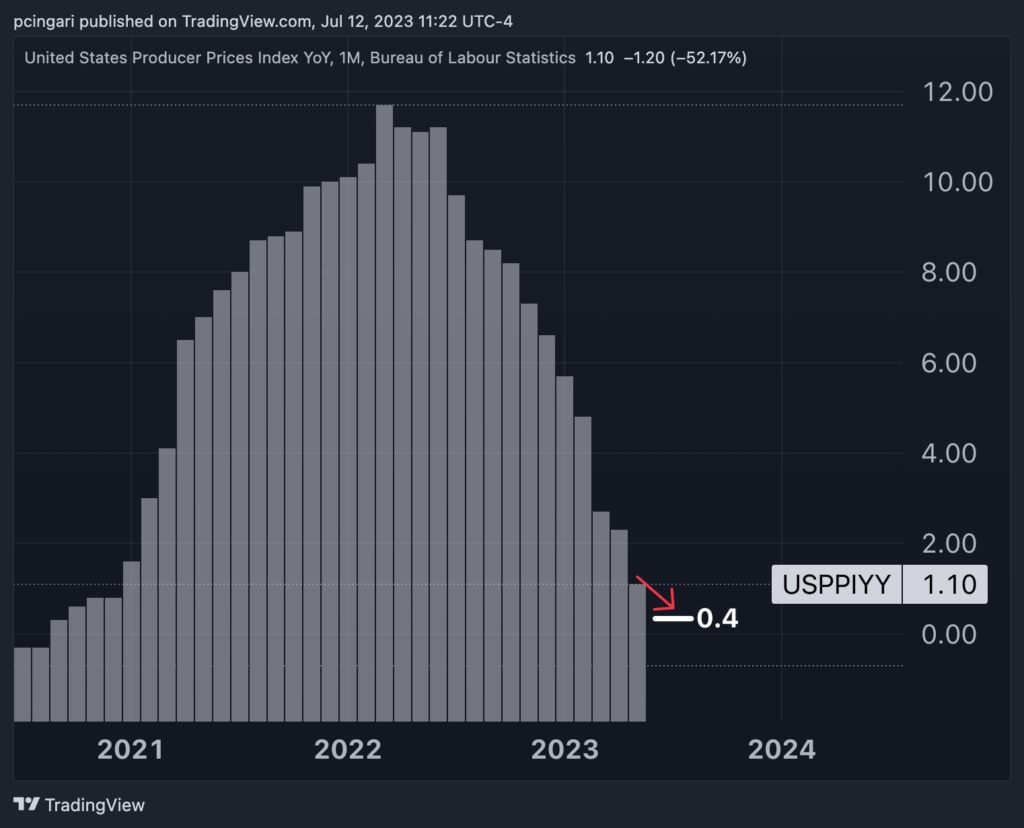

PPI Inflation Could Hit Lowest Level Since September 2020, Reflecting Easing Inflationary Pressures

PPI Inflation Could Hit Lowest Level Since September 2020, Reflecting Easing Inflationary Pressures

Following the lower-than-expected consumer price inflation data released Wednesday, there may be more positive news coming on the inflation front with the Thursday release U.S. producer price index (PPI) report.

继周三发布低于预期的消费者价格通胀数据后,周四发布的美国生产者价格指数(PPI)报告可能会在通胀方面传出更多积极消息。

Economists predict a year-over-year increase of 0.4% for the PPI index in June, down from 1.1% in May, marking the lowest level since September 2020 and the twelfth consecutive month of declining producer inflation.

经济学家预测,6月份PPI指数同比上涨0.4%,低于5月份的1.1%,这是自2020年9月以来的最低水平,也是生产者通胀连续第12个月下降。

The monthly producer inflation is expected to show a 0.2% gain, consistent with May's figures. Core PPI inflation is seen falling from 2.8% to 2.6% annually, the lowest since February 2021.

月度生产者出厂价格指数预计将上涨0.2%,与5月份的数据一致。核心PPI通胀率预计将从2.8%降至2.6%,为2021年2月以来的最低水平。

The upcoming release of the producer price index will provide additional insights into inflation trends, which will have ramifications for monetary policy choices and market expectations about future rate hikes by the Federal Reserve.

即将发布的生产者价格指数将提供对通胀趋势的更多洞察,这将对货币政策选择和市场对美联储未来加息的预期产生影响。

Chart: US PPI Seen Falling To Nearly 3-Year Lows

图表:美国PPI降至近三年低点

June PPI Inflation Preview: What You Need To Know Before The Print

6月份PPI通胀预览:打印前需要了解的内容

- Consumer inflation in June decreased to 3% year-on-year, posting a full percentage drop from May, and the lowest reading since March 2021. Core inflation, excluding food and energy, also declined to 4.8% year-on-year, falling short of expectations of 5%.

- 6月份消费者通胀同比下降至3%,较5月份下降了整整一个百分点,是自2021年3月以来的最低读数。不包括食品和能源的核心通胀率同比也降至4.8%,低于5%的预期。

- This alleviating inflationary pressure is a result of the manufacturing sector's dismal activity data, where prices paid have dropped significantly. According to the ISM Manufacturing PMI, June witnessed the fastest rate of contraction in the manufacturing sector since May 2020, with the activity gauge down from 46.9 in May to 46 in June. The subindex for prices paid registered a dramatic fall into contraction, down from 44.2 to 41.8 in June.

Read also: US Manufacturing Crisis Worsens: Activity Shrinks For 8th Straight Month To Lowest In 3 Years

- Manufacturers surveyed by the ISM indicated the presence of "a buyers' market, as sellers are concerned about filling order books to support their backlogs." Only one of the top six manufacturing industries (Computer and Electronic Products) reported price increases in June. Eighty-nine percent of companies reported the same or lower prices in June, compared to 85% in May.

- 这种缓解的通胀压力是制造业活动数据惨淡的结果,制造业支付的价格大幅下降。根据ISM制造业采购经理人指数,6月份是自2020年5月以来制造业收缩速度最快的月份,制造业活动指数从5月份的46.9降至6月份的46。支付价格分类指数大幅下降,从6月份的44.2降至41.8。

另请阅读:美国制造业危机恶化:经济活动连续第8个月萎缩至3年来最低

- 接受ISM调查的制造商表示,存在“买家市场,因为卖家担心填写订单来支持他们的积压订单。”六大制造业中只有一个行业(计算机和电子产品)在6月份报告了价格上涨。89%的公司报告6月份价格持平或更低,而5月份的这一比例为85%。

- In the month of June, the Bloomberg Commodity Index, as tracked by the iShares Bloomberg Roll Select Commodity Strategy ETF (NYSE:CMDY), rose 2.6%, after falling as much as 6% in May. Compared to the June 2022's levels the commodity gauge was 15% lower in June 2023.

- Oil prices, tracked by the United States Oil Fund ETF (NYSE:USO), increased by 3.7% in June 2023 but remained 33% below June 2022 levels.

- Freight costs, as monitored by the Baltic Dry Index, widely regarded as the most popular global shipping costs index, rose 11% in June after plummeting 39% in May, but remained over 50% lower than June 2022 levels.

- 在6月份,彭博商品指数,根据IShares Bloomberg Roll精选商品策略ETF(纽约证券交易所股票代码:CMDY),继5月份下跌6%后,上涨2.6%。与2022年6月的S水平相比,2023年6月的大宗商品价格指数低了15%。

- 石油价格,由美国石油基金ETF(纽约证券交易所股票代码:USO),2023年6月增加了3.7%,但仍比2022年6月的水平低33%。

- 运费,由波罗的海乾散货运价指数被广泛认为是最受欢迎的全球航运成本指数,继5月份暴跌39%后,6月份上涨了11%,但仍比2022年6月的水平低50%以上。

Read also: 5 Commodity ETFs To Watch When PPI Inflation Data Drops Wednesday

另请阅读:周三PPI通胀数据下跌时需要关注的5只大宗商品ETF

Photo via Shutterstock.

照片来自Shutterstock。

The upcoming release of the producer price index will provide additional insights into inflation trends, which will have ramifications for monetary policy choices and market expectations about future rate hikes by the Federal Reserve.

The upcoming release of the producer price index will provide additional insights into inflation trends, which will have ramifications for monetary policy choices and market expectations about future rate hikes by the Federal Reserve.