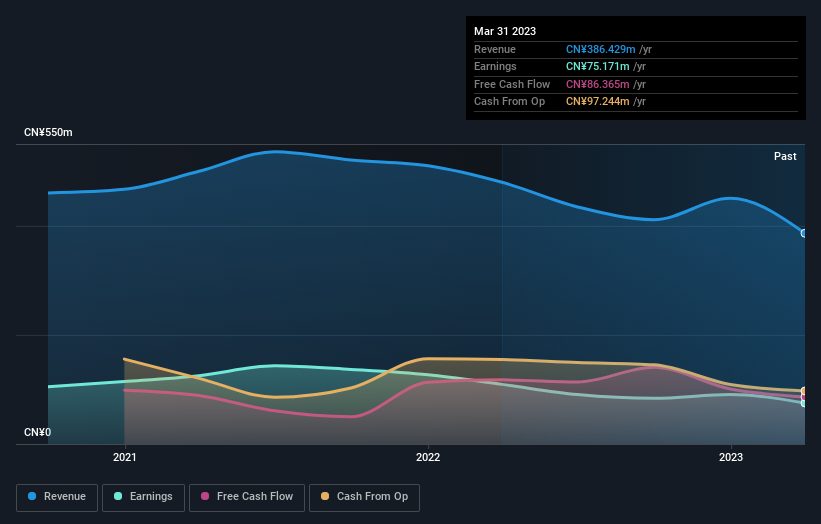

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

您可以在下面看到收入和收入如何随着时间的推移而变化(点击图片了解确切的值)。

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

资产负债表的实力至关重要。可能值得一看我们的 免费的 报告其财务状况如何随着时间的推移而变化。

A Different Perspective

不同的视角

Nanjing Railway New TechnologyLtd shareholders should be happy with the total gain of 34% over the last twelve months, including dividends. A substantial portion of that gain has come in the last three months, with the stock up 17% in that time. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Nanjing Railway New TechnologyLtd , and understanding them should be part of your investment process.

南京铁道新技术有限公司的股东应该对此感到满意 总 在过去的十二个月中增长了34%,包括股息。其中很大一部分涨幅来自过去三个月中,该股在此期间上涨了17%。这表明该公司正在继续赢得新投资者的青睐。虽然值得考虑市场状况可能对股价产生的不同影响,但还有其他因素更为重要。例如,以永远存在的投资风险幽灵为例。 我们已经确定了 2 个警告信号 与南京铁路新技术有限公司合作,了解它们应该是您投资过程的一部分。

Of course Nanjing Railway New TechnologyLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

当然 南京铁路新技术有限公司可能不是最值得买入的股票。所以你可能希望看到这个 免费的 成长型股票的收集。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

请注意,本文引用的市场回报反映了目前在中国交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧? 取得联系 直接和我们联系。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是一般性的。 我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章无意提供财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能未将最新的价格敏感型公司公告或定性材料考虑在内。简而言之,华尔街对上述任何股票都没有头寸。