Shandong Chenming Paper Holdings Limited (SZSE:000488) Looks Inexpensive But Perhaps Not Attractive Enough

Shandong Chenming Paper Holdings Limited (SZSE:000488) Looks Inexpensive But Perhaps Not Attractive Enough

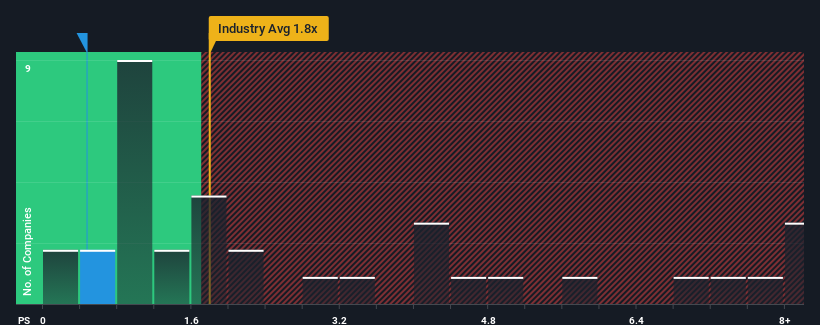

You may think that with a price-to-sales (or "P/S") ratio of 0.5x Shandong Chenming Paper Holdings Limited (SZSE:000488) is a stock worth checking out, seeing as almost half of all the Forestry companies in China have P/S ratios greater than 1.8x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

你可能会认为,如果价格与销售额(或“市盈率”)之比为0.5倍山东晨鸣纸业集团有限公司深交所(SZSE:000488)是一只值得一看的股票,因为中国几乎一半的林业公司的市盈率都高于1.8倍,即使是高于5倍的市盈率S也并不稀奇。尽管如此,只看市盈率/S的面值是不明智的,因为可能会有一个解释为什么它是有限的。

Check out our latest analysis for Shandong Chenming Paper Holdings

查看我们对山东晨鸣纸业控股的最新分析

How Shandong Chenming Paper Holdings Has Been Performing

山东晨鸣纸业控股如何表现

Shandong Chenming Paper Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

山东晨鸣纸业控股公司最近的表现不佳,因为其不断下降的收入与其他公司相比要差一些,其他公司的收入平均有一些增长。或许本益比仍然较低,因为投资者认为营收强劲增长的前景还没有出现。如果是这样的话,现有股东很可能很难对股价的未来走势感到兴奋。

Do Revenue Forecasts Match The Low P/S Ratio?

收入预测是否符合较低的市盈率?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shandong Chenming Paper Holdings' to be considered reasonable.

有一个固有的假设,即一家公司的表现应该逊于行业,才能让山东晨鸣纸业这样的市盈率被认为是合理的。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.4%. This means it has also seen a slide in revenue over the longer-term as revenue is down 2.2% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

首先回顾一下,该公司去年的收入增长并不令人兴奋,因为它公布了令人失望的5.4%的下降。这意味着它的长期营收也出现了下滑,因为过去三年的总营收下降了2.2%。因此,股东们会对中期营收增长率感到悲观。

Turning to the outlook, the next year should generate growth of 9.5% as estimated by the three analysts watching the company. With the industry predicted to deliver 13% growth, the company is positioned for a weaker revenue result.

谈到前景,据关注该公司的三位分析师估计,明年应该会产生9.5%的增长。由于该行业预计将实现13%的增长,该公司的营收结果将较为疲软。

In light of this, it's understandable that Shandong Chenming Paper Holdings' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

有鉴于此,山东晨鸣纸业控股有限公司的P/S排名低于其他大多数公司也是可以理解的。似乎大多数投资者预计未来的增长有限,只愿意为该股支付较低的价格。

What We Can Learn From Shandong Chenming Paper Holdings' P/S?

我们可以从山东晨鸣纸业控股的P/S那里学到什么?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

有人认为,在某些行业中,市销率是衡量价值的次要指标,但它可能是一个强大的商业信心指标。

We've established that Shandong Chenming Paper Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

我们已经确定,山东晨鸣纸业控股有限公司维持其低市盈率S的原因是其预期增长低于整个行业的疲软,正如预期的那样。目前,股东们正在接受S的低市盈率,因为他们承认,未来的收入可能不会带来任何令人愉快的惊喜。在这种情况下,很难看到股价在不久的将来强劲上涨。

Before you settle on your opinion, we've discovered 1 warning sign for Shandong Chenming Paper Holdings that you should be aware of.

在你决定你的观点之前,我们发现山东晨鸣纸业控股公司的1个警告标志这一点你应该知道。

If you're unsure about the strength of Shandong Chenming Paper Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不确定山东晨鸣纸业控股的业务实力,为什么不探索我们的互动列表,为其他一些你可能没有达到预期的公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。