Qingdao Zhongzi Zhongcheng Group Co.,Ltd.'s (SZSE:300208) Market Cap Surged CN¥427m Last Week, Retail Investors Who Have a Lot Riding on the Company Were Rewarded

Qingdao Zhongzi Zhongcheng Group Co.,Ltd.'s (SZSE:300208) Market Cap Surged CN¥427m Last Week, Retail Investors Who Have a Lot Riding on the Company Were Rewarded

Key Insights

主要见解

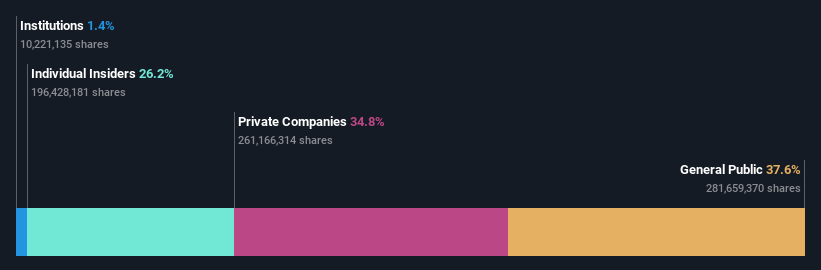

- The considerable ownership by retail investors in Qingdao Zhongzi Zhongcheng GroupLtd indicates that they collectively have a greater say in management and business strategy

- The top 4 shareholders own 52% of the company

- Insiders own 26% of Qingdao Zhongzi Zhongcheng GroupLtd

- 散户投资者对青岛中资中诚集团有限公司的大量持股表明,他们共同在管理和经营战略上拥有更大的发言权

- 最大的4个股东拥有公司52%的股份

- 内部人士持有青岛中资中成集团有限公司26%的股份

A look at the shareholders of Qingdao Zhongzi Zhongcheng Group Co.,Ltd. (SZSE:300208) can tell us which group is most powerful. And the group that holds the biggest piece of the pie are retail investors with 38% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

看看青岛中资中成集团股份有限公司(深交所股票代码:300208)的股东,我们就知道哪个集团最强大。持有这块蛋糕最大份额的是持有38%股权的散户投资者。换句话说,该集团将从他们对公司的投资中获得最大(或损失最大)。

As a result, retail investors collectively scored the highest last week as the company hit CN¥6.5b market cap following a 7.0% gain in the stock.

因此,散户投资者上周的得分最高,该公司在股价上涨7.0%后,市值达到人民币65亿元。

Let's take a closer look to see what the different types of shareholders can tell us about Qingdao Zhongzi Zhongcheng GroupLtd.

让我们仔细看看不同类型的股东对青岛中资中成集团有限公司有什么启示。

Check out our latest analysis for Qingdao Zhongzi Zhongcheng GroupLtd

查看我们对青岛中资中成集团有限公司的最新分析

What Does The Institutional Ownership Tell Us About Qingdao Zhongzi Zhongcheng GroupLtd?

关于青岛中资中成集团有限公司,机构持股告诉了我们什么?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

机构通常在向自己的投资者报告时,以基准来衡量自己,因此一旦一只股票被纳入主要指数,它们往往会对这只股票变得更加热情。我们预计,大多数公司都会有一些机构登记在册,特别是在它们正在增长的情况下。

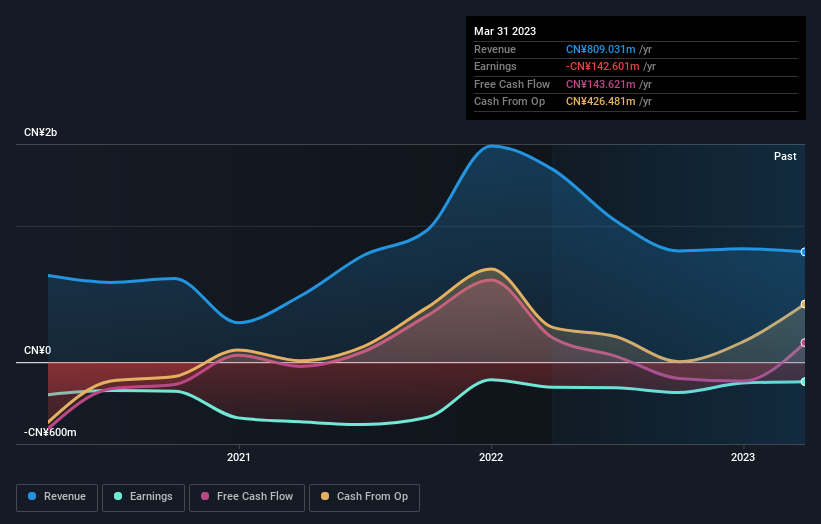

Institutions have a very small stake in Qingdao Zhongzi Zhongcheng GroupLtd. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

机构持有青岛中资中成集团有限公司很小的股份。这表明该公司受到了一些基金的关注,但目前并不是特别受专业投资者的欢迎。如果该公司的收益在增长,这可能表明它才刚刚开始引起这些财力雄厚的投资者的注意。当几家大机构想要同时购买某只股票时,我们有时会看到股价上涨。下面你可以看到的收益和收入的历史,可能有助于考虑是否有更多的机构投资者会想要这只股票。当然,还有很多其他因素需要考虑。

We note that hedge funds don't have a meaningful investment in Qingdao Zhongzi Zhongcheng GroupLtd. Qingdao City Construction Investment (Group) Limited is currently the company's largest shareholder with 22% of shares outstanding. Yi Ming Dai is the second largest shareholder owning 10% of common stock, and Xiao Yu Jia holds about 10% of the company stock. Xiao Yu Jia, who is the third-largest shareholder, also happens to hold the title of Member of the Board of Directors.

我们注意到,对冲基金没有对青岛中资中诚集团有限公司进行有意义的投资。青岛城建投资(集团)有限公司目前是该公司的第一大股东,持有22%的流通股。戴一鸣是第二大股东,持有10%的普通股,小鱼佳持有公司约10%的股份。第三大股东萧于嘉也恰好拥有董事会成员的头衔。

On looking further, we found that 52% of the shares are owned by the top 4 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company.

进一步观察,我们发现前四大股东持有52%的股份。换句话说,这些股东在公司的决策中拥有有意义的发言权。

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

研究机构持股是衡量和筛选股票预期表现的好方法。通过研究分析师的情绪,也可以达到同样的效果。我们的信息显示,分析师没有对该股进行任何报道,因此它可能鲜为人知。

Insider Ownership Of Qingdao Zhongzi Zhongcheng GroupLtd

青岛中资中成集团有限公司内部人持股

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

不同国家对内部人的定义可能略有不同,但董事会成员总是算数的。公司管理层管理企业,但首席执行官将向董事会负责,即使他或她是董事会成员。

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

内部人持股是积极的,当它标志着领导层像公司的真正所有者一样思考时。然而,高内部人持股也可以给公司内部的一个小团体带来巨大的权力。在某些情况下,这可能是负面的。

Our information suggests that insiders maintain a significant holding in Qingdao Zhongzi Zhongcheng Group Co.,Ltd.. Insiders have a CN¥1.7b stake in this CN¥6.5b business. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

我们的信息显示,内部人士持有青岛中资中诚集团有限公司的大量股份。业内人士在这笔65亿元的交易中拥有17亿元的股份。我们会说,这表明了与股东的一致,但值得注意的是,该公司仍相当小;一些内部人士可能创建了这家企业。你可以点击这里,看看这些内部人士是一直在买入还是卖出。

General Public Ownership

一般公有制

The general public-- including retail investors -- own 38% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

包括散户投资者在内的普通公众持有该公司38%的股份,因此不能轻易忽视。这种规模的所有权虽然可观,但如果决策与其他大股东不同步,可能不足以改变公司政策。

Private Company Ownership

私营公司所有权

It seems that Private Companies own 35%, of the Qingdao Zhongzi Zhongcheng GroupLtd stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

看来,民营企业持有青岛中资中成集团有限公司35%的股份。仅从这一事实很难得出任何结论,因此值得调查一下谁拥有这些私营公司。有时,内部人士或其他关联方通过一家独立的私人公司拥有上市公司的股份。

Next Steps:

接下来的步骤:

It's always worth thinking about the different groups who own shares in a company. But to understand Qingdao Zhongzi Zhongcheng GroupLtd better, we need to consider many other factors. Take risks for example - Qingdao Zhongzi Zhongcheng GroupLtd has 2 warning signs we think you should be aware of.

拥有一家公司股票的不同集团总是值得考虑的。但要更好地了解青岛中资中成集团有限公司,我们还需要考虑许多其他因素。以风险为例-青岛中资中诚集团有限公司2个警告标志我们认为你应该意识到。

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

当然了这可能不是最值得购买的股票。。所以让我们来看看这个免费 免费有趣的公司名单。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注:本文中的数字是使用过去12个月的数据计算的,指的是截至财务报表日期的最后一个月的12个月期间。这可能与全年的年度报告数字不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。